In January, our emerging markets (EM) debt outlook called for steady growth, manageable inflation, and resilience in the face of geopolitical noise. Six months in, how has that view held up? From macro dynamics to credit spreads, trade policy to local market flows, much of what we anticipated is playing out—but with a few important surprises along the way.

When you released your EM outlook in January, you believed EM gross domestic product (GDP) growth would remain stable in 2025. How has that played out?

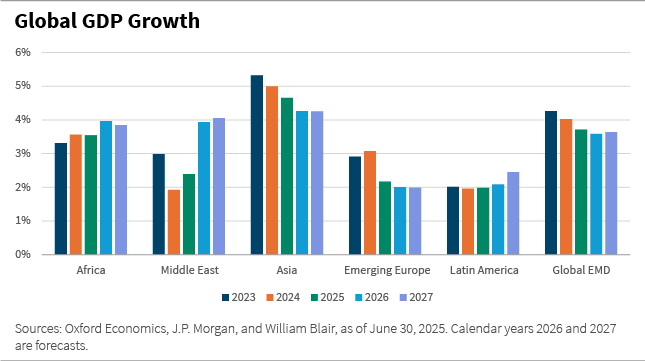

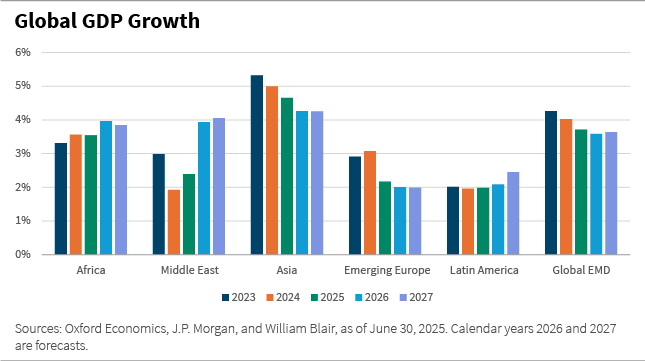

As we expected, EM macro dynamics remained resilient. Overall, expectations were for deceleration of the global economy, predominantly driven by the impact that rising U.S. tariffs could have on global trade. However, we are seeing just a marginal repricing of expectations for EM growth, and we believe that growth should remain between 3.5% and 4.0% going forward, which highlights the resilience of EM economies.

How did your inflation expectations play out?

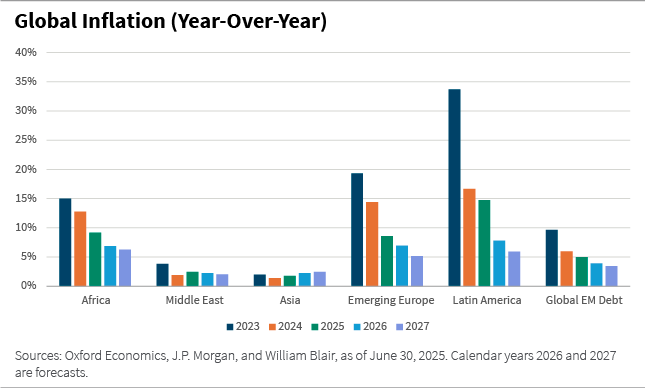

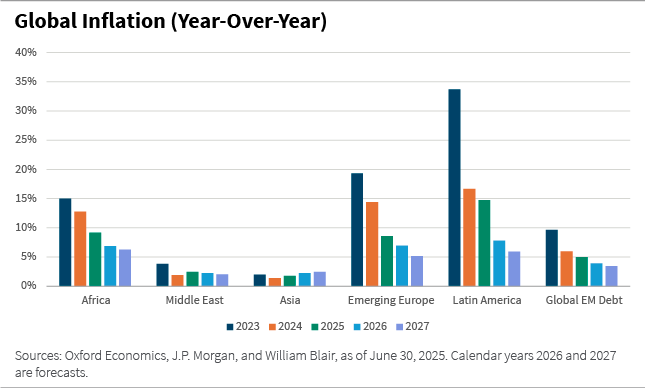

Overall, pretty much as we expected. Inflation has generally been benign across the board, with few exceptions. This has allowed most EM central banks to decouple from the U.S. Federal Reserve (Fed) and continue cutting interest rates, providing an additional stimulus for growth.

