January 30, 2025 | Emerging Markets Debt

Subscribe Now

Want the latest insights on the economy and other forces shaping the investment landscape?

Subscribe to our Investing Insights newsletter.

January 30, 2025 | Emerging Markets Debt

Want the latest insights on the economy and other forces shaping the investment landscape?

Subscribe to our Investing Insights newsletter.

Emerging markets (EM) corporate credit demonstrated robust performance in 2024, with index returns exceeding 7.6%. This strong showing surpassed returns in both EM and developed market (DM) credit across all rating categories, except for CCC-rated bonds.

As we look ahead to 2025, several key themes are likely to influence the performance of EM corporate debt: negative net supply, U.S. policies, crude oil markets, interest rates and financing costs, and improved default rates.

The 2010s were marked by rapid growth in the EM corporate debt universe, with the number of issuers increasing from 269 to 845. The market cap of EM corporate debt expanded from $300 billion to $1.4 trillion during this period, largely driven by Asia, particularly China.

Since 2021, however, the dynamics of issuance have changed.

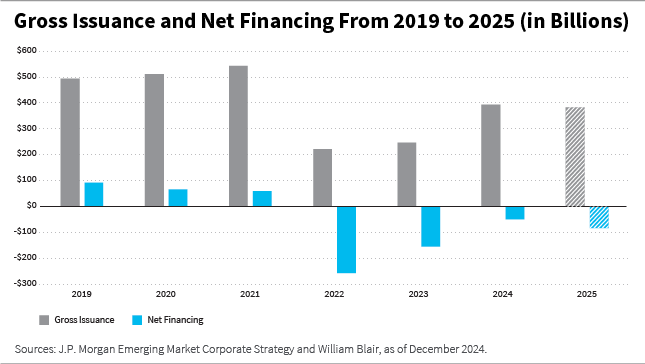

Gross issuance of EM corporate debt peaked in 2021 but has since declined. As a result, net financing—which accounts for gross issuance minus coupons, amortizations, tenders, and buybacks—turned deeply negative in 2022 and 2023.

While issuance rebounded slightly in 2024 and is expected to stabilize in 2025, net financing is likely to remain negative, albeit at reduced levels. In addition, local debt financing and private credit markets have provided alternative funding sources for issuers, reducing the need to access public hard currency markets.

The decline in new issuance has had notable effects. Portfolios have become more stable, trading liquidity has been reduced, and demand surges have triggered technical rallies as market participants seek limited available bonds.

A healthy issuance market is critical for the functioning and pricing of corporate credit, and gross issuance projections for 2025 are still likely to lead to negative net financing.

The policies of the Trump 2.0 administration are expected to play a significant role in shaping the EM corporate debt landscape. Trade policies, including potential tariffs on China and a softer outlook for EM currencies, are key risks for the asset class. Tariffs could directly impact certain sectors, while currency depreciation poses more diverse risks to issuers.

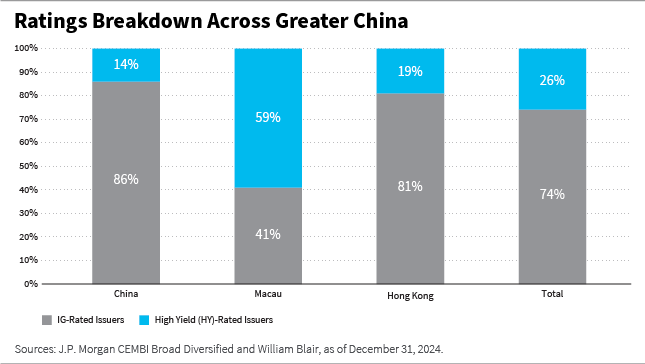

We define Greater China as China, Hong Kong, and Macau, which collectively represent about 15% of the J.P. Morgan Corporate Emerging Markets Bond Index (CEMBI) Broad Diversified[1], with financials, consumer, and technology sectors dominating the composition.

