The Chinese domestic steel market is going through a major downturn, affecting the industry around the globe, exacerbating global trade tensions, and increasing protectionism. We believe emerging markets (EM) debt investors would be wise to be wary, given the potential for the situation to impact the economy, drive political instability, and create trade tensions in many countries.

Weak Domestic Demand Drives Plummeting Steel Prices

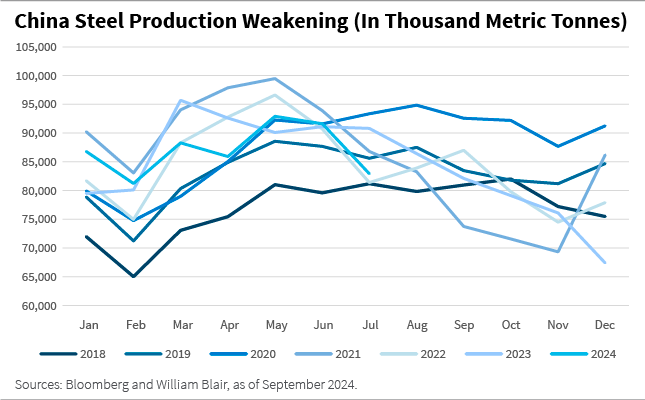

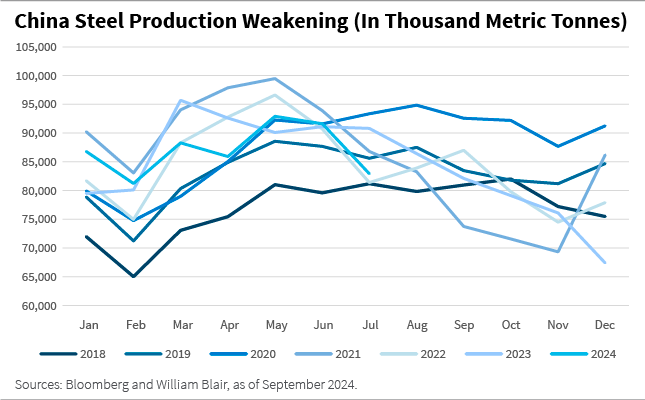

Onshore Chinese demand for steel has been collapsing on the back of the enduring downturn in the property sector and tepid economic growth. Several steel mills have been self-sanctioning by reducing steel output, which drove Chinese steel production lower again in August.

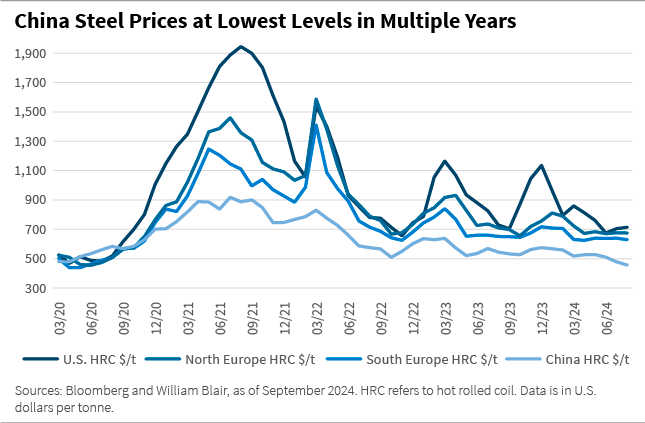

The result has been softening prices domestically. Steel prices in China fell further last month amid demand weakness. Absent significant infrastructure or property stimulus, this situation is unlikely to change anytime soon, in our opinion.

We also see no indication of a nationwide steel production cut, which might have provided a floor to declining steel prices.

