Over the past couple of years, solid economic activity and stubborn inflation led central banks to hike interest rates to levels not seen in decades. In 2023, these rising global rates, combined with a strong U.S. dollar and tightening liquidity conditions, weighed on fixed-income returns and wider market sentiment. This proved particularly challenging for emerging markets (EM) debt. However, after a few years of lackluster investment performance, we anticipate a strong 2024 for the asset class.

Below we review some of the factors contributing to that assessment, then discuss the outlook for hard currency, local currency, and corporate debt across EMs.

Normalizing Growth and Policy Easing

We expect a significant improvement in the global macro backdrop in 2024, characterized by still-resilient economic growth, lower global rates, and improving global liquidity conditions.

While it appears likely that the global economy will continue to gradually decelerate, growth should remain close to its long-term potential.

In that environment, central banks in advanced economies have likely reached the end of their hiking cycles, with monetary policy easing a predominant theme in 2024.

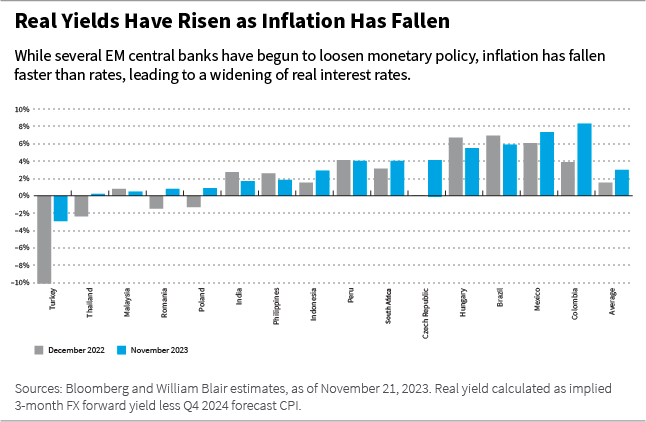

Many EM central banks have already started cutting policy rates, and we expect this process to continue into 2024. Recall that in the global fight against inflation, EM central banks hiked interest rates sooner and faster than their counterparts in the developed world. As a result of such a timely and assertive policy reaction, inflation started to fall sooner and faster in EM countries.

In our opinion, easier monetary conditions will be one of the factors supporting economic growth in the EM world in the next year.

