May 30, 2024 | Emerging Markets Debt

3 Metals to Watch

We believe that the fundamentals for copper, nickel, and aluminum are strengthening due to improving demand prospects supported by electric vehicles (EVs), renewable energy, and data centers along with supply rationing in the form of production challenges or outright production cuts. Here’s where we think these commodities are headed in the second half of 2024 and the possible impact on our emerging markets debt portfolios.

Copper: Investor Enthusiasm in the Driver’s Seat

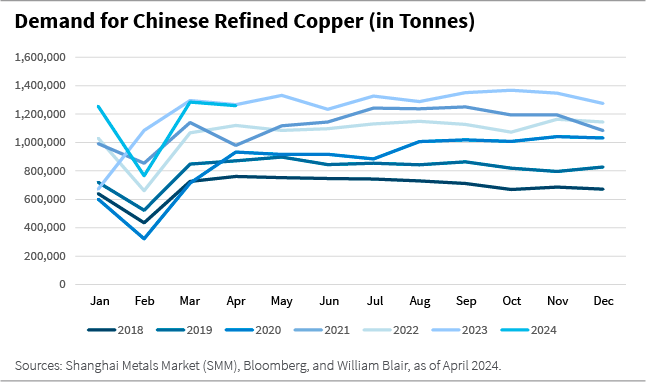

Copper demand remains robust in both Chinese and ex-Chinese markets, fueled by investments in renewable energy, EVs, and data centers. China’s focus on expanding three key sectors—EVs, solar panels, and batteries—has driven an 8% year-over-year increase in refined copper demand as of April 2024.

Copper mine supply remains challenging, however, with the industry facing declining grades, environmental and regulatory issues, and a general lack of project pipeline. The shutdown of Panama’s copper mine in 2023 has exacerbated the situation, removing an additional 1.5% to 2% from the total copper supply in 2024.

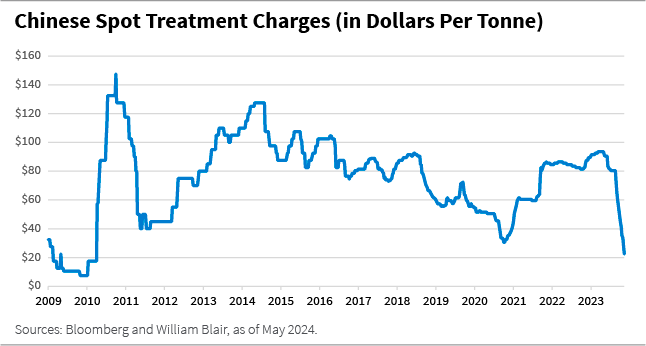

This combination of supply and demand factors has resulted in a distinct and sudden tightening in the concentrate market in China, driving spot treatment charges to levels not seen since 2010.

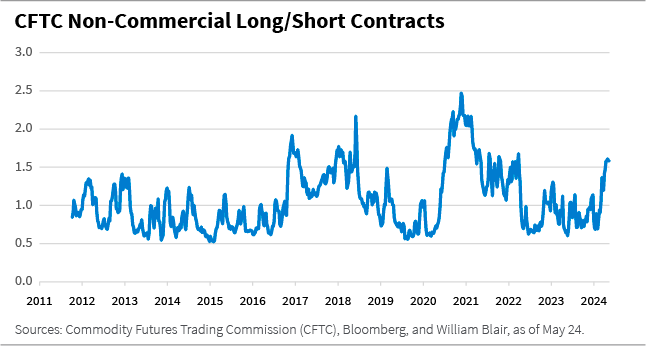

We believe that the strong rally in copper this year is, to an extent, a result of increased speculative positioning as investors anticipate copper shortages. Non-commercial net long positions in the largest metal exchanges are at the highest levels they have been in the past three years, with COMEX, the primary futures and options market for trading metals in the United States, leading the way.

However, we believe copper fundamentals are set to improve in the second half of 2024 because weak seasonal mine supply is reducing inventories and aggravating market tightness. A production cut by the agreed 5% to 10% of the top Chinese smelters should provide new support for copper prices during the remainder of the year.

Nickel: Have the Bears Gone Silent?