While tariffs on Chinese goods may influence market perception, the predominantly investment-grade (IG) nature of these sectors suggests resilience.

For example, the financials sector, which account for more than 40% of the Greater China CEMBI composition, are well-capitalized and systemic in importance. In addition, gaming issuers in Macau, part of the consumer sector, have shown improved credit quality due to strong demand and deleveraging and have a less direct transmission mechanism due to tariffs.

Meanwhile, the technology sector, which consists of 98% IG-rated issuers, is also largely domestically focused and capable of absorbing external volatility. But the embattled real estate sector’s outlook, in our view, is more tied to government support policies than external dynamics at this point.

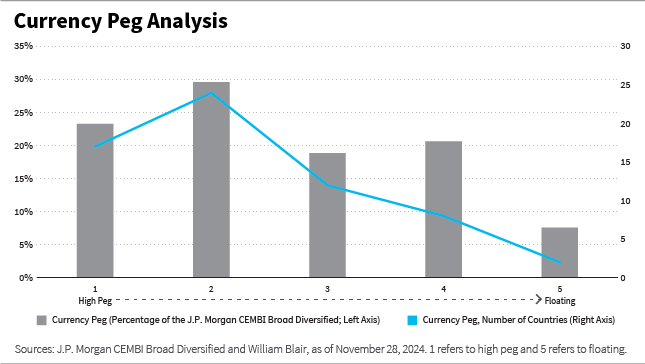

Currency volatility, heightened by the U.S. election and subsequent policy shifts, has spread from DM to EM currencies. A significant portion of EM corporate debt is tied to countries with currency pegs or interventionist central banks, mitigating apparent currency depreciations.

Moreover, many issuers in commodity-linked sectors, such as oil and gas, benefit from dollar-denominated revenues, providing further insulation. Bottom-up analysis will likely remain essential to assess individual issuer risks, as local currency-denominated debt can introduce mismatches despite broader protective measures.

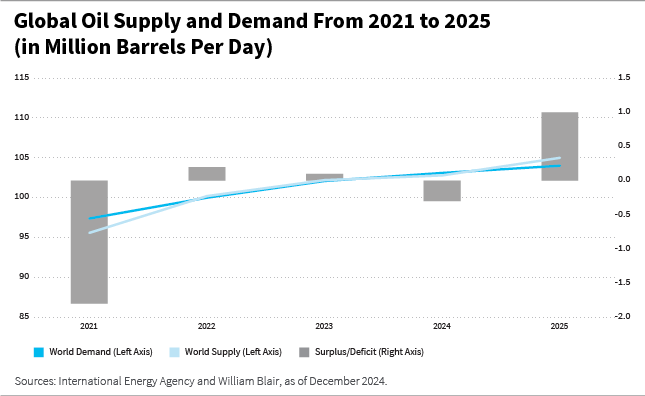

Crude oil markets are poised for a year of uncertainty in 2025, shaped by evolving demand patterns, supply dynamics, and geopolitical tensions. Global demand growth is forecast at approximately 1 million barrels per day, slightly below historical averages.

While India and the Middle East are becoming larger consumers, China and the United States remain the primary drivers of demand. China’s demand growth is expected to remain subdued due to economic challenges and the increasing penetration of electric vehicles (EVs). And in the United States, oil intensity and consumption growth have plateaued, although new policies could introduce volatility.

On the supply side, non-Organization of the Petroleum Exporting Countries (OPEC) production is set to grow, particularly in countries like Brazil, Guyana, Canada, and the United States. However, OPEC’s output decisions and the potential release of additional barrels add uncertainty to the supply outlook.

In addition, geopolitical factors, including conflicts in the Middle East and Ukraine, as well as U.S. policies toward Iran, Venezuela, and Russia, will likely exacerbate market volatility.