In your opinion, what is the main reason for this resilience?

The main reason—in addition to monetary stimulus and benign inflationary dynamics—is that EMs have reduced dependence on the U.S. economy over the years, and increased trade between themselves. So at this point many EM economies are somewhat isolated from what’s happening in the United States.

You also noted in January that the Trump presidency introduced uncertainty due to his positions on immigration, taxation, trade, regulation, and energy. Has the reality differed from the expectation?

The situation has unfolded as we expected. We never believed that the changes would create a major disruption in the global economy. We believed that there would be more bark than bite, or escalating to de-escalate, especially about trade policy. This is exactly what we’re seeing. There was a lot of noise after “Liberation Day,” followed by a more pragmatic approach from the U.S. administration, which opened channels for dialogue and negotiation. A good example was how the United States and China backed off from very high tariffs, postponing absurd levels as they engaged in conversations. But there are still open questions. Over the next few months, we expect trade agreements reached with important U.S. trading partners. Now, as then, we believe investors need to separate noise from fact.

At this point many EM economies are somewhat isolated from what’s happening in the United States.

We saw many markets struggle after the “Liberation Day” announcement. How did EM debt fare in that environment?

There was a market correction after “Liberation Day” because investors were concerned about the potential impact of U.S. trade policy on the global economy. I think the markets were starting to price in a global recession, and pretty much all asset classes sold off. Then, as the U.S. government started signaling that it was open to negotiation with trade partners, the markets calmed.

When investors became less concerned about the potential implications for the global economy … our portfolios benefited.

How did your portfolios fare in the wake of the tariff announcements? Did you make any adjustments?

We were expecting some noise when the new U.S. administration took over, so we decided to reduce risks in our portfolios across the board by increasing cash and reducing overall beta. Then, as markets sold off and valuations became more attractive, we started to rebuild the positions and increase risk exposure. When investors became less concerned about the potential implications for the global economy, and markets started to rally again, our portfolios benefited.

Could you give some examples of EM countries that have both benefited and been hurt by U.S. tariff changes?

It’s too early to say which countries will benefit and which countries will not, because the U.S. government is in the middle of negotiations with several important trading partners, and we just don’t know where things will land. But I think it’s safe to say that countries that compete with the United States could benefit if the United States enters a trade war with Asia (and China more specifically). For example, if China buys fewer agricultural products from the United States, it will have to buy more from South America, and important producers of agricultural commodities such as Brazil and Argentina could benefit.

You spoke a bit about the oil outlook in January; could you provide an update?

We were anticipating lower oil prices due to rising production from OPEC+ and softening demand due to a deceleration in global growth. Rising tensions in the Middle East drove oil prices significantly higher. Now we’re seeing oil prices fall again. We believe oil prices will move marginally lower from here due to higher supply, but we don’t expect prices to move abruptly because we don’t believe the global economy will enter a recession. We believe the moving prices are just an accommodation in terms of growth dynamics, which in turn should support the demand for energy.

Where do you see opportunities in hard currency EM debt?

At the start of the year, our hard currency strategy emphasized an overweight to high-yield debt and an underweight to investment-grade credit, based on the view that high yield offered better value. We expected spread compression between the two segments, and that dynamic has played out, benefiting our portfolios. We continue to prefer high-yield debt and remain positioned for further compression.

Beyond credit quality, we see opportunities in countries with access to multilateral and bilateral financing, those resilient to trade disruptions, and those that could even benefit from rising trade tensions. Frontier markets and corporate credit also stand out, particularly given the breadth and diversity of the opportunity set.

