April 13, 2023 | Emerging Markets Debt

Subscribe Now

Want the latest insights on the economy and other forces shaping the investment landscape?

Subscribe to our Investing Insights newsletter.

April 13, 2023 | Emerging Markets Debt

Want the latest insights on the economy and other forces shaping the investment landscape?

Subscribe to our Investing Insights newsletter.

There has been increasing scrutiny of emerging markets (EM) banks over the past few weeks as the market looks to uncover vulnerabilities to the same issues that hit developed market (DM) banks in the United States and Europe. While EM banks are not immune to the kind of banking stress felt in the United States and Europe, we think it’s unlikely that they will face similar issues—meaning the impact should come primarily through second-order effects.

Here are four reasons why.

Deposits are the main source of funding for EM commercial banks. The average share of deposits in banks’ funding base ranges from 60% to 80%, depending on the region (Asia, Central and Eastern Europe, Middle East and Africa, or Latin America). These banks’ deposit bases are generally granular and well diversified. These factors limit the reliance of EM banks on wholesale funding and makes them less vulnerable to sudden deposit outflows.

Moreover, banks with leading market positions—those that rank among the top five financial institutions within their respective countries—make up more than 80% of the banking sector market cap within the J.P. Morgan Corporate Emerging Market Index (CEMBI) Broad Diversified. That is important because large banks with leading market positions tend to be perceived as safe havens, and as such are likely to benefit from a flight to quality in a scenario in which deposits flow out from smaller institutions.

Basel III—an international regulatory accord that introduced a set of reforms designed to mitigate risk within the international banking sector by requiring banks to maintain certain leverage, capital, and liquidity ratios—is either in place or underway in most EM countries where banks are based.

More than 80% of the 33 countries in the J.P. Morgan CEMBI Broad Diversified with issuers in the banking sector are subject to these stricter capital and liquidity requirements. Banks in these countries represent 95% of the index’s banking sector exposure.

Some frontier countries still lag in terms of regulatory best practices. However, banks in these countries represent a very small part of the investable universe.

In addition, most EM countries in the J.P. Morgan CEMBI Broad Diversified have some type of deposit insurance or guarantee system in place. Although coverage varies widely across countries, we believe this supports the stability of deposits.

The only countries with banks in the index that do not have fully established deposit insurance systems are Israel, South Africa, Qatar, the United Arab Emirates, and Panama—but most of these countries are currently in the process of setting up deposit insurance systems.

The developments at Silicon Valley Bank put banks’ exposure to fixed-income securities marked as held-to-maturity into the spotlight. These holdings are not marked to market and can negatively impact banks’ capital position in the event that the fair value losses are realized.

Unrealized losses in HTM securities only becomes a risk once a bank starts seeing meaningful deposit outflows, which, based on our analysis of EM banks’ funding profiles, seems unlikely.

This risk is likely to be higher in jurisdictions that hiked interest rates more aggressively over the past one to two years, as did most Latin American, Central European, and Eastern European countries. The financial impact ultimately depends on how large HTM portfolios are relative to total capital, duration of the securities holdings, and the degree of rate increases in each country.

An analysis of EM banks suggests that we will see modest impacts to capital arising from these exposures, mostly limited to less than 100 basis points (bps) of common equity tier 1 (CET1). Among financial institutions for which the impact would be larger than that, we believe the total effect on capital would be largely manageable relative to minimum capital requirements.

Importantly, unrealized losses in HTM securities only becomes a risk once a bank starts seeing meaningful deposit outflows, requiring it to raise liquidity through investment sales, which, based on our analysis of EM banks’ funding profiles, seems unlikely.

Additional tier one (AT1) bonds have become an important component of banks’ capital structures. These bonds, which can be converted into equity or written off if a bank’s capital levels fall below a certain threshold, are a cost-effective way to meet regulatory capital requirements. But some controversy arose in Switzerland when Credit Suisse’s AT1 holders found themselves lower on the pecking order than equity shareholders.

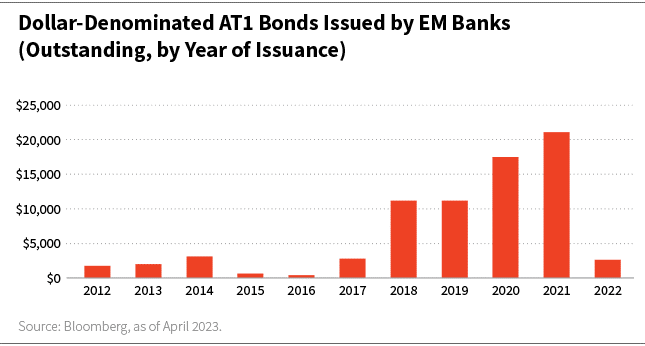

EM banks have been issuing AT1s for the last 10 years, and issuance has gained pace over the past five years amid low interest rates, as the chart below shows. Still, AT1s represent a small portion of EM corporate debt, making up less than 5% of the J.P. Morgan CEMBI Broad Diversified.

