Supply-chain disruptions are causing some turmoil in the minds of Asian investors. But while COVID-19 restrictions in China highlighted the problems with supply-chain concentration and drove many businesses to diversify to other Asian countries, we believe the impact should be short-lived. As China eases its zero-COVID policy, it should see more foreign direct investment (FDI) inflows. Still, we believe Asia ex-China stands to benefit from supply-chain diversification efforts, particularly in select labor-intensive manufacturing sectors.

Below are four reasons emerging markets debt investors may want to look at Asia.

Background

Asia is not immune from the gloomy global outlook, which features persistently high inflation, uncertain energy prices due to the prolonged conflict in Ukraine, and depressed demand for manufactured goods thanks to slower global growth and recessionary risks.

Exports of Asian goods have trended down considerably since the third quarter of 2022, and economic growth in Asian countries is forecast to come in between 4% and 6% in 2023. And during the pandemic, we saw Chinese imports decline, especially in industries that rely heavily on global value chains—such as electronics, healthcare, automotive, and textiles—which tend to be more susceptible to supply-chain disruptions.

“We are selectively overweight corporate and sovereign credits that may benefit from post-lockdown recovery, stronger FDI, and supply-chain diversification efforts.”

Given China’s easing of its zero-COVID policy, however, we believe Asia’s economic growth could come in toward the higher end of the range in 2023. China is reopening its borders to both inbound and outbound traffic, and the post-COVID Chinese growth story could cushion the economies of other countries in the region from a downside surprise this year. Southeast Asian countries, in particular, could see a robust recovery in tourism and consumption.

Still, we believe we can expect to see supply-chain diversification and changing FDI flows within Asia. On the following pages, we explain our thinking and then provide an overview of how it is affecting our positioning.

1. Supply-Chain Disruptions Are Driving Diversification

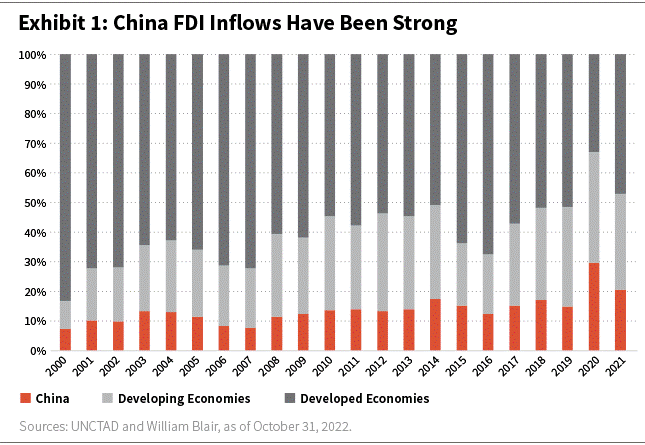

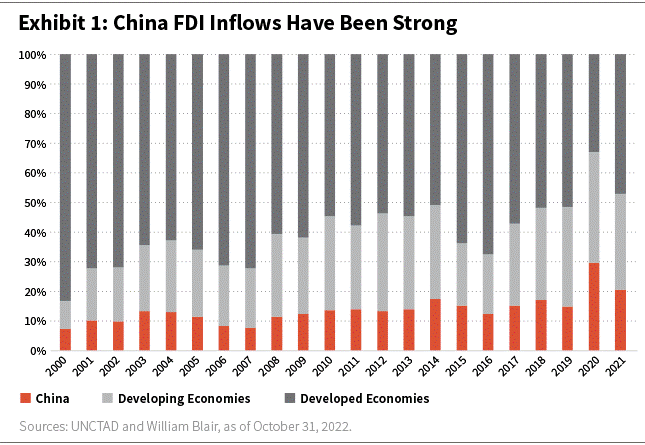

China has been a significant contributor to the increase in developing economies’ share of global FDI inflows. In 2020 and 2021, China ranked among the top two nations attracting the most FDI inflows globally, as exhibit 1 shows.

However, COVID-19–related supply-chain disruptions and geopolitical turmoil (including the Russia-Ukraine conflict) have driven discussions about supply-chain diversification. Supply-chain disruptions during the pandemic were big news. According to the International Monetary Fund (IMF), COVID-19 containment policies in exporting countries shocked the global supply chain, driving down imports across the world.[1]

Because China is one of the major actors in global supply chains, accounting for up to 30% of global manufacturing output and up to a fifth of global manufacturing trade, its zero-COVID restrictions reverberated globally and led businesses to reconsider their FDI in the country.

