August 21, 2024 | News

Subscribe Now

Want the latest insights on the economy and other forces shaping the investment landscape?

Subscribe to our Investing Insights newsletter.

August 21, 2024 | News

Want the latest insights on the economy and other forces shaping the investment landscape?

Subscribe to our Investing Insights newsletter.

U.S. equities have outperformed non-U.S. equities over the past decade, but our global equity team believes several factors are making non-U.S. markets more attractive, including lower valuation, less concentrated opportunity set, and country-specific factors (such as corporate reforms in Japan and the easing of Europe’s energy crisis). Below are some insights from our global equity team.

There are three drivers of U.S. equity outperformance over the past decade. First, lower interest rates in the United States have bolstered the expansion of multiples. Second, U.S. companies have experienced higher earnings growth, driven primarily by stronger nominal gross domestic product (GDP) growth in the United States than other regions, most notably Europe. Third, in the past year alone, U.S. companies have repurchased an amount equivalent to 10% of the European equity market, which has boosted earnings per share growth and further contributes to their outperformance, amplified further by expanding multiples.

Why would that be about to change?

First, outside the United States, inflation rates are generally lower and government deficits are significantly smaller. In contrast, the United States exhibits a mix of restrictive policies and expansive fiscal measures, contributing to its unique economic environment. This scenario of lower inflation and interest rates abroad supports higher multiples for non-U.S. equities.

Second, U.S. equity market outperformance is partly due to concentration. The top 10% of companies account for 80% of cash-flow profits and 70% of market capitalization, a phenomenon not mirrored to such an extent elsewhere.

But when looking at U.S. companies in the top quartile of sustainable value creation (SVC), our global equity team's measure of quality, the picture is markedly different when excluding the largest companies. And historical shifts in the ranks of the largest companies suggest that today’s dominant players may not maintain their positions indefinitely.

In addition, while non-U.S. markets may not have giants like NVIDIA, Microsoft, Meta, or Google, they boast leading companies such as Novo Nordisk and Taiwan Semiconductor Manufacturing Company, and some of the best banks and consumer brands in the world in our global equity team's view.

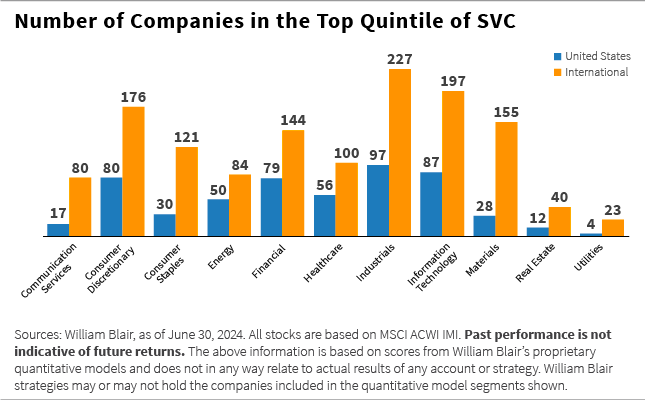

So, our global equity team believes that there are numerous thematic growth opportunities outside the United States, and the chart below supports that.

It’s also worth mentioning the evolving dynamics of global trade flows. Exports from emerging markets (EMs) to other EMs account for about 45% of total exports—much higher than it was a decade ago. More specifically, China’s share of exports to Group of Seven (G7) countries is decreasing sharply, while its exports to non-G7 countries, particularly in the global south, are rising significantly.

Why is this happening?

First, countries are increasingly trading with those that are geographically closer and more like-minded.

Second, foreign direct investment (FDI) in China has plummeted to virtually zero due to geopolitical tensions, a tightening regulatory environment, an economic slowdown, and shifts in global supply chains to mitigate risks highlighted by the COVID-19 pandemic.

Countries such as Vietnam are capturing market share in manufactured goods from China.

Third, countries such as Vietnam are capturing market share in manufactured goods from China, which is becoming more expensive. These countries offer cheaper alternatives and are often viewed as friendlier trade partners.

Fourth, the conflict between Russia and Ukraine has altered energy trade routes. Less Russian energy is flowing westward, while more is directed eastward, benefiting countries such as India.