Stable Credit Fundamentals

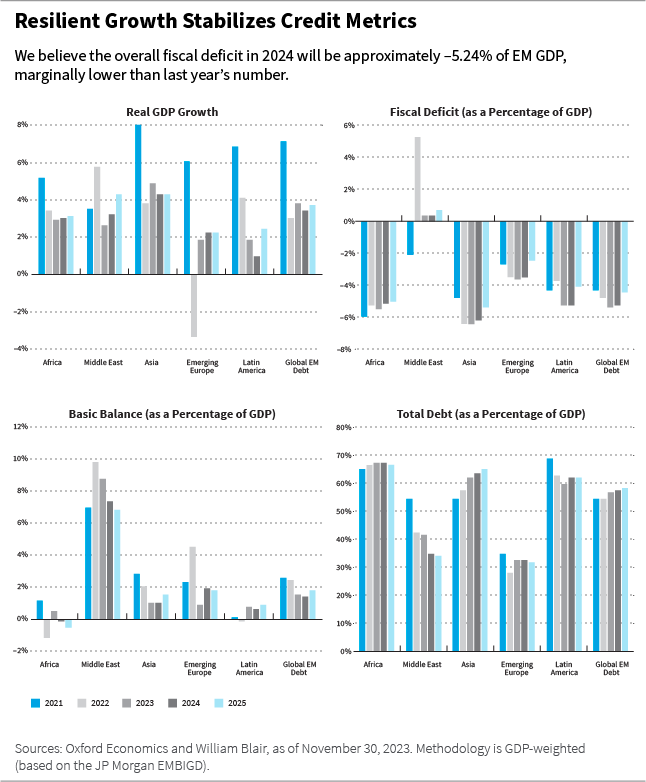

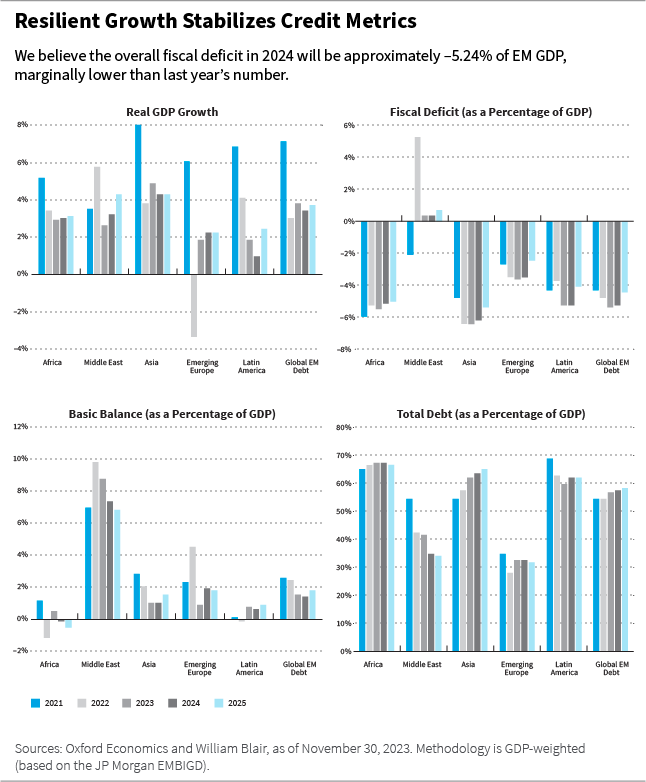

Additionally, credit fundamentals should remain well supported in most EM countries, in our opinion. We believe real gross domestic product (GDP) growth for our investment universe will be 3.5% in 2024, only marginally lower than in 2023. We also expect stable fiscal and debt dynamics. In our opinion, the budget-balance deficit and total government debt should remain relatively stable at approximately 5.2% and 57.5% of GDP, respectively. From an external account perspective, we expect a basic balance (current account plus foreign direct investments) surplus of approximately 1.5% of GDP in 2024.

Supportive Commodity Prices

Commodity prices should also remain supportive of EM economic growth, in our opinion. Consider, for example, energy and industrial metals.

In energy, supply and demand factors are currently expected to balance themselves out into 2024 amid historically low inventory levels, average speculative positioning, and a latent geopolitical risk premium. On the supply side, we expect OPEC+,[1] in particular Saudi Arabia, to continue restraining supply in 2024; at the same time, the United States, Brazil, Guyana, and Canada will likely add to production. On the demand side, we anticipate lower demand growth from developed markets but increased demand from EMs, China in particular.

In industrial metals, we believe prices should remain supported by the green demand dynamic at play in China, Europe, and the United States, with these countries moving ahead with their energy transition plans. Supply increases should also moderate next year in most metals due to lack of new projects and low profitability.

A Positive Influence in China

In China, an important driver of sentiment given the country’s strong economic and financial links to the EM world, the proactive policy easing measures implemented in the second half of 2023 helped set a floor for growth expectations in the coming year. Please see our China part of this series for more details.

A Solid Financial Sector

In the EM financial sector, we believe earnings have peaked as top-line growth has leveled off. Monetary policy easing in most major EMs is likely to pressure banks’ revenues as assets reprice at lower rates, although the impact could be mitigated by lower funding costs.

Asset-quality metrics are expected to be broadly stable, but we see risks skewed to the downside in some jurisdictions due to myriad country-specific factors, including stress in certain sectors, macroeconomic imbalances, weather effects, and elevated household debt.

Still, we expect capitalization to remain solid as we do not see loan growth significantly picking up into next year.

Technical Conditions and Valuations Support EM Debt

Overall, we anticipate a benign global macro backdrop and solid EM credit fundamentals underpinning a positive outlook for EM debt in 2024—a change from 2023.

