February 6, 2025 | Emerging Markets Debt

Investments

ASSET-CLASS CAPABILITIES

Insights

EDUCATION CENTER

SUBSCRIBE

February 6, 2025 | Emerging Markets Debt

Emerging markets (EM) debt, which performed well for most of 2024, lost momentum in the fourth quarter due to uncertainty about the new U.S. administration’s policy agenda, inflation concerns, and monetary policy repricing.

We now believe EM debt credit spreads are more indicative of fair valuations. While high-grade credit spreads are below long-term averages, high-yield credit spreads are still marginally above long-term averages. Moreover, the spread between high-yield EM debt and high-grade EM debt (as well as U.S. corporate high-yield credit) remains above long-term averages.

While EM debt credit spreads are clearly less appealing than they were in 2023 and early 2024, yield levels remain attractive, in our opinion, driven by higher underlying U.S. Treasury yields. Therefore, we expect EM hard currency debt returns in 2025 to be driven predominantly by lower U.S. underlying Treasury yields and carry, and less by credit-spread compression.

Our favorable outlook for the 10-year U.S. Treasury yield has not changed since the U.S. elections, and we continue to believe that there are attractive opportunities for investors to increase exposure to long-duration securities to lock in attractive real and nominal yields.

We also expect favorable technical conditions, and 2025 should be another year of subdued new net debt issuance. And we could see positive flows into the asset class as higher yields drive investors back to fixed income in a U.S. Federal Reserve (Fed) rate-cutting cycle.

We continue to see marginally better value in high-yield, high-beta credit and remain positioned for further high-yield/investment-grade credit spread compression. That said, we believe the distressed/defaulted universe should present fewer investment opportunities as most defaulted countries have restructured. Furthermore, we do not expect EM sovereign credit defaults over the next year.

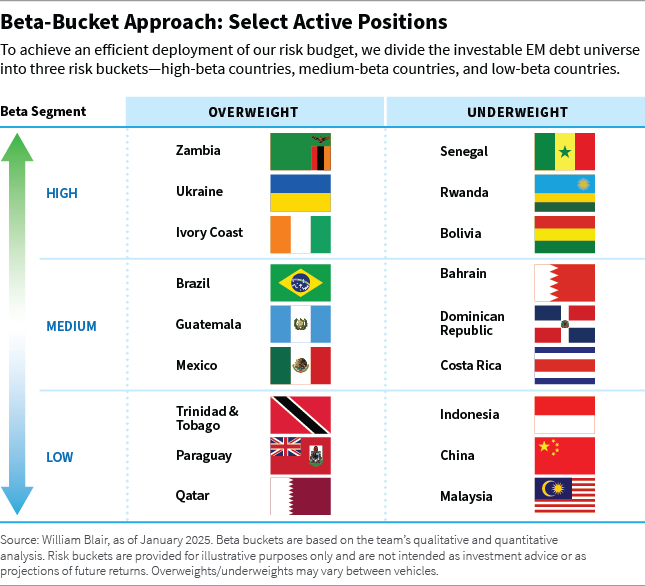

Below, we break down some of our largest active positions by beta bucket, which is how we allocate our risk budget.

In the high-beta bucket, our largest overweight positions are in Zambia, Ukraine, and Ivory Coast, while our largest underweight positions are in Senegal, Rwanda, and Bolivia.

Zambia (overweight): Valuations appear favorable and the fundamental outlook is positive. We believe 2025 is likely to show improved agricultural performance and energy availability as rains bring much-needed relief. Activity in the mining sector should also support copper output, in our view.

Ukraine (overweight): There is the potential for conflict negotiations, multilateral support, and a more optimistic growth outlook in 2025. We express this view through an overweight to warrants, but have recently reduced our allocation to the B bonds based on valuations.

Ivory Coast (overweight): We are overweight euro-denominated hard currency bonds due to attractive valuations and our view that the country fundamentally is on a path of improvement. Authorities appear committed to prudent fiscal policies, supported by strong backing from development partners.

Senegal (underweight): Public debt and fiscal deficit figures have been revised upward for the past five years, with sharp fiscal underperformance in 2024. The 2025 budget’s fiscal consolidation faces significant implementation risks. While bond valuations have improved, we see limited potential for outperformance without credible policy measures to restore fiscal credibility.

Rwanda (underweight): Our lack of a position is the result of tight valuations and fundamental concerns about the size of Rwanda’s twin deficits.

Bolivia (underweight): Our underweight is largely due to credit concerns. The policy mix of large fiscal deficits and a pegged exchange rate appears unsustainable amid low reserves, a current account deficit, and 2024’s foreign currency shortages. Valuations are not compelling enough to justify a position given the country’s weak fundamentals, in our opinion.

In Brazil, we have shifted corporate credit exposure toward sovereign positions.

