The Dubai real estate sector has defied expectations over the past three years, but with higher tariffs, recession concerns, and lower oil prices, will the positive momentum continue in 2025? What key drivers and risks should investors monitor? In this blog, we explore those considerations; we also explain how Dubai’s real estate sector has evolved compared to previous cycles and why developers now view their industry as more resilient to downturns.

A Look at the Sector

The Dubai real estate sector’s momentum has been underpinned by demographic expansion, pro-growth structural reforms, investor flows, and a supportive macroeconomic environment.

In 2024, primary market sales in Dubai amounted to 275 billion dirham (AED), which is equivalent to $74 billion—five-year growth of 6.5x. Year-over-year, residential transactions increased by 39%, the Dubai price index increased by 18% (up 17% since the 2014 peak), and residential rents increased by 16%[1].

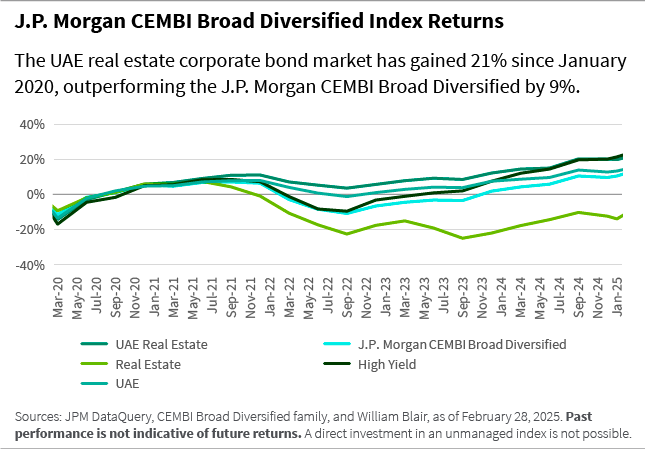

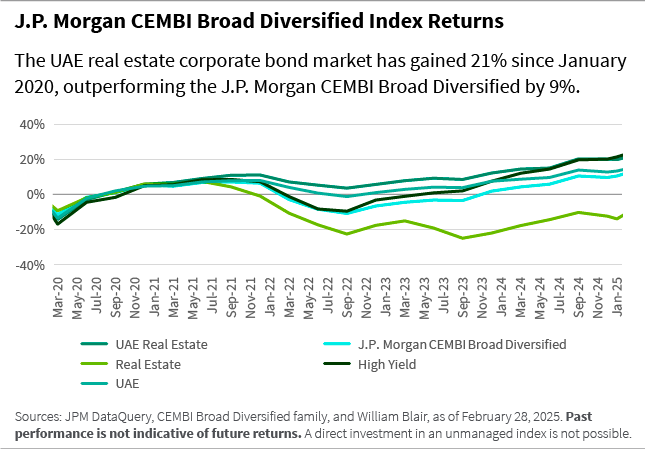

Despite being relatively small—comprising just 0.6% of the J.P. Morgan Corporate Emerging Markets Bond Index (CEMBI) Broad Diversified[2]—the United Arab Emirates (UAE) real estate corporate bond market has performed impressively. It has gained 21% since January 2020, outperforming the index by 11%, buoyed by the industry’s fundamentals.[3]

2025 Drivers

The UAE’s position in the region as a global financial and trade hub was reinforced by the country’s 2024 accession to BRICS,[4]the implementation of multiple Comprehensive Economic Partnership Agreements (CEPAs), and the IPO Accelerator Program, among other initiatives. Pro-business reforms under “We the UAE 2031”[5]are directing investments in strategic sectors such as manufacturing, trade, technology, and financial services, thereby enhancing economic diversification and lifting the economy’s potential growth. Alongside these efforts, visa programs—including the Golden Visa, the five-year multi-entry visa, and the 10-year residency visa are attracting both foreign and human capital.

In 2023, the UAE attracted $31 billion in foreign direct investment inflows, making it the 11th largest recipient worldwide.

In 2023, the UAE attracted $31 billion in foreign direct investment inflows[6], making it the 11th largest recipient worldwide. Amid crises elsewhere—including the conflict between Russia and Ukraine, weak property markets in China and Europe, and currency devaluations in Egypt and Turkey—Dubai has also attracted significant safe-haven flows from high-net-worth individuals (HNWI). In fact, Dubai expected 6,700 new millionaires in 2024, more than any other city globally.[7]

This influx of HNWI parallels Dubai’s overall population growth, which reached 3.8 million in 2024, up 4% year-over-year. S&P estimates Dubai’s population will surpass 4 million by 2026, driven by the UAE’s relaxed regulations for long-term residency through the visa programs mentioned above.[8]Moreover, Dubai’s Urban Master Plan targets a population of 5.8 million by 2040, implying a compound annual growth rate (CAGR) of 2.7%. We believe that is achievable given the 3.6% average CAGR of the preceding seven-year period, which includes the last property market downturn.