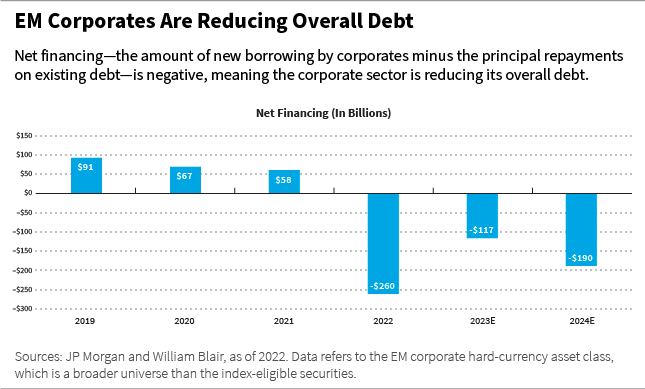

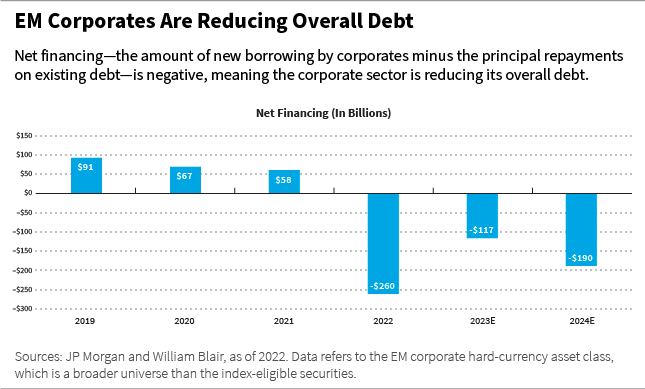

In 2023, we saw substantial outflows from dedicated EM debt portfolios as investors shied away from asset classes sensitive to interest-rate duration risk. However, the market impact from sizable outflows was attenuated by muted activity in the primary market. Unfavorable financing conditions caused by rising interest rates led to another year of negative new net debt issuance, resulting in more balanced supply-and-demand dynamics in the marketplace.

We believe market technical conditions should gradually improve as developed market central banks approach the end of their monetary tightening cycles. We anticipate inflows to dedicated EM debt portfolios in 2024 as investors look for opportunities to increase interest-rate duration exposure to potentially benefit from attractive real and nominal yields. And, while we expect a pickup in activity in the primary bond market, we believe net debt issuance should remain in negative territory (in both the sovereign and corporate credit spaces) as issuers seek alternative sources of funding. High investor cash levels, defensive positioning, and multiyear-low foreign ownership of EM local bond markets should also add to a more constructive technical picture in 2024, in our opinion.

We believe EM debt valuations continue to overcompensate investors for credit risks, currency and local rate risks, and volatility.

Additionally, we believe EM debt valuations continue to overcompensate investors for credit risks, currency and local rate risks, and volatility, and currently offer attractive value to investors with a medium- to long-term horizon and who have a willingness to tolerate a period of higher volatility.

EM debt credit spreads appear compelling on both an absolute and relative basis, with current levels remaining wider than their historical levels. While EM sovereign high-grade credit spreads appear unattractive, high-yield credit spreads appear compelling, particularly relative to U.S. corporate high-yield levels. In the distressed credit space, we believe current prices continue to overestimate the probability of credit default and underestimate potential restructuring and recovery values.

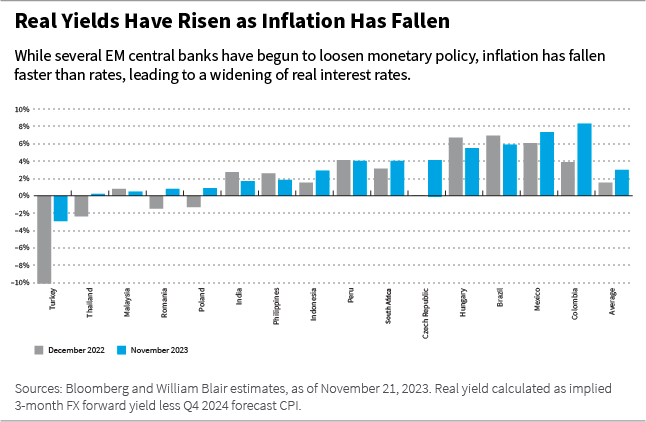

For the local currency universe, headwinds of tighter U.S. Federal Reserve (Fed) policy and a stronger dollar have eased while interest rates in EMs remain elevated. Indeed, while several EM central banks have begun to loosen monetary policy, inflation has fallen faster than rates, leading to a widening of real interest rates. With valuations in dollar terms little changed over the past year, the relative attractiveness of EM currencies against their developed market counterparts has risen substantially. We see further scope for modest currency appreciation over the coming year, led by high-beta countries.

