April 16, 2025 | Emerging Markets Debt

Investments

ASSET-CLASS CAPABILITIES

Insights

EDUCATION CENTER

SUBSCRIBE

April 16, 2025 | Emerging Markets Debt

The emerging markets (EM) debt investable universe is large, diverse, and often misunderstood. While it offers the potential for higher returns, it also comes with higher risks. To unlock alpha opportunities, it’s important to have a full understanding of this unique asset class.

Comments are edited excerpts from our continuing education series, Understanding Emerging Markets Debt.

Learn how to earn CE credits now.

The EM debt investable universe is composed of fixed-income securities issued by EM governments and companies. Overall, EM debt consists of 900 issuers from more than 90 countries.

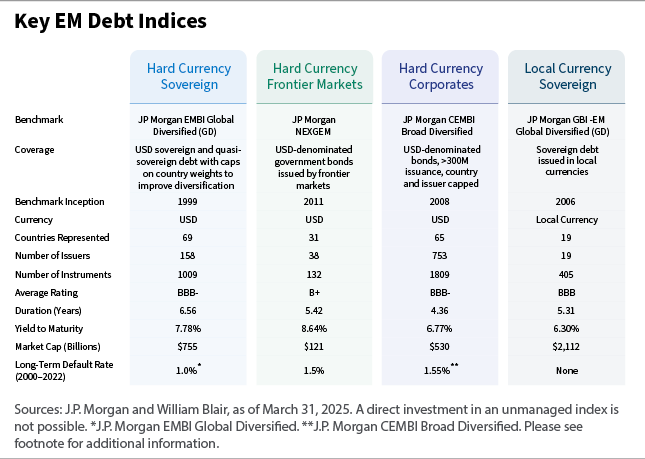

Securities can be issued in hard currencies or local currencies, and there are four universes within EM debt: hard currency sovereign debt, hard currency frontier markets debt, hard currency corporate debt, and local currency sovereign debt.

Hard currency debt is denominated in developed-market currencies (such as the U.S. dollar), issued in international markets, and subject to the issuing country’s laws. On the other hand, local currency debt is denominated in EM currencies (such as the Brazilian real or the Mexican peso) and predominantly issued in local markets under the issuing country’s laws.

In addition, sovereign debt is issued by a national government to finance its activities or manage its debt and is tied to a country’s fiscal health and political stability. Corporate debt is issued by corporations to raise capital for business operations and depends on the financial strength and profitability of the issuing company. One can also further narrow both of these categories down by focusing on frontier markets debt, which is issued by governments or corporations in frontier markets; these are economies that are less developed than emerging markets but have high growth potential.

EM debt is often tracked and analyzed through various indices, which serve as benchmarks for both hard currency and local currency debt. One of the most prominent indices for hard currency EM debt is the J.P. Morgan EMBI Global Diversified. For local currency debt, the J.P. Morgan GBI-EM Global Diversified is widely used.

These indices are crucial for investors as they provide a framework for measuring performance, assessing risk, and making informed allocation decisions within the EM debt universe. And inclusion in these indices often signals a certain level of credibility and market access for the issuing countries, which can influence investment flows and borrowing costs.

EM debt is a sizable asset class that has substantially grown over the years. It now represents close to a quarter of the global fixed-income universe, and is diversified across countries, currencies, and corporate credit issuers.

From a credit perspective, we believe EM debt appears solid, with strong fundamentals in both sovereign and corporate credit when compared to similar issuers in developed markets. Multilateral and bilateral institutions, such as the International Monetary Fund (IMF), provide strong support via accessible and affordable financing for EM countries as well. This helps contribute to lower default rates, as countries can secure stable funding even in unfavorable market conditions.

EM debt now represents close to a quarter of the global fixed-income universe, and is diversified across countries, currencies, and corporate credit issuers.

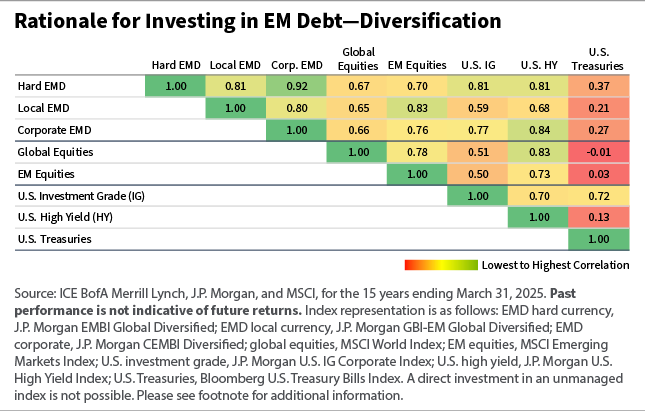

In addition, EM debt has tended to have a lower correlation to other global asset classes, which may offer investors the potential for diversification.