While lower oil prices are anticipated in 2025, most issuers in the oil and gas sector remain fundamentally strong, with cost structures well below forecast prices. The sector’s business diversity, from integrated companies to pure play producers and flexible capital expenditure (capex) strategies, provides resilience and investable opportunities under all market conditions.

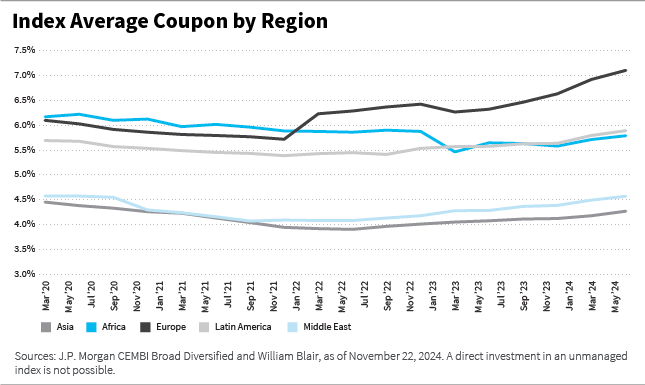

The trajectory of interest rates will likely continue to shape financing conditions for EM corporates. Higher rates translate into increased financing costs for new debt, potentially reducing free cash flow and financial flexibility.

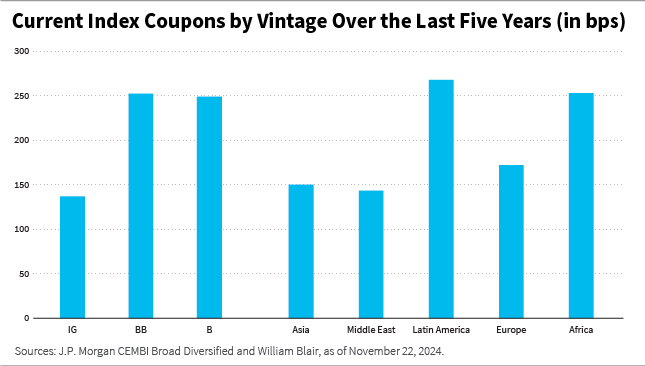

Over the past few years, the average coupon for EM corporate debt has risen, with significant increases observed across all ratings. For instance, coupons for IG-rated bonds issued between 2020 and 2024 have increased by an average of 140 basis points, while coupons for lower-rated HY issuers rose by more than 250 basis points.

Despite these increases, many issuers have locked in lower rates in previous years, insulating them from immediate refinancing pressures. The maturity profile of the index remains stable, with approximately 5% of index bonds maturing in 2025 and 10% to 15% maturing annually over the next five years.

However, refinancing at current yields could lead to substantial increases in borrowing costs, particularly for shorter-maturity bonds. The diversity of the asset class means that issuers will likely respond differently to these challenges, highlighting the importance of bottom-up analysis to identify those best positioned to adapt.

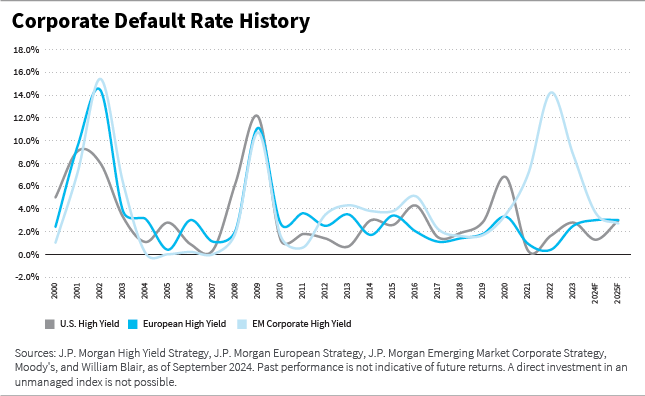

Default rates in the EM corporate universe have historically been comparable to those in DMs, averaging 3.6%[2]for HY issuers and under 1.5% for the overall index. And although the COVID-19 pandemic and subsequent economic shocks led to a spike in defaults, recent trends suggest a more benign outlook for 2025.

