September 25, 2023 | Emerging Markets Debt

Featured Strategies

View Strategy:

https://im.williamblair.com/investments/separate-accounts/emerging-markets-debt

September 25, 2023 | Emerging Markets Debt

View Strategy:

https://im.williamblair.com/investments/separate-accounts/emerging-markets-debt

Amid the challenges China’s property market faces, which we described in the first part of this two-part series, the sector remains in need of further supportive measures to restore consumer confidence and address entrenched structural problems of high leverage and housing surplus. Anticipating an increased dominance of state-owned enterprises (SOEs) in the market, we see a potential path toward a more sustainable sector emerging from the turmoil in the long term.

Recognizing that the Chinese property sector remains an important pillar to sustain Chinese growth in the long run, the government has also made several attempts to revive the presale market, although the outcome so far has been very mixed.

In November 2022, the People’s Bank of China (PBOC) and China Banking and Insurance Regulatory Commission (CBIRC) joined forces in rolling out a package consisting of 16 financial measures to support the recovery of the real-estate market and encourage its healthy development.

These supportive measures can be broadly categorized into four policy objectives: 1) promoting smooth refinancing for developers, mortgages, and construction loans; 2) ensuring property delivery; 3) facilitating sector reforms and protecting buyers’ legal rights; and 4) providing headroom for banks to fulfill regulatory requirements if the weakness in the sector persists.

Financial markets initially responded positively to these policy announcements, but that early optimism proved to be misplaced, as the property sector met with more defaults and credit downgrades in the first quarter of 2023. There were also disappointments on the macro level as the reopening rebound peaked and political tensions hurt export outlooks, depressing purchasing managers’ indices (PMIs) and industrial profits. Even the services sector, which was expected to enjoy a prolonged period of above-trend recovery, started to see its momentum fading.

The stakes are now high for the government to react with some economic stimulus measures for the broader economy, including the property sector.

Given several growing near-term risks—including a shrinking export market (due to escalating geopolitical tensions), contracting domestic demand, and disinflation due to an aging demographic trend and high youth unemployment—the stakes are now high for the government to react with some economic stimulus measures for the broader economy, including the property sector.

It was reported in early June that the government is mulling a new set of property market support measures in the second half of 2023, including but not limited to reducing down payments, lowering commissions, further relaxing home-purchase restrictions, and extending measures under the 16-point plan mentioned earlier.

In our opinion, the focus of a second round of significant measures should be on how the government can help induce a faster pickup of home sales in lower-tier cities, rebuild buyer confidence in privately owned developers, and, most importantly, ensure that these measures are effective in lifting demand.

During China’s Politburo meetings (the most recent one took place on July 24, 2023), the committee of 24 top-brass party members discusses current economic conditions in China and reveals its latest policymaking preferences.

While the Politburo has previously described the country as facing “triple pressures in economic development” (shrinking demand, disrupted supply, and weakening expectations), at its most recent meetings the committee acknowledged that weak domestic demand is now a primary concern.

In July, the Politburo maintained its cautious outlook for the Chinese economy, citing slowing external demand, lagging domestic demand, and the emergence of new difficulties. Yet the committee fell short of specifying any stimulus plans, other than dialing up its rhetoric by pledging strong countercyclical adjustments to spur demand.

China is pinning its hopes on increasing household income and improving industrial profitability, which unfortunately hasn’t happened.

In the past, the Chinese government had hoped both elements of demand—retail consumption and industrial spending— would catch up. In other words, China is pinning its hopes on increasing household income and improving industrial profitability, which unfortunately hasn’t happened, as evidenced by recent data.

The committee also emphasized the importance of attracting foreign direct investment (FDI) and supporting the private sector, vowing to dismantle legal and administrative obstacles to ensure room for growth and competition between private and public players.

Regarding the roadblocks to full recovery, the committee highlighted three key risks: the high level of local government debt, the high youth unemployment rate, and the ongoing Chinese property crisis. While the high local debt levels and a lack of youth job opportunities will likely drag on economic growth in the medium to long term, the downfall of the Chinese property sector, which had been contributing as much as 30% to gross domestic product (GDP) growth (directly and indirectly), has already made a significant dent in economic growth.