While we do not believe recent events mark the beginning of the end of AT1s, we acknowledge that these events represent a major shock to this portion of the fixed-income investment universe, as reflected in the pricing of these instruments in the secondary market.

As such, it might take some time for issuers to return to the primary market to issue AT1s at yield levels deemed acceptable. We also believe the recent spread widening in AT1 paper is likely to increase extension (non-call) risk for bank capital instruments, as it becomes more expensive to issue new bonds to replace existing callable instruments.

Although a permanent shutdown of the AT1 primary market is not our base case, we have analyzed the capital positions of 45 issuers whose AT1 bonds are part of the J.P. Morgan CEMBI Broad Diversified to assess their ability to meet Tier 1 capital requirements solely with common equity Tier 1 (CET1). Our analysis showed that only three banks in the sample would not be able to do so. Within those cases, the maximum Tier 1 capital shortfall would be 70 bps, while the median excess capital buffer stood above 300 bps.

In our view, developed market banking stress is most likely to affect emerging markets banks indirectly, through growth and capital flow channels.

There’s also been a renewed focus on documentation as the developments in Switzerland raised questions about the priority of AT1s within banks’ capital stack in a resolution event. The track record of AT1 write-downs in EMs is limited to one institution in India, making it hard to come to any conclusions. So far, Singapore and Hong Kong regulators have publicly confirmed the seniority of AT1 instruments of equity holders in the event of a resolution.

We believe the recent banking stress in DMs is likely to have limited direct impact on most EM banks because these institutions benefit from stable deposit bases, are well capitalized, and are well regulated. In our view, DM banking stress is most likely to affect EMs and EM banks indirectly, through growth and capital flow channels. The appetite for AT1 instruments has also been negatively impacted, and it’s still uncertain whether these effects will be long-lasting.

Moreover, the volatility seen in the aftermath of recent events created investment opportunities. We will continue to assess the market for good entry points to add exposure to banks with strong fundamentals at attractive valuations across the capital structure.

We see the resumption of primary market activity as evidence that investors are, to a certain extent, comfortable with the risk profile of EM banks with solid credit fundamentals—at least in the investment-grade space. Since the last week of March, banks based in Indonesia, Saudi Arabia, and Korea have successfully priced senior debt issuances in the Eurobond market. These transactions had strong demand from investors and were priced at spreads relatively close to secondary market levels.

Mariana Villalba, CFA, is a portfolio manager and analyst on William Blair's emerging markets debt team.

JP Morgan Corporate Emerging Markets Bond Index (CEMBI) Broad Diversified tracks the performance of U.S.-dollar denominated corporate bonds issued by emerging markets entities.

Index information has been obtained from sources believed to be reliable but J.P. Morgan does not warrant its completeness or accuracy. The indices are used with permission. The indices may not be copied, used, or distributed without J.P. Morgan’s prior written approval. Copyright 2023, JPMorgan Chase & Co. All rights reserved.

Any investment or strategy mentioned herein may not be appropriate for every investor. There can be no assurance that investment objectives will be met. Products and services listed are available only to residents of this jurisdiction and may only be available to certain categories of investors. The information on this website does not constitute an offer for products or services, or a solicitation of an offer to any persons outside of this jurisdiction who are prohibited from receiving such information under applicable laws and regulations. Nothing on this webpage should be construed as advice and is therefore not a recommendation to buy or sell shares.

Please carefully consider the William Blair Funds’ investment objectives, risks, charges, and expenses before investing. This and other information is contained in the Funds’ prospectus and summary prospectus, which you may obtain by calling 1-800-742-7272. Read the prospectus and summary prospectus carefully before investing. Investing includes the risk of loss.

The William Blair Funds are distributed by William Blair & Company, L.L.C., member FINRA/SIPC.

The William Blair SICAV is a Luxembourg investment company with variable capital registered with the Commission de Surveillance du Secteur Financier (“CSSF”) which qualifies as an undertaking for collective investment in transferable securities (“UCITS”). The Management Company of the SICAV has appointed William Blair Investment Management, LLC as the investment manager for the fund.