The default peak during the pandemic was driven by stress in the Chinese real estate sector, geopolitical conflicts, and capital controls in countries such as Argentina. However, default rates in regions such as the Middle East remain contained.

In addition, issuers continue to take adequate steps to address near-term maturities and diversify financing options, while local and private credit markets have provided additional flexibility, reducing reliance on international capital markets.

While idiosyncratic risks remain, the absence of a clear sector or country poised for widespread credit stress supports a favorable default outlook, in our view.

As we enter 2025, the EM corporate debt landscape is shaped by both challenges and opportunities. Negative net supply dynamics, U.S. policy shifts, oil market uncertainties, rising interest rates, and a favorable default environment will collectively shape the near-term investment environment.

But the diversity of the asset class, which spans regions, sectors, and credit profiles, underscores the importance of detailed analysis to uncover relative value. With careful navigation, investors can capitalize on the nuanced themes driving EM corporate credit in the year ahead.

This blog is excerpted from our 2025 EM corporate debt outlook.

Luis Olguin, CFA, is a portfolio manager on William Blair’s emerging markets debt team.

[1]The J.P. Morgan Corporate Emerging Markets Bond Index (CEMBI) Broad Diversified is a market capitalization-weighted index that tracks the total returns of U.S.-dollar-denominated debt instruments issued by corporate entities in EM countries. (Index information has been obtained from sources believed to be reliable but J.P. Morgan does not warrant its completeness or accuracy. The indices are used with permission. The indices may not be copied, used, or distributed without J.P. Morgan’s prior written approval. Copyright 2024, JPMorgan Chase & Co. All rights reserved.) Index performance is provided for illustrative purposes only. Indices are unmanaged and do not incur fees or expenses. A direct investment in an unmanaged index is not possible. [2]Source: J.P. Morgan. CEMBI default rates are par weighted and based on bond stock at prior year-end. Note: Long-term average since 2002. 2024 level is as of September 2024.

Any investment or strategy mentioned herein may not be appropriate for every investor. There can be no assurance that investment objectives will be met. Products and services listed are available only to residents of this jurisdiction and may only be available to certain categories of investors. The information on this website does not constitute an offer for products or services, or a solicitation of an offer to any persons outside of this jurisdiction who are prohibited from receiving such information under applicable laws and regulations. Nothing on this webpage should be construed as advice and is therefore not a recommendation to buy or sell shares.

Please carefully consider the William Blair Funds’ investment objectives, risks, charges, and expenses before investing. This and other information is contained in the Funds’ prospectus and summary prospectus, which you may obtain by calling 1-800-742-7272. Read the prospectus and summary prospectus carefully before investing. Investing includes the risk of loss.

The William Blair Funds are distributed by William Blair & Company, L.L.C., member FINRA/SIPC.

The William Blair SICAV is a Luxembourg investment company with variable capital registered with the Commission de Surveillance du Secteur Financier (“CSSF”) which qualifies as an undertaking for collective investment in transferable securities (“UCITS”). The Management Company of the SICAV has appointed William Blair Investment Management, LLC as the investment manager for the fund.

Please carefully consider the investment objectives, risks, charges, and expenses of the William Blair SICAV. This and other important information is contained in the prospectus and Key Investor Information Document (KIID). Read these documents carefully before investing. The information contained on this website is not a substitute for those documents or for professional external advice.

Information and opinions expressed are those of the authors and may not reflect the opinions of other investment teams within William Blair Investment Management, LLC, or affiliates. Factual information has been taken from sources we believe to be reliable, but its accuracy, completeness or interpretation cannot be guaranteed. Information is current as of the date appearing in this material only and subject to change without notice. Statements concerning financial market trends are based on current market conditions, which will fluctuate. This material may include estimates, outlooks, projections, and other forward-looking statements. Due to a variety of factors, actual events may differ significantly from those presented.

