As investors and headlines have focused on tariff policy and trade talks, Asian currencies have been strengthening. For years, many Asian economies have run persistent current account surpluses and recycled their earnings into U.S. assets. But with the U.S. dollar losing some altitude, capital flows may be shifting.

Asian Currency Strength Signals Change in Investor Sentiment

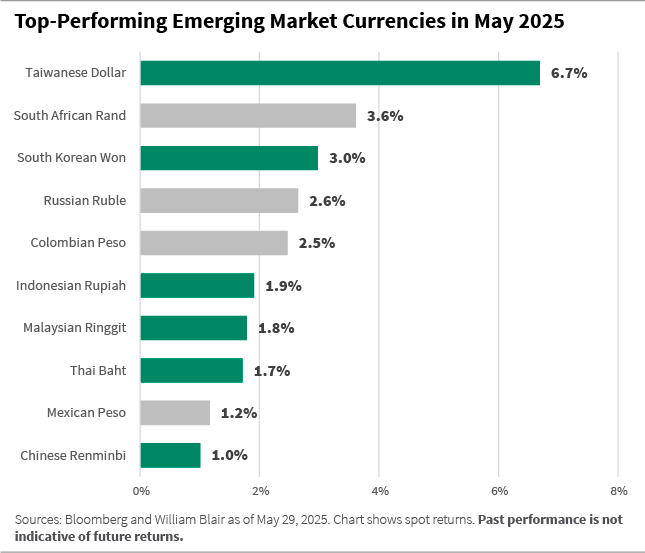

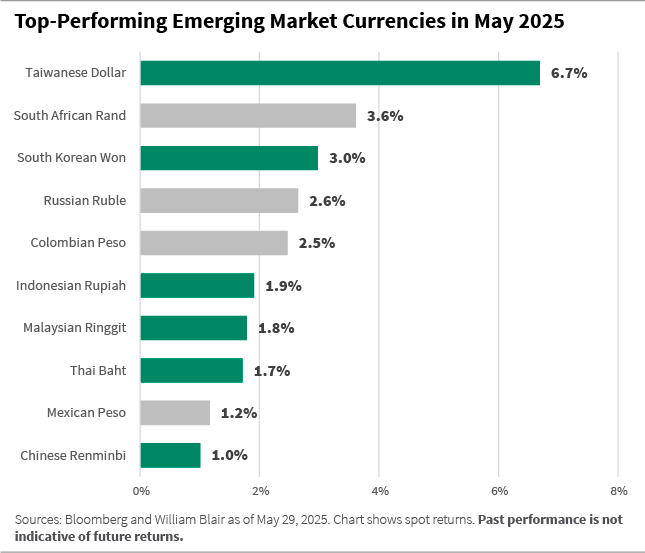

After four years of broad U.S. dollar strength against Asian currencies, the tide appears to be turning, with Asian currencies attracting renewed attention from global investors over the past month. The Taiwanese dollar led the move, strengthening as much as 7% against the U.S. dollar. The South Korean won also posted notable gains, rising 3%.

While concerns about U.S. trade and fiscal policy likely contributed to the dollar’s weakness, the pace and scale of recent moves in Asia have been unusual. Asian currencies are not just participating in the broader rebound in emerging market currencies—they’re leading it.

The strength of these currencies may point to shifting capital flows and a potential change in investor sentiment across the region.

