January 16, 2024 | Emerging Markets Debt

Investments

ASSET-CLASS CAPABILITIES

Insights

EDUCATION CENTER

SUBSCRIBE

January 16, 2024 | Emerging Markets Debt

We anticipate a strong 2024 for emerging markets (EM) debt on the back of a significant improvement in the global macro backdrop.

While it appears likely that the global economy will continue to gradually decelerate, we believe growth should remain close to its long-term potential. In such an environment, central banks in advanced economies have likely reached the end of their hiking cycles, and many EM central banks have already started cutting policy rates.

The increased likelihood that the global monetary tightening cycle is nearly over leads us to believe that there are attractive opportunities for investors to start adding to duration to lock in attractive real and nominal yields. In this context, we are looking for opportunities to increase allocation to longer-duration securities.

We see ample opportunities in EM frontier and distressed credit.

We continue to see value in high-beta, high-yield credit and are positioned for high-yield/investment-grade spread compression because we believe the global market environment will be conducive to the outperformance of high-beta, high-yield credit.

We also see scope for fundamental differentiation. We prefer countries with easier access to multilateral and bilateral funding. Multilateral and bilateral support to EMs remains strong and could make a meaningful contribution to external funding in 2024. In this context, we see ample opportunities in EM frontier and distressed credit.

Meanwhile, the corporate credit space continues to exhibit a combination of differentiated fundamental drivers, favorable supply technical conditions, and attractive relative valuations to select sovereign curves. We are seeking investment opportunities where corporate credit fundamentals and attractive spreads coincide. Short-maturity bonds have outperformed, but opportunities in longer bonds are beginning to appear. We continue to focus on issuers with low refinancing needs, robust balance sheets, and positive credit trajectories.

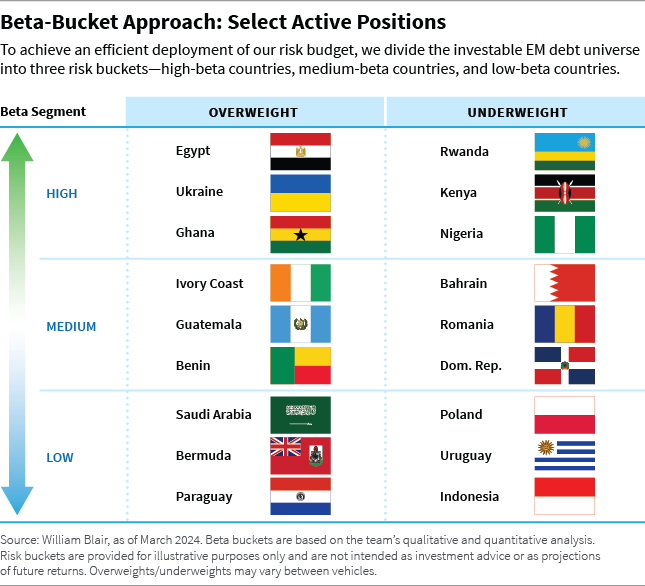

Below, we break down some of our largest active positions by beta bucket, which is how we allocate our risk budget.

In the high-beta bucket, our largest overweight positions are in Egypt, Angola, and El Salvador, and our largest underweight positions are in Nigeria, Kenya, and Honduras.

Egypt (overweight): We believe Egypt’s external financing needs will be met with support from partners in the Middle East and the International Monetary Fund (IMF). We see scope for Egypt to catch up to the broader move in high-yield credits and believe valuations are attractive.

Angola (overweight): Angola has attractive valuations, and we believe authorities’ commitment to fiscal consolidation and broader economic reform is genuine. Moreover, the depreciation of the kwanza demonstrates commitment to a flexible exchange rate, in our view. We believe this will serve the economy well over the medium term.

El Salvador (overweight): In our view, it is likely that President Nayib Bukele, one of the most popular politicians in Latin America, will be reelected in February. This could provide the political cover to reach an agreement with the IMF (although one potential obstacle is the country’s adoption of bitcoin as legal tender).

We remain concerned about governance issues within Honduras, which lead us to believe there is better relative value elsewhere.

Nigeria (underweight): Nigeria has tight valuations relative to peers. After strong performance in the immediate aftermath of the elections, we are looking for signs of more cohesive policies and full implementation of reforms announced earlier this year.

Kenya (underweight): Spreads have tightened to levels at which we believe there is better value in other high-beta names. There have been some conflicting statements from authorities as to how maturing 2024 bonds will be financed, the twin deficits remain wide, and ongoing currency weakness is likely to persist in the near term, in our opinion. IMF support should, however, ensure that there is not a default event on the upcoming maturity.

Honduras (underweight): We do not hold any Honduran bonds because we do not like the valuations, given fundamental risks. Although Honduras has the capacity to service its debt in the near term, credit fundamentals have been declining. The electricity sector has been particularly mismanaged, creating additional fiscal challenges. Overall, we remain concerned about governance issues within Honduras, which lead us to believe there is better relative value elsewhere.

In the medium-beta bucket, our largest overweight positions are in Benin, Guatemala, and Brazil, and our largest underweight positions are in Oman, Costa Rica, and Turkey.