However, EM debt is often misunderstood, and therefore under-owned and undervalued, in our opinion. Several factors contribute to this: perceived risk vs. actual risk, underrepresentation in global fixed-income indices, inefficient pricing, and historical biases.

We believe this misunderstanding creates potential opportunities for investors who can recognize the asset class’s true strengths and potential for alpha generation.

We believe performance of EM debt is primarily driven by two forces: global economic growth and global liquidity conditions.

Improving economic conditions can lead to fundamental improvement in EM countries, which can result in lower risk premiums. And when global interest rates are low and global liquidity is abundant, we have seen EM debt perform well at times.

In market environments with declining inflation or falling interest rates, EM debt has also performed well, as it has tended to display a higher sensitivity to rates. In volatile market environments, EM debt has typically displayed higher volatility than other fixed-income asset classes in the developed market space due to rising risk aversion and investor outflows. But this asset class has historically performed well after periods of high market volatility.

In addition, we believe the U.S. dollar plays an important role in EM debt, and securities may benefit when the U.S. dollar depreciates.

We believe this misunderstanding creates potential opportunities for investors who can recognize the asset class’s true strengths and potential for alpha generation.

Investing in EM debt is often viewed through a lens of caution and underscored by a common narrative that emphasizes perceived heightened risk. One common myth about the asset class is, “EM debt isn’t right for my investment portfolio,” as some investors often avoid EM debt because of concerns over risk, volatility, and lack of familiarity.

However, we believe this myth, among others, tends to overshadow the nuanced realities of EM debt, and dissecting them reveals an asset class that, when navigated with insight and expertise, presents compelling opportunities for discerning investors.

Marcelo Assalin, CFA, partner, is the head of William Blair’s emerging markets debt team, on which he also serves as a portfolio manager.

The J.P. Morgan U.S. High Yield Index measures the performance of U.S.-dollar-denominated below-investment-grade corporate debt publicly issued in the U.S. market. The J.P. Morgan U.S. Investment Grade Corporate Index measures the performance of U.S. investment-grade corporate debt. The J.P. Morgan CEMBI Broad Diversified Core Index tracks the performance of U.S-dollar-denominated bonds issued by emerging market corporate entities. The J.P. Morgan GBI-EM Global Diversified Index tracks local currency bonds issued by emerging market governments. The J.P. Morgan EMBI Global Diversified Index tracks liquid, U.S. dollar emerging market fixed- and floating-rate debt instruments issued by sovereign and quasi-sovereign entities. The J.P. Morgan NEXGEM Index tracks U.S. dollar-denominated government bonds issued by frontier markets. (Index information has been obtained from sources believed to be reliable, but J.P. Morgan does not warrant its completeness or accuracy. The indices are used with permission. The indices may not be copied, used, or distributed without J.P. Morgan’s prior written approval. Copyright J.P. Morgan Chase & Co. All rights reserved.) The MSCI Emerging Markets Index is a free-float-adjusted market capitalization index that is designed to measure equity market performance in global emerging markets. The MSCI World Index is a market-capitalization-weighted index of stocks from companies throughout the world and is used as a common benchmark for “world” or “global” stock funds intended to represent a broad cross-section of global markets. The Bloomberg U.S. Treasury Bills Index measures U.S.-dollar-denominated, fixed, rate, nominal debt issued by the U.S. Treasury.

Index performance is provided for illustrative purposes only. A direct investment in an unmanaged index is not possible.

Want the latest insights on the economy and other forces shaping the investment landscape?

Subscribe to our Investing Insights newsletter.

Any investment or strategy mentioned herein may not be appropriate for every investor. There can be no assurance that investment objectives will be met. Products and services listed are available only to residents of this jurisdiction and may only be available to certain categories of investors. The information on this website does not constitute an offer for products or services, or a solicitation of an offer to any persons outside of this jurisdiction who are prohibited from receiving such information under applicable laws and regulations. Nothing on this webpage should be construed as advice and is therefore not a recommendation to buy or sell shares.

Please carefully consider the William Blair Funds’ investment objectives, risks, charges, and expenses before investing. This and other information is contained in the Funds’ prospectus and summary prospectus, which you may obtain by calling 1-800-742-7272. Read the prospectus and summary prospectus carefully before investing. Investing includes the risk of loss.

The William Blair Funds are distributed by William Blair & Company, L.L.C., member FINRA/SIPC.