Lastly, countries such as Brazil, Indonesia, and India have seen substantial growth, affecting trade volumes and patterns.

Then there are some country-specific factors that make non-U.S. equities attractive. Let’s start by turning our gaze eastward to Japan, where the landscape is transforming.

Japanese corporate reforms—mandated by Tokyo Stock Exchange in collaboration with the government—are substantial. Second, a generational cultural shift in capital allocation is underway, prioritizing shareholder interests and increased capital expenditures. Third, Japanese constitutional amendments driving military expansion are increasing capital expenditures.

Next, in Europe, the initial severe impact of the energy crisis following Russia’s invasion of Ukraine has softened. Changes in energy supply dynamics have led to lower gas prices, diminishing the competitive disadvantages previously faced by European manufacturers compared to their global counterparts.

Lastly, India has emerged from the shadows of China’s economic influence over the last two decades and has reached an economic tipping point, leading our global equity team to believe it is poised to redefine its role on the global stage. Several factors are contributing to this success.

Bureaucratic reforms under Narendra Modi’s governance have simplified business operations in India, fostering a more favorable environment for economic activities. The overhaul of the monetary system, primarily through digitalization, has increased transparency and efficiency in a traditionally cash-heavy economy. In addition, rising capital expenditure from both the government and private sector is driving infrastructure and development projects across the country.

India stands on its own two feet in ways it couldn’t a decade ago.

As GDP per capita rises, consumption patterns in India are shifting from basic needs to aspirational goods, reflecting the growing middle class’s increasing purchasing power. Geopolitically, India maintains a neutral stance, strategically leveraging its relationships. It is not a close ally of China but benefits from its ties with Russia to secure energy supplies, often paying in rupees instead of dollars. This approach reduces India’s external dollar dependency and allows it to re-export energy to Europe.

Moreover, about 80% of globally traded options contracts were executed in India last year, underscoring significant price discovery within the country. However, the high valuation of Indian consumer stocks, which often trade at 60 to 70 times earnings, exerts pressure on Indian banks as investors shift their funds from banks to equity markets.

India’s economic transformation is notable. It now stands on its own two feet in ways it couldn’t a decade ago, presenting an optimistic outlook for its role in international trade.

These qualitative reasons for considering non-U.S. investments are now reinforced by our global equity team's quantitative models, which indicate that the valuation attractiveness has shifted in favor of non-U.S. markets, a reversal from a long-standing trend.

Considering these dynamics, our global equity team believes the potential for non-U.S. equities to outperform is compelling—particularly for active managers.

Any investment or strategy mentioned herein may not be appropriate for every investor. There can be no assurance that investment objectives will be met. Products and services listed are available only to residents of this jurisdiction and may only be available to certain categories of investors. The information on this website does not constitute an offer for products or services, or a solicitation of an offer to any persons outside of this jurisdiction who are prohibited from receiving such information under applicable laws and regulations. Nothing on this webpage should be construed as advice and is therefore not a recommendation to buy or sell shares.

Please carefully consider the William Blair Funds’ investment objectives, risks, charges, and expenses before investing. This and other information is contained in the Funds’ prospectus and summary prospectus, which you may obtain by calling 1-800-742-7272. Read the prospectus and summary prospectus carefully before investing. Investing includes the risk of loss.

The William Blair Funds are distributed by William Blair & Company, L.L.C., member FINRA/SIPC.

The William Blair SICAV is a Luxembourg investment company with variable capital registered with the Commission de Surveillance du Secteur Financier (“CSSF”) which qualifies as an undertaking for collective investment in transferable securities (“UCITS”). The Management Company of the SICAV has appointed William Blair Investment Management, LLC as the investment manager for the fund.

Please carefully consider the investment objectives, risks, charges, and expenses of the William Blair SICAV. This and other important information is contained in the prospectus and Key Investor Information Document (KIID). Read these documents carefully before investing. The information contained on this website is not a substitute for those documents or for professional external advice.

