The Indian telecommunications sector, now the second-largest mobile market in the world, has undergone a dramatic transformation over the past decade, consolidating from a fragmented landscape to an oligopoly dominated by three players. With a range of demand drivers, anticipated tariff increases, and substantial investment, the sector now appears well positioned to capitalize on India’s demographic dividend and the growing need for connectivity—and its growth is set to outpace the Asia-Pacific telecom average. Below, we discuss the Indian telecommunications sector’s transformation over the last decade, highlight its main growth drivers, and explore the recent regulatory developments in the space.

From Fragmentation to Oligopoly

The Indian telecom sector is on a growth path, buoyed by favorable demographics; increasing mobile data consumption; expanding availability of 4G, 5G, and digital services; and supportive industry dynamics. The current growth phase follows an extended period of disruption and consolidation, intensified by regulatory hurdles.

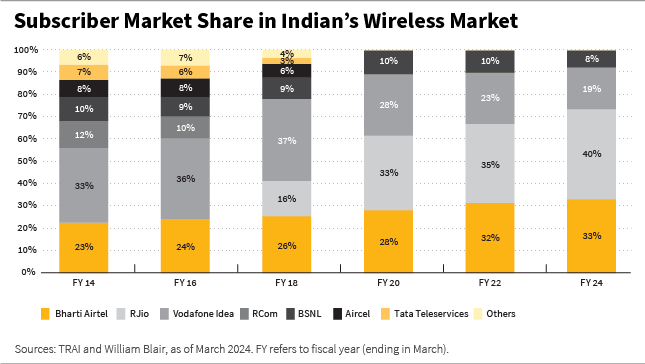

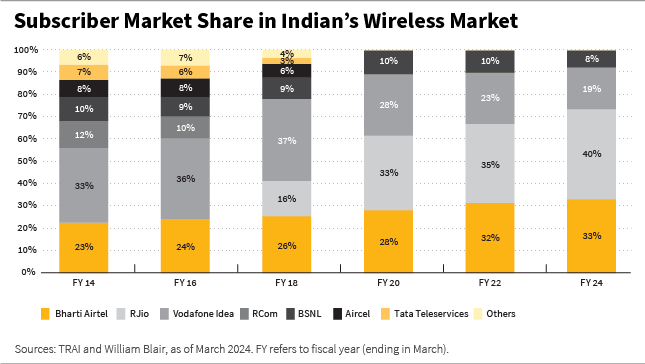

Looking back, in 2016 and 2017 the sector witnessed a sharp decline in average revenue per user (ARPU) following the entrance of Reliance Jio. Fierce price wars followed, forcing incumbents to lower their prices. Consequently, the competitive environment drove many players out of the market and the sector experienced significant consolidation. By 2018 the market had reduced from eight players to an oligopoly dominated by just three operators, as shown in the chart below 1—Reliance Jio, Bharti Airtel, and Vodafone Idea—with the smaller operators exiting or consolidating into larger firms.

Regulatory challenges have marred progress in the sector in the past, putting financial strain on the operators and hindering domestic and international investments. Spectrum prices have also been historically high in India, and a dispute between the government and the operators over adjusted gross revenue (AGR) dues, which was ruled in favor of the government, led to significant financial liabilities for operators across the industry. Although the government alleviated the financial pressure by offering flexible payment options, these struggles led the top two operators with healthier financials to garner more than 70% of industry’s subscribers, as the smaller players particularly struggled with their financial positions.

Now, these major players can enjoy operating in the second largest telecommunications industry globally by number of subscribers. Based on a rating agency’s report,[1] the sector’s revenue is projected to grow by more than 15% year over year in 2024 and by 11% in 2025, outperforming the Asian telcos, which are expected to grow by mid single digits in 2024 and by low single digits in 2025. This environment, therefore, can offer higher revenue visibility, improving free cash flow generation, stronger balance sheets, and overall improved credit metrics.

Additionally, on the back of rising private consumption, the International Monetary Fund (IMF)[2] has revised upward India’s real gross domestic product (GDP) growth to 7% in 2024 and 6.5% in 2025. This positions India among the fastest-growing major economies globally, and the country’s positive economic backdrop augurs well for the industry’s growth outlook.

