April 11, 2023 | Global Equity

Subscribe Now

Want the latest insights on the economy and other forces shaping the investment landscape?

Subscribe to our Investing Insights newsletter.

April 11, 2023 | Global Equity

Want the latest insights on the economy and other forces shaping the investment landscape?

Subscribe to our Investing Insights newsletter.

China has exhibited one of the most transformational evolutions ever seen in emerging markets (EMs), with its weight in the MSCI EM Index doubling over the past five years. But China’s own dynamic and mega-cap stocks have somehow skewed EM benchmarks’ performance. We believe that beyond China, EMs offer an attractive and differentiated opportunity set—one which drove our launch of our EM ex China Growth strategy.

In brief, China has become the predominant market within EM indices, and while there would likely be some setbacks over shorter time periods, the country’s weighting appears poised to continue increasing over the long term amid the continued development of the equity market, growth and innovation, and further integration of China A-shares.

A natural consequence of the prominence of China’s inclusion in main benchmarks, market depth, and unique characteristics is that some investors may wish to implement a dedicated strategic allocation to China, seeking to benefit from the abundant alpha opportunities China offers across sectors, market caps, and share classes. Another consequence is that the focus on the vast China opportunities may overshadow attractive investments in smaller emerging markets.

By launching our EM ex China Growth strategy, we seek to offer the potential for alpha generation across sectors, regions, and market capitalizations in the broad EM space—in Asia; Emerging Europe, Middle East and Africa (EMEA); and Latin America. This allows investors to have a deeper exposure to EM investment opportunities and complement a China allocation, including a zero allocation.

Through its deep transformation and successful economic growth over the past decades, China has become the second-largest world economy, and Chinese companies have capitalized on changes in consumer patterns and scale and have become an engine of innovation and sustainable value creation.

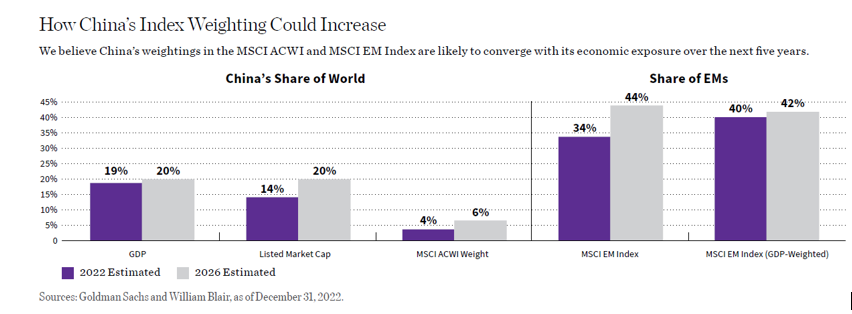

A natural consequence of this is that China’s weighting in the MSCI EM Index has increased from almost nonexistent in 2000 to 35% in 2022.

That said, China is still not even fully represented in the MSCI EM Index because the index artificially caps its domestic China A-share weighting, applying an inclusion factor of 20% to China A-shares. If this inclusion factor were 100%, China would represent closer to 45% of the index.

As China’s share of world gross domestic product (GDP) and listed market cap increases, so should its weight in both the MSCI All Country World Index (ACWI) and MSCI EM Index. Currently, China’s share of world GDP is 19% and its share of listed market cap is 14%. These numbers are expected to rise to 20% for both. As that happens, China’s weight in the MSCI ACWI and MSCI EM Index should continue to increase, as the chart below illustrates.

As a single country becomes such a prominent weight in the benchmark, its performance has an overwhelming impact on the entire asset class, blurring the contribution from smaller countries. As a result, it makes sense to differentiate that market from the rest of the space.

This is even more important in the case of China, as its specific macroeconomic, political, and regulatory developments have had a dominant impact on its equity market performance, and was largely desynchronized with the rest of emerging and developed markets.

Ex China, EMs have much more technology (particularly semiconductor and broad hardware), materials, and financials and less consumer discretionary and communications services than the MSCI EM Investable Market Index (IMI).

