July 30, 2024 | Emerging Markets Debt

Investments

ASSET-CLASS CAPABILITIES

Insights

EDUCATION CENTER

SUBSCRIBE

July 30, 2024 | Emerging Markets Debt

Despite the uninspiring performance of emerging markets (EM) debt in the second quarter, we expect a stronger second half of the year characterized by resilient economic growth, lower global rates, and improving global liquidity conditions.

EM debt is driven by two predominant macro forces—global economic growth and global liquidity conditions—and we have a constructive near-term view of global economic dynamics and expect a gradual improvement in global liquidity conditions.

In terms of global economic dynamics, we believe the global economy should continue to expand close to potential growth levels. In our view, the U.S. economy should remain resilient despite early signs of deceleration, European economic conditions should continue to normalize, and Chinese government stimulus should continue to support economic activity.

In terms of global liquidity conditions, we expect the global disinflationary process to continue, albeit gradually, and see policy rate cuts in sight in developed economies. The gradual removal of monetary policy restrictions should, in our opinion, lead to lower global rates and improved liquidity conditions in the second half of the year.

We believe EM debt offers an attractive investment opportunity within the fixed-income space.

Meanwhile, in EMs more specifically, growth remains surprisingly strong. Commodity prices are supportive. Disinflation is creating opportunities for monetary policy easing, and some EM central banks have already started easing. We expect the growth differential of EMs to developed markets to accelerate to above 2% in the next few years, and this should be a driver of capital flows into EM economies.

At the same time, EM credit fundamentals remain resilient in most places. Strong multilateral organizations—including the International Monetary Fund (IMF), World Bank, and Regional Development Banks—and bilateral organizations have provided ample and affordable funding to countries facing difficulties to refinance in the marketplace.

All in all, we believe EM debt offers an attractive investment opportunity within the fixed-income space as valuations remain attractive, yield levels are above long-term averages, real interest rate differentials are high relative to developed markets, and currencies remain undervalued in many places.

That said, geopolitical tensions are concerning—in particular, potential military escalation in Ukraine (dragging NATO countries into the conflict) and tensions in the Middle East. We will also watch the U.S. presidential election closely.

Broadly speaking, we believe there are several attractive opportunities for EM debt investors. First, we are seeking to lock in attractive real and nominal yields via exposure to long-duration securities. Second, we believe the global market environment will remain conducive to the outperformance of high-beta, high-yield credit. Third, we see scope for fundamental differentiation and prefer countries with easier access to multilateral and bilateral funding. And lastly, while the higher-for-longer rate environment is affecting corporate credit quality on the margin, many corporate issuers have extended maturities and have refinancing options.

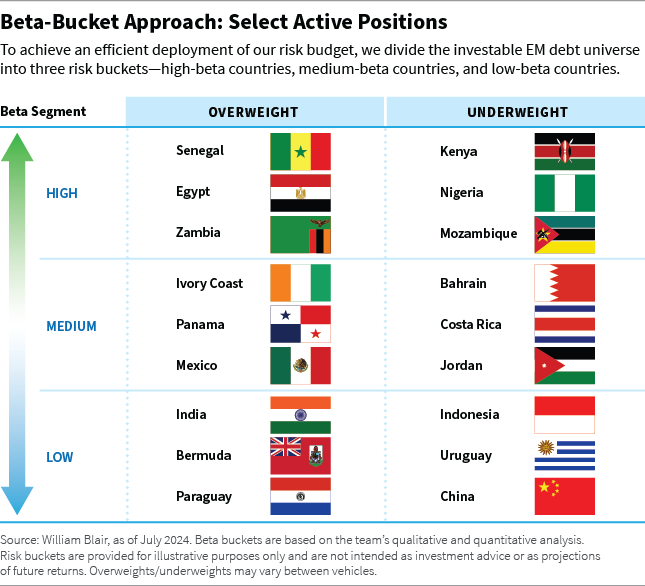

Below, we break down some of our largest active positions by beta bucket, which is how we allocate our risk budget.

In the high-beta bucket, our largest overweight positions are in Senegal, Egypt, and Zambia, and our largest underweight positions are in Kenya, Nigeria, and Mozambique.

Senegal (overweight): We believe Senegal will see a marked improvement in its credit metrics as its burgeoning oil sector develops. Meanwhile, political risks have diminished after the opposition won the presidential election—and while the opposition’s campaign was premised on populist claims, ministerial appointments under the incoming government suggest a continuation of economic reforms and prudent macroeconomic policies.

Egypt (overweight): We have a constructive view of valuations and believe short-term fundamentals should be supported by financial assistance from bilateral and multilateral donors and substantial foreign direct investment flows from regional investors.

Zambia (overweight): Following the restructuring and exchange into two performing bonds, one of which has triggers for a step-up in coupon payments, we believe Zambia is attractive. These triggers are likely to be reached in the coming years. Despite the current drought-related shock, our outlook on Zambia's fundamentals remains broadly positive. We anticipate further financial assistance to help mitigate the negative impact.

We believe the administration of Mexican President-elect Claudia Sheinbaum Pardo should support Pemex.