Steelmakers’ Losses Deepen

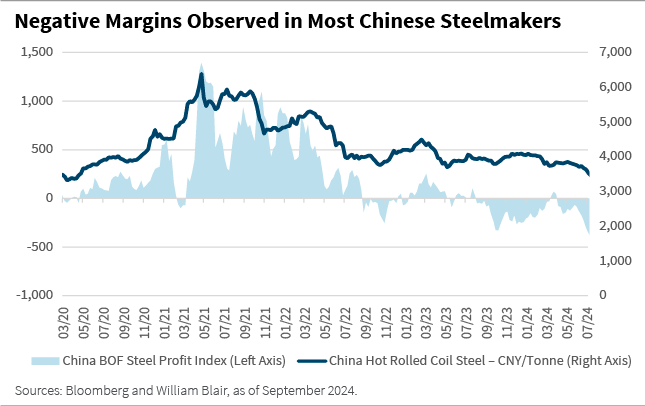

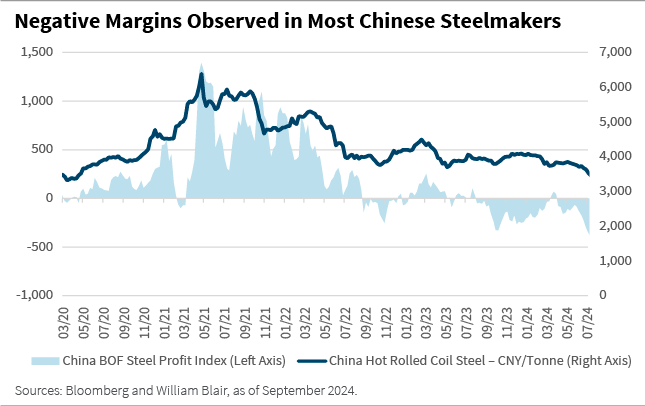

Compounding the situation, the costs of the materials and processes required to produce steel have not fallen as much as prices, squeezing steel margins. Only about 5% of Chinese steelmakers are currently able to turn a profit, according to Mysteel, a data and analytics provider that focuses on the steel industry, particularly in China.

The industry’s dire straits were highlighted by the chairman of the largest steelmaker in the world, Baowu Steel, which accounts for 7% of global output. He warned the market to brace for a prolonged winter given that the situation is more severe than the downturns of 2008 and 2015. These downturns were eventually resolved via large stimulus.

Steel Product Exports Grow and Global Trade Tensions Rise

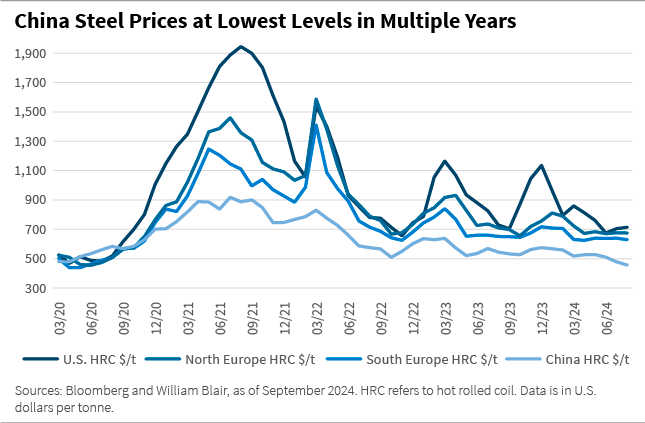

China is by far the largest steel producer in the world; its economies of scale, cheaper input costs, and excess capacity allow domestic steel prices to be lower in comparable terms than in other regions, such as Europe and the United States. We highlight these price differences in the chart above titled “China Steel Prices at Lowest Levels in Multiple Years.”

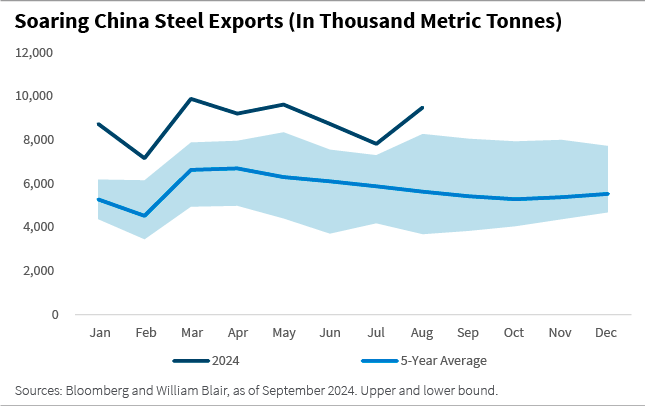

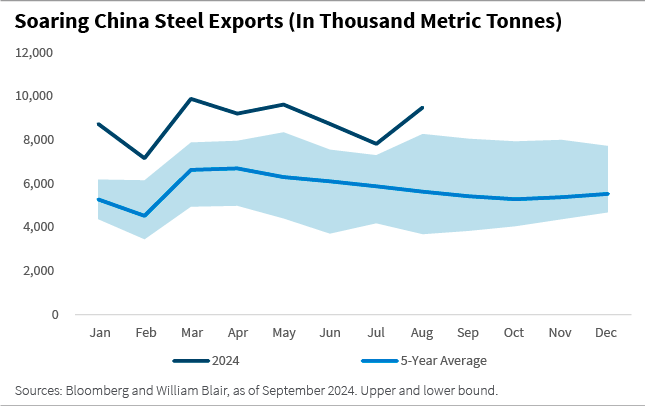

The combination of weak domestic demand, excess capacity, and higher prices internationally has incentivized directing surpluses toward exports. This year, Chinese steel exports have surged, and are now 50% above the five-year average and 19% higher than in the same period last year. In fact, 2024 Chinese steel exports are at their highest level since 2015-2016, when the sector was facing another downturn.