The William Blair SICAV is a Luxembourg investment company with variable capital registered with the Commission de Surveillance du Secteur Financier (“CSSF”) which qualifies as an undertaking for collective investment in transferable securities (“UCITS”). The Management Company of the SICAV has appointed William Blair Investment Management, LLC as the investment manager for the fund.

Please carefully consider the investment objectives, risks, charges, and expenses of the William Blair SICAV. This and other important information is contained in the prospectus and Key Investor Information Document (KIID). Read these documents carefully before investing. The information contained on this website is not a substitute for those documents or for professional external advice.

Information and opinions expressed are those of the authors and may not reflect the opinions of other investment teams within William Blair Investment Management, LLC, or affiliates. Factual information has been taken from sources we believe to be reliable, but its accuracy, completeness or interpretation cannot be guaranteed. Information is current as of the date appearing in this material only and subject to change without notice. Statements concerning financial market trends are based on current market conditions, which will fluctuate. This material may include estimates, outlooks, projections, and other forward-looking statements. Due to a variety of factors, actual events may differ significantly from those presented.

Investing involves risks, including the possible loss of principal. Equity securities may decline in value due to both real and perceived general market, economic, and industry conditions. The securities of smaller companies may be more volatile and less liquid than securities of larger companies. Investing in foreign denominated and/or domiciled securities may involve heightened risk due to currency fluctuations, and economic and political risks. These risks may be enhanced in emerging markets and frontier markets. Investing in the bond market is subject to certain risks including market, interest rate, issuer, credit, and inflation risk. High-yield, lower-rated, securities involve greater risk than higher-rated securities. Different investment styles may shift in and out of favor depending on market conditions. Diversification does not ensure against loss.

Past performance is not indicative of future returns. References to specific companies are for illustrative purposes only and should not be construed as investment advice or a recommendation to buy or sell any security.

William Blair Investment Management, LLC is an investment adviser registered with the U.S. Securities and Exchange Commission.

Issued in the United Kingdom by William Blair International, Ltd., authorized and regulated by the Financial Conduct Authority (FCA), and is only directed at and is only made available to persons falling within articles 19, 38, 47, and 49 of the Financial Services and Markets Act of 2000 (Financial Promotion) Order 2005 (all such persons being referred to as "relevant persons").

Issued in the European Economic Area (EEA) by William Blair B.V., authorized and supervised by the Dutch Authority for the Financial Markets (AFM) under license number 14006134 and also supervised by the Dutch Central Bank (DNB), registered at the Dutch Chamber of Commerce under number 82375682 and has its statutory seat in Amsterdam, the Netherlands. This material is only intended for eligible counterparties and professional clients.

Issued in Switzerland by William Blair Investment Services (Zurich) GmbH, Talstrasse 65, 8001 Zurich, Switzerland ("WBIS"). WBIS is engaged in the offering of collective investment schemes and renders further, non-regulated services in the financial sector. WBIS is affiliated with FINOS Finanzomubdsstelle Schweiz, a recognized ombudsman office where clients may initiate mediation proceedings pursuant to articles 74 et seq. of the Swiss Financial Services Act ("FinSA"). The client advisers of WBIS are registered with regservices.ch by BX Swiss AG, a client adviser registration body authorized by the Swiss Financial Market Supervisory Authority ("FINMA"). WBIS is not supervised by FINMA or any other supervisory authority or self-regulatory organization. This material is only intended for institutional and professional clients pursuant to article 4(3) to (5) FinSA.

Issued in Australia by William Blair Investment Management, LLC (“William Blair”), which is exempt from the requirement to hold an Australian financial services license under Australia's Corporations Act 2001 (Cth). William Blair is registered as an investment advisor with the U.S. Securities and Exchange Commission (“SEC”) and regulated by the SEC under the U.S. Investment Advisers Act of 1940, which differs from Australian laws. This material is intended only for wholesale clients.

Issued in Singapore by William Blair International (Singapore) Pte. Ltd. (Registration Number 201943312R), which is regulated by the Monetary Authority of Singapore under a Capital Markets Services License to conduct fund management activities. This material is intended only for institutional investors and may not be distributed to retail investors.

Issued in Canada by William Blair Investment Management, LLC, which relies on the international adviser exemption, pursuant to section 8.26 of National Instrument 31-103 in Canada.

The content contained in this site is intended as informational or educational in nature and does not constitute investment advice or a recommendation of any investment strategy or product for a particular investor. Investment advice and recommendations can be provided only after careful consideration of an investor’s objectives, guidelines, and restrictions. Investors should consult a financial professional/financial consultant or investment adviser before making any investment decisions. Investing includes the risk of loss.

Copyright © 2026 William Blair. William Blair is a registered trademark of William Blair & Company, L.L.C. “William Blair” refers to William Blair Investment Management, LLC and affiliates.