In the medium-beta bucket, our largest overweight positions are in Brazil, Guatemala, and Mexico, while our largest underweight positions are in Bahrain, Dominican Republic, and Costa Rica.

Brazil (overweight): We increased exposure late in the fourth quarter, finding valuations attractive despite a weaker fundamental outlook. While the budget deficit raises concerns, it primarily impacts local currency debt, as Brazil’s liabilities are mostly denominated in the real. We have shifted corporate credit exposure toward sovereign positions.

Guatemala (overweight): The country has what we consider attractive valuations and strong fundamentals, including low debt, stable deficits, and robust growth, all of which support a positive ratings trajectory.

Mexico (overweight): We favor Pemex for its sovereign backing and attractive valuations relative to the sovereign. We also maintain positions in Mexican financials and airlines. However, we are underweight the Mexico sovereign because we don’t find the valuations compelling.

Bahrain (underweight): We are concerned about volatility in regional geopolitics, the country’s weak fiscal-reform efforts, lower oil prices, and tight valuations.

Dominican Republic (underweight): Although the country appears to be on a positive fundamental trajectory, we do not find valuations compelling.

Costa Rica (underweight): Fundamentals are strong, but we find valuations unattractive because spreads have compressed materially.

In the low-beta bucket, our largest overweight positions are in Trinidad and Tobago, Paraguay, and Qatar, while our largest underweight positions are in Indonesia, China, and Malaysia.

Trinidad and Tobago (overweight): We recently moved to an overweight position due to the country’s more appealing valuations relative to its low-beta peers.

Paraguay (overweight): We believe the country has attractive valuations relative to low-beta peers. We also find its fundamentals solid: the country’s debt-to-gross-domestic-product ratio remains low and the country has a strong history of low fiscal deficits.

We believe Qatar is the most resilient market in the region in case of falling oil prices due to its lower fiscal breakeven.

Qatar (overweight): We believe Qatar is the most resilient market in the region in case of falling oil prices due to its lower fiscal breakeven.

Indonesia (underweight): We find valuations unappealing, and the outlook appears uncertain following the February 2024 presidential elections. With the new government prioritizing growth over stability, fiscal slippage risks have increased. Indonesia is expected to be a significant external debt issuer in 2025. However, we maintain diverse corporate positions, supported by resilient fundamentals in financials, renewable utilities, and oil and gas.

China (underweight): Valuations are tight, and Chinese state-owned entities have unpredictable regulatory risks. Based on a bottom-up analysis, we hold selective corporate bonds at attractive valuations and positive credit trajectories.

Malaysia (underweight): Valuations are unappealing. Although the country’s economic growth remains robust, supported by resilient exports and strong private consumption, and fiscal consolidation efforts are ongoing, the spreads for Malaysia’s sovereign bonds are among the lowest in the index.

Marco Ruijer, CFA, partner, is a portfolio manager on William Blair’s emerging markets debt team.

View Fund:

https://im.williamblair.com/investments/sicav-funds/lu2093691256-emerging-markets-debt-hard-currency-fund

View Fund:

https://im.williamblair.com/investments/sicav-funds/lu2093699408-emerging-markets-debt-local-currency-fund

View Fund:

https://im.williamblair.com/investments/sicav-funds/lu2879845290-emerging-markets-frontier-debt-fund

View Strategy:

https://im.williamblair.com/investments/separate-accounts/emerging-markets-debt

View Strategy:

https://im.williamblair.com/investments/separate-accounts/emerging-markets-debt-hard-currency

View Strategy:

https://im.williamblair.com/investments/separate-accounts/emerging-markets-debt-local-currency

View Strategy:

https://im.williamblair.com/investments/separate-accounts/emerging-markets-frontier-debt

Want the latest insights on the economy and other forces shaping the investment landscape?

Subscribe to our Investing Insights newsletter.

Any investment or strategy mentioned herein may not be appropriate for every investor. There can be no assurance that investment objectives will be met. Products and services listed are available only to residents of this jurisdiction and may only be available to certain categories of investors. The information on this website does not constitute an offer for products or services, or a solicitation of an offer to any persons outside of this jurisdiction who are prohibited from receiving such information under applicable laws and regulations. Nothing on this webpage should be construed as advice and is therefore not a recommendation to buy or sell shares.

Please carefully consider the William Blair Funds’ investment objectives, risks, charges, and expenses before investing. This and other information is contained in the Funds’ prospectus and summary prospectus, which you may obtain by calling 1-800-742-7272. Read the prospectus and summary prospectus carefully before investing. Investing includes the risk of loss.

The William Blair Funds are distributed by William Blair & Company, L.L.C., member FINRA/SIPC.

