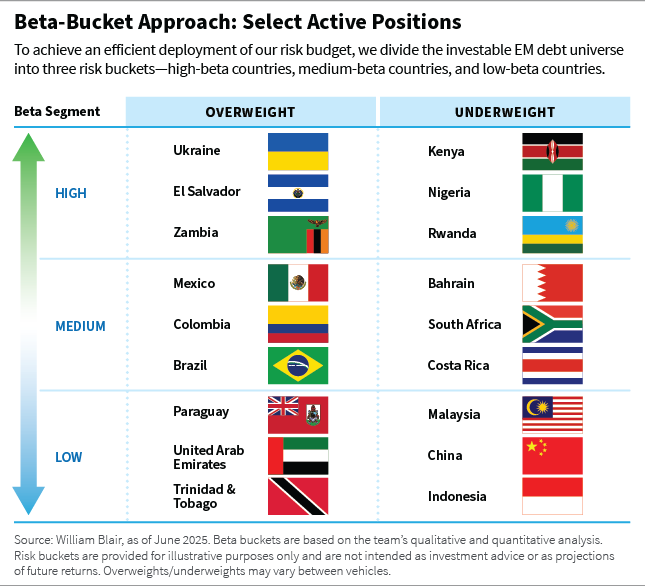

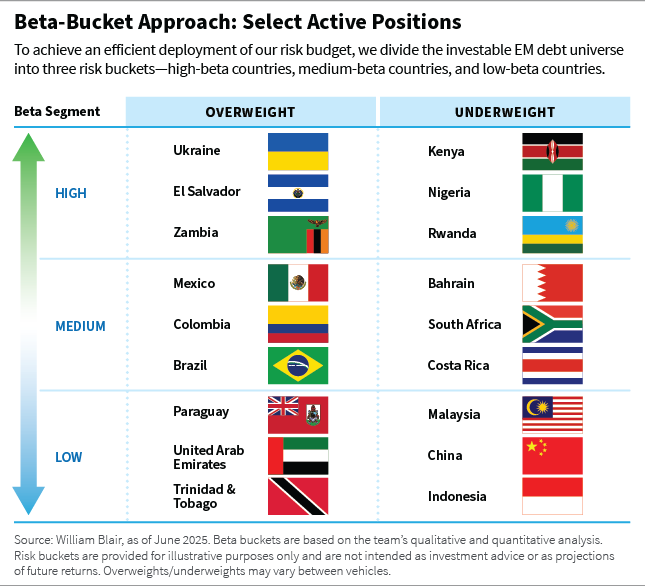

Uncertainty about the future path of tariffs led to heightened market swings in the second quarter, and in this environment, emerging markets (EM) debt valuations have improved. We view the recent sell-off as an opportunity to add exposure to the asset class at more attractive levels, and below break down some of our largest active hard-currency positions by beta bucket, which is how we allocate our risk budget.

High-Beta Bucket

The largest overweight positions on a spread duration basis were in Ukraine, El Salvador, and Zambia. Conversely, the largest underweight positions were in Kenya, Nigeria, and Rwanda.

Ukraine (overweight): We are overweight via warrants on the potential for conflict negotiations, multilateral support, and a more optimistic growth outlook. However, we recently reduced our allocation to “A” bonds based on valuations—that is, to raise the beta in case of misplaced pessimism in the conflict resolution.

El Salvador (overweight): We recently increased our overweight as El Salvador had lagged peers, but its International Monetary Fund (IMF) program remains on track and adherence to the program should be achievable because of cuts in the fiscal deficit. The long end of the curve remains steep, making it attractive, in our opinion.

Zambia (overweight): Following the restructuring and the exchange into two performing bonds—one with triggers for a coupon step-up that we believe are likely to be met within the next 12 months—we remain broadly constructive on Zambia’s outlook. The shock from the recent drought is easing, and investment in the natural resource sector is gaining momentum, with copper production poised to expand.

Kenya (underweight): We have concerns about the fiscal outlook, despite funding support from the United Arab Emirates. While the government aims to reduce borrowing, it has struggled to implement revenue measures, and further tax increases appear politically untenable. Spending cuts are also likely to face resistance, casting doubt on the viability of the current macroeconomic plan under the IMF program. In our view, narrowing the fiscal deficit and improving revenue collection will be essential to restoring credibility—particularly with public dissatisfaction high and limited time remaining before the September 2027 elections.