Heavyweights in these sectors such as Tencent, Alibaba, Meituan, and JD.com are eliminated. The MSCI EM ex China Index also has a higher weighting in commodities than the MSCI China Index.

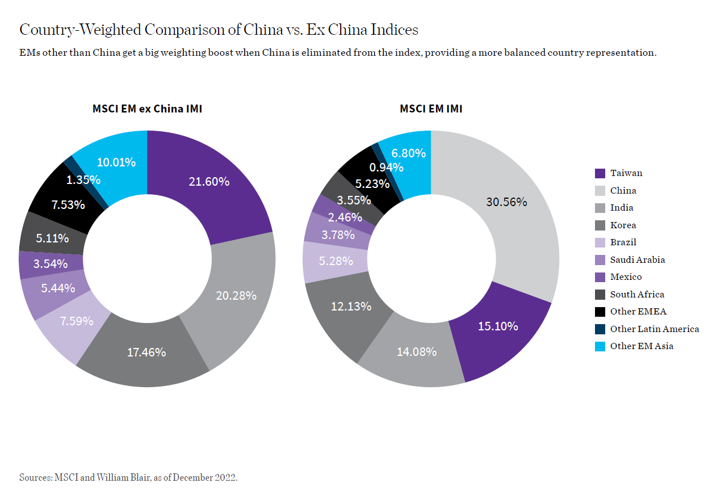

From a regional perspective, as would be expected, when China is excluded, there is less exposure to Asia: Asia represents almost 80% of the MSCI EM Index and 70% in the MSCI EM ex China IMI.

Eliminating China also boosts the weight of EMEA and Latin America by 5.5% and 3.8%, respectively, vs. the MSCI EM IMI. The chart below shows the country weightings in the MSCI EM IMI vs. the MSCI EM ex China IMI. Taiwan becomes the largest market in the MSCI EM ex China IMI, alongside India and Korea. But every other market, from Brazil to Mexico, gets boosted as well. This certainly provides a more balanced representation of EM countries within Asia and regions other than Asia.

Even after removing China, EMs offer a deep opportunity set with more than 1,000 listed larger-cap stocks (those with at least $2 billion of market cap). More than half of those trade at least $10 million per day. That suggests that there are significant investable opportunities in EMs ex China.

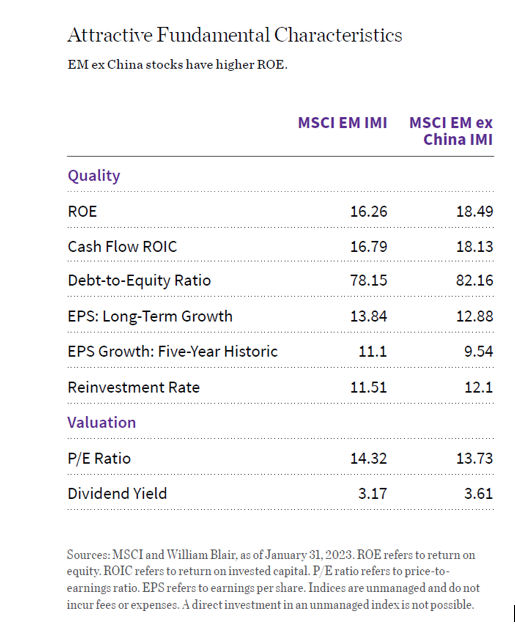

Meanwhile, quality characteristics of EMs ex China are attractive, as illustrated by higher return on equity (ROE) and cash flow return on invested capital (CFROIC) for the MSCI EM ex China IMI versus the MSCI EM IMI.

In addition, while the MSCI EM ex China IMI’s historic earnings per share (EPS) growth has lagged the broad index including China, earnings growth expectations show a marked improvement for the MSCI EM ex China IMI and valuations are more attractive.

Not surprisingly, EM ex China companies are well represented in our quality growth investment universe (our eligibility list). Our eligibility list, as of January 2023, includes 48% EM stocks, of which 68% are EM ex China names. That gives us approximately 650 EM ex China names to draw from.