2. COVID-19 Restrictions Dented Regional FDI, but the Impact Is Likely Temporary

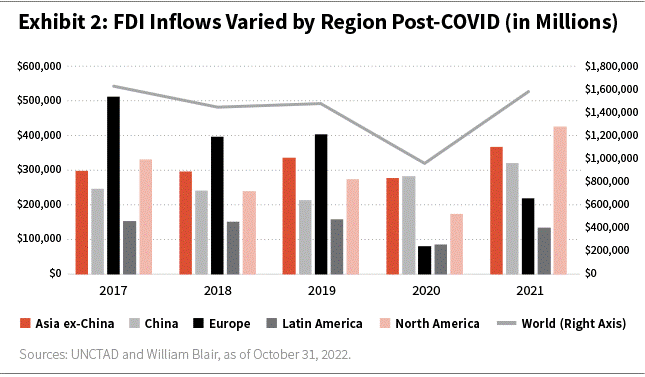

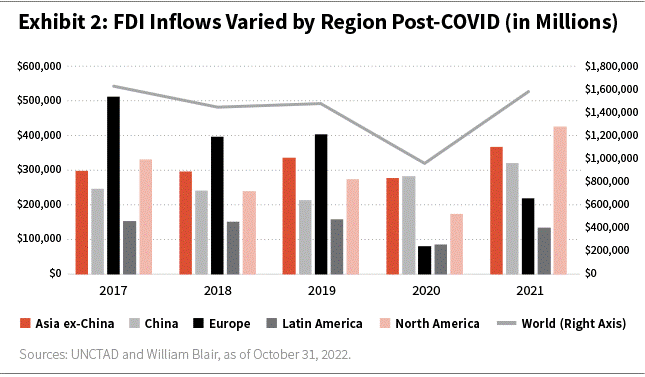

There is no denying that COVID restrictions hurt FDI flows as increased economic uncertainty associated with lockdowns caused businesses to retrench. Globally, FDI fell by 42% in 2020.[2]

However, Asia fared much better than the Americas and Europe, where FDI inflows plummeted in 2020 before rebounding swiftly in 2021. In Asia, FDI inflows remained resilient in 2020 and grew further in 2021. Asia ex-China led this growth. India received $45 billion of FDI inflows in 2021, and Association of Southeast Asian Nation (ASEAN) countries received $174 billion of FDI inflows in 2021, led by manufacturing, in areas such as electronics, electric vehicles (EVs), and EV battery plants. Exhibit 2 illustrates these trends.

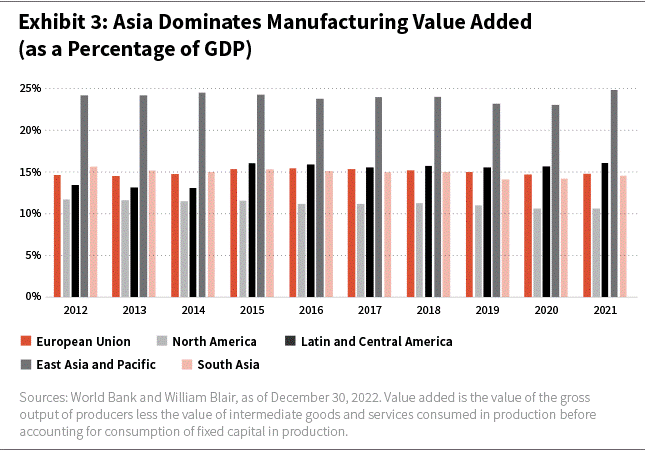

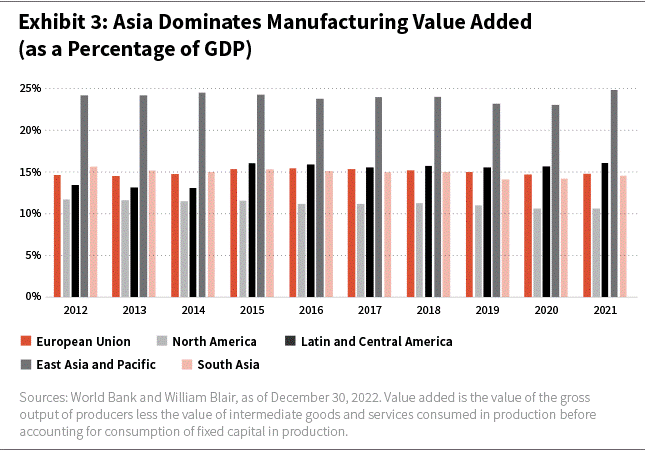

One explanation for Asia’s FDI resilience in 2020 and 2021 may be that during the pandemic, demand for manufactured goods was more resilient than demand for services, and manufacturing is a significant portion of Asia’s economy—more so than in many other regions.[3]Exhibit 3 illustrates.