The William Blair SICAV is a Luxembourg investment company with variable capital registered with the Commission de Surveillance du Secteur Financier (“CSSF”) which qualifies as an undertaking for collective investment in transferable securities (“UCITS”). The Management Company of the SICAV has appointed William Blair Investment Management, LLC as the investment manager for the fund.

Please carefully consider the investment objectives, risks, charges, and expenses of the William Blair SICAV. This and other important information is contained in the prospectus and Key Investor Information Document (KIID). Read these documents carefully before investing. The information contained on this website is not a substitute for those documents or for professional external advice.

Information and opinions expressed are those of the authors and may not reflect the opinions of other investment teams within William Blair Investment Management, LLC, or affiliates. Factual information has been taken from sources we believe to be reliable, but its accuracy, completeness or interpretation cannot be guaranteed. Information is current as of the date appearing in this material only and subject to change without notice. Statements concerning financial market trends are based on current market conditions, which will fluctuate. This material may include estimates, outlooks, projections, and other forward-looking statements. Due to a variety of factors, actual events may differ significantly from those presented.

Investing involves risks, including the possible loss of principal. Equity securities may decline in value due to both real and perceived general market, economic, and industry conditions. The securities of smaller companies may be more volatile and less liquid than securities of larger companies. Investing in foreign denominated and/or domiciled securities may involve heightened risk due to currency fluctuations, and economic and political risks. These risks may be enhanced in emerging markets and frontier markets. Investing in the bond market is subject to certain risks including market, interest rate, issuer, credit, and inflation risk. High-yield, lower-rated, securities involve greater risk than higher-rated securities. Different investment styles may shift in and out of favor depending on market conditions. Diversification does not ensure against loss.

Past performance is not indicative of future returns. References to specific companies are for illustrative purposes only and should not be construed as investment advice or a recommendation to buy or sell any security.

William Blair Investment Management, LLC is an investment adviser registered with the U.S. Securities and Exchange Commission.

Issued in the United Kingdom by William Blair International, Ltd., authorized and regulated by the Financial Conduct Authority (FCA), and is only directed at and is only made available to persons falling within articles 19, 38, 47, and 49 of the Financial Services and Markets Act of 2000 (Financial Promotion) Order 2005 (all such persons being referred to as "relevant persons").

Issued in the European Economic Area (EEA) by William Blair B.V., authorized and supervised by the Dutch Authority for the Financial Markets (AFM) under license number 14006134 and also supervised by the Dutch Central Bank (DNB), registered at the Dutch Chamber of Commerce under number 82375682 and has its statutory seat in Amsterdam, the Netherlands. This material is only intended for eligible counterparties and professional clients.

Issued in Switzerland by William Blair Investment Services (Zurich) GmbH, Talstrasse 65, 8001 Zurich, Switzerland ("WBIS"). WBIS is engaged in the offering of collective investment schemes and renders further, non-regulated services in the financial sector. WBIS is affiliated with FINOS Finanzomubdsstelle Schweiz, a recognized ombudsman office where clients may initiate mediation proceedings pursuant to articles 74 et seq. of the Swiss Financial Services Act ("FinSA"). The client advisers of WBIS are registered with regservices.ch by BX Swiss AG, a client adviser registration body authorized by the Swiss Financial Market Supervisory Authority ("FINMA"). WBIS is not supervised by FINMA or any other supervisory authority or self-regulatory organization. This material is only intended for institutional and professional clients pursuant to article 4(3) to (5) FinSA.

Issued in Australia by William Blair Investment Management, LLC (“William Blair”), which is exempt from the requirement to hold an Australian financial services license under Australia's Corporations Act 2001 (Cth). William Blair is registered as an investment advisor with the U.S. Securities and Exchange Commission (“SEC”) and regulated by the SEC under the U.S. Investment Advisers Act of 1940, which differs from Australian laws. This material is intended only for wholesale clients.

Issued in Singapore by William Blair International (Singapore) Pte. Ltd. (Registration Number 201943312R), which is regulated by the Monetary Authority of Singapore under a Capital Markets Services License to conduct fund management activities. This material is intended only for institutional investors and may not be distributed to retail investors.

Issued in Canada by William Blair Investment Management, LLC, which relies on the international adviser exemption, pursuant to section 8.26 of National Instrument 31-103 in Canada.

The content contained in this site is intended as informational or educational in nature and does not constitute investment advice or a recommendation of any investment strategy or product for a particular investor. Investment advice and recommendations can be provided only after careful consideration of an investor’s objectives, guidelines, and restrictions. Investors should consult a financial professional/financial consultant or investment adviser before making any investment decisions. Investing includes the risk of loss.

Copyright © 2026 William Blair. William Blair is a registered trademark of William Blair & Company, L.L.C. “William Blair” refers to William Blair Investment Management, LLC and affiliates.