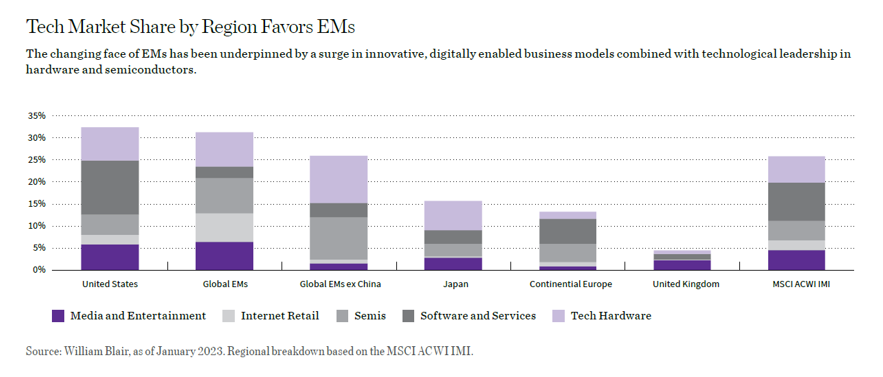

EMs have experienced significant changes over the past decade. Their key drivers are now largely growth sectors, such as IT and consumer, reflecting increased innovation and income growth and contrasting with the largely dominating commodity plays of the past.

The changing face of EMs has been underpinned by a surge of innovative, digitally enabled business models in e-commerce, communications services, and fintech, to name just a few areas. This phenomenon has been a key development in China—but also outside of China.

So, IT is a key theme in EMs ex China (IT and tech-related sectors account for 32% of the MSCI EM ex China IMI, close to 37% of the MSCI USA IMI, and well ahead of other developed markets, as the chart below illustrates).

Within IT, EM ex China has a clear leadership in semiconductors and hardware, which are export-oriented and driven by global demand. In addition, financials are also a key sector; this provides more domestic exposure.

From a geographic perspective, India is a key market in the MSCI EM ex China IMI and a very attractive opportunity set for us.

Given the market and index developments; conversations with clients and consultants; and an analysis of our expertise, track record, and opportunity set, we decided to launch our EM ex China Growth strategy in 2021. We first launched a private fund vehicle with seed money and sometime later launched a mutual fund in collaboration with an existing client in our broad EM Growth strategy.

The design of the strategy is similar to our longstanding flagship EM Growth strategy. That strategy offers broad exposure to high-quality growth names across EMs (including frontier markets) and sectors, and has a constant exposure to small-cap stocks. We believe this breadth provides broad sources of alpha, and is a differentiating feature of our EM ex China Growth strategy.

In addition to having a similar design as our EM Growth strategy, our EM ex China Growth strategy is managed by the same portfolio managers as the EM Growth strategy: Todd McClone, CFA, partner; Casey Preyss, CFA, partner; and Vivian Lin Thurston, CFA, partner, which further ensures consistency across these strategies.

Besides the China allocation, the main difference between our EM Growth strategy and our EM ex China Growth strategy is the number of holdings (typically 120 to 175 in EM Growth versus 80 to 130 in EM ex China Growth) and the maximum sector weighting (40% for EM Growth and 50% for EM ex China Growth). This is designed to reflect the opportunity set and larger IT weighting in the MSCI EM ex China IMI.

Naturally, the overlap between our EM ex China Growth and EM Growth strategies is typically high—greater than 90% as of January 2023. It is important to highlight that our EM ex China Growth strategy is actively managed by the team as a standalone strategy (meaning it is not an automatic carveout from our EM Growth strategy) and it continuously reflects what the team believes are the most attractive investment opportunities in EMs outside of China.

In managing the strategy, the team leverages the full breadth of the team’s platform, including attractive investment opportunities that are part of our EM Small Cap Growth strategy. Individual stock weightings are the result from conviction on fundamental thesis and portfolio fit as well as stock liquidity and, to some extent, weightings in the MSCI EM ex China IMI. Sector, country, and market-cap positioning are generally consistent with our EM Growth strategy, with the most noticeable difference being a higher weighting in financials and IT and a lower weighting in consumers and industrials.

