In the first of this three-part series about metals of the future, we explored how demand for copper, lithium, and nickel has been shaped by the transition to a low-carbon future.

In this post, we move on to supply dynamics, where the response to the very pronounced demand shifts observed in these metals has been remarkable.

Automakers, equipment manufacturers, and battery cell makers all want to get involved in the value chain of these critical metals, and as we illustrated in our previous paper, demand for these metals is expected to accelerate even further, raising questions about scarcity and the ability of supply to meet demand.

Copper

While copper miners recognize copper’s importance for green technologies, production is challenging. Copper miners have faced increased regulatory scrutiny, aging assets, declining grades (the concentration of copper in the ore being mined)and changing weather patterns, including pronounced droughts in Chile and flooding in Zambia.

Global copper supply has grown only in the low-single-digit levels over the past three years, with new projects in Peru and the Democratic Republic of Congo mostly offsetting lower production in the world’s largest copper producing country, Chile.

Copper miners are ramping up investments to fulfil the high anticipated demand.

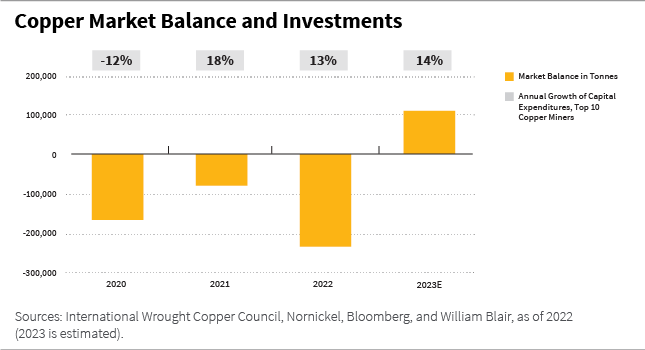

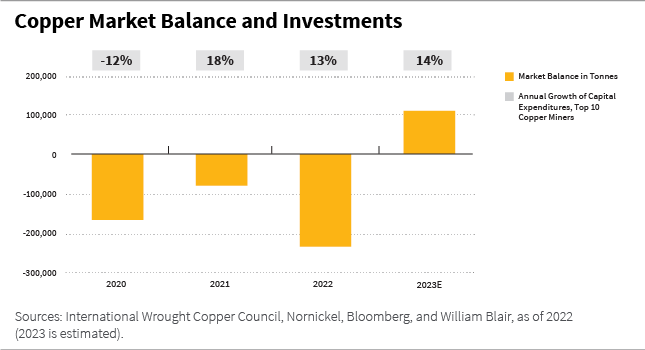

This has resulted in market deficits over the past three years. In 2023, a surplus is expected due to lackluster demand from developed markets.

Despite these dynamics, copper miners are ramping up investments to fulfil the high anticipated demand. Capital expenditures in the 10 largest miners, which represent about 44% of global production, increased 13% in 2022 and are expected to grow another 14% in 2023.

Lithium

The supply of lithium is highly concentrated in a few locations and companies. The two largest lithium operations in the world accounted for 43% of total lithium production in 2022.

Still, lithium supply has increased to meet the growing use of rechargeable lithium-ion batteries, which are widely used in consumer electronics, electric vehicles (EVs), and energy storage systems.

A brief decline of lithium carbonate prices was observed in 2020 as a result of supply-demand dynamics, but prices peaked in 2022.

Thus far in 2023, lithium production has surpassed consumption, resulting in an abrupt price correction from all-time highs. Lower EV sales, inventory build-up in the energy storage sector, demand uncertainty in China, and new supply coming online faster than anticipated are key reasons.