But in many countries, the influx of low-cost steel Chinese imports threatens local steel producers, which struggle to compete with the significantly cheaper imports. This dynamic is prompting many countries to impose protective measures in the form of tariff hikes or anti-dumping duties. Earlier this year, Latin American countries such as Mexico, Chile, and Brazil began increasing tariffs on Chinese steel, a move that was soon mirrored by the United States and the European Union. Recently, key Asian trading partners of China, including India and Thailand, have also joined this wave of protectionism. This might test economic relationships as China is a top buyer and investor in many countries in Latin America and Asia. However, direct tariffs and duties do not fully safeguard steel industries worldwide as low-cost Chinese steel is entering many countries through transshipment routes.

Global Iron Ore Market Likely Affected

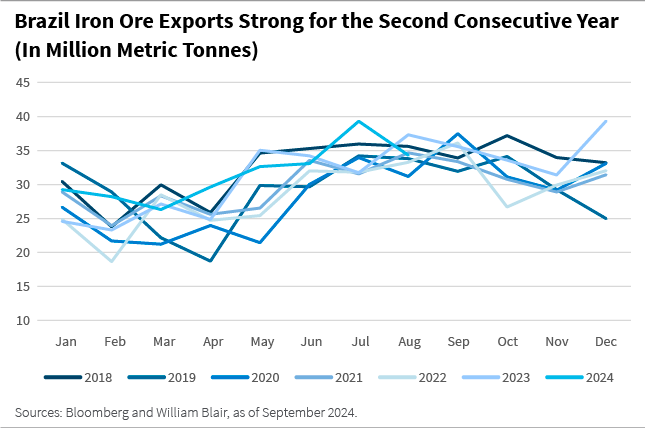

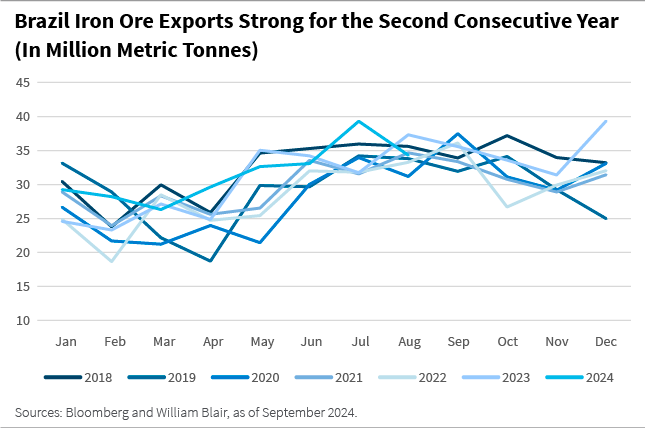

The depressed state of the Chinese steel market has significant implications for the global iron ore market because iron ore is the primary raw material used to produce steel, and China is the largest buyer of iron ore, making up approximately 75% of all seaborne iron ore. Despite weak demand for iron ore, supply has remained strong, leading to increased inventories. Specifically, so far this year, iron ore exports from the world’s second largest producer, Brazil, have increased 6% over 2023, which was a strong year for iron ore supply. This has led to accumulating inventories of iron ore in Chinese ports and prices facing further downside risks.

Implications for EM Debt Investors

The downturn in the Chinese steel market is relevant for EM debt investors given the potential for the situation to impact the economy, drive political instability, and create trade tensions in many countries.

Many EMs, such as Brazil and South Africa, are major exporters of raw materials (such as iron ore) that are essential for steel production. A slowdown in Chinese steel demand can lead to reduced demand for these commodities, causing lower export revenues in these countries.

Additionally, persistent steel dumping might put several steelmakers in EMs out of business. This would likely create political instability because the sector is a major employer in many countries.

Lastly, the influx of steel imports and the protectionism measures implemented in response can lead to currency volatility and trade tensions in EMs. This uncertainty can disrupt trade and capital flows, lead to higher borrowing costs and challenges in debt servicing.

While these conditions may offer opportunities for EM debt investors to uncover value opportunities in the sector, the short-term risks to economic stability and market volatility remain significant, making the situation critical for debt investors to monitor closely.

Alexandra Symeonidi, CFA, is a senior corporate credit and sustainability analyst on William Blair’s emerging markets debt team.

The China BOF Steel Profit Index measures the profitability of China's steel producers, specifically those using the Basic Oxygen Furnace (BOF) method. It reflects the current demand and profit margins within the steel industry in China. China hot rolled coil steel refers to a measure of steel spot prices in China.