Another plausible explanation may be China’s relative success in containing the COVID-19 pandemic in 2020, with less stringent restrictions than the rest of the world for most of 2020 and 2021.[4],[5]

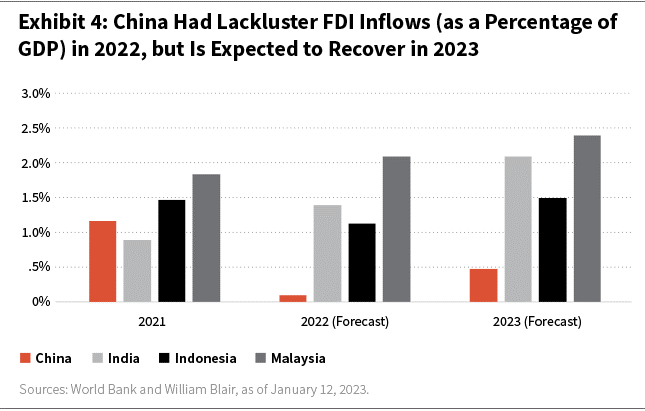

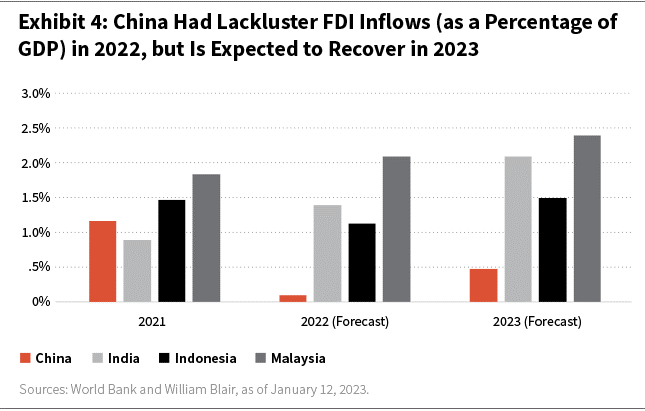

So, lockdowns, and the policy and macroeconomic uncertainty associated with them, impacted FDI, and China seems to be the relative loser in Asia, with FDI inflows to Asia ex-China increasing on the back of supply-chain disruptions. This will likely be particularly evident in 2022’s data, as exhibit 4 shows. But we believe Chinese FDI inflows remain resilient. In other words, the impact of lockdowns on FDI inflows appears to be short-term.

3. Many Factors Determine the Direction of FDI—And Asia Could Benefit

Moreover, COVID-related lockdowns are not the only driver of supply-chain diversification and FDI inflows. We believe some of these other factors bode well for China, and some bode well for Asia ex-China.