Growth Drivers

We believe a young population, increases in per-capita income, the rising adoption of mobile technologies, and a more favorable urban/rural distribution will continue broadening the addressable market and drive demand for advanced services such as 5G. These factors, coupled with efforts to connect underserved regions and narrow the digital divide between urban and rural areas, represent structural demand drivers key to the sector’s revenue growth.

1. India’s Demographic Dividend

We believe demographics will be a key tailwind for the sector. India has a large, young workforce with median age of 28.4 years, surpassing China as of 2023.

Still, India’s success in leveraging its formidable labor pool hinges on effective labor reforms and job creation. Structural issues in its labor market, such as low labor-force participation and high unemployment/underemployment remain areas of focus. These hurdles have created barriers to labor contributing more to India’s GDP growth.[3] Specifically, in a survey released in September 2024,[4] the labor-force participation rate in India stood at 60.1%, primarily due to low female participation, which stands at a precarious 41.7%. For comparison, China’s female labor participation rate was 60.5% in 2023.

Younger consumers are more likely to adopt new digital services, which is a catalyst for higher data consumption and spending.

An S&P study[5] suggests that India’s demographic dividend will persist at least until 2055. However, growing investments to sustain productivity and GDP growth, job creation, and increased female participation will be key factors in the demand for mobile data consumption and digital solutions.

This environment can enhance an important demographic advantage: younger consumers are more likely to adopt new digital services, which is a catalyst for higher data consumption and spending. This foreshadows a rise in ARPU, directly contributing to mobile operators’ revenue growth while incentivizing them to innovate with their digital offerings.

2. Urbanization, Rural Connectivity, and Broadband Boom

India’s rising income and low mobile tariffs have contributed to the rising demand for digital services and content. Urbanization and rural connectivity could be the tipping points for greater broadband adoption. The major players will likely leverage these demand factors to enable additional market growth by improving their offerings, particularly in terms of service availability and broadband quality. This involves expanding 4G and 5G networks and fixed broadband through fixed wireless access (FWA).

Ongoing urbanization can boost growth through multiple channels. According to the United Nations (UN), by 2030 more than 50% of India’s population will reside in cities, up from the current urbanization rate of about 36%.[6] An urban population is more likely to use data-heavy applications such as cloud services and video streaming, which can drive higher both data consumption and ARPUs.

Consumers in rural regions can also propel growth for telecom operators. Out of India’s 1.2 billion wireless and wireline subscribers, 44% are in rural areas, with the penetration numbers suggesting the segment is still largely untapped.[7] India’s urban teledensity, as reported by its Telecom Regulatory Authority (TRAI), was 131% in 2024; rural teledensity was far below, at 58%. Digital India and BharatNet, government projects targeted to increase mobile connectivity and connect rural areas through optical fiber, are helping realize the potential of data consumption, improve digital literacy, and bridge the digital divide of underserved rural areas.

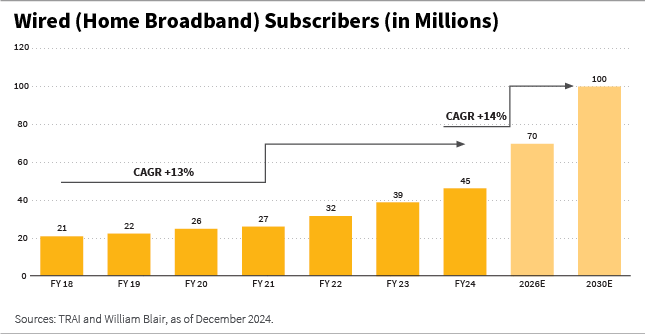

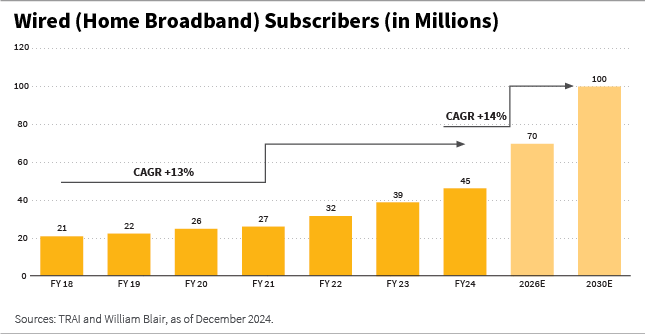

India’s wired broadband subscribers could reach 100 million by 2030.