Concerns about the outlook for global trade and growth in the context of escalating tariff disputes are rising, while Organization of the Petroleum Exporting Countries (OPEC)+ producers unexpectedly raised oil production projections, weighing on oil prices. We believe the UAE is well positioned to weather these challenges, thanks to significant fiscal buffers (which it has given its low fiscal breakeven oil price of around $55 and low government debt). In terms of economic performance, the UAE’s real gross domestic product (GDP) grew at a healthy level of 3.6% to 4.0% over 2023 and 2024, and according to the International Monetary Fund (IMF), GDP is projected to accelerate to 5% this year and to 4.8% in 2026. This would make the UAE the fastest-growing economy among the Gulf Cooperation Council (GCC) countries.

Public spending should also support the economic outlook, with a record budget of AED 272 billion approved for 2025-2027. Notably, 46% is allocated to infrastructure and related construction projects, including roads, bridges, tunnels, and parks, which should facilitate urban development and housing expansion.

The UAE is considered the most diversified economy in the GCC region and macroeconomic fundamentals are overall robust, while exports from the UAE to the US are relatively low at 2%. However, spillover risks from slower global growth in the region and lower oil revenue pose downside risks to government spending and continued growth of the non-oil sector. These factors could weigh on transactional activity in the sector, which has remained resilient so far this year.

Three Factors to Watch

History is instructive as we consider the sector’s outlook, as risks related to global growth, financial conditions, prolonged periods of lower oil prices, and surplus inventories have challenged it in the past.

1. Weakening Global Growth and Strained Financial Conditions

Historically, 55% to 65% of primary market buyers are classified as investors, and they originate from a diverse mix of countries. According to feedback from developers, Russian buyers that flooded the market in 2022 were replaced by British, Chinese, and Indian buyers more recently, with the latter being a relatively stable buying group. While a diverse customer base offers greater resilience, a shock in global growth or financial conditions could dampen investor appetite and disrupt global flows. However, the recent weakening of the dollar should support liquidity conditions and improve affordability for European, British, and other FX-dependent midtier investors, as Dubai's gross rental yields have remained consistently attractive, hovering between 5% to 7 % as deliveries in the market remained limited.[9]

2. Prolonged Oil Prices Below the Fiscal Breakeven

Oil prices below the fiscal breakeven (which for UAE was $54 per barrel in 2024, according to the IMF) have in the past strained regional liquidity, reduced bank credit available to developers and contractors, and ultimately lowered public and private sector spending. However, aggregate banking capital and liquidity ratios suggest that domestic liquidity is currently ample. Oil however, has been on a downward trend—13% lower year-over-year. Brent expected to average $65 per barrel in 2025, in line with current levels, and $62 per barrel in 2026, still above fiscal breakeven prices but with growing downside risks.[10] Fitch estimates Saudi Arabia’s breakeven at $92 per barrel in 2025. Considering that around 20% of the buyers in the companies we monitor originate from the Middle East, we should be cognizant of potential spillover effects that could emerge from other GCC countries with higher fiscal breakeven oil prices.