Interestingly, in the statement issued after its July meeting, the Politburo omitted its long-held phrase that “property is for living, not for speculation.”

We do not think that the omission suggests a diversion from the government’s pledge to support a “new development model” for the property sector—i.e., ensuring uninterrupted delivery of completed projects to homeowners, thereby improving the livelihood of the Chinese people and reforming the sector (which has been plagued by property developers’ excess borrowing and aggressive expansion).

Nevertheless, the omission signals that the Politburo is more open to providing support not only to first-time homebuyers but also to those upgrading their homes or even second home purchases.

Additional commitments to “adjust and optimize property policies timely” and vows to “invigorate the capital market” for financing activities are positive twists to the rather lower expectation set by the market before the July meeting.

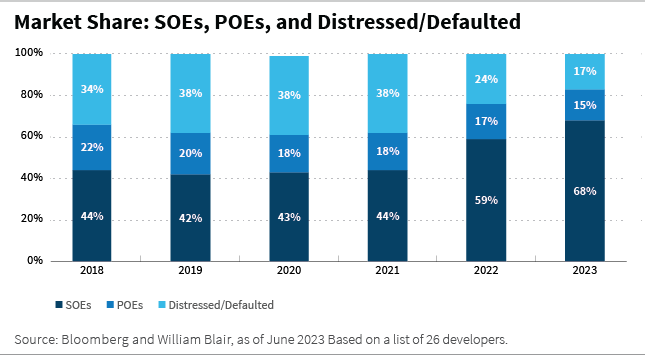

SOEs represent only around 20% of the Chinese property offshore issuers under our coverage, but they now account for almost 70% of the presale market share through June 2023, as the chart below shows. This is a notable increase from their 44% market share just two years ago.

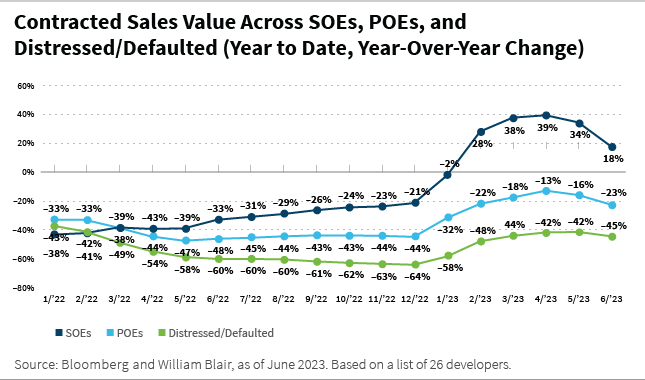

Thus far, SOEs have emerged as clear winners from the recent turmoil in the Chinese property market. Although the fundamentals and implied support from their parent companies vary greatly for SOEs with mixed ownership, they have generally experienced a remarkable sales recovery, averaging a year-over-year increase of 18% in contracted sales through June 2023. Although monthly sales growth turned negative for SOEs in June, they are outperforming the sector year-to-date, as the chart below shows.

SOEs’ outperformance can be mainly attributed to stronger buyer confidence in project delivery (due to implied government support), continued funding access, superior financial capabilities, and high exposure to tier-1 and tier-2 cities. This contrasts with privately owned enterprises (POEs), which have more exposure to lower-tier cities.

Remarkably, SOEs, saw their absolute debt levels rise year over year as of fiscal year 2022, as most maintained open their funding channels, while absolute debt levels fell for POEs, which have limited access to external financing.

Due to the supportive liquidity provisions by banks and the central government, SOEs have continued to acquire land bank, build their investment capacity, and strengthen their competitive advantages over POEs. This ability to replenish their saleable property inventory should enable them to gain further market share in the medium term, particularly as private developers are squeezed out of the physical market. Given these factors, we believe SOEs should maintain their dominant position in the property market in the coming years.

The rebound in the Chinese property sector, spurred by the post-COVID reopening and government support, was promising but proved short lived. Housing sales ended fiscal year 2022 down 27% year-over-year, and a broad recovery in 2023 seems unlikely due to some deeply rooted structural challenges—specifically, high leverage and excess housing stock in lower-tier cities.