Style exposure in our EM ex China Growth strategy is consistent with all other EM strategies managed by the team. They typically display higher-quality characteristics and stronger growth than their respective benchmarks. These attractive fundamental metrics typically result in higher P/E multiples.

We don’t look at geographic revenue to define eligibility (or non-eligibility) for this strategy. Our EM ex China Growth strategy does not invest in companies that have their principal offices in the People’s Republic of China (PRC). Mainland China, Hong Kong, and Macau are included in the definition of PRC.

If you’d like to learn more about our EM Ex China Growth strategy—including how we think about Taiwan and how we address environmental, social, and governance (ESG) considerations—please see our paper.

Romina Graiver, partner, is a portfolio specialist for William Blair’s global equity team.

The MSCI All Country World Index (ACWI) and the MSCI All Country World Index (ACWI) Investable Market Index (IMI) capture large- and mid-cap representation across 23 developed markets and 24 EMs. The latter is broader, with a larger number of securities. The MSCI China Index captures large- and mid-cap representation across China A shares, H shares, B shares, Red chips, and P chips. The MSCI Emerging Markets (EM) Index captures large- and mid-cap representation across 24 EMs. The MSCI Emerging Markets (EM) ex China Index captures large- and mid-cap representation across 23 of 24 EM countries excluding China. The MSCI Emerging Markets (EM) Investable Market Index (IMI) captures large-, mid- and small-cap representation across 27 EMs; the MSCI EM ex China Investable Market Index (IMI) excludes China. The MSCI USA Investable Market Index (IMI) is designed to measure the performance of the large-, mid-, and small-cap segments of the U.S. market. The MSCI World Index captures large- and mid-cap representation across 23 developed markets. Cash flow return on invested capital (ROIC) is a measure of how effectively a company generates cash flow based on capital investment. EPS: long-term growth represents the weighted average of forecasted growth in earnings expected to be experienced by stocks over the next three to five years. EPS growth: five-year historic reflects the weighted average earnings per share growth for stocks over the past five years. P/E ratio is the ratio of a stock’s current price to its per-share earnings over the past year.

Any investment or strategy mentioned herein may not be appropriate for every investor. There can be no assurance that investment objectives will be met. Products and services listed are available only to residents of this jurisdiction and may only be available to certain categories of investors. The information on this website does not constitute an offer for products or services, or a solicitation of an offer to any persons outside of this jurisdiction who are prohibited from receiving such information under applicable laws and regulations. Nothing on this webpage should be construed as advice and is therefore not a recommendation to buy or sell shares.

Please carefully consider the William Blair Funds’ investment objectives, risks, charges, and expenses before investing. This and other information is contained in the Funds’ prospectus and summary prospectus, which you may obtain by calling 1-800-742-7272. Read the prospectus and summary prospectus carefully before investing. Investing includes the risk of loss.

The William Blair Funds are distributed by William Blair & Company, L.L.C., member FINRA/SIPC.

The William Blair SICAV is a Luxembourg investment company with variable capital registered with the Commission de Surveillance du Secteur Financier (“CSSF”) which qualifies as an undertaking for collective investment in transferable securities (“UCITS”). The Management Company of the SICAV has appointed William Blair Investment Management, LLC as the investment manager for the fund.

Please carefully consider the investment objectives, risks, charges, and expenses of the William Blair SICAV. This and other important information is contained in the prospectus and Key Investor Information Document (KIID). Read these documents carefully before investing. The information contained on this website is not a substitute for those documents or for professional external advice.

Information and opinions expressed are those of the authors and may not reflect the opinions of other investment teams within William Blair Investment Management, LLC, or affiliates. Factual information has been taken from sources we believe to be reliable, but its accuracy, completeness or interpretation cannot be guaranteed. Information is current as of the date appearing in this material only and subject to change without notice. Statements concerning financial market trends are based on current market conditions, which will fluctuate. This material may include estimates, outlooks, projections, and other forward-looking statements. Due to a variety of factors, actual events may differ significantly from those presented.