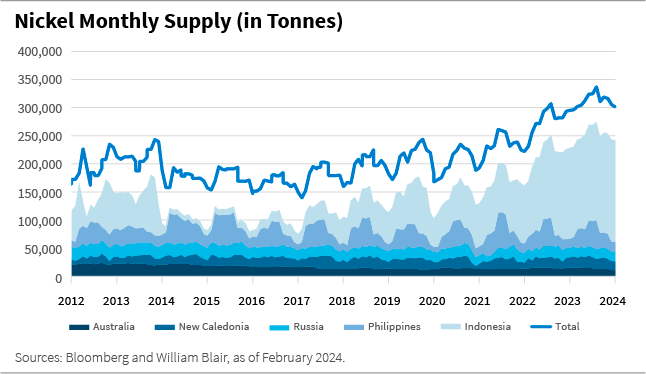

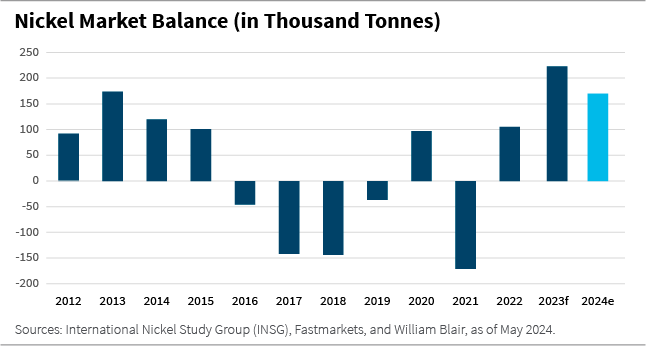

Nickel prices fell by 45% on the London Metal Exchange (LME) and 46% in China last year, driven by a supply surge from Indonesia and China and demand concerns relating to nickel substitution in EV batteries. Indonesia grew production by more than 200 thousand tonnes in 2023, while China expanded the pace through which producers convert intermediaries to refined metal, leading to a nickel supply glut.

The sharp price correction at the end of 2023 led to the suspension of some high-cost operations in Australia and New Caledonia this year. While these cuts have helped reduce the surplus, the market is still in oversupply due to Indonesia’s continuing supply growth year-to-date in 2024.

LME’s ban on new Russian nickel inventories and better demand expectations for the second half of 2024 and beyond spurred new life into nickel prices beginning in April this year. Further supply rationing from Indonesia and China in the second half of the year, with plans to cut supply by 100 thousand tonnes, should help ease the downside risk on nickel prices.

Unraveling Aluminum’s Obscure Catalysts

While aluminum’s feedstock is widely available, its energy-intensive and high-cost production process makes maintaining a stable supply challenging. The European smelter curtailments of 2021 and 2022, equal to 2% of global supply, seem unlikely to be reversed despite a sharp reduction in energy costs in the region. China’s hydropower issues hinder the country’s ability to ramp up its aluminum production.

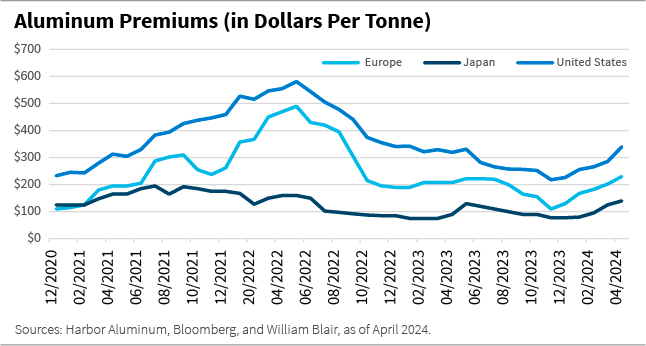

Despite weak property demand, aluminum demand in China remains resilient, supported by renewable energy investments, autos, and white goods (that is, large household appliances) for export. The improvement in manufacturing activity, coupled with recent increases in aluminum premiums in Europe, the United States, and Japan, suggests that demand outside China may be on the rise.

Restrictions in Russian metal flows in Europe reflected by a ban on Russian metal trading in the United States and the United Kingdom and an exclusion of newly produced metal from the LME may help the market rebalance. Aluminum had the biggest share of Russian metal in LME stocks at the beginning of 2024, reaching 90% of total stocks.

Positioning Our Portfolios

We believe the likelihood of improving fundamentals and higher prices for copper, nickel, and aluminum bodes well for emerging markets (EM) debt investors, as countries rich in these metals tend to be in EMs and could increasingly benefit from their production and sale.

For the corporate credit investor, this should translate into robust credit fundamentals, such as margins and cash flows. For the sovereign debt investor, export value and tax revenue from these metals could increase due to higher production and a resilient price outlook, leading to an improvement in sovereign credit fundamentals.

Alexandra Symeonidi, CFA, is a senior corporate credit and sustainability analyst on William Blair’s emerging markets debt team.