Capital Is Likely Shifting

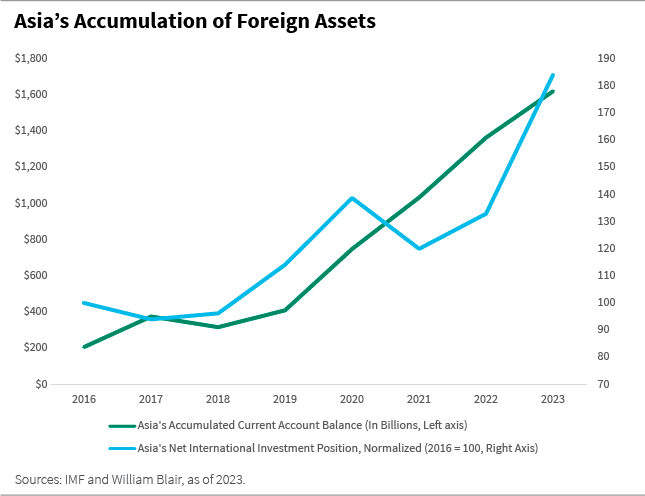

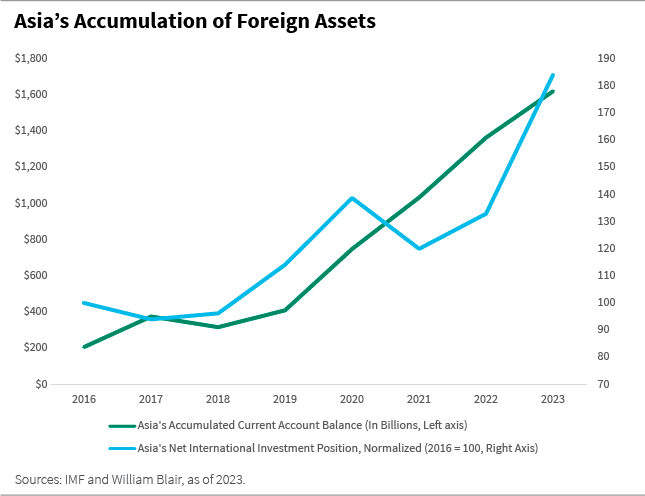

Over the past several years, many Asian countries—including China, Japan, South Korea, Taiwan, and Malaysia—have run current account surpluses, fueled by strong export sectors. These surpluses have enabled the region to accumulate significant foreign assets, as the chart below illustrates.

A substantial share of this capital appears to have been deployed into U.S. assets. Asia’s holdings of U.S. stocks exceeded $4 trillion last year, and total capital invested in U.S. securities reached $7.5 trillion. This concentration suggests that if concerns about U.S. policy escalate, the potential for capital to return to Asia—through repatriation or diversification—is high.

This dynamic is particularly relevant for countries with high net foreign assets, such as Taiwan, South Korea, and Malaysia, where foreign currency deposits have increased significantly. In Malaysia, for example, we estimate foreign currency deposits have increased by 75% over the last five years.

A low-inflation environment may further drive portfolio flows into the region.

Moreover, in some Asian economies, such as Taiwan, much foreign asset exposure is unhedged, leaving the economy more sensitive to shifts in currency sentiment. Without hedging, investors bear the full impact of currency moves—so when the U.S. dollar weakens, these countries have a stronger incentive to repatriate capital or to increase their hedge ratios to avoid further foreign exchange (FX) losses. That can amplify demand for the Taiwan dollar and accelerate its appreciation.

These factors help explain the sharp recent moves in the Taiwan dollar and South Korean won, which may offer a preview of how quickly positioning can unwind if sentiment toward U.S. assets deteriorates. A combination of onshore hedging by institutional investors, repatriation of foreign capital, and exporters converting foreign currency deposits back into local currency could put meaningful upward pressure on Asian currencies.

Moreover, in a low-inflation environment, as is currently the case in most Asian countries, reduced currency risk premia on local currency bonds may cause bond investors to further drive portfolio flows into the region.

How Have Trade and Investment in Asia Evolved?

The outcome of U.S. tariff policy is uncertain, in part because as of writing, the legality of tariffs imposed under the International Emergency Economic Powers Act is in question.

However, during May, bilateral trade talks took place between the United States and several Asian countries, including China, South Korea, and India. The United States and China have agreed to a 90-day tariff reduction as ongoing bilateral trade talks continue. The United States and South Korea have discussed trade imbalances and currency dynamics. The United States and India have shown some progress in trade talks, but a deal has yet to be struck.