Kenya (underweight): Kenyan authorities want to reduce fiscal borrowing needs but face challenges in implementing measures to increase revenue. Given the current political climate, pursuing fiscal consolidation by raising taxes will be increasingly challenging: For example, recently, the president did not sign a finance bill that would introduce several tax measures due to widespread public protests. Further cuts in expenditures are also likely to prove difficult, casting doubt on the current macroeconomic plan under an IMF reform package.

Nigeria (underweight): Nigeria has tight valuations relative to peers and has shown slow progress on economic reforms, and there are only 18 months left for this regime to focus on implementation of reforms before its focus is likely to shift toward the next elections. We continue to await further issuance of Eurobonds by Nigeria, which may present a more attractive proposition to reduce our underweight.

Mozambique (underweight): We currently do not hold a position in Mozambique due to the relatively tight spread and the possibility of development delays in the liquefied natural gas sector. In addition, the upcoming presidential election in October 2024 suggests that fiscal policy is unlikely to tighten, potentially introducing political risks and uncertainty.

In the medium-beta bucket, our largest overweight positions are in Ivory Coast, Panama, and Mexico, and our largest underweight positions are in Bahrain, Costa Rica, and Jordan.

Ivory Coast (overweight): We believe Ivory Coast has favorable valuations relative to its peers. The country’s debt is also supported by strong fundamentals and support from development partners, including the IMF. Ivory Coast authorities will receive further funding from the IMF under the Resilience and Sustainability Facility in 2024. In our view, the peaceful political transition following Senegalese presidential elections will also bolster confidence in the political process in Ivory Coast as we head toward the elections next year.

Panama (overweight): We are optimistic that the new administration will attempt to tackle Panama’s fiscal and growth challenges but recognize that there is uncertainty in regard to implementation. Hence, we prefer a more convex position, and have a small overweight in the long end of the curve. We also believe valuations remain attractive despite the risk of a potential downgrade in the tail end of 2024.

India has relatively high economic growth, resilient credit conditions, and likely policy continuity.

Mexico (overweight): We reduced some of our risk in Pemex based on valuations, but our overall outlook is constructive, because we believe the administration of President-elect Claudia Sheinbaum Pardo should support Pemex, and this could lead to spread compression over time.

Bahrain (underweight): Our positioning is based on a combination of relatively weak fiscal reform efforts, deterioration in regional geopolitical risks, and tight valuations.

Costa Rica (underweight): Fundamentals remain strong, but we believe valuations are unattractive as spreads have compressed materially.

Jordan (underweight): Conflict in the Middle East is hurting Jordan’s economy via severely reduced tourism, which reduces Jordan’s potential creditworthiness. These challenges have been largely offset by stronger international support, but geopolitical risks remain elevated.

In the low-beta bucket, our largest overweight positions are in India, Bermuda, and Paraguay, and our largest underweight positions are in Indonesia, Uruguay, and China

India (overweight): We have a neutral spread duration position in quasi-sovereign risk based on tight valuations but are overweight through selective corporate bond exposure. India has relatively high economic growth, resilient credit conditions, and likely policy continuity after its elections earlier this year, which saw Prime Minister Narendra Modi’s National Democratic Alliance retain a majority in parliament.

Bermuda (overweight): We prefer valuations and fundamentals in Bermuda to those of other low-beta sovereigns. Bermuda’s bonds have similar valuations to those of Peru and Chile, but we believe the country has a stronger fundamental trajectory with less institutional uncertainty.

Paraguay (overweight): We also prefer Paraguay’s valuations and fundamentals to those of other low-beta sovereigns. Although Paraguay has lagged year to date, we believe the country is on an improving fundamental trajectory and has attractive valuations for the low-beta bucket.

Indonesia (underweight): The country’s fundamental outlook became murkier after presidential elections in February, and there is risk of fiscal slippage should the new government increase spending. In addition, a slowdown in the windfall from commodity exports and a persistently strong U.S. dollar backdrop could weaken external positions. Overall, we find valuations unappealing.

Uruguay (underweight): In our view, valuations are poor. Credit fundamentals remain strong, but bond prices have compressed materially since the COVID-19 pandemic, and we believe this results in limited scope for additional spread tightening.

China (underweight): Spread valuations are tight and regulatory risks for Chinese state-owned entities are unpredictable. Domestic consumption is lackluster, while the property market recovery has been slow. Based on bottom-up analysis, we hold selective corporate bonds that we believe show some upside potential.

Marco Ruijer, CFA, partner, is a portfolio manager on William Blair’s emerging markets debt team.

Want the latest insights on the economy and other forces shaping the investment landscape?

Subscribe to our Investing Insights newsletter.

Any investment or strategy mentioned herein may not be appropriate for every investor. There can be no assurance that investment objectives will be met. Products and services listed are available only to residents of this jurisdiction and may only be available to certain categories of investors. The information on this website does not constitute an offer for products or services, or a solicitation of an offer to any persons outside of this jurisdiction who are prohibited from receiving such information under applicable laws and regulations. Nothing on this webpage should be construed as advice and is therefore not a recommendation to buy or sell shares.

