While we retain a constructive medium- and long-term outlook for emerging markets (EM) debt, we have downgraded our near-term views for the asset class.

Tariff Turmoil

Prospects for global retaliation against U.S. President Donald Trump’s latest tariffs pose significant risks for the global economy. While real impacts are difficult to assess at this point, we believe uncertainty and instability should continue to cloud the outlook in the short term.

In the United States, higher tariffs on imported goods would likely lead to a temporary increase in inflation, pressuring consumer discretionary spending and economy activity. While we would not expect the U.S. Federal Reserve (Fed) to initially react to transitory inflationary pressures, the path toward monetary easing is uncertain.

Globally, higher tariffs could negatively impact trade. Countries running large trade surpluses with the United States would likely see the biggest impact on their economies. China, and to a lesser extent Europe, should be particularly affected. In these places, we expect significant fiscal and monetary policy reaction to offset the impacts of higher tariffs imposed by the U.S. administration. We would also expect strong retaliation, as tariffs could violate World Trade Organization (WTO) commitments, creating additional risks for global trade.

We believe EM countries are better positioned to withstand a global trade war than developed countries.

We believe EM countries are better positioned to withstand a global trade war than developed countries, as the universe should be less directly exposed given the significant growth in intra-EM trade observed over the past years.

China, for example, is likely to deploy fiscal and monetary stimulus, allow its currency to weaken, and continue redirecting exports away from the United States. EMs now account for nearly half of Chinese exports, and we expect trade between China, EMs, and other developed countries to increase.

A Challenging Market Environment

Despite the constructive fundamental backdrop in EM countries, we now believe U.S. policy uncertainty, a looming trade war, and unresolved geopolitical conflicts should result in a challenging market environment in the next few months.

As a result, we have adopted a more defensive stance in our portfolios. That said, we will look for opportunities to reposition as market volatility creates opportunities for long-term investors. Valuations have recently become more attractive after recent credit spread decompression. We prefer countries with stronger ability to withstand rising trade tariffs and continue to favor the ones with easier access to multilateral and bilateral funding.

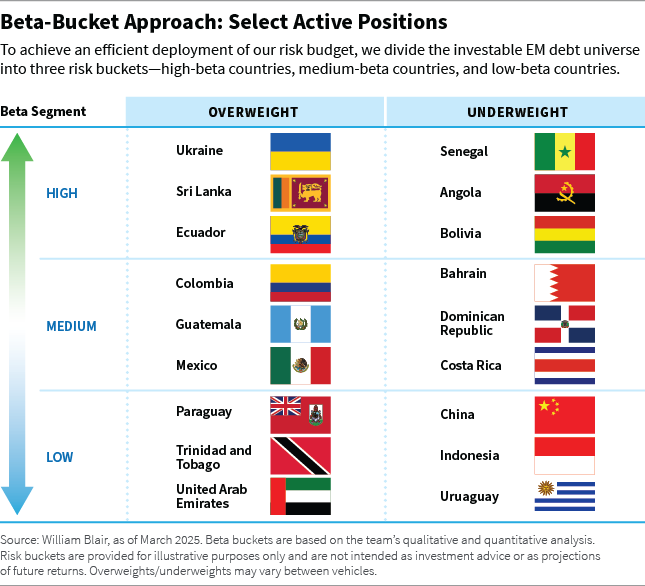

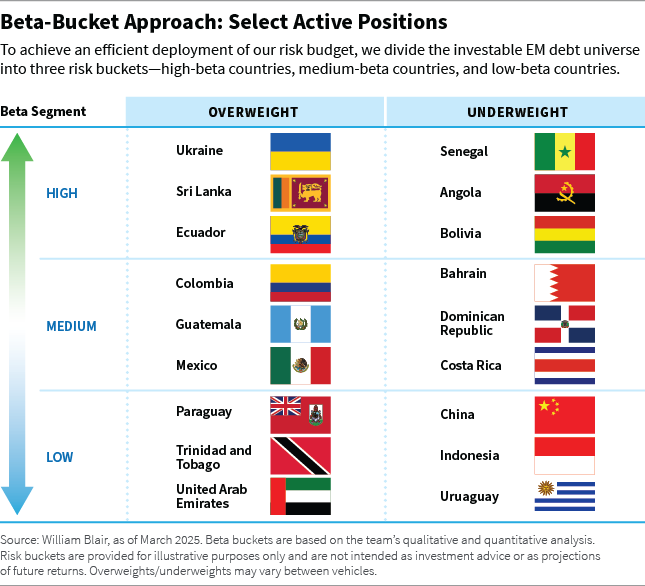

Below, we break down some of our largest active hard-currency positions by beta bucket, which is how we allocate our risk budget.

High-Beta Bucket

In the high-beta bucket, we are overweight Ukraine, Sri Lanka, and Ecuador, and underweight Senegal, Angola, and Bolivia.