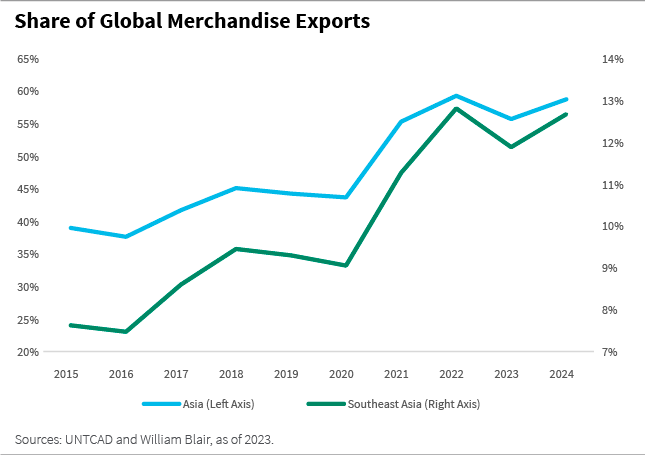

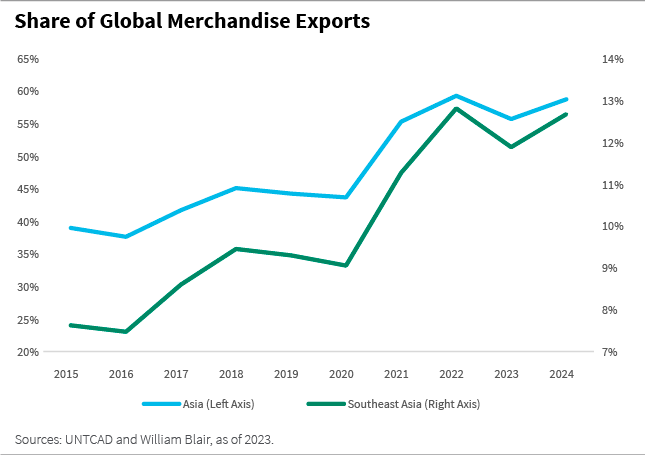

While the eventual outcome of tariff developments is unclear, we believe Asia will likely remain competitive in exporting goods and attracting foreign investment. Over the past 10 years, the share of global merchandise exports in Asia has increased almost 20 percentage points—from below 40% in 2015 to about 60% last year, as the chart below shows.

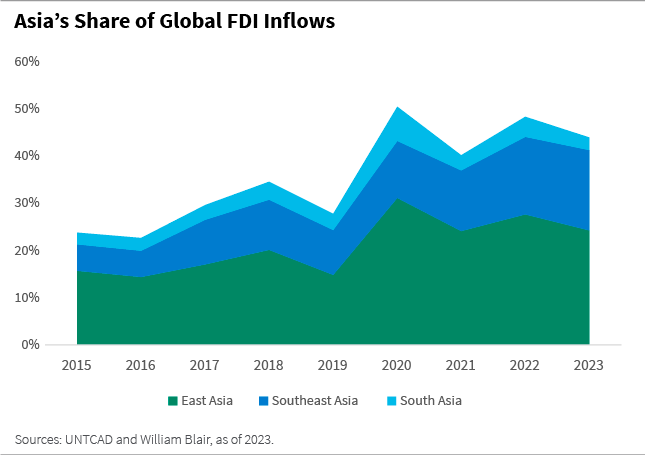

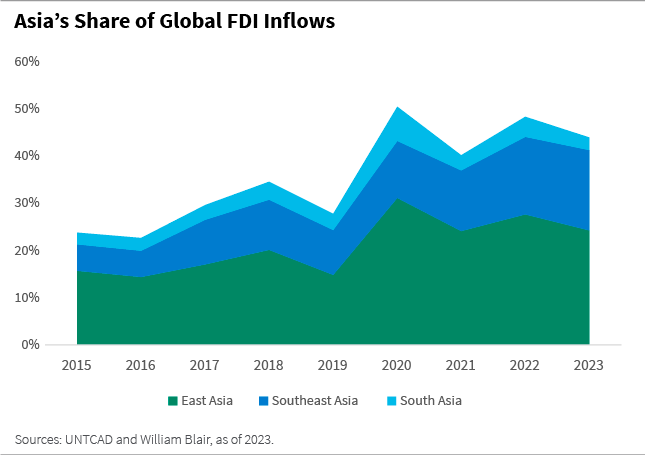

Southeast Asia has gained ground in global exports, likely reflecting the shift in manufacturing capabilities toward the region. Over the past several years, it has attracted a growing share of foreign direct investment (FDI), with its share of global FDI inflows rising from less than 6% in 2015 to 17% in 2023, as the chart below shows.

Southeast Asia has likely attracted these inflows as companies diversify supply chains beyond China. Relatively lower manufacturing sector wages and FDI-friendly incentives—such as expansion of Special Economic Zones—have added to the region’s appeal. While future trade and investment flows may be influenced by tariff rates and other policy shifts, Asia’s competitiveness appears structural and not easily reversed.

Conclusion

For many years, in a strong U.S. dollar environment, Asian policymakers have focused on countering excessive weakness in their local currencies. As capital flows shift, policymakers in the region may need to evaluate the implications of their local currencies strengthening. Volatility may stay elevated as the story unfolds. Investors should be prepared.

Johnny Chen, CFA, is a portfolio manager on William Blair’s emerging markets debt team.