As we celebrate the three-year anniversary of the William Blair Emerging Markets (EM) Debt strategy, EM fixed income has been hit by an increase in risk aversion led by concerns about the health of the U.S. banking sector. But we retain our constructive medium-term view for EM debt despite near-term risks and high volatility.

A Volatile Environment, Attractive Investment Opportunities

Poor market technical conditions exacerbated the sell-off in EM fixed income in the wake of risk aversion stemming from concerns about the health of the U.S. banking sector. But we believe current prices provide a very attractive investment opportunity.

- EM fundamentals remain resilient.

- The EM financial sector is well capitalized and properly regulated.

- EM debt credit spreads, yields, and currency valuations are at historically attractive levels.

- Moreover, we believe concerns about the U.S. financial sector should bring forward the end of the monetary tightening cycle.

All things considered, our positive medium-term view for EM debt remains intact, and we have been gradually increasing exposure to high-yield EM credit and local currency debt. But let’s look at some of our reasoning in more detail.

Global Macro Backdrop Supportive

We believe the overall global macro backdrop should remain supportive of EM debt fundamentals.

China’s reopening improves prospects for global growth, outweighing concerns about a U.S. economic slowdown. Commodity prices, while below the peaks seen over the past couple of years, remain at levels that continue to benefit exporters. Moreover, strong multilateral and bilateral support has resulted in ample and affordable funding to EM countries, especially to those without access to primary debt markets. We anticipate favorable economic conditions, stable fiscal and debt dynamics, and supportive external accounts in most regions this year.

Banking Systems Well Positioned

Importantly, most EM banking systems look better positioned in terms of capital than they were during the Global Financial Crisis, thanks to the implementation of robust macroprudential regulation in recent years.

We continue to see value in high-beta, high-yield credit and are positioned for high-yield/investment-grade spread compression.

While there are a few countries where the banking system displays certain vulnerabilities, very few of them have broad challenges that would create near-term solvency and financial-stability concerns.

We believe recent developments in the global banking sector will impact EM banks mostly through second-order effects, as direct links to affected institutions are limited.

The majority of EM bank debt issuers are leading local institutions that benefit from granular and well-diversified deposit bases, which support robust liquidity profiles.

Sell-off Unjustified

In our opinion, the recent sell-off is not justified by EM credit fundamentals. Forced selling from exchange-traded and other passive funds amid very poor liquidity conditions exacerbated the sell-off.

We expect outflows from EM debt–dedicated portfolios to stabilize in the near term as investors return to the asset class amid more stable market conditions and improved valuations. High investor cash levels, defensive positioning, and low foreign ownership of local bond markets should add to a more positive technical backdrop.

Attractive Valuations

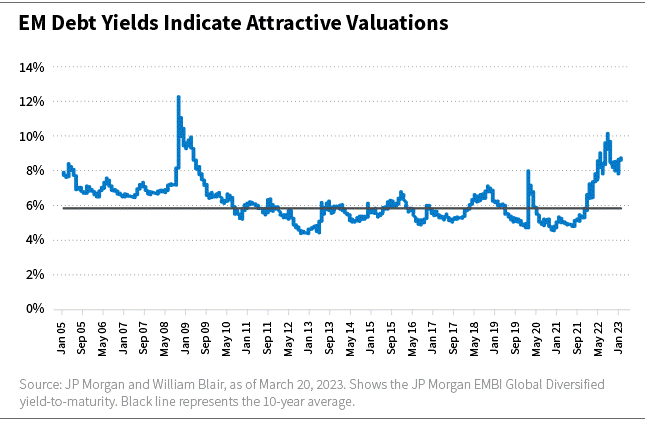

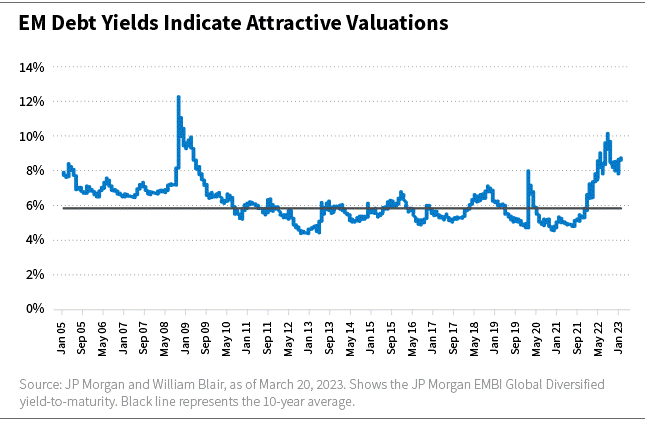

We believe EM debt continues to offer attractive valuations as yield levels remain above long-term averages, with the yield of the J.P. Morgan EMBI Global Diversified at 8.71% at the time of this writing.

Additionally, high-yield EM debt credit spreads look attractive, trading significantly above historical averages, and they are particularly attractive versus developed market credit.

We believe the distressed debt market offers opportunities given our view of underestimated recovery values in restructuring credit.

In the local markets space, currency valuations and term premiums for local rates also appear attractive.

Additionally, the real interest rate differential versus developed markets continues to favor EMs, and there are many EM central banks in a position to cut interest rates, which should lend additional support for local rates markets.

A Constructive Outlook

We therefore retain our constructive medium-term view despite near-term risks and high volatility.

We continue to see value in high-beta, high-yield credit and are positioned for high-yield/investment-grade spread compression. We continue to see scope for fundamental differentiation and have a preference for countries with easier access to multilateral and bilateral funding. We see opportunities in the EM frontier, distressed, and corporate credit spaces as well as select opportunities in the EM local currency debt market.

Marcelo Assalin, CFA, partner, is the head of William Blair’s emerging markets debt team, on which he also serves as a portfolio manager.

The J.P. Morgan EMBI Global Diversified tracks the total return of U.S.-dollar-denominated debt instruments issued by sovereign and quasi-sovereign entities.

Index performance is provided for illustrative purposes only. Indices are unmanaged and do not incur fees or expenses. A direct investment in an unmanaged index is not possible. Past performance is not indicative of future returns.

Index information has been obtained from sources believed to be reliable but J.P. Morgan does not warrant its completeness or accuracy. The indices are used with permission. The indices may not be copied, used, or distributed without J.P. Morgan’s prior written approval. Copyright 2023, JPMorgan Chase & Co. All rights reserved.