Information and opinions expressed are those of the authors and may not reflect the opinions of other investment teams within William Blair Investment Management, LLC, or affiliates. Factual information has been taken from sources we believe to be reliable, but its accuracy, completeness or interpretation cannot be guaranteed. Information is current as of the date appearing in this material only and subject to change without notice. Statements concerning financial market trends are based on current market conditions, which will fluctuate. This material may include estimates, outlooks, projections, and other forward-looking statements. Due to a variety of factors, actual events may differ significantly from those presented.

Investing involves risks, including the possible loss of principal. Equity securities may decline in value due to both real and perceived general market, economic, and industry conditions. The securities of smaller companies may be more volatile and less liquid than securities of larger companies. Investing in foreign denominated and/or domiciled securities may involve heightened risk due to currency fluctuations, and economic and political risks. These risks may be enhanced in emerging markets and frontier markets. Investing in the bond market is subject to certain risks including market, interest rate, issuer, credit, and inflation risk. High-yield, lower-rated, securities involve greater risk than higher-rated securities. Different investment styles may shift in and out of favor depending on market conditions. Diversification does not ensure against loss.

Past performance is not indicative of future returns. References to specific companies are for illustrative purposes only and should not be construed as investment advice or a recommendation to buy or sell any security.

William Blair Investment Management, LLC is an investment adviser registered with the U.S. Securities and Exchange Commission.

Issued in the United Kingdom by William Blair International, Ltd., authorized and regulated by the Financial Conduct Authority (FCA), and is only directed at and is only made available to persons falling within articles 19, 38, 47, and 49 of the Financial Services and Markets Act of 2000 (Financial Promotion) Order 2005 (all such persons being referred to as "relevant persons").

Issued in the European Economic Area (EEA) by William Blair B.V., authorized and supervised by the Dutch Authority for the Financial Markets (AFM) under license number 14006134 and also supervised by the Dutch Central Bank (DNB), registered at the Dutch Chamber of Commerce under number 82375682 and has its statutory seat in Amsterdam, the Netherlands. This material is only intended for eligible counterparties and professional clients.

Issued in Switzerland by William Blair Investment Services (Zurich) GmbH, Talstrasse 65, 8001 Zurich, Switzerland ("WBIS"). WBIS is engaged in the offering of collective investment schemes and renders further, non-regulated services in the financial sector. WBIS is affiliated with FINOS Finanzomubdsstelle Schweiz, a recognized ombudsman office where clients may initiate mediation proceedings pursuant to articles 74 et seq. of the Swiss Financial Services Act ("FinSA"). The client advisers of WBIS are registered with regservices.ch by BX Swiss AG, a client adviser registration body authorized by the Swiss Financial Market Supervisory Authority ("FINMA"). WBIS is not supervised by FINMA or any other supervisory authority or self-regulatory organization. This material is only intended for institutional and professional clients pursuant to article 4(3) to (5) FinSA.

Issued in Australia by William Blair Investment Management, LLC (“William Blair”), which is exempt from the requirement to hold an Australian financial services license under Australia's Corporations Act 2001 (Cth). William Blair is registered as an investment advisor with the U.S. Securities and Exchange Commission (“SEC”) and regulated by the SEC under the U.S. Investment Advisers Act of 1940, which differs from Australian laws. This material is intended only for wholesale clients.

Issued in Singapore by William Blair International (Singapore) Pte. Ltd. (Registration Number 201943312R), which is regulated by the Monetary Authority of Singapore under a Capital Markets Services License to conduct fund management activities. This material is intended only for institutional investors and may not be distributed to retail investors.

Issued in Canada by William Blair Investment Management, LLC, which relies on the international adviser exemption, pursuant to section 8.26 of National Instrument 31-103 in Canada.

The content contained in this site is intended as informational or educational in nature and does not constitute investment advice or a recommendation of any investment strategy or product for a particular investor. Investment advice and recommendations can be provided only after careful consideration of an investor’s objectives, guidelines, and restrictions. Investors should consult a financial professional/financial consultant or investment adviser before making any investment decisions. Investing includes the risk of loss.

Copyright © 2026 William Blair. William Blair is a registered trademark of William Blair & Company, L.L.C. “William Blair” refers to William Blair Investment Management, LLC and affiliates.