Nigeria’s Dangote refinery is now operational and may reduce reliance on fuel imports, but recent oil price volatility poses a risk to government revenues.

Nigeria (underweight): We are currently neutral on Nigerian sovereign credit, with a small underweight in cash, as valuations have tightened. Fundamentals have improved somewhat, supported by exchange rate reform, monetary tightening, and progress on fuel subsidy reduction. However, structural challenges remain significant. The long-delayed Dangote refinery is now operational and may reduce reliance on fuel imports, but recent oil price volatility—trending lower—poses a risk to government revenues.

Rwanda (underweight): We do not hold any Rwanda bonds, because we believe valuations offer limited protection against risks to the fundamental outlook stemming from the country’s wide twin deficits and reliance on concessional financing.

Medium-Beta Bucket

The largest overweight positions on a spread duration basis were in Mexico, Colombia, and Brazil. Conversely, the largest underweight positions were in Bahrain, South Africa, and Costa Rica.

Mexico (overweight): We are overweight Pemex, given strong sovereign support and more attractive valuations relative to the sovereign. We remain underweight Mexican sovereign bonds on valuation grounds but continue to hold positions in financials and airlines.

Colombia (overweight): We increased our overweight based on valuations. Colombia had underperformed on concerns about its rising fiscal deficit, but we now believe it looks cheap versus peer countries. With President Gustavo Petro’s popularity low, we also anticipate a potential regime change in the 2026 elections.

In Brazil we’re seeing better corporate opportunities following strong sovereign performance in the first half of the year.

Brazil (overweight): We’ve recently added corporate positions, seeing better opportunities following strong sovereign performance in the first half of the year. Our current exposure includes an independent oil and gas producer, an issuer linked to the Petrobras ecosystem, and a name in environmental services.

Bahrain (underweight): We are underweight as a result of more volatility in regional geopolitics, the country’s relatively weak fiscal-reform efforts, lower oil prices, and tight valuations.

South Africa (underweight): We believe there is limited room for outperformance versus peers at current valuations. Political risks have subsided with the passing of the budget in parliament, while external and fiscal sector performances are relatively resilient (with a primary surplus and modest current account deficit). Nevertheless, relations in the Government of National Union (GNU) could drive ongoing asset-price volatility as the market weighs the risks to political stability. Still, we believe that the Democratic Alliance (DA) and the African National Congress (ANC) have a vested interest in keeping the GNU together ahead of municipal elections and the ANC National Conference scheduled for late 2026. Broadly speaking, the fundamental weakness in South Africa remains endemically low growth.

Costa Rica (underweight): Fundamentals remain strong, but we believe valuations are unattractive because spreads have compressed materially.

Low-Beta Bucket

The largest overweight positions on a spread duration basis were in Paraguay, United Arab Emirates, and Trinidad and Tobago. Conversely, the largest underweight positions were in Malaysia, China, and Indonesia.

Paraguay (overweight): Our overweight is based on attractive valuations relative to low-beta peers and solid fundamentals. The country’s ratio of debt to gross domestic product (GDP) is low, and it has a strong history of low fiscal deficits.

United Arab Emirates (overweight): Our overweight position is driven predominantly by a combination of corporates and the smaller emirates, where we believe valuations are attractive relative to Abu Dhabi.

Trinidad and Tobago (overweight): We finds the country’s valuations appealing relative to its low-beta peers.

Indonesia is also expected to be a major external debt issuer in 2025.

Malaysia (underweight): We are underweight sovereign bonds as a result of tight valuations but maintain selective overweights in quasi-sovereigns, where we see more attractive relative value.

China (underweight): Valuations are tight and we see unpredictable regulatory risks to Chinese state-owned entities. Based on a bottom-up analysis, we hold selective corporate bonds at what we believe are attractive valuations and positive credit trajectories.

Indonesia (underweight): Valuations remain unappealing, and the country’s fundamental outlook has become less clear following the February 2024 presidential election and the new administration’s October inauguration. With a shift in focus from economic stability to growth, the risk of fiscal slippage has increased. Indonesia is also expected to be a major external debt issuer in 2025. That said, we maintain diversified corporate exposure, supported by a resilient outlook across financials, renewable utilities, and oil and gas.

Marco Ruijer, CFA, is a portfolio manager on William Blair’s emerging markets debt team.