Primary property sales numbers for the first half of 2023 show marginal growth compared to a year ago, and real-estate investments through June 2023 are down by 8% year-over-year. At the same time, secondary market sales continue to be soft, leading us to believe that absent any significant policy measures, the property sector will take time to recover.

We believe the softness of Chinese macroeconomic data since April 2023, along with the persistently weak performance of the Chinese property market, should provide incentive to the government to dial up its policy support for the economy in general and the property sector more specifically. We will closely monitor upcoming Politburo meetings for any policy signals.

That said, there are fiscal limitations on the government underpinning the market as it has done previously—for example, much higher debt-to-GDP ratios and higher fiscal deficits than in past decades. Therefore, we believe any policy-easing package will likely be moderate and targeted, complementing existing measures, which should, over time, pass through the economy and support the sector.

Although the opportunity set has narrowed significantly, we expect surviving developers to be better off.

Investing in the Chinese property bond market, however, remains challenging. The depressed physical market will likely continue to worsen the liquidity profile of developers. In addition, their inability to raise capital to keep their businesses afloat—along with the lack of constructive news about debt restructurings for the defaulted issuers—will likely make the already distressed pricing of offshore debts range-bound at best in the near future.

A sustainable recovery in the sector would require that many top-down and bottom-up policies work together to revitalize economic activity, rebuild consumer confidence, improve income expectations, and support private investments to broaden employment opportunities.

While turmoil in the Chinese property sector has certainly taken investors on a rough ride, and uncertainty about the future of many POEs remains, we believe a more sustainable sector could emerge from the turmoil in the long term.

Although the opportunity set has narrowed significantly, with more than half of the developers we cover in deep distress (some facing default), we expect surviving developers to be better off—more aligned with central government plans, less levered, and more cautious in their future development, resulting in a healthier and more conducive investment environment.

Anezina Mytilinaiou, CFA, is a senior corporate credit analyst on William Blair’s emerging markets debt team.

Clifford Lau, CFA, is a portfolio manager on William Blair’s emerging markets debt team.

View Strategy:

https://im.williamblair.com/investments/separate-accounts/emerging-markets-debt-hard-currency

View Strategy:

https://im.williamblair.com/investments/separate-accounts/emerging-markets-debt-local-currency

Want the latest insights on the economy and other forces shaping the investment landscape?

Subscribe to our Investing Insights newsletter.

Any investment or strategy mentioned herein may not be appropriate for every investor. There can be no assurance that investment objectives will be met. Products and services listed are available only to residents of this jurisdiction and may only be available to certain categories of investors. The information on this website does not constitute an offer for products or services, or a solicitation of an offer to any persons outside of this jurisdiction who are prohibited from receiving such information under applicable laws and regulations. Nothing on this webpage should be construed as advice and is therefore not a recommendation to buy or sell shares.

Please carefully consider the William Blair Funds’ investment objectives, risks, charges, and expenses before investing. This and other information is contained in the Funds’ prospectus and summary prospectus, which you may obtain by calling 1-800-742-7272. Read the prospectus and summary prospectus carefully before investing. Investing includes the risk of loss.

The William Blair Funds are distributed by William Blair & Company, L.L.C., member FINRA/SIPC.

The William Blair SICAV is a Luxembourg investment company with variable capital registered with the Commission de Surveillance du Secteur Financier (“CSSF”) which qualifies as an undertaking for collective investment in transferable securities (“UCITS”). The Management Company of the SICAV has appointed William Blair Investment Management, LLC as the investment manager for the fund.

Please carefully consider the investment objectives, risks, charges, and expenses of the William Blair SICAV. This and other important information is contained in the prospectus and Key Investor Information Document (KIID). Read these documents carefully before investing. The information contained on this website is not a substitute for those documents or for professional external advice.