For local rates, the backdrop is similar, albeit with the caveat that outperformance in recent quarters has eroded valuations somewhat when compared to foreign exchange (FX). We see further scope for curve flattening, however, and expect strong price momentum to bolster interest returns. With global growth slowing and inflation returning quickly to central bank targets in most countries in the benchmark index, we believe there is further scope for monetary easing and investor rotation from equities to bonds.

Opportunities in Hard Currency EM Debt

We have a constructive outlook for hard currency EM debt.

To start, multilateral support to EMs remains strong, and we believe it will make a meaningful contribution to external funding.

The International Monetary Fund (IMF) appears set to continue expanding its support to EMs in a number of ways: continuation of increased access limits (as agreed in March 2023); a 50% increase in member quotas in December 2023 (under the 16th General Review); the replenishment of the Poverty Reduction and Growth Trust (from which 0% loans are financed); and further engagements with sovereigns under additional programs and instruments.

The combination of these factors has the potential to substantially boost the financing beyond the $192 billion committed by the IMF under existing programs for EMs within our universe, of which $137 billion is yet to be disbursed.

We continue to see scope for fundamental differentiation, and prefer countries with easier access to multilateral and bilateral funding, particularly in the EM frontier and distressed space.

Meanwhile, the World Bank continues to engage across our universe, providing critical financing to development expenditures through inter alia project financing for infrastructure development and direct budget support (under its development policy financing tool).

Bilateral development partners are also becoming more diverse, increasing support from the Middle East to countries in our universe.

In our opinion, hard currency EM debt returns should be driven predominantly by lower underlying U.S. Treasury yields (duration) and carry, while credit spreads should remain relatively stable.

We believe the global market environment will be conducive to the outperformance of high-beta, high-yield credit, and we continue to position our portfolios for high-yield/investment-grade spread compression.

We also continue to see scope for fundamental differentiation and prefer countries with easier access to multilateral and bilateral funding, particularly in the EM frontier and distressed space.

Opportunities in EM Corporate Credit

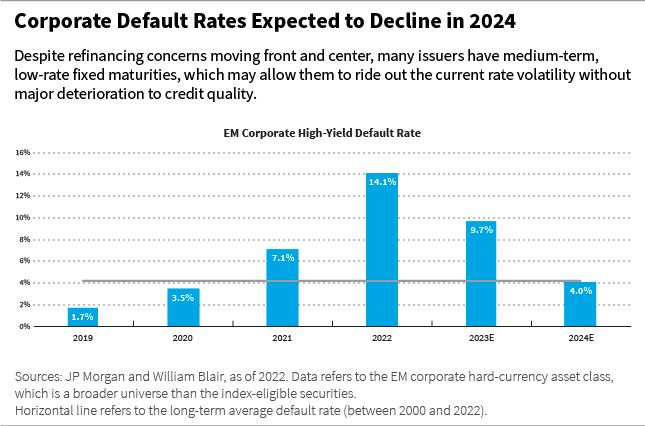

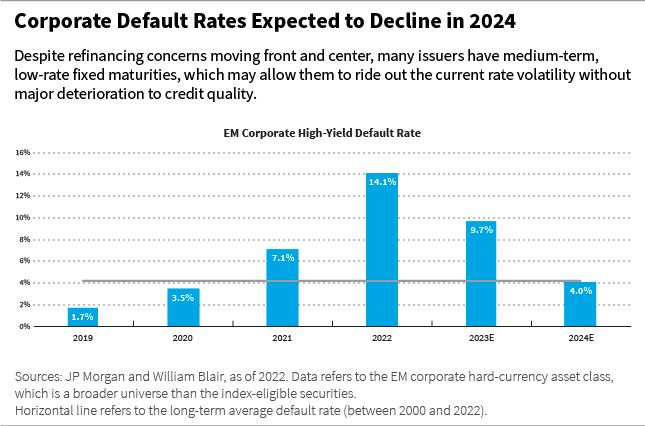

We believe EM corporate credit could enter 2024 with normalizing default expectations and diverse yet resilient fundamentals.