Fixed broadband penetration remains low, with only 45 million subscribers[8] as of December 2024. However, a recent study[9] suggests that India’s wired broadband subscribers could grow to 70 million by 2026 and reach 100 million by 2030, implying a compound annual growth rate (CAGR) of 14% from 2024 to 2030 (as shown in the chart below). This trend is reinforced by the 5G fixed wireless access (FWA) expansion, a strategy that has proven to be more scalable than fiber-to-the-home solutions (FTTH).

Admittedly, the increasing home broadband penetration is pertinent to consumer behaviors that demand more connectivity from home and to rising economic growth. Even though the direction of causality[10] between rising economic growth and home broadband penetration remains unclear, the correlation between the two portends well for the industry growth. To that point, the IMF projects that GDP per capita will increase from $2,500 in 2023 to $4,200 by 2029, supporting our view that home broadband penetration should rise alongside.

Lastly, studies[11] suggest that average data consumption per user could double by 2027, primarily through increased content and digital services consumption. Interestingly, social media penetration in India is 32% in 2024, much lower than the global average of 63%.[12] Yet, Indians are among the largest data consumers globally. As of March 24, 2024, the average data usage per wireless data subscriber per month is 20.8 gigabytes, which is an increase of more than 17% year-over-year, or 2.3x since December 18, 2023.

3. Tariff Recovery

Despite India having the highest data consumption per subscriber, and implementing tariff hikes between 2019 and 2021, ARPUs remain among the lowest in the world. Telecom companies have struggled in the last decade with competition and aggressive price wars, which have kept tariffs low. Before the tariff announcements, monthly ARPU was hovering around $2, which is significantly lower than other selected emerging markets. Investments in network expansion have been heavy, particularly with the rollout of 5G, and future aspirations like 6G, along with spectrum charges and AGR dues, require tariff increases to support the sector's financial sustainability.

The key telecom players have been vocal that a healthier monthly ARPU would be in the range of 200 to 300 rupees in the medium term, higher than the range it hovered in first-quarter 2025 (ended in June 2024) at 145 to 210 rupees per month. With the announcement of a 10% to 25% tariff increase in 2024 and a CAGR of 7% to 13% within the next three years, the target looks achievable. Even though we do expect SIM card consolidation and churn to increase in the next few quarters, the increase in ARPU on the back of the tariff increases would offset any weakness stemming from the subscriber losses. We will monitor the actual ARPU realized; as most of the subscribers are in prepaid plans, it’s likely that customers will downgrade to smaller plans or simply recharge less frequently.

We believe another likely ARPU growth driver will be the transition to 4G and 5G plans. Currently, for two out of the three industry players, the percentage of the subscribers not yet on 4G or 5G plans ranges from 25% to 35%. These users generally pay lower tariffs than 4G/5G subscribers because they do not benefit from high-speed internet and premium content. As connectivity expands to rural areas and affordability rises, migrating these subscribers to higher-paying plans presents another area of growth for the key players.

4. Regulatory Shifts and FDI Trends

As mentioned above, the Indian regulatory landscape has exerted considerable influence in the sector, presenting challenges such as spectrum auction prices and the AGR dispute. However, projects such as the Digital India and BharatNet, which promote online infrastructure and digital and financial inclusion, can drive progress. The 2023 Telecommunication Act, enacted in June 2024, aims to update India’s telecom legislation by enhancing key areas, such as the simplification of spectrum allocation, cybersecurity, and consumer protection.

A more conducive regulatory backdrop facilitates telecom and infrastructure development, reducing uncertainty, thus incentivizing foreign investors.