Investing involves risks, including the possible loss of principal. Equity securities may decline in value due to both real and perceived general market, economic, and industry conditions. The securities of smaller companies may be more volatile and less liquid than securities of larger companies. Investing in foreign denominated and/or domiciled securities may involve heightened risk due to currency fluctuations, and economic and political risks. These risks may be enhanced in emerging markets and frontier markets. Investing in the bond market is subject to certain risks including market, interest rate, issuer, credit, and inflation risk. High-yield, lower-rated, securities involve greater risk than higher-rated securities. Different investment styles may shift in and out of favor depending on market conditions. Diversification does not ensure against loss.

Past performance is not indicative of future returns. References to specific companies are for illustrative purposes only and should not be construed as investment advice or a recommendation to buy or sell any security.

William Blair Investment Management, LLC is an investment adviser registered with the U.S. Securities and Exchange Commission.

Issued in the United Kingdom by William Blair International, Ltd., authorized and regulated by the Financial Conduct Authority (FCA), and is only directed at and is only made available to persons falling within articles 19, 38, 47, and 49 of the Financial Services and Markets Act of 2000 (Financial Promotion) Order 2005 (all such persons being referred to as "relevant persons").

Issued in the European Economic Area (EEA) by William Blair B.V., authorized and supervised by the Dutch Authority for the Financial Markets (AFM) under license number 14006134 and also supervised by the Dutch Central Bank (DNB), registered at the Dutch Chamber of Commerce under number 82375682 and has its statutory seat in Amsterdam, the Netherlands. This material is only intended for eligible counterparties and professional clients.

Issued in Switzerland by William Blair Investment Services (Zurich) GmbH, Talstrasse 65, 8001 Zurich, Switzerland ("WBIS"). WBIS is engaged in the offering of collective investment schemes and renders further, non-regulated services in the financial sector. WBIS is affiliated with FINOS Finanzomubdsstelle Schweiz, a recognized ombudsman office where clients may initiate mediation proceedings pursuant to articles 74 et seq. of the Swiss Financial Services Act ("FinSA"). The client advisers of WBIS are registered with regservices.ch by BX Swiss AG, a client adviser registration body authorized by the Swiss Financial Market Supervisory Authority ("FINMA"). WBIS is not supervised by FINMA or any other supervisory authority or self-regulatory organization. This material is only intended for institutional and professional clients pursuant to article 4(3) to (5) FinSA.

Issued in Australia by William Blair Investment Management, LLC (“William Blair”), which is exempt from the requirement to hold an Australian financial services license under Australia's Corporations Act 2001 (Cth). William Blair is registered as an investment advisor with the U.S. Securities and Exchange Commission (“SEC”) and regulated by the SEC under the U.S. Investment Advisers Act of 1940, which differs from Australian laws. This material is intended only for wholesale clients.

Issued in Singapore by William Blair International (Singapore) Pte. Ltd. (Registration Number 201943312R), which is regulated by the Monetary Authority of Singapore under a Capital Markets Services License to conduct fund management activities. This material is intended only for institutional investors and may not be distributed to retail investors.

Issued in Canada by William Blair Investment Management, LLC, which relies on the international adviser exemption, pursuant to section 8.26 of National Instrument 31-103 in Canada.

The content contained in this site is intended as informational or educational in nature and does not constitute investment advice or a recommendation of any investment strategy or product for a particular investor. Investment advice and recommendations can be provided only after careful consideration of an investor’s objectives, guidelines, and restrictions. Investors should consult a financial professional/financial consultant or investment adviser before making any investment decisions. Investing includes the risk of loss.

Copyright © 2026 William Blair. William Blair is a registered trademark of William Blair & Company, L.L.C. “William Blair” refers to William Blair Investment Management, LLC and affiliates.