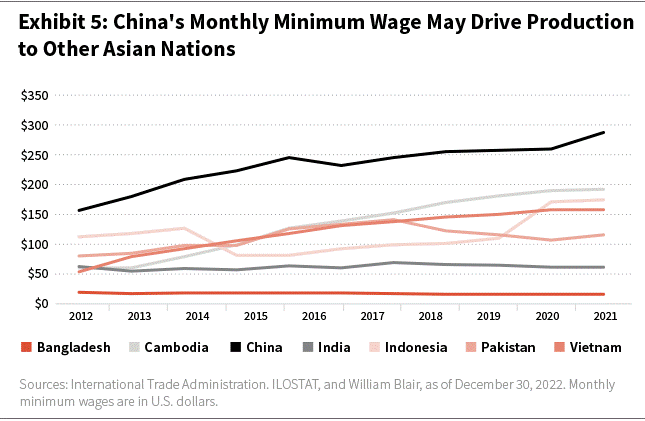

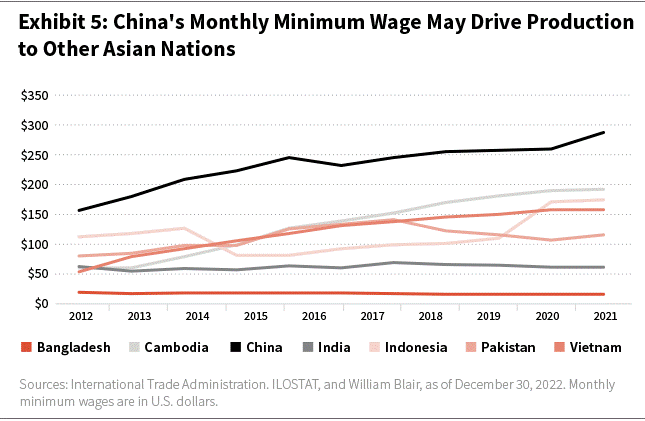

For example, another driver of supply-chain diversification may be the relative cost of labor in Asia ex-China. The Chinese minimum wage has grown over the last decade, from $157 per month in 2011 to $287 per month in 2021. This is significantly higher than other countries in the region, including India ($63 per month in 2021) and Vietnam ($159 per month in 2021), as exhibit 5 illustrates.

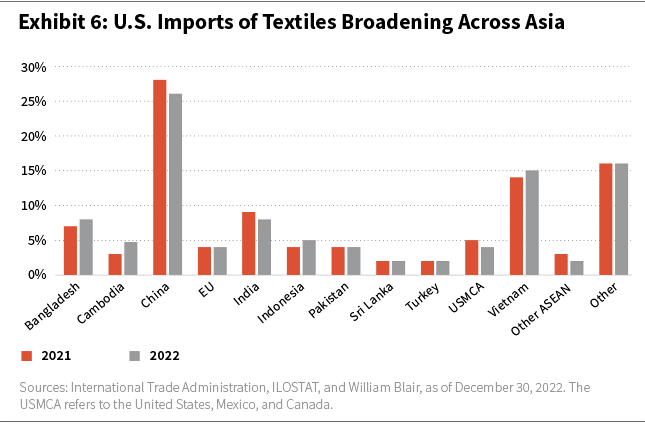

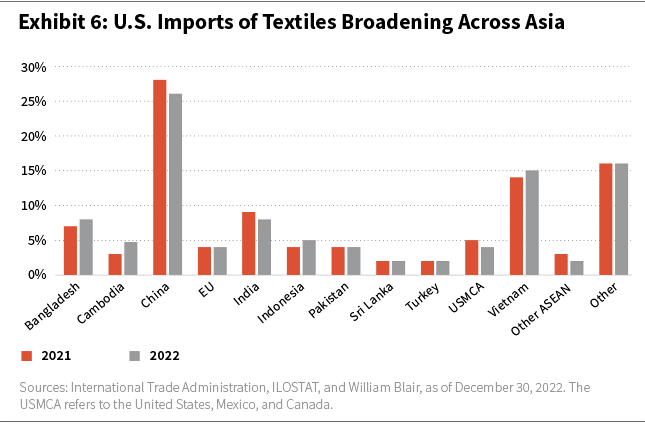

As a result, it may be economical for companies to shift some manufacturing capacity from China to lower-cost countries in the region. The lower cost of labor may be the prevailing factor in the decision to shift supply chains in some labor-intensive, lower-value-added manufacturing areas, such as textiles and apparel. In recent years, U.S. imports of textile and apparel goods from China have decreased, while imports from Bangladesh, Cambodia, Indonesia, and Vietnam have increased, as exhibit 6 shows.[6]

Other considerations in diversifying supply chains include the size and growth of the market, the supply of skilled labor, transportation infrastructure, market access, and government incentive policies. In many of these areas, China still holds significant advantages over its neighboring countries. China’s FDI inflows toward high-tech industries—including advanced manufacturing, technological innovation, and technology research and development—continued to show double-digit growth in 2021 and the first half of 2022.[7]

4. Businesses Are Now Aware of the Need for More Resilient Supply Chains

The COVID-related supply-chain disruptions highlighted the importance of diversifying supply chains to spread risk across locations,[8]and many international businesses reacted with the dual approach of continuing to invest in China while also diversifying outside China—the so-called “China Plus-One” strategy.