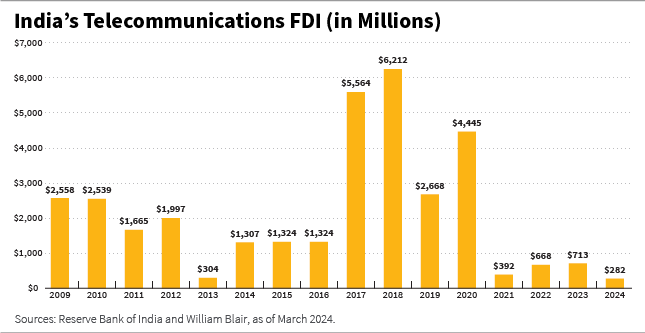

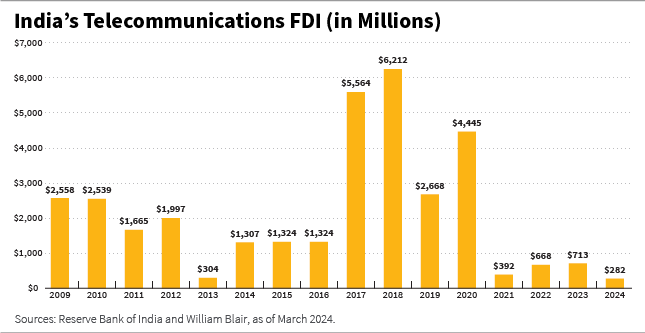

A more conducive regulatory backdrop facilitates telecom and infrastructure development, reducing uncertainty, thus incentivizing foreign investors to tap into a particular sector. Looking back, the major players in the sector attracted capital from global investors including Blackrock, Singtel, Qatar Foundation, Facebook, and Google,[13] and many private equity firms provided funding for the 4G/5G network expansion and the development of services in the companies’ digital ecosystem. These investments were reflected in the foreign direct investment (FDI) data between 2000 and 2024. The telecom sector is among the top four FDI recipient sectors in the country, accounting for 6%[14] of the cumulative FDI inflows.

This trend has decelerated over the past few years, though, due to many factors, as shown in the chart below. The consolidation of the sector created a natural barrier of entry, and a less favorable regulatory backdrop might also have dissuaded foreign investors. Since 2021, the government has been raising the FDI limits in the sector, allowing 100% of FDIs through the automatic route without previous regulatory checks to further open up the sector to foreign investors. Additionally, due to the introduction of the 2023 Telecommunication Act, new technology being deployed, and the recent opening up of the satellite communications to the private sector, it wouldn’t be a surprise to see FDIs returning to the sector.

Conclusion

We believe the TMT sector in India is at the tipping point of a new era characterized by synchronized demand drivers—including increasing urbanization, rising per capita income, and growing demand for digital services— and complemented by the anticipated tariff increases.

Mobile revenue growth is expected to be driven by improvements in ARPU, while revenue from home broadband is set to accelerate due to a surge in subscriber base supported by improving affordability

The telecom providers operate in the second largest telecom industry in the world by number of subscribers. A stable competitive environment, coupled with the aforementioned demand drivers, can offer high revenue visibility, better credit metrics, and higher returns.

However, it’s key for the telecommunications sector to address challenges, including increasing affordability for low-income segments, continuing to invest in infrastructure, and extending reach to underserved regions.

Key factors for the government to monitor include implementing further labor reforms, maintaining a productive labor pool, creating a conducive regulatory backdrop, and executing digital inclusion policies. Addressing these hurdles is essential for the sector to reach sustainable financial health, attract investments, and create a positive and diverse investment environment that will continue to contribute to the country's economic growth.

This blog is excerpted from our white paper.

Anezina Mytilinaiou, CFA, is a senior corporate credit analyst on William Blair’s emerging markets debt team.

[1] Fitch, [2] IMF, [3] IMF, [4] MOSPI, [5] S&P Global, [6] Unhabitat, [7] TRAI, [8] TRAI, [9] EY, [10] IMF, [11] Ericsson, [12] Datareportal, [13] IBEF, [14] DPIIT