Please carefully consider the William Blair Funds’ investment objectives, risks, charges, and expenses before investing. This and other information is contained in the Funds’ prospectus and summary prospectus, which you may obtain by calling 1-800-742-7272. Read the prospectus and summary prospectus carefully before investing. Investing includes the risk of loss.

The William Blair Funds are distributed by William Blair & Company, L.L.C., member FINRA/SIPC.

The William Blair SICAV is a Luxembourg investment company with variable capital registered with the Commission de Surveillance du Secteur Financier (“CSSF”) which qualifies as an undertaking for collective investment in transferable securities (“UCITS”). The Management Company of the SICAV has appointed William Blair Investment Management, LLC as the investment manager for the fund.

Please carefully consider the investment objectives, risks, charges, and expenses of the William Blair SICAV. This and other important information is contained in the prospectus and Key Investor Information Document (KIID). Read these documents carefully before investing. The information contained on this website is not a substitute for those documents or for professional external advice.

Information and opinions expressed are those of the authors and may not reflect the opinions of other investment teams within William Blair Investment Management, LLC, or affiliates. Factual information has been taken from sources we believe to be reliable, but its accuracy, completeness or interpretation cannot be guaranteed. Information is current as of the date appearing in this material only and subject to change without notice. Statements concerning financial market trends are based on current market conditions, which will fluctuate. This material may include estimates, outlooks, projections, and other forward-looking statements. Due to a variety of factors, actual events may differ significantly from those presented.

Investing involves risks, including the possible loss of principal. Equity securities may decline in value due to both real and perceived general market, economic, and industry conditions. The securities of smaller companies may be more volatile and less liquid than securities of larger companies. Investing in foreign denominated and/or domiciled securities may involve heightened risk due to currency fluctuations, and economic and political risks. These risks may be enhanced in emerging markets and frontier markets. Investing in the bond market is subject to certain risks including market, interest rate, issuer, credit, and inflation risk. High-yield, lower-rated, securities involve greater risk than higher-rated securities. Different investment styles may shift in and out of favor depending on market conditions. Diversification does not ensure against loss.

Past performance is not indicative of future returns. References to specific companies are for illustrative purposes only and should not be construed as investment advice or a recommendation to buy or sell any security.

William Blair Investment Management, LLC is an investment adviser registered with the U.S. Securities and Exchange Commission.

Issued in the United Kingdom by William Blair International, Ltd., authorized and regulated by the Financial Conduct Authority (FCA), and is only directed at and is only made available to persons falling within articles 19, 38, 47, and 49 of the Financial Services and Markets Act of 2000 (Financial Promotion) Order 2005 (all such persons being referred to as "relevant persons").

Issued in the European Economic Area (EEA) by William Blair B.V., authorized and supervised by the Dutch Authority for the Financial Markets (AFM) under license number 14006134 and also supervised by the Dutch Central Bank (DNB), registered at the Dutch Chamber of Commerce under number 82375682 and has its statutory seat in Amsterdam, the Netherlands. This material is only intended for eligible counterparties and professional clients.

Issued in Switzerland by William Blair Investment Services (Zurich) GmbH, Talstrasse 65, 8001 Zurich, Switzerland ("WBIS"). WBIS is engaged in the offering of collective investment schemes and renders further, non-regulated services in the financial sector. WBIS is affiliated with FINOS Finanzomubdsstelle Schweiz, a recognized ombudsman office where clients may initiate mediation proceedings pursuant to articles 74 et seq. of the Swiss Financial Services Act ("FinSA"). The client advisers of WBIS are registered with regservices.ch by BX Swiss AG, a client adviser registration body authorized by the Swiss Financial Market Supervisory Authority ("FINMA"). WBIS is not supervised by FINMA or any other supervisory authority or self-regulatory organization. This material is only intended for institutional and professional clients pursuant to article 4(3) to (5) FinSA.

Issued in Australia by William Blair Investment Management, LLC (“William Blair”), which is exempt from the requirement to hold an Australian financial services license under Australia's Corporations Act 2001 (Cth). William Blair is registered as an investment advisor with the U.S. Securities and Exchange Commission (“SEC”) and regulated by the SEC under the U.S. Investment Advisers Act of 1940, which differs from Australian laws. This material is intended only for wholesale clients.

Issued in Singapore by William Blair International (Singapore) Pte. Ltd. (Registration Number 201943312R), which is regulated by the Monetary Authority of Singapore under a Capital Markets Services License to conduct fund management activities. This material is intended only for institutional investors and may not be distributed to retail investors.

Issued in Canada by William Blair Investment Management, LLC, which relies on the international adviser exemption, pursuant to section 8.26 of National Instrument 31-103 in Canada.

The content contained in this site is intended as informational or educational in nature and does not constitute investment advice or a recommendation of any investment strategy or product for a particular investor. Investment advice and recommendations can be provided only after careful consideration of an investor’s objectives, guidelines, and restrictions. Investors should consult a financial professional/financial consultant or investment adviser before making any investment decisions. Investing includes the risk of loss.

Copyright © 2026 William Blair. William Blair is a registered trademark of William Blair & Company, L.L.C. “William Blair” refers to William Blair Investment Management, LLC and affiliates.