3. Oversupply in Dubai

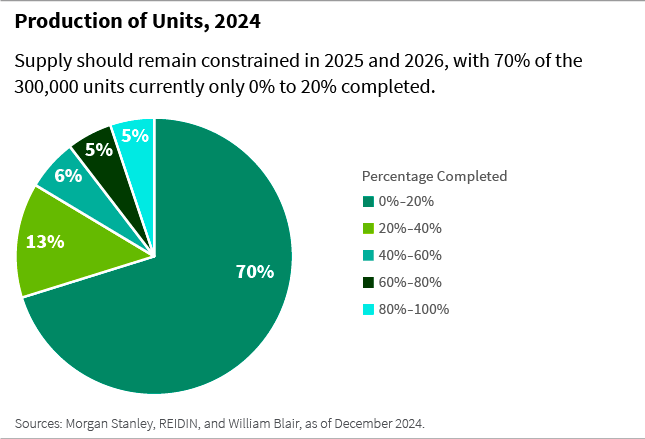

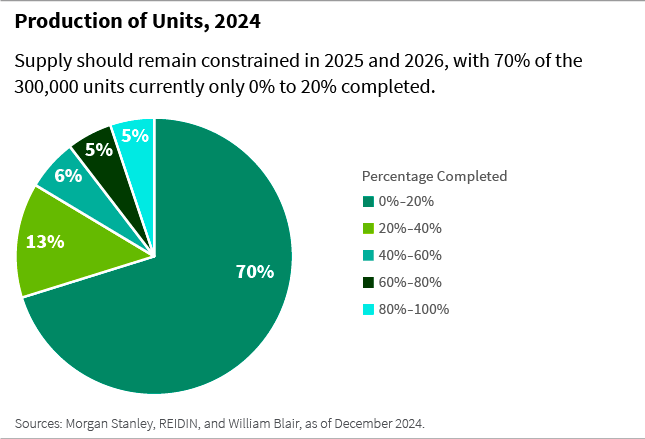

Dubai developers launched more than 220,000 property units in 2023 and 2024—a 34% increase over the total number launched in the preceding nine years (2014-2022). This record-breaking activity has resulted in more than 300,000 units currently under construction, typically delivered over a three- to five-year cycle. To put this in perspective, that is equivalent to the total number of units delivered in Dubai over the past decade.

Trends in the secondary and rental markets will largely influence the activity in the primary market.

As noted earlier, many primary market buyers are investors who plan to rent their properties or sell them in the secondary market. As a result, strong underlying demand in secondary and rental markets will be critical to absorbing the upcoming supply and preventing price declines. So, ultimately, we believe the trends in the secondary and rental markets will largely influence the activity in the primary market.

One mitigating factor is that supply often falls short of planned deliveries and can be somewhat flexible. Historically, only 60% of planned completions in Dubai have been delivered on schedule, as developers often face construction delays or tactically extend timelines to avoid flooding the market.

What Makes Dubai Different This Time?

Dubai’s real estate market has experienced several boom-and-bust cycles, but we believe key structural changes now provide a more resilient foundation. Stronger regulatory safeguards, healthier developer credit metrics, and supportive government policies are creating conditions for more sustainable growth, mitigating risks and attracting long-term investment. The following outlines how Dubai’s approach has evolved and why the current cycle may prove more durable than in the past.

Stronger Regulatory Safeguards

Government requirements have significantly changed Dubai’s real estate market, promoting greater transparency, investor protection, and financial stability compared to previous cycles. Key reforms include stricter oversight of developer financing, tighter mortgage lending practices, and higher upfront buyer contributions, all aimed at reducing speculative risks and promoting sustainable market growth.

Government requirements have significantly changed Dubai’s real estate market.

For example, payments from off-plan buyers are now deposited into escrow accounts from which developers withdraw funds incrementally—subject to regulatory approval—as construction milestones are reached. The developers we cover typically use front-loaded payment plans, collecting 35% to 40% of the property’s value within the first 12 months and only 10% to 20% at handover, greatly reducing construction risk.

Additionally, the UAE central bank enforces strict mortgage caps, limiting loan-to-value (LTV) to between 70% and 85% for UAE nationals and residents, 50% for non-residents, and even lower for second homes. Moreover, a recent directive increased upfront costs by adding roughly 6% to the existing 20% down payment, bringing total upfront payments in line with international standards.

Developers With Healthier Credit Metrics

With record presales, healthy credit metrics, and proactive self-regulation measures, developers appear better prepared for the next cyclical downturn.