Please carefully consider the investment objectives, risks, charges, and expenses of the William Blair SICAV. This and other important information is contained in the prospectus and Key Investor Information Document (KIID). Read these documents carefully before investing. The information contained on this website is not a substitute for those documents or for professional external advice.

Information and opinions expressed are those of the authors and may not reflect the opinions of other investment teams within William Blair Investment Management, LLC, or affiliates. Factual information has been taken from sources we believe to be reliable, but its accuracy, completeness or interpretation cannot be guaranteed. Information is current as of the date appearing in this material only and subject to change without notice. Statements concerning financial market trends are based on current market conditions, which will fluctuate. This material may include estimates, outlooks, projections, and other forward-looking statements. Due to a variety of factors, actual events may differ significantly from those presented.

Investing involves risks, including the possible loss of principal. Equity securities may decline in value due to both real and perceived general market, economic, and industry conditions. The securities of smaller companies may be more volatile and less liquid than securities of larger companies. Investing in foreign denominated and/or domiciled securities may involve heightened risk due to currency fluctuations, and economic and political risks. These risks may be enhanced in emerging markets and frontier markets. Investing in the bond market is subject to certain risks including market, interest rate, issuer, credit, and inflation risk. High-yield, lower-rated, securities involve greater risk than higher-rated securities. Different investment styles may shift in and out of favor depending on market conditions. Diversification does not ensure against loss.

Past performance is not indicative of future returns. References to specific companies are for illustrative purposes only and should not be construed as investment advice or a recommendation to buy or sell any security.

William Blair Investment Management, LLC is an investment adviser registered with the U.S. Securities and Exchange Commission.

Issued in the United Kingdom by William Blair International, Ltd., authorized and regulated by the Financial Conduct Authority (FCA), and is only directed at and is only made available to persons falling within articles 19, 38, 47, and 49 of the Financial Services and Markets Act of 2000 (Financial Promotion) Order 2005 (all such persons being referred to as "relevant persons").

Issued in the European Economic Area (EEA) by William Blair B.V., authorized and supervised by the Dutch Authority for the Financial Markets (AFM) under license number 14006134 and also supervised by the Dutch Central Bank (DNB), registered at the Dutch Chamber of Commerce under number 82375682 and has its statutory seat in Amsterdam, the Netherlands. This material is only intended for eligible counterparties and professional clients.

Issued in Switzerland by William Blair Investment Services (Zurich) GmbH, Talstrasse 65, 8001 Zurich, Switzerland ("WBIS"). WBIS is engaged in the offering of collective investment schemes and renders further, non-regulated services in the financial sector. WBIS is affiliated with FINOS Finanzomubdsstelle Schweiz, a recognized ombudsman office where clients may initiate mediation proceedings pursuant to articles 74 et seq. of the Swiss Financial Services Act ("FinSA"). The client advisers of WBIS are registered with regservices.ch by BX Swiss AG, a client adviser registration body authorized by the Swiss Financial Market Supervisory Authority ("FINMA"). WBIS is not supervised by FINMA or any other supervisory authority or self-regulatory organization. This material is only intended for institutional and professional clients pursuant to article 4(3) to (5) FinSA.

Issued in Australia by William Blair Investment Management, LLC (“William Blair”), which is exempt from the requirement to hold an Australian financial services license under Australia's Corporations Act 2001 (Cth). William Blair is registered as an investment advisor with the U.S. Securities and Exchange Commission (“SEC”) and regulated by the SEC under the U.S. Investment Advisers Act of 1940, which differs from Australian laws. This material is intended only for wholesale clients.

Issued in Singapore by William Blair International (Singapore) Pte. Ltd. (Registration Number 201943312R), which is regulated by the Monetary Authority of Singapore under a Capital Markets Services License to conduct fund management activities. This material is intended only for institutional investors and may not be distributed to retail investors.

Issued in Canada by William Blair Investment Management, LLC, which relies on the international adviser exemption, pursuant to section 8.26 of National Instrument 31-103 in Canada.

The content contained in this site is intended as informational or educational in nature and does not constitute investment advice or a recommendation of any investment strategy or product for a particular investor. Investment advice and recommendations can be provided only after careful consideration of an investor’s objectives, guidelines, and restrictions. Investors should consult a financial professional/financial consultant or investment adviser before making any investment decisions. Investing includes the risk of loss.

Copyright © 2026 William Blair. William Blair is a registered trademark of William Blair & Company, L.L.C. “William Blair” refers to William Blair Investment Management, LLC and affiliates.