March 24, 2023 | News

Subscribe Now

Want the latest insights on the economy and other forces shaping the investment landscape?

Subscribe to our Investing Insights newsletter.

March 24, 2023 | News

Want the latest insights on the economy and other forces shaping the investment landscape?

Subscribe to our Investing Insights newsletter.

On March 22, the U.S. Federal Reserve (Fed) hiked interest rates by 25 basis points to curb inflation despite turmoil in the banking industry, noting that “the U.S. banking system is sound and resilient,” but “recent developments are likely to result in tighter credit conditions for households and businesses and to weigh on economic activity, hiring, and inflation. The extent of these effects is uncertain.”

While the full impact of the turmoil in the banking industry and the Fed’s response is still unknowable, we are gaining perspective on its economic impact, and thus its investment implications. Captured below are perspectives from each of our investment teams.

Since the beginning of March, U.S. policymakers have taken aggressive steps to alleviate liquidity stress in the U.S. banking system. For as long as the yield curve remains inverted, concerns about some banks—particularly smaller, regional ones—may persist.

As these smaller financial institutions play a critical role in the U.S. economy, continued liquidity challenges in the banking sector may dampen banks’ appetite and ability to lend, thereby curtailing some economic activity. Smaller banks—those with assets of less than $250 billion—account for 60% of residential and 80% of commercial real estate lending. All in all, smaller U.S. banks extend about 50% of all commercial and industrial (C&I) loans and 45% of consumer lending.

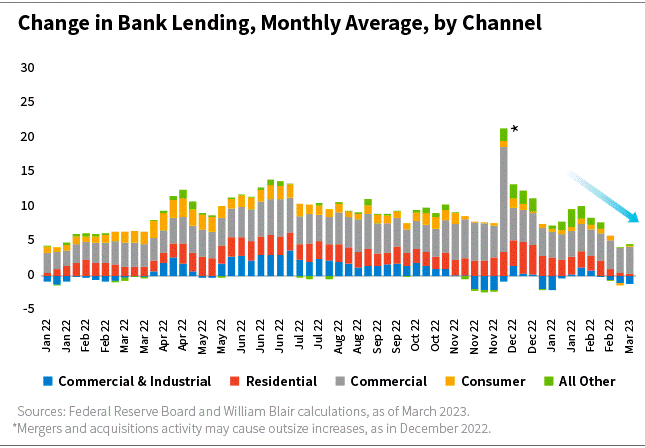

The Fed provides weekly data on various types of bank lending with a 10-day lag. We note that lending by small banks has decelerated already—presumably in response to the stress in the banking system. Whatever the reason, softer bank lending effectively amplifies the already dampening effect of higher rates on economic activity. In this sense, banking system stress may obliviate the need for additional rate increases.

While we remain of the view that the Fed will prefer to raise rates and then pause for a considerable period of time, liquidity challenges in the banking sector may effectively lower the federal funds rate setting necessary to cool domestic demand enough to cool consumer price inflation to 2% to 3% by 2024 year-end.

It’s shocking to think that the KBW Bank Stock Index (BKX) has fallen by nearly 30% in the month of March. However, when bank failures occur, it’s not uncommon for investors to sell shares and ask questions later. Even prior to the Silicon Valley Bank (SVB) Financial debacle, we had been actively reducing our exposure to the banking subsector and are net underweight relative to our respective indices. Why? As fundamental investors, it’s important to remember the factors we believe drive bank stocks over the longer term: net interest margins, loan growth, and credit quality.

Net interest margins: We believe we are closer to the end of this rate-hiking cycle than the beginning. It’s generally believed, however, that the stress of the last several weeks will help further the disinflation narrative, and some investors are now predicting rate cuts for the back half of 2023. We, however, continue to believe inflation, while moderating, will take time to return back to the Fed’s 2% target. If the Fed is forced to hold rates higher for longer than the market is pricing, pressure on net interest margins will likely continue as banks have to keep paying up to retain deposits. As such, we believe the expansion in net interest margins that regional banks have enjoyed over the last several years is likely not to continue.

