Does the conventional approach to investing in emerging markets (EM) debt—which is top down and blended—lead to less efficient capital allocation? We believe so, due to the oversized and concentrated representation of Asia (particularly China) in EM debt local currency and corporate indices. The end-result of a top-down blended approach, then, is larger, concentrated positions in less attractive or riskier parts of the investment universe.

Challenges in Asia

Asia represents more than 40% of the EM debt local currency index, the J.P. Morgan Government Bond Index—Emerging Markets (GBI-EM) Global Diversified, and that number will grow to near 50% later this year when India is included in the index, resulting in even greater concentration.

This region is characterized by low or negative real interest rates and unattractively valued currencies. Take, for example, China, Thailand, and Malaysia, which together represent approximately 30% of the index. In all of these countries, government bond yields are currently trading below U.S. Treasury yields.

Moreover, the traditional EM debt local currency universe is very narrow. There are only 18 countries in the index, and most portfolios are highly concentrated in a few countries with significant representation. As a result, active risk allocation tends to be concentrated in a small number of places, and that concentration tends to lead to high volatility, high correlation between alpha and beta, and inconsistent alpha generation over the long run.

China’s troubled real estate sector is an important part of the corporate debt investment universe.

Asia also represents approximately 42% of the EM debt corporate credit index, the J.P. Morgan Corporate Emerging Markets Bond Index (CEMBI) Broad Diversified. In this space, the region also displays tight credit spreads and unattractive valuations.

China is also over-represented in the EM debt corporate universe. For example, Greater China (which includes China, Hong Kong, and Macau) represents approximately 15% of the J.P. Morgan CEMBI Broad Diversified. In China specifically, the financial sector has a large weight within the investment-grade space, whereas the troubled real estate sector represents an important part of the high-yield investment universe.

In our opinion, then, the traditional benchmark-driven approach to EM debt investing, which is blended, can lead to the allocation of capital to potentially unattractive or riskier markets.

A Different Approach

Most EM debt managers don’t have the willingness or ability to fully underweight countries with large weights in the benchmark. But at William Blair, our approach is different.

We believe that over the long run, investors are better compensated for taking credit risk than currency risk in the EM debt space. This is particularly true in sovereign hard currency credit, which has a history of low credit defaults and high recovery values. The chart below illustrates the attractive risk/reward profile of EMD hard currency debt (including the noteworthy historical performance of frontier markets debt).