Information and opinions expressed are those of the authors and may not reflect the opinions of other investment teams within William Blair Investment Management, LLC, or affiliates. Factual information has been taken from sources we believe to be reliable, but its accuracy, completeness or interpretation cannot be guaranteed. Information is current as of the date appearing in this material only and subject to change without notice. Statements concerning financial market trends are based on current market conditions, which will fluctuate. This material may include estimates, outlooks, projections, and other forward-looking statements. Due to a variety of factors, actual events may differ significantly from those presented.

Investing involves risks, including the possible loss of principal. Equity securities may decline in value due to both real and perceived general market, economic, and industry conditions. The securities of smaller companies may be more volatile and less liquid than securities of larger companies. Investing in foreign denominated and/or domiciled securities may involve heightened risk due to currency fluctuations, and economic and political risks. These risks may be enhanced in emerging markets and frontier markets. Investing in the bond market is subject to certain risks including market, interest rate, issuer, credit, and inflation risk. High-yield, lower-rated, securities involve greater risk than higher-rated securities. Different investment styles may shift in and out of favor depending on market conditions. Diversification does not ensure against loss.

Past performance is not indicative of future returns. References to specific companies are for illustrative purposes only and should not be construed as investment advice or a recommendation to buy or sell any security.

William Blair Investment Management, LLC is an investment adviser registered with the U.S. Securities and Exchange Commission.

Issued in the United Kingdom by William Blair International, Ltd., authorized and regulated by the Financial Conduct Authority (FCA), and is only directed at and is only made available to persons falling within articles 19, 38, 47, and 49 of the Financial Services and Markets Act of 2000 (Financial Promotion) Order 2005 (all such persons being referred to as "relevant persons").

Issued in the European Economic Area (EEA) by William Blair B.V., authorized and supervised by the Dutch Authority for the Financial Markets (AFM) under license number 14006134 and also supervised by the Dutch Central Bank (DNB), registered at the Dutch Chamber of Commerce under number 82375682 and has its statutory seat in Amsterdam, the Netherlands. This material is only intended for eligible counterparties and professional clients.

Issued in Switzerland by William Blair Investment Services (Zurich) GmbH, Talstrasse 65, 8001 Zurich, Switzerland ("WBIS"). WBIS is engaged in the offering of collective investment schemes and renders further, non-regulated services in the financial sector. WBIS is affiliated with FINOS Finanzomubdsstelle Schweiz, a recognized ombudsman office where clients may initiate mediation proceedings pursuant to articles 74 et seq. of the Swiss Financial Services Act ("FinSA"). The client advisers of WBIS are registered with regservices.ch by BX Swiss AG, a client adviser registration body authorized by the Swiss Financial Market Supervisory Authority ("FINMA"). WBIS is not supervised by FINMA or any other supervisory authority or self-regulatory organization. This material is only intended for institutional and professional clients pursuant to article 4(3) to (5) FinSA.

Issued in Australia by William Blair Investment Management, LLC (“William Blair”), which is exempt from the requirement to hold an Australian financial services license under Australia's Corporations Act 2001 (Cth). William Blair is registered as an investment advisor with the U.S. Securities and Exchange Commission (“SEC”) and regulated by the SEC under the U.S. Investment Advisers Act of 1940, which differs from Australian laws. This material is intended only for wholesale clients.

Issued in Singapore by William Blair International (Singapore) Pte. Ltd. (Registration Number 201943312R), which is regulated by the Monetary Authority of Singapore under a Capital Markets Services License to conduct fund management activities. This material is intended only for institutional investors and may not be distributed to retail investors.

Issued in Canada by William Blair Investment Management, LLC, which relies on the international adviser exemption, pursuant to section 8.26 of National Instrument 31-103 in Canada.

The content contained in this site is intended as informational or educational in nature and does not constitute investment advice or a recommendation of any investment strategy or product for a particular investor. Investment advice and recommendations can be provided only after careful consideration of an investor’s objectives, guidelines, and restrictions. Investors should consult a financial professional/financial consultant or investment adviser before making any investment decisions. Investing includes the risk of loss.

Copyright © 2026 William Blair. William Blair is a registered trademark of William Blair & Company, L.L.C. “William Blair” refers to William Blair Investment Management, LLC and affiliates.