Ukraine (overweight): We’re overweight based on the potential for conflict negotiations, multilateral support, and a more optimistic growth outlook. We express this view through an overweight to Ukrainian warrants but recently trimmed our allocation to the B bonds on valuation grounds. We want to stay somewhat defensive in case optimism around conflict resolution proves misplaced or fades.

Sri Lanka (overweight): We are overweight macro-linked bonds, reflecting the positive trajectory of gross domestic product (GDP) growth, as shown in the third and fourth quarter 2024 real GDP prints. We also believe the International Monetary Fund’s (IMF’s) successful third review of Sri Lanka’s Extended Fund Facility (EFF) program should further boost investor confidence in the country’s economic outlook.

Ecuador (overweight): Valuations are appealing. Markets were pricing in a first-round win for incumbent Daniel Noboa, but first-round results showed almost a dead tie between Noboa and Luisa Gonzalez. Since no candidate secured a majority in the first round, there will be a run-off, and markets seem to be pricing in a much higher probability of Luisa Gonzalez winning, which we think offers asymmetric upside.

Senegal (underweight): Senegal has seen upward revisions to public debt and fiscal deficit figures over the past five years. Fiscal performance sharply deteriorated in 2024, and the 2025 budget’s planned consolidation faces significant implementation risks. While bond valuations have improved following the underperformance, we see limited scope for outperformance without more credible policy measures to restore fiscal credibility. We continue to monitor Senegal’s discussions with the IMF for signs of progress toward a funded program.

Angola (underweight): We are underweight in spread-duration terms but overweight in cash, primarily through a short-dated amortizing bond. While we remain cautious on downside risks to oil prices, we believe Angola is both willing and able to meet its external obligations in the near term.

Bolivia (underweight): We have credit concerns, viewing Bolivia’s policy mix—large fiscal deficits and a pegged exchange rate—as unsustainable amid low and falling reserves and a current account deficit. Persistent foreign currency shortages in 2024 highlight these risks. Given the weak fundamentals and unattractive valuations, we remain on the sidelines.

Medium-Beta Bucket

In the medium-beta bucket, we are overweight Colombia, Guatemala, and Mexico, and underweight Bahrain, Dominican Republic, and Costa Rica.

Colombia (overweight): Valuations are appealing. Colombia had underperformed on concerns over its widening fiscal deficit, but we now see the bonds as inexpensive relative to peers. President Gustavo Petro’s low approval ratings also point to a likely regime change in the 2026 elections, which could further support sentiment.

Guatemala (overweight): Valuations are appealing, fundamentals are strong, and Guatemala appears to be on a positive rating trajectory, largely due to low debt, stable and low deficits, and a strong growth trajectory.

Mexico (overweight): We are overweight Pemex, given strong sovereign support and attractive valuations relative to the sovereign. However, we are underweight the Mexican sovereign on valuation grounds. We do hold positions in select financials and airlines.

Guatemalan valuations are appealing, fundamentals are strong, and the country appears to be on a positive ratings trajectory.

Bahrain (underweight): We are concerned about volatility in regional geopolitics, the country’s weak fiscal-reform efforts, lower oil prices, and tight valuations.

Dominican Republic (underweight): Valuations are not compelling despite the country appearing to be on a positive fundamental trajectory.

Costa Rica (underweight): Fundamentals are strong, but we believe valuations are unattractive because spreads have compressed materially.

Low-Beta Bucket

In the low-beta bucket, we are overweight Paraguay, Trinidad and Tobago, and the United Arab Emirates, and underweight China, Indonesia, and Uruguay.

Paraguay (overweight): Valuations are attractive relative to low-beta peers and fundamentals are solid. The country’s debt-to-GDP ratio remains low, and the country has a strong history of low fiscal deficits.

Trinidad and Tobago (overweight): We recently moved to an overweight position due to the country’s more appealing valuations relative to its low-beta peers.

United Arab Emirates (overweight): Our overweight position is driven predominantly by a combination of corporates and the smaller emirates, where we believe valuations are attractive relative to Abu Dhabi.

We see unpredictable regulatory risks to Chinese state-owned entities.

China (underweight): Valuations are tight and we see unpredictable regulatory risks to Chinese state-owned entities. Based on bottom-up analysis, we hold selective corporate bonds at attractive valuations and positive credit trajectories.

Indonesia (underweight): Valuations are unappealing, and the fundamental outlook has become less clear following the February 2024 presidential elections. With the new administration in place as of October, there’s a risk of fiscal slippage as priorities shift from stability to growth. The country is also expected to be a sizable external debt issuer in 2025. That said, we hold a diversified set of corporate positions, supported by resilient fundamentals across financials, renewable utilities, and oil and gas.

Uruguay (underweight): We remain underweight on valuations, as Uruguay trades among the tightest of Latin America’s low-beta countries.

Marco Ruijer, CFA, partner, is a portfolio manager on William Blair’s emerging markets debt team.