More broadly, the environment for EM hard currency debt remains constructive. Yields and carry are high, default risk appears low (we don’t expect any significant credit events over the next 18 to 24 months), and fundamentals are holding up. Technical conditions are also favorable, with net new issuance expected to stay limited. Altogether, we believe it’s a solid backdrop for the asset class.

We believe local currency EM debt is particularly compelling right now, given our view that the U.S. dollar will continue to depreciate.

Where do you see opportunities in local currency EM debt?

Local currency EM debt is particularly compelling right now, given our view that the U.S. dollar will continue to depreciate. Much local market debt offers higher nominal and real interest rates than the United States and other advanced economies, as well as undervalued currencies.

Are there any new developments in frontier EMD?

From a hard currency perspective, default risk is low, and frontier countries still offer decent value in terms of credit spreads. But we’re mostly excited about local currency debt in frontier markets.

More and more frontier countries have been opening to international investors, so the opportunity set keeps expanding. This allows us to invest in a very diversified way.

Plus, with the U.S. dollar weaker, these countries can better manage their currencies. In most frontier markets, we see high local interest rates and stable to appreciating currencies because of the weaker dollar.

So, it’s a very interesting place to be right now—an asset class that we believe is misunderstood, mispriced, and where the expected potential returns, in our opinion, outweigh the risks.

Where are you seeing the most compelling opportunities in EM corporate credit right now, and what does recent issuance suggest about investor appetite and refinancing risk?

We believe EM corporate credit continues to offer attractive risk-reward opportunities, supported by a more stable macro backdrop, easing rate volatility, and still-low default rates. While EM corporates have lagged longer-duration credit this year, we see room for catch-up, particularly in high-yield segments with manageable leverage. Regionally, opportunities span across geographies. In Latin America, Brazilian metals, oil-linked names, and segments of the bank capital structure remain appealing. In Central and Eastern Europe, Middle East, and Africa (CEEMEA), Turkish corporates offer high yields, and Middle Eastern demand has proven resilient. In Asia, Indian and Indonesian utilities stand out, while China remains highly idiosyncratic. Meanwhile, the primary market has stayed healthy in 2025. Issuance briefly slowed in April but rebounded strongly in May and June, signaling solid investor appetite. Gross supply is now expected to surpass earlier projections, even as net financing stays negative. Refinancing accounts for about one-third of issuance, which is in line with historical norms, and we see no signs of stress. Latin America and the Middle East continue to lead supply, with Asia rebounding but still below pre-COVID levels.

Although there has been some increase in U.S. tariffs, so far we have not seen any significant impacts on growth and inflation.

Are you watching any potential developments for the remainder of 2025?

We believe the asset class is influenced by two predominant forces: global growth and global liquidity. So, we need to analyze the risk factors that will impact this balance.

The first risk factor is trade-related—any tensions or trade wars that could significantly impact global trade, resulting in weaker economic growth and even a recessionary environment. The key is to watch how trade negotiations unfold.

The second risk factor is inflation—that is, whether a significant adjustment in U.S. tariffs leads to higher U.S. inflation and forces the Fed to tighten monetary conditions. We think that’s unlikely because we expect a pragmatic approach from the U.S. government, but it’s a risk.

If we see a combination of weaker growth, rising inflation, and tighter monetary conditions, we expect that risk assets, including EM debt, will likely be affected.

That said, we believe risks are low in terms of growth and inflation. Although there has been some increase in U.S. tariffs, so far we have not seen any significant impacts on growth and inflation. So, I believe investors were overly concerned about these risks in the beginning of the year, and today there is more confidence that we will muddle through this situation.

Can you sum up what’s different now versus January in a few sentences?

I think there is less uncertainty. In the beginning of the year, we didn’t know what to expect in terms of U.S. policies. Today, there is less uncertainty about the policy agenda and also more confidence that there will be pragmatism. And in our opinion, that’s good news for investors.

Marcelo Assalin, CFA, partner, is the head of William Blair’s emerging markets debt team, on which he also serves as a portfolio manager.