June 17, 2024 | Global Equity

Evolving Corporate Governance in Japan

Japanese economic reform efforts began in earnest during the Abenomics era, when Prime Minister Shinzo Abe spearheaded a comprehensive agenda to address the prolonged period of deflation and corporate inefficiency that had plagued Japan for decades. But today, Japan is undergoing a remarkable transformation in its corporate governance landscape, which we believe makes it an increasingly attractive destination for global investors.

GPIF’s Influence in Improving Standards

A pivotal player in Japan’s corporate reform story is the Government Pension Investment Fund (GPIF), which is Japan’s largest public pension fund. Established in 2001, it is one of the largest pension funds in the world.

To support Japan’s aging population, the country’s Government Pension Investment Fund has significantly shifted its investment strategy from bonds to equities.

Over the past decade, to drive the growth needed to support Japan’s aging population, the GPIF has significantly shifted its investment strategy from low-yielding Japanese government bonds to equities, increasing its equity target allocation fivefold, with a significant portion dedicated to Japanese equities.

The GPIF is also driven by a “universal owner” mentality, which acknowledges that it owns a substantial portion of the entire market, with significant stakes in numerous companies across various sectors. Given this extensive influence, GPIF promotes long-term market sustainability and stability by pushing for higher governance standards. For example, the GPIF has adopted ESG-focused indices for passive allocations, encouraging companies to improve their practices to be included in these indices.

Corporate Governance Reforms

At the same time, Japan’s corporate governance reforms have been substantial, focusing on enhancing board independence and diversity.

Over the past decade, there has been a significant increase in the number of companies with independent directors, a critical component of effective governance.

Additionally, there has been a cultural shift toward greater gender diversity on boards, with a noticeable rise in the participation of women. Revisions to Japan’s corporate governance code, effective April 2022, set a target of one female director by 2025 and 30% female directors by 2030.

Japan is the only country we are aware of where the percentage of men taking paternity leave is required corporate disclosure.

This shift reflects broader societal changes in Japan, including efforts to destigmatize paternity leave, promoting shared responsibility in child-rearing. In fact, Japan is the only country we are aware of where the percentage of men taking paternity leave is required corporate disclosure.

Despite these advancements, challenges remain. I terms of board independence, separation of CEO and chair, and female directors, Japanese companies rank well behind their developed market peers and even behind most emerging markets. Japanese companies also have the highest number of directors over age 70 (which isn’t surprising, given its demographics).

Tokyo Stock Exchange Reforms

The Tokyo Stock Exchange (TSE) has also played a crucial role in Japan’s corporate governance evolution. In April 2022, the TSE restructured its market into three segments: prime, standard, and growth, each with specific governance requirements.

For example, companies listed on the prime segment must have at least one-third independent directors, one female director by 2025, and a skills matrix disclosure to provide transparency about board members’ roles.

The TSE has also mandated electronic voting and simultaneous disclosure of information in English and Japanese to enhance investor engagement and transparency

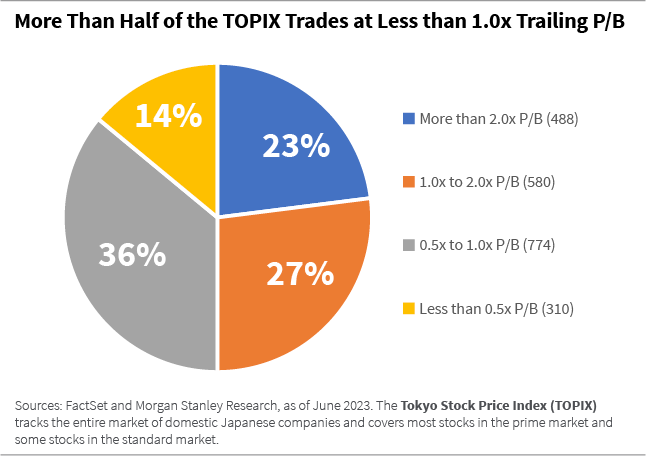

The Tokyo Stock Exchange is urging all companies with a P/B ratio of less than one or ROE of less than 8% to improve capital efficiency … or be delisted.

Lastly, the TSE is urging all companies with a price-to-book (P/B) ratio of less than one (meaning the market values the company below its book value, which could indicate undervaluation or potential problems with the company's fundamentals) or return on equity (ROE) of less than 8% to devise a plan to improve capital efficiency and promote investment. Companies that do not develop such a plan could be delisted.

In January 2024, the TSE began publicly naming the listed companies that have complied with its request. Hiromi Yamaji, chief executive of the Japan Exchange Group, which controls the TSE, was quoted in The Financial Times as follows: “We will renew the list every month. In Japan … peer pressure or nudge is a very important method to push people to go forward.”[1]

The Push for Better Capital Efficiency

Speaking of ROE, improving capital management is another key focus of Japan’s ongoing reforms, as many Japanese companies have poor ROE, which indicates how well a company uses its equity to generate profit. Higher ROE suggests that the company is using its capital effectively to produce earnings.

But currently, many Japanese companies have low ROE. About 40% of Japanese stocks listed on the TOPIX 500 have a ROE of less than 8%. In the United States, that number is 14%, and in Europe 19%.

Aligning Japan’s cross-shareholding ratios with those of the United States and Europe could potentially increase market ROE by up to 300 basis points.

To address this, Japan has introduced the Plan-Do-Check-Act (PDCA) method, which is an improvement cycle based on the scientific method of proposing a change in a process, implementing the change, measuring the results, and taking appropriate action.

This, Japan believes, should encourage companies to articulate and improve their investment strategies, including research and development, capital expenditures, and shareholder returns through buybacks and dividends.

Additionally, there is a significant push to reduce cross-shareholdings, which could have a substantial impact on overall market returns. For example, aligning Japan’s cross-shareholding ratios with those of the United States and Europe could potentially increase market ROE by up to 300 basis points.

Engaging the Global Investor Community

The TSE is actively working to foster transparent and effective dialogues between companies and investors. This effort includes global investor meetings, where Japanese companies are encouraged to engage with international investors, enhancing their visibility and investment appeal.

Conclusion

Japan’s corporate governance journey over the past decade has been transformative, laying the foundation for a promising future.

While there is still much work to be done, the progress made so far is encouraging. The ongoing reforms, combined with Japan’s strategic focus on improving capital efficiency and investor engagement, should create better alignment between executive decision-makers and investors, which we believe will lead to enhanced risk management, better decision-making that focuses on value creation, and ultimately, better shareholder returns.

As Japan continues to evolve and modernize, we believe it stands poised to become a more relevant and attractive market for global investors, offering compelling growth and profit improvement prospects. We also see a compelling bottom-up story based on multiple on-the-ground research trips.

Blake Pontius, CFA, is the director of sustainable investing at William Blair Investment Management.

[1]https://www.ft.com/content/94dfe7fb-d244-4c26-809b-3d1ec213815d