Loan growth: We estimate that between the start of the pandemic and when the Fed began raising interest rates last year, deposits at U.S. banks rose by more than $5 trillion. However, due to weak loan demand, less than $1 trillion was lent out. We have yet to see how much of those deposits have now left smaller regional banks to either higher-yielding alternatives (such as money markets) or the safety of systemically important financial institutions (SIFIs). Regardless, it’s hard to imagine an environment in which loan growth can catch up with deposits in the near term, especially if we are entering a potential recession in which banks will tighten their lending standards.

Credit quality: Historically, bank failures have occurred due to credit issues as opposed to a mismatch of duration between assets (long-term government debt) and liabilities (deposits). We find it intriguing that some (admittedly poorly managed) banks have failed due to their inability to hedge their interest-rate exposure properly in a rising-rate environment. It makes one ask if credit will be the next shoe to drop. It’s quite plausible to expect that banks will react to this turmoil by tightening their own lending standards. This, in turn, could cut off access to credit for individuals and businesses seeking to borrow, increasing the chance of a recession and likely credit issues. We are already starting to see the cracks of such, whether in venture-backed technology, the California wine industry, or the commercial real estate sector, where smaller banks have grown their exposure compared to their larger peers in recent years.

Longer term, we believe regional banks that have been prudently managing their balance sheets with diversified deposit bases will likely benefit.

Given the magnitude and speed of recent events, it will take time to truly understand the far-reaching implications. It’s likely the banking industry will now face much tougher regulation, a higher risk of increased capital requirements, higher fees to cover the likelihood of FDIC insurance increases, and a renewed debate about which institutions are too big to fail.

For these reasons, along with the factors referenced above, we remain cautious about increasing our weighting to banks in the current environment. However, the recent volatility does offer the opportunity to upgrade the quality of our holdings. Given the sell-off, valuations for some banks are beginning to look attractively priced, even when we stress their tangible book value for unrealized losses in their held-to-maturity portfolios.

Longer term, we believe there will continue to be a place for regional banks within the banking system, and that those that have been prudently managing their balance sheets with diversified deposit bases will likely benefit.

As we shift through the rubble looking for high-quality franchises that have been indiscriminately punished, we will continue to prudently manage the portfolios and alert you to our thinking about portfolio positioning.

While the issues that resulted in SVB Financial’s failure were largely driven by the unique nature of the company’s asset and deposit base, the economic and stock market implications are potentially much broader. All banks have a fundamental mismatch between the duration of their assets and liabilities, and their revenues and costs can respond differently to changes in interest rates. This mismatch can come with significant consequences when confidence in the banking system falters, as we are seeing today. As individuals and businesses pull deposits from banks they view to be less safe and put those deposits into larger banks, you could see additional bank failures and/or sustained higher market share at larger banks at the expense of smaller regional players.

We are actively assessing our U.S. growth and core portfolio companies against a widened range of potential outcomes as this situation unfolds.

At a higher level, the funding costs for banks are likely to increase given pressure on deposit flows and the higher cost of those deposits. Higher funding costs and a preference to build excess capital on their balance sheets could lead banks to tighten lending standards. This in turn would reduce the availability and increase the cost of financing for businesses broadly and for the consumer. It is too early to know, but the lagged impact of the Fed’s tightening cycle and potentially more restrictive bank lending standards may lead to slower economic growth ahead.

Following an era of inexpensive capital for the last 10-plus years, an environment of higher interest rates and higher inflation could result in a more challenging operating environment for businesses and a more discerning market environment. Companies with strong balance sheets, durable business models, sustainable cash flow, and the ability to self-fund growth are uniquely positioned in this type of environment and over the long term. While we remain focused on investing in mispriced, durable business franchises, we are actively assessing our portfolio companies against a widened range of potential outcomes as this situation unfolds.

UBS’s acquisition of Credit Suisse last weekend marked what was essentially the fourth major bank failure in recent weeks. The combined failure of these four banks prompted an in-depth analysis of the global banking landscape.

We believe Credit Suisse is a fundamentally impaired business after years of instability and losses. Moreover, comments from a key shareholder (Saudi National Bank) and heightened volatility in the global banking sector impaired confidence in the bank. The UBS deal is a best-case outcome to prevent contagion and systemic risk to the financial system because Credit Suisse is a global systemically important bank (GSIB).