Benin (overweight): We see value in Benin relative to other more liquid sub-Saharan names. Reform momentum remains strong, and Benin continues to enjoy a strong relationship with the IMF. Robust growth, relatively low levels of public debt, and ongoing fiscal discipline led Benin to receive an upgrade from Standard & Poor’s in the last quarter of 2023, and the outlook is now rated “positive” (up from “stable” previously).

We believe Guatemalan President Juan José Arevalo will likely face political obstacles when he assumes office, but Guatemala will remain a strong credit.

Guatemala (overweight): Political noise has increased following President Juan José Arevalo’s win in the August elections, as some branches of government have taken an aggressive stance toward Arevalo’s Semilla party, raising concerns about the stability of the transition period. However, we still believe Arevalo will assume office in January and the electoral process will be respected. Arevalo will likely face political obstacles when he assumes office, but we believe that due to strong initial conditions in the country via strong leverage ratios and low fiscal deficits, Guatemala will remain a strong credit, as it has strong macroeconomic conditions and attractive valuations.

Brazil (overweight): We continue to hold diversified positions across several sectors in Brazil and have been adding through the new-issue market as well. We currently hold seven issuers across seven different sectors of the Brazilian economy.

Oman (underweight): A medium-beta-bucket country during the fourth quarter, we upgraded Oman to our low-beta bucket at the end of the year due to its lower volatility and consistently strong performance. Oman has enjoyed a strong fiscal reform story over the past couple of years. However, we believe this story is now priced in. The country is still highly dependent on the oil sector, where prices remain vulnerable to slowing global growth, and we believe there is the potential for the positive reform momentum to stall if oil prices fall below the fiscal breakeven level and remain there.

Costa Rica (underweight): Costa Rica has unappealing valuations, in our opinion. Spreads in Costa Rica are now the tightest they’ve been since 2013.

Turkey (underweight): We see risks ahead of local elections in March, as President Recep Tayyip Erdogan has unexpectedly shifted policy direction before with no advance warning. Valuations also look tight given the recent change in positioning, and the recent large increase in the minimum wage suggests that it is prudent to adopt more of a wait-and-see approach to this market for now.

In the low-beta bucket, our largest overweight positions are in Qatar, Poland, and Bermuda, and our largest underweight positions are in Indonesia, Uruguay, and UAE.

Qatar (overweight): We believe issuance is likely to be a key theme for investment-grade countries in the first quarter of 2024, given the dramatic rally in U.S. Treasury yields and EM bond spreads in the last quarter of 2023. Although Qatar may issue opportunistically, we do not expect issuance in as large a size as some of its peers, given Qatar’s strong fiscal position and lower debt levels.

Poland could benefit from the result of last year’s parliamentary elections, which led to a more market-friendly government taking over in December.

Poland (overweight): Although we expect heavy issuance from Poland in 2024, we expect issuance to be skewed largely toward the domestic and euro currency. In our opinion, Poland could benefit from the result of last year’s parliamentary elections, which led to a more market-friendly government taking over in December.

Bermuda (overweight): Bermuda’s bonds have similar valuations to other low-beta sovereigns, such as those of Peru and Chile, but we believe the country has a stronger fundamental trajectory with less institutional uncertainty.

Indonesia (underweight): We underweighted Indonesia after a year of significant spread compression resulted in unappealing valuation compared to its low-beta peers. By the end of 2023, the country’s J.P. Morgan EMBIGD spread was 87 basis points. Based on fundamentals, the outlook is stable, although the presidential election scheduled for February 2024 and risk of new-year supply are impediments to near-term spread performance.

Uruguay (underweight): Credit fundamentals in Uruguay remain strong, but bond prices have compressed materially since the COVID-19 pandemic, and we believe this results in limited scope for additional spread tightening.

UAE (underweight): We find valuations unappealing. Bonds in weaker credits, such as Sharjah and Dubai, have rallied to the point where we believe valuations are no longer attractive relative to fundamentals. We prefer to own positions in real estate issuers at more attractive valuations. Moreover, within the Gulf Cooperation Council (GCC) region, we continue to prefer Qatar to UAE; reflecting this, we hold a relative overweight spread duration position in Qatar. This overweight is driven by the lower issuance needs in this market relative to GCC peers.

Marco Ruijer, CFA, partner, is a portfolio manager on William Blair’s emerging markets debt team.

Want the latest insights on the economy and other forces shaping the investment landscape?

Subscribe to our Investing Insights newsletter.

Any investment or strategy mentioned herein may not be appropriate for every investor. There can be no assurance that investment objectives will be met. Products and services listed are available only to residents of this jurisdiction and may only be available to certain categories of investors. The information on this website does not constitute an offer for products or services, or a solicitation of an offer to any persons outside of this jurisdiction who are prohibited from receiving such information under applicable laws and regulations. Nothing on this webpage should be construed as advice and is therefore not a recommendation to buy or sell shares.