The impact of higher-for-longer interest rates should become more apparent in the fundamental credit quality of EM corporate issuers in the next year. However, despite some deterioration in leverage metrics in 2023, these metrics remain better than those of developed market credit and are likely to level off into next year. While coverage metrics should, in theory, deteriorate, it will likely depend on the composition of debt. Most issuers in the universe locked in longer fixed-term rates, and some could even experience a competitive advantage due to relatively lower interest costs in the near term.

All things considered, EM corporate credit has continued to exhibit a combination of differentiated fundamental drivers, favorable supply technical conditions, and attractive relative valuations to select sovereign curves.

Even as rates have risen and refinancing concerns have moved front and center, many issuers have medium-term, low-rate fixed maturities, allowing them to ride out the current rate volatility without major deterioration to credit quality.

We see select opportunities in the EM corporate credit space and are seeking investment opportunities where credit fundamentals and attractive spreads coincide. Short-maturity bonds have outperformed, but opportunities in longer bonds are beginning to appear. We continue to focus on issuers with low refinancing needs, robust balance sheets, and positive credit trajectories.

Opportunities in Local Currency EM Debt

In local markets, one of the highlights of the past year has been the resilience of currencies to rising U.S. interest rates and higher U.S. Treasury volatility. This is indicative of light positioning among investors, lower external funding requirements among benchmark index countries, and a much-improved outlook for EM growth and macro balance sheets compared to developed market counterparts.

We expect this macro backdrop to remain largely in place, with EM growth slowing below potential levels but not slipping into recession, inflation returning to target, and investor flows providing a tailwind to asset prices.

In our opinion, high-beta countries should see rapid monetary easing, which could support these trends in the coming quarters. At the same time, an easing of global liquidity conditions should benefit frontier markets seeking external funding, in our opinion.

Risks

While we have a high level of conviction in our constructive 2024 outlook, there are a few downside risks to our optimistic outlook.

We believe the Fed has reached the end of its hiking cycle and will start cutting policy rates at some point in the second half of 2024. However, keeping monetary policy conditions too tight for too long could result in a policy mistake that could lead to a U.S. recession.

Geopolitical tensions are also likely to continue to weigh on investor sentiment. The unresolved Russia/Ukraine conflict, instability in the Middle East, and tensions between China and Taiwan all have risks of escalation.

However, it is important to remember that there have always been potential incidents that could act as disruptors, and the current set of risks are already well known and perhaps fully priced by the markets already. We will nevertheless monitor all these risks very closely.

Marcelo Assalin, CFA, partner, is the head of William Blair’s emerging markets debt team, on which he also serves as a portfolio manager.

Emerging Markets 2024 Outlook Series

Part 1 | Economy Hits Cruising Altitude, But Beware of Bumps

Part 2 | Emerging Markets Diverge as a New Cycle Unfolds

Part 3 | EM Debt: From Headwinds to Tailwinds

Part 4 | Restarting China's Economic Growth

[1] OPEC+ refers to the Organization of the Petroleum Exporting Countries (OPEC) and its allies, including Russia.

The J.P. Morgan EMBIGD tracks the total return of U.S.-dollar-denominated debt instruments issued by sovereign and quasi-sovereign entities. (Index information has been obtained from sources believed to be reliable but J.P. Morgan does not warrant its completeness or accuracy. The indices are used with permission. The indices may not be copied, used, or distributed without J.P. Morgan’s prior written approval. Copyright 2020, JPMorgan Chase & Co. All rights reserved.) Indices are unmanaged and do not incur fees or expenses. A direct investment in an unmanaged index is not possible.