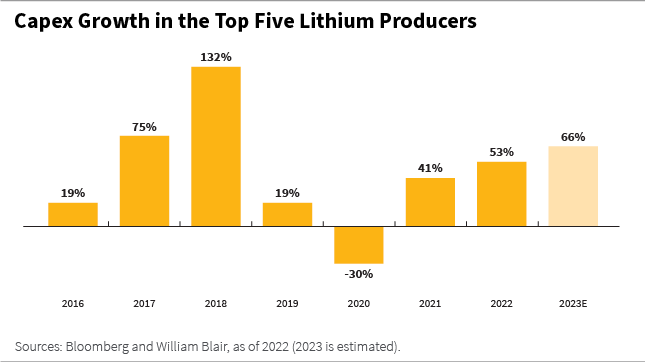

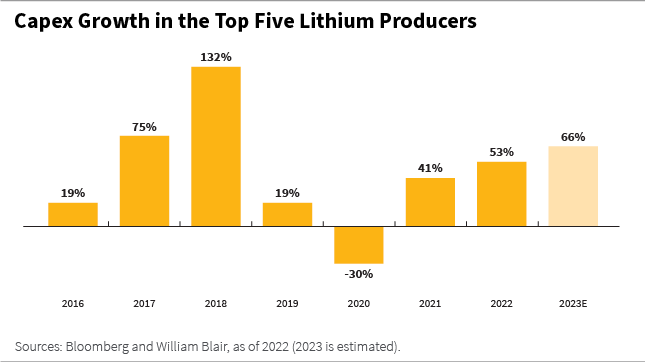

An acceleration in demand growth is anticipated for lithium, prompting producers to expand their investments in the sector. Capital expenditures in the five largest lithium producers worldwide, which account for 65% of total production, grew 53% in 2022 and are expected to pick up another 66% this year.

Nickel

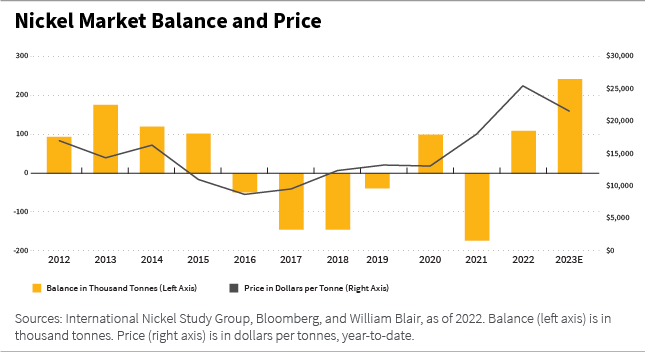

Alongside lithium, nickel has probably seen the largest expansion in production volumes compared to other metals.

Since 2019, Indonesia, which accounts for 50% of global nickel ore production, has rapidly developed domestic processing facilities in an attempt to capture more value from the metal and to become a global EV supply-chain hub.

According to government estimates, the value of processed nickel products in 2022 was $30 billion, 10 times higher than it was four years ago. Indonesia increased the number of operating smelters from 15 in 2021 to 43 this year; another 28 smelters are under construction and 24 are in the planning stages.

It’s worth highlighting China’s contribution to this expansion. The country has made investments of around $30 billion, and two of the largest nickel industrial hubs (the Morowali Industrial Park and the Weda Bay Industrial Park) are operated by the same Chinese company. This investment stands out as one of the largest under China’s Belt and Road Initiative (BRI).

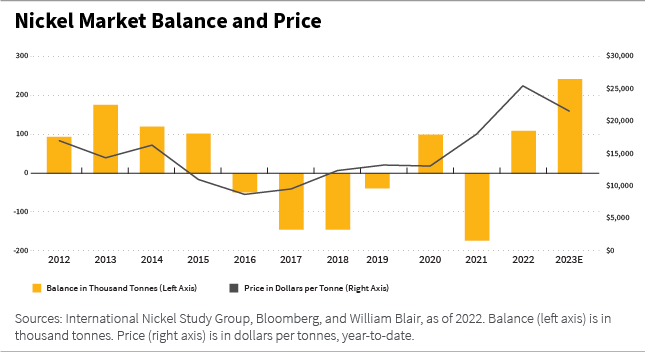

This vast increase in smelting capacity led Indonesia to become a net importer of nickel ore for the first time in its history in 2023. However, the most significant consequence of this expansion is that total primary nickel production has surged to peak levels leading to market imbalances. The International Nickel Study Group expects this year’s surplus to be the largest in the last decade.

Several emerging markets governments recognize the value of these metals to future technologies and aim to capture a larger share of a growing pie. In my next post, I highlight such cases.

Alexandra Symeonidi, CFA, is a senior corporate credit and sustainability analyst on William Blair’s emerging markets debt team.

Metals of the Future 2.0 Series

Part 1 | Metals of the Future: Demand Dynamics in the Driver’s Seat

Part 2 | Metals of the Future: Can Supply Meet Demand?

Part 3 | Metals of the Future: Capturing a Share of the Pie