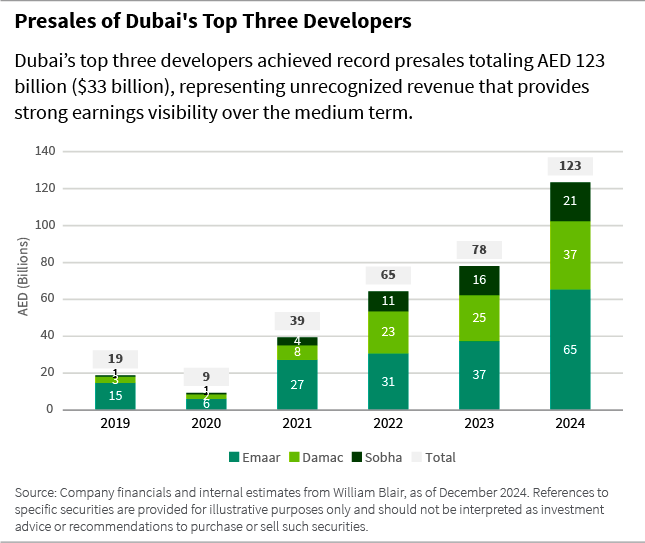

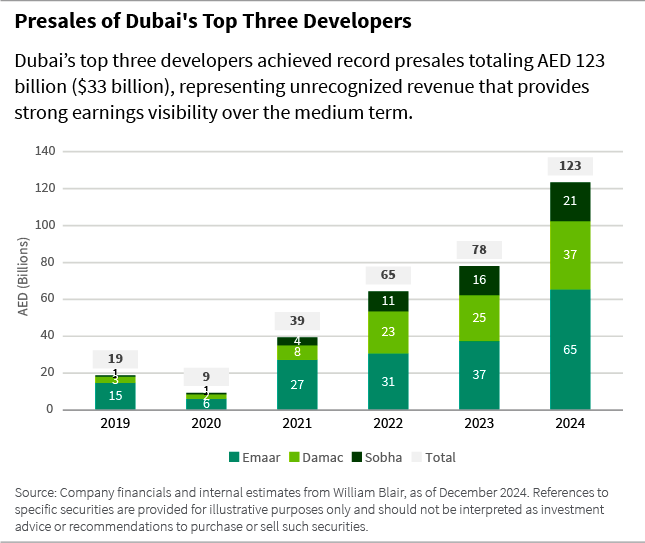

Developers’ presales are at record levels—up 58% year-over-year, with AED 123 billion ($33 billion) in sales yet to be recognized as revenue across the top three developers. This revenue backlog provides robust earnings visibility and indicates potential for strong growth over the next two to three years.

Many developers have also strengthened their balance sheets by accumulating cash, enhancing liquidity, and reducing leverage. To mitigate risks, some have imposed restrictions on prepayments, preventing investors from flipping their apartments in the secondary market.

And, despite a more diversified buyer base, with growing interest from investors in India, the United Kingdom, the United States, Pakistan, and other European and Asian markets, certain developers have introduced client concentration limits to manage credit risk.

Policy Support, Economic Resilience, Stable Population

Dubai’s Real Estate Strategy 2033 seeks to double the real estate sector’s GDP contribution to AED 73 billion, contributing to economic diversification, increasing real estate transactions by 70%, and expanding the value of Dubai’s real estate portfolios twentyfold to AED 20 billion—key performance indicators (KPIs) outlined in the plan. Strategic initiatives such as the Dubai 2040 Urban Master Plan, Dubai Economic Agenda D33, and We the UAE 2031 demonstrate the government’s strong commitment to economic diversification, resilience, and long-term growth across various sectors, including real estate.

Expanded visa programs and the Social Agenda D33 are further designed to attract businesses and highly skilled workers, encouraging long-term residency and reducing potential workforce turnover.

Conclusion

Population growth, robust economic activity, and a series of pro-growth reforms, strategic infrastructure investments, and public spending suggest that internal demand drivers remain strong.

As of March 2025, year-to-date activity in Dubai is solid, with transaction volumes up 23% year-over-year and values rising 29%. Record presales in 2023 and 2024, combined with a typical construction cycle of three to five years, indicate that supply will remain constrained in 2025 and 2026.

While we believe the sector will continue to experience cyclical trends, UAE developers point to improved regulations, greater discipline, and a supportive economic and policy environment as key factors mitigating vulnerabilities to external macroeconomic or regional pressures. The current environment of lower revenue in the region poses downside risks to government and private sector spending, which also affects non-oil sector growth. However, we believe the ongoing socio-economic reforms in the UAE and improved credit metrics for developers should help limit these risks.

After four strong years, and with the global growth outlook revised lower, we expect a moderation in activity over the medium term, depending on the depth and duration of the economic slowdown.

Anezina Mytilinaiou, CFA, is a senior corporate credit analyst on William Blair’s emerging markets debt team.

[1]Source: REIDIN and CBRE, which provide property price indices for Dubai. REIDIN publishes the Dubai Residential Property Sales Price Index, which tracks changes in residential property prices over time. CBRE also offers detailed analyses of Dubai's residential market, including average property prices and trends, as seen in their Dubai Residential Market Snapshot reports. [2]The J.P. Morgan CEMBI Broad Diversified tracks the performance of U.S. dollar-denominated corporate bonds issued by emerging markets companies, applying issuer-weight limits to enhance diversification. [3]As of April 10, 2025. [4]BRICS refers to Brazil, Russia, India, China, and South Africa, a group of major emerging economies cooperating politically and economically. [5]“We the UAE 2031" is a national vision and strategic roadmap launched by the UAE, aiming to position the country among the world’s top-ranking nations by 2031 through ambitious goals in economic growth, social development, innovation, sustainability, and global competitiveness. [6]Source: UN. [7]Source: Henley & Partners.[8]Source: S&P Global. [9]Sources: Global Property and REIDIN.[10]Source: Bloomberg’s forecast composite, as of April 11, 2025.