Investing involves risks, including the possible loss of principal. Equity securities may decline in value due to both real and perceived general market, economic, and industry conditions. The securities of smaller companies may be more volatile and less liquid than securities of larger companies. Investing in foreign denominated and/or domiciled securities may involve heightened risk due to currency fluctuations, and economic and political risks. These risks may be enhanced in emerging markets and frontier markets. Investing in the bond market is subject to certain risks including market, interest rate, issuer, credit, and inflation risk. High-yield, lower-rated, securities involve greater risk than higher-rated securities. Different investment styles may shift in and out of favor depending on market conditions. Diversification does not ensure against loss.

Past performance is not indicative of future returns. References to specific companies are for illustrative purposes only and should not be construed as investment advice or a recommendation to buy or sell any security.

William Blair Investment Management, LLC is an investment adviser registered with the U.S. Securities and Exchange Commission.

Issued in the United Kingdom by William Blair International, Ltd., authorized and regulated by the Financial Conduct Authority (FCA), and is only directed at and is only made available to persons falling within articles 19, 38, 47, and 49 of the Financial Services and Markets Act of 2000 (Financial Promotion) Order 2005 (all such persons being referred to as "relevant persons").

Issued in the European Economic Area (EEA) by William Blair B.V., authorized and supervised by the Dutch Authority for the Financial Markets (AFM) under license number 14006134 and also supervised by the Dutch Central Bank (DNB), registered at the Dutch Chamber of Commerce under number 82375682 and has its statutory seat in Amsterdam, the Netherlands. This material is only intended for eligible counterparties and professional clients.

Issued in Switzerland by William Blair Investment Services (Zurich) GmbH, Talstrasse 65, 8001 Zurich, Switzerland ("WBIS"). WBIS is engaged in the offering of collective investment schemes and renders further, non-regulated services in the financial sector. WBIS is affiliated with FINOS Finanzomubdsstelle Schweiz, a recognized ombudsman office where clients may initiate mediation proceedings pursuant to articles 74 et seq. of the Swiss Financial Services Act ("FinSA"). The client advisers of WBIS are registered with regservices.ch by BX Swiss AG, a client adviser registration body authorized by the Swiss Financial Market Supervisory Authority ("FINMA"). WBIS is not supervised by FINMA or any other supervisory authority or self-regulatory organization. This material is only intended for institutional and professional clients pursuant to article 4(3) to (5) FinSA.

Issued in Australia by William Blair Investment Management, LLC (“William Blair”), which is exempt from the requirement to hold an Australian financial services license under Australia's Corporations Act 2001 (Cth). William Blair is registered as an investment advisor with the U.S. Securities and Exchange Commission (“SEC”) and regulated by the SEC under the U.S. Investment Advisers Act of 1940, which differs from Australian laws. This material is intended only for wholesale clients.

Issued in Singapore by William Blair International (Singapore) Pte. Ltd. (Registration Number 201943312R), which is regulated by the Monetary Authority of Singapore under a Capital Markets Services License to conduct fund management activities. This material is intended only for institutional investors and may not be distributed to retail investors.

Issued in Canada by William Blair Investment Management, LLC, which relies on the international adviser exemption, pursuant to section 8.26 of National Instrument 31-103 in Canada.

The content contained in this site is intended as informational or educational in nature and does not constitute investment advice or a recommendation of any investment strategy or product for a particular investor. Investment advice and recommendations can be provided only after careful consideration of an investor’s objectives, guidelines, and restrictions. Investors should consult a financial professional/financial consultant or investment adviser before making any investment decisions. Investing includes the risk of loss.

Copyright © 2026 William Blair. William Blair is a registered trademark of William Blair & Company, L.L.C. “William Blair” refers to William Blair Investment Management, LLC and affiliates.