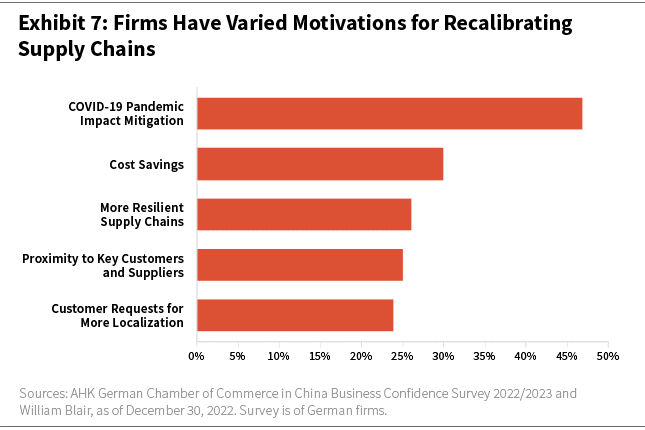

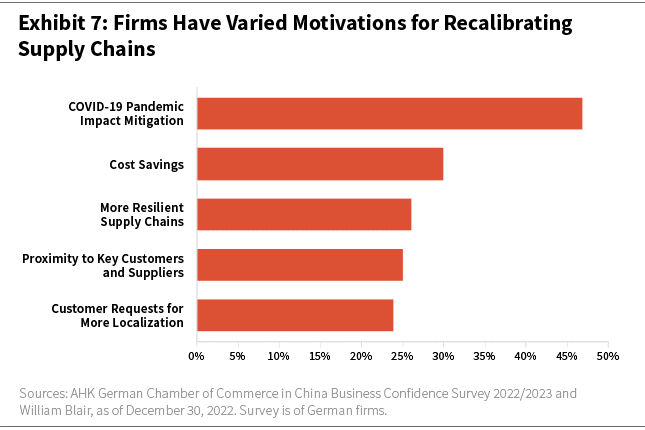

According to a survey by the German Chamber, in response to China’s prolonged zero-COVID-19 policy, 29% of companies intended to localize supply chains in China, while 29% intended to diversify supply chains away from China.[9]Similarly, the American Chamber’s China Business Report shows that while a third of respondents have redirected planned Chinese investments to other destinations in 2022, 30% of companies increased investments in China year-over-year.[10]Exhibit 7 illustrates some of the motivations for recalibrating supply chains.

Conclusion: FDI Likely to Remain Strong in Asia, Including China

While COVID-19 restrictions affected FDI inflows in the countries with the restrictions (China being a prime example), the bulk of the impact appears to be short-lived. But supply-chain diversification is real, for a number of reasons, and is affecting FDI.

We believe FDI in Asia ex-China should increase on the back of supply-chain diversification efforts, particularly in select labor-intensive manufacturing sectors. Selective countries from Asia could play a bigger role in global supply chains as the quest for diversification continues.

FDI in China, however, is also likely to remain strong, especially as the country eases its COVID-19 restrictions. We believe more and more multinational companies will adopt a “China Plus-One” strategy to achieve supply-chain diversification while protecting profits from pent-up domestic demand in China. This will likely keep China a core member of the global value chain and a major recipient of FDI inflows.

In sum, China will likely remain an important part of global value chains given its competitive advantages, including a vast market size, skilled labor supply, and solid infrastructure. In our opinion, the Chinese industries that attract the most FDI will likely include advanced manufacturing and investments that support its large domestic market.

Investment Implications

We believe credit spreads can tighten in Asia ex-China and China on the back of China’s anticipated reopening recovery. In our EM debt portfolios, we are selectively overweight corporate and sovereign credits that may benefit from post-lockdown recovery, stronger FDI, and supply-chain diversification efforts. We also favor Southeast Asian currencies as we believe their balance of payments should be supported as these countries build their manufacturing capacity and enhance their export competitiveness.

Clifford Lau, CFA, is a portfolio manager on William Blair’s emerging markets debt team.

Johnny Chen, CFA, is a portfolio manager on William Blair’s emerging markets debt team.

[1]United Nations Statistics Division,[2]Rocky Roads Ahead: AHK German Chamber of Commerce in China Business Confidence Survey 2022/2023, [3]AmCham Shanghai: “AmCham Shanghai Releases 2022 China Business Report”, [4]International Trade Administration; International Labor Organization Statistics, [5]Embassy of the People’s Republic of China in the United States: “China’s FDI Inflow Up 16.4 Pct in First Eight Months”, [6]United Nations ESCAP: “Foreign Direct Investment Trends and Outlook in Asia and the Pacific in 2021/2022”, [7]Federal Reserve Bank of Cleveland: “Why Has Durable Goods Spending Been So Strong During the COVID-19 Pandemic?”, [8]The Economist: “A Clumsy Lockdown of Shanghai Is Testing the ‘Zero-Covid’ Strategy”, [9]ADB Economics Working Paper Series No. 653, [10]Global Trade and Value Chains During the Pandemic, Chapter 4 World Economic Outlook, April 2022.