Please carefully consider the William Blair Funds’ investment objectives, risks, charges, and expenses before investing. This and other information is contained in the Funds’ prospectus and summary prospectus, which you may obtain by calling 1-800-742-7272. Read the prospectus and summary prospectus carefully before investing. Investing includes the risk of loss.

The William Blair Funds are distributed by William Blair & Company, L.L.C., member FINRA/SIPC.

The William Blair SICAV is a Luxembourg investment company with variable capital registered with the Commission de Surveillance du Secteur Financier (“CSSF”) which qualifies as an undertaking for collective investment in transferable securities (“UCITS”). The Management Company of the SICAV has appointed William Blair Investment Management, LLC as the investment manager for the fund.

Please carefully consider the investment objectives, risks, charges, and expenses of the William Blair SICAV. This and other important information is contained in the prospectus and Key Investor Information Document (KIID). Read these documents carefully before investing. The information contained on this website is not a substitute for those documents or for professional external advice.

Information and opinions expressed are those of the authors and may not reflect the opinions of other investment teams within William Blair Investment Management, LLC, or affiliates. Factual information has been taken from sources we believe to be reliable, but its accuracy, completeness or interpretation cannot be guaranteed. Information is current as of the date appearing in this material only and subject to change without notice. Statements concerning financial market trends are based on current market conditions, which will fluctuate. This material may include estimates, outlooks, projections, and other forward-looking statements. Due to a variety of factors, actual events may differ significantly from those presented.

Investing involves risks, including the possible loss of principal. Equity securities may decline in value due to both real and perceived general market, economic, and industry conditions. The securities of smaller companies may be more volatile and less liquid than securities of larger companies. Investing in foreign denominated and/or domiciled securities may involve heightened risk due to currency fluctuations, and economic and political risks. These risks may be enhanced in emerging markets and frontier markets. Investing in the bond market is subject to certain risks including market, interest rate, issuer, credit, and inflation risk. High-yield, lower-rated, securities involve greater risk than higher-rated securities. Different investment styles may shift in and out of favor depending on market conditions. Diversification does not ensure against loss.

Past performance is not indicative of future returns. References to specific companies are for illustrative purposes only and should not be construed as investment advice or a recommendation to buy or sell any security.

William Blair Investment Management, LLC is an investment adviser registered with the U.S. Securities and Exchange Commission.

Issued in the United Kingdom by William Blair International, Ltd., authorized and regulated by the Financial Conduct Authority (FCA), and is only directed at and is only made available to persons falling within articles 19, 38, 47, and 49 of the Financial Services and Markets Act of 2000 (Financial Promotion) Order 2005 (all such persons being referred to as "relevant persons").

Issued in the European Economic Area (EEA) by William Blair B.V., authorized and supervised by the Dutch Authority for the Financial Markets (AFM) under license number 14006134 and also supervised by the Dutch Central Bank (DNB), registered at the Dutch Chamber of Commerce under number 82375682 and has its statutory seat in Amsterdam, the Netherlands. This material is only intended for eligible counterparties and professional clients.

Issued in Switzerland by William Blair Investment Services (Zurich) GmbH, Talstrasse 65, 8001 Zurich, Switzerland ("WBIS"). WBIS is engaged in the offering of collective investment schemes and renders further, non-regulated services in the financial sector. WBIS is affiliated with FINOS Finanzomubdsstelle Schweiz, a recognized ombudsman office where clients may initiate mediation proceedings pursuant to articles 74 et seq. of the Swiss Financial Services Act ("FinSA"). The client advisers of WBIS are registered with regservices.ch by BX Swiss AG, a client adviser registration body authorized by the Swiss Financial Market Supervisory Authority ("FINMA"). WBIS is not supervised by FINMA or any other supervisory authority or self-regulatory organization. This material is only intended for institutional and professional clients pursuant to article 4(3) to (5) FinSA.

Issued in Australia by William Blair Investment Management, LLC (“William Blair”), which is exempt from the requirement to hold an Australian financial services license under Australia's Corporations Act 2001 (Cth). William Blair is registered as an investment advisor with the U.S. Securities and Exchange Commission (“SEC”) and regulated by the SEC under the U.S. Investment Advisers Act of 1940, which differs from Australian laws. This material is intended only for wholesale clients.

Issued in Singapore by William Blair International (Singapore) Pte. Ltd. (Registration Number 201943312R), which is regulated by the Monetary Authority of Singapore under a Capital Markets Services License to conduct fund management activities. This material is intended only for institutional investors and may not be distributed to retail investors.

Issued in Canada by William Blair Investment Management, LLC, which relies on the international adviser exemption, pursuant to section 8.26 of National Instrument 31-103 in Canada.

The content contained in this site is intended as informational or educational in nature and does not constitute investment advice or a recommendation of any investment strategy or product for a particular investor. Investment advice and recommendations can be provided only after careful consideration of an investor’s objectives, guidelines, and restrictions. Investors should consult a financial professional/financial consultant or investment adviser before making any investment decisions. Investing includes the risk of loss.

Copyright © 2026 William Blair. William Blair is a registered trademark of William Blair & Company, L.L.C. “William Blair” refers to William Blair Investment Management, LLC and affiliates.