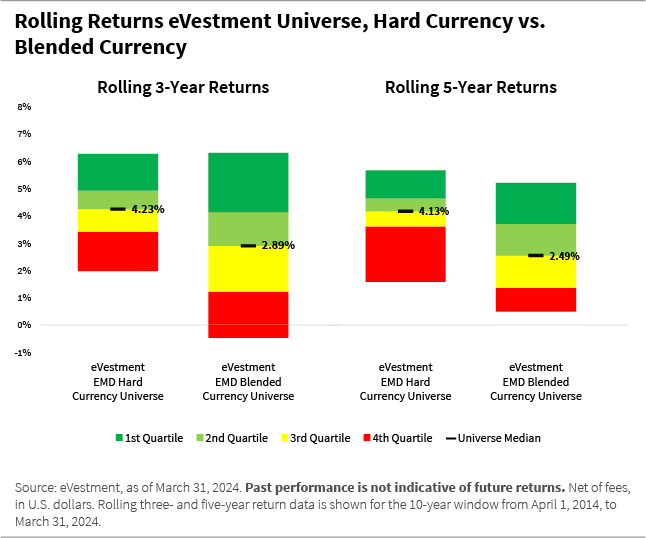

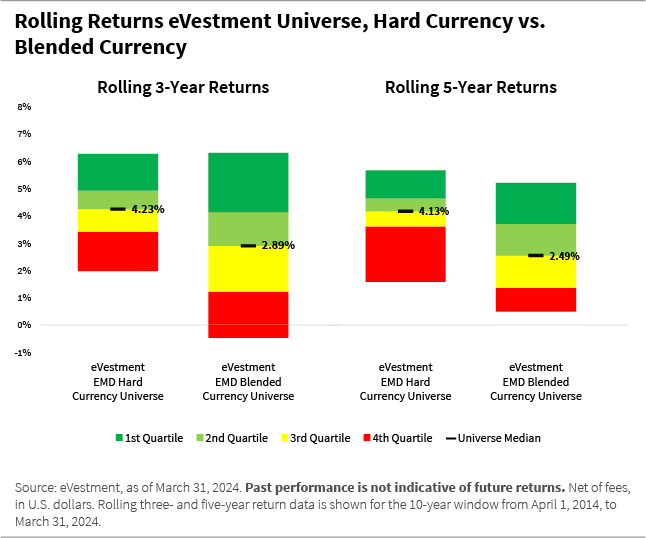

The chart below illustrates how managers with a hard currency approach have fared better than managers with a blended approach over the medium term (rolling three- and five-year time periods ending March 31, 2024). Over the rolling five-year period ending 3/31/24, the median return for the eVestment hard currency universe is 4.13% vs. 2.49% for blended. Over the rolling three-year period, the median return for the eVestment hard currency universe is 4.23% vs. 2.89% for blended.

Given this, we believe that investors for whom EM debt allocation is appropriate should be strategically invested in EM hard currency sovereign debt with opportunistic allocations to EM corporate and local currency debt.

While our William Blair Emerging Markets Debt strategy is benchmarked against the EMD sovereign hard currency index (J.P. Morgan Emerging Markets Bond Index Global Diversified), it may opportunistically and selectively invest up to 20% in EM corporate credit and 20% in EM local currency debt.

We strategically invest in EM hard currency sovereign debt with opportunistic allocations to EM corporate and local currency debt.

With a diversified EM sovereign debt universe as the starting point, we apply a robust bottom-up country and security selection process to identify what we believe is the optimal allocation to sovereign, quasi-sovereign, corporate, and supranational securities denominated in developed and/or EM currencies.

Our William Blair Emerging Markets Debt strategy has a strong focus on frontier markets debt, because we believe structurally higher levels of excess risk premium can be found in frontier markets. To ensure adequate diversification and minimize portfolio drawdown risk, we use a strong macro-driven credit, currency, and rates analysis process; concentration risk controls; and liquidity constraints in each market.

This bottom-up, security-selection approach to investing across the EM debt universe, we believe, has the potential to achieve a more efficient allocation of capital, and in turn better risk-adjusted returns over the medium and long term.

Marcelo Assalin, CFA, partner, is the head of William Blair’s emerging markets debt team, on which he also serves as a portfolio manager.

JP Morgan Emerging Markets Bond Index (EMBI) Global Diversified tracks the total return of U.S.-dollar denominated debt instruments issued by sovereign and quasi-sovereign entities. JP Morgan Government Bond Index Emerging Market (GBI EM) Global Diversified is a comprehensive global local emerging market index, consisting of regularly traded, liquid fixed-rate, domestic currency government bonds. JP Morgan Corporate Emerging Markets Bond Index (CEMBI) Diversified is a market capitalization weighted index consisting of U.S.-dollar denominated corporate bonds issued by emerging markets entities, uniquely-weighted to result in more balanced weightings for countries included in the index. JP Morgan Next Generation Markets Index tracks U.S.-dollar denominated debt issued by sovereign and quasi-sovereign issuers in frontier markets. The index provides a benchmark for the smaller, less liquid population of emerging market credits. Bloomberg Barclays US Treasury Index measures US dollar-denominated, fixed-rate, nominal debt issued by the US Treasury. Bloomberg Barclays U.S. Aggregate Bond Index is a broad-based benchmark that measures the investment grade, U.S. dollar-denominated, fixed-rate taxable bond market. J.P. Morgan U.S. High-Yield Index is designed to track the U.S. high yield corporate debt market. J.P. Morgan U.S. IG Corporate Index is designed to track the U.S. investment grade corporate debt market. MSCI EAFE Index is a stock market index that is designed to measure the equity market performance of developed markets outside of the U.S. & Canada. MSCI Emerging Markets Index is a free float-adjusted market capitalization index that is designed to measure equity market performance in the global emerging markets. MSCI World Index captures large and mid-cap representation across developed markets.

Index performance is provided for illustrative purposes only. Indices are unmanaged and do not incur fees or expenses. A direct investment in an unmanaged index is not possible. Index information has been obtained from sources believed to be reliable but J.P. Morgan does not warrant its completeness or accuracy. The indices are used with permission. The indices may not be copied, used, or distributed without J.P. Morgan’s prior written approval. Copyright 2024, JPMorgan Chase & Co. All rights reserved.