The biggest surprise was the full writedown of Credit Suisse’s additional tier-one (AT1) bonds, but not its common equity, which would usually receive priority over equity in a bank failure. The fact that this did not occur in the Credit Suisse/UBS deal led AT1s to trade down until other regulators outside of the Swiss clarified their own stance where AT1s fall in the capital stack, partly alleviating market concerns. Although funding costs may rise, we do not believe this will cause concerns about capital more broadly at this point.

Across developed and emerging markets, we tend to invest in higher-quality banks, which generally have held up well through the current situation.

Additionally, some indicators that we watch for signs of financial market stress—such as spreads in wholesale U.S. dollar funding markets and credit index default swap (CDX) levels—started to subside this week from elevated levels the prior week.

Broadly speaking, we believe developed market ex-U.S. banks’ balance sheets are generally sound. The market structure is more consolidated than it is in the United States, with the largest five or six banks having the majority of market share. Developed market banks are also heavily regulated and stress-tested, and key liquidity and capital ratios are at healthy levels. That said, as interest rates rise and the economic environment deteriorates, banks in developed markets will likely see loan growth slow, the benefits of higher interest rates ease, competition for deposits increase funding costs, and asset quality deteriorate. Although balance sheets are generally solid, the environment will likely result in lower growth and returns.

Similar to developed market banks, emerging markets (EM) banks generally have sound balance sheets, but we look at them on a case-by-case basis because their market structures and risks tend to be idiosyncratic.

Across developed and emerging markets, we tend to invest in higher-quality banks—those with strong competitive advantage, high return on equity (ROE), and healthy capital ratios—which have proven their ability to deliver through credit cycles. Generally, these banks have held up well through the current situation. Contagion is, of course, a concern, and the situation is highly fluid, so we are constantly reevaluating the situation to ensure we are comfortable with our investments across financials as the situation evolves.

EM fixed income is not directly exposed to problems in the U.S. financial sector, but high-yield EM debt has been significantly impacted by increased risk aversion. Forced selling from exchange-traded and other passive funds amid very poor liquidity conditions exacerbated the sell-off.

That said, we believe EM fundamentals remain resilient and that current prices provide a very attractive investment opportunity.

We have been gradually increasing exposure to high-yield EM credit and local currency debt.

EM banking systems look better positioned in terms of capital than they were during the Global Financial Crisis, thanks to the implementation of robust macroprudential regulation in recent years. While there are a few countries where the banking system displays certain vulnerabilities, very few of them have broad challenges that would create near-term solvency and financial-stability concerns.

We believe recent developments in the global banking sector will impact EM banks mostly through second-order effects, as direct links to affected institutions are limited. Most EM bank debt issuers are leading local institutions and benefit from granular and well-diversified deposit bases, which support robust liquidity profiles.

Overall, EM credit spreads, yields, and currency valuations are at historically attractive levels. Moreover, concerns about the U.S. financial sector should bring forward the end of the monetary tightening cycle, in our opinion.

All things considered, our positive medium-term view for EMD remains intact, and we have been gradually increasing exposure to high-yield EM credit and local currency debt.

Any investment or strategy mentioned herein may not be appropriate for every investor. There can be no assurance that investment objectives will be met. Products and services listed are available only to residents of this jurisdiction and may only be available to certain categories of investors. The information on this website does not constitute an offer for products or services, or a solicitation of an offer to any persons outside of this jurisdiction who are prohibited from receiving such information under applicable laws and regulations. Nothing on this webpage should be construed as advice and is therefore not a recommendation to buy or sell shares.

Please carefully consider the William Blair Funds’ investment objectives, risks, charges, and expenses before investing. This and other information is contained in the Funds’ prospectus and summary prospectus, which you may obtain by calling 1-800-742-7272. Read the prospectus and summary prospectus carefully before investing. Investing includes the risk of loss.

The William Blair Funds are distributed by William Blair & Company, L.L.C., member FINRA/SIPC.

The William Blair SICAV is a Luxembourg investment company with variable capital registered with the Commission de Surveillance du Secteur Financier (“CSSF”) which qualifies as an undertaking for collective investment in transferable securities (“UCITS”). The Management Company of the SICAV has appointed William Blair Investment Management, LLC as the investment manager for the fund.

Please carefully consider the investment objectives, risks, charges, and expenses of the William Blair SICAV. This and other important information is contained in the prospectus and Key Investor Information Document (KIID). Read these documents carefully before investing. The information contained on this website is not a substitute for those documents or for professional external advice.

Information and opinions expressed are those of the authors and may not reflect the opinions of other investment teams within William Blair Investment Management, LLC, or affiliates. Factual information has been taken from sources we believe to be reliable, but its accuracy, completeness or interpretation cannot be guaranteed. Information is current as of the date appearing in this material only and subject to change without notice. Statements concerning financial market trends are based on current market conditions, which will fluctuate. This material may include estimates, outlooks, projections, and other forward-looking statements. Due to a variety of factors, actual events may differ significantly from those presented.

Investing involves risks, including the possible loss of principal. Equity securities may decline in value due to both real and perceived general market, economic, and industry conditions. The securities of smaller companies may be more volatile and less liquid than securities of larger companies. Investing in foreign denominated and/or domiciled securities may involve heightened risk due to currency fluctuations, and economic and political risks. These risks may be enhanced in emerging markets and frontier markets. Investing in the bond market is subject to certain risks including market, interest rate, issuer, credit, and inflation risk. High-yield, lower-rated, securities involve greater risk than higher-rated securities. Different investment styles may shift in and out of favor depending on market conditions. Diversification does not ensure against loss.

Past performance is not indicative of future returns. References to specific companies are for illustrative purposes only and should not be construed as investment advice or a recommendation to buy or sell any security.

William Blair Investment Management, LLC is an investment adviser registered with the U.S. Securities and Exchange Commission.

Issued in the United Kingdom by William Blair International, Ltd., authorized and regulated by the Financial Conduct Authority (FCA), and is only directed at and is only made available to persons falling within articles 19, 38, 47, and 49 of the Financial Services and Markets Act of 2000 (Financial Promotion) Order 2005 (all such persons being referred to as "relevant persons").

Issued in the European Economic Area (EEA) by William Blair B.V., authorized and supervised by the Dutch Authority for the Financial Markets (AFM) under license number 14006134 and also supervised by the Dutch Central Bank (DNB), registered at the Dutch Chamber of Commerce under number 82375682 and has its statutory seat in Amsterdam, the Netherlands. This material is only intended for eligible counterparties and professional clients.

Issued in Switzerland by William Blair Investment Services (Zurich) GmbH, Talstrasse 65, 8001 Zurich, Switzerland ("WBIS"). WBIS is engaged in the offering of collective investment schemes and renders further, non-regulated services in the financial sector. WBIS is affiliated with FINOS Finanzomubdsstelle Schweiz, a recognized ombudsman office where clients may initiate mediation proceedings pursuant to articles 74 et seq. of the Swiss Financial Services Act ("FinSA"). The client advisers of WBIS are registered with regservices.ch by BX Swiss AG, a client adviser registration body authorized by the Swiss Financial Market Supervisory Authority ("FINMA"). WBIS is not supervised by FINMA or any other supervisory authority or self-regulatory organization. This material is only intended for institutional and professional clients pursuant to article 4(3) to (5) FinSA.

Issued in Australia by William Blair Investment Management, LLC (“William Blair”), which is exempt from the requirement to hold an Australian financial services license under Australia's Corporations Act 2001 (Cth). William Blair is registered as an investment advisor with the U.S. Securities and Exchange Commission (“SEC”) and regulated by the SEC under the U.S. Investment Advisers Act of 1940, which differs from Australian laws. This material is intended only for wholesale clients.

Issued in Singapore by William Blair International (Singapore) Pte. Ltd. (Registration Number 201943312R), which is regulated by the Monetary Authority of Singapore under a Capital Markets Services License to conduct fund management activities. This material is intended only for institutional investors and may not be distributed to retail investors.

Issued in Canada by William Blair Investment Management, LLC, which relies on the international adviser exemption, pursuant to section 8.26 of National Instrument 31-103 in Canada.

The content contained in this site is intended as informational or educational in nature and does not constitute investment advice or a recommendation of any investment strategy or product for a particular investor. Investment advice and recommendations can be provided only after careful consideration of an investor’s objectives, guidelines, and restrictions. Investors should consult a financial professional/financial consultant or investment adviser before making any investment decisions. Investing includes the risk of loss.

Copyright © 2026 William Blair. William Blair is a registered trademark of William Blair & Company, L.L.C. “William Blair” refers to William Blair Investment Management, LLC and affiliates.