August 12, 2025 | Emerging Markets Debt

Investments

ASSET-CLASS CAPABILITIES

Insights

EDUCATION CENTER

SUBSCRIBE

August 12, 2025 | Emerging Markets Debt

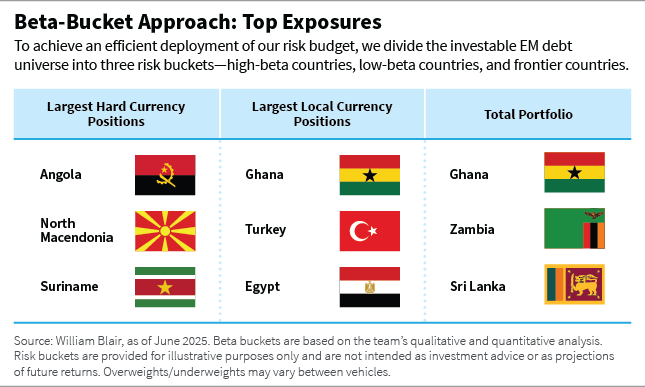

Frontier markets debt delivered strong returns in the second quarter, supported by strong risk appetite, growing prospects of monetary easing in developed markets, and a weakening of the U.S. dollar. High metal prices—gold in particular—further supported the performance of local currency frontier markets debt. Below, we break down some of our largest active positions by beta bucket, which is how we allocate our risk budget.

Our largest hard currency positions are in Angola, North Macedonia, and Suriname.

Angola: We hold a long-dated Eurobond, as its valuation appears attractive relative to peers. Angola’s fiscal policy remains prudent, albeit vulnerable to sustained declines in oil prices. The authorities are likely to continue to explore development finance options while avoiding issuing in the Eurobond market in the months to come, which we believe is likely to support bonds.

North Macedonia: A European Union (EU) accession story is gaining traction as the country works more closely with the EU. Growth remains robust and some fiscal consolidation is now underway.

Suriname: We like the valuations of both bonds and warrants. In addition, the country has International Monetary Fund (IMF) support and strong fundamentals. We believe it is also on a path of structural improvement, as it is following an IMF extended fund facility (EFF) program and experiencing positive developments in the oil sector.

Our largest local currency positions are in Ghana, Turkey, and Egypt.

Ghana: We continue to see value in local currency bonds even after strong second-quarter performance, particularly given June’s sharp inflation decline and the potential for further disinflation. However, following significant currency appreciation, we view the cedi as marginally overvalued and have hedged our FX exposure accordingly. That said, the country’s terms of trade are likely to remain strong, in our opinion.

Turkey’s economic reform story remains intact despite some political uncertainty.

Turkey: We see extremely attractive carry and an economic reform story that remains intact despite some political uncertainty. The central bank continues to rebuild reserves, inflation is declining, and we believe the current account deficit is less of a concern than it was a year or so ago.

Egypt: We remain long the carry trade, with the currency proving remarkably resilient amid bouts of heighted risk aversion in the first quarter.

Our largest total positions are in Ghana, Zambia, and Sri Lanka.

Ghana: We remain exposed to both hard currency and local currency bonds, with most of our exposure in the local rates market. Economic fundamentals after the IMF program restructuring are improving, with high commodity prices (in particular gold) helping the current account surplus and international reserves growth. While outperformance in Ghanaian assets over the second quarter made valuations less appealing, we think that fundamentals will continue to anchor the performance of assets.

Zambia: We remain exposed to both hard currency and local currency bonds, as we continue to see value in local rates and the long-dated hard currency bond. The fundamental outlook has strengthened as the effect of the country’s drought fades and reforms progress under Zambia’s IMF-supported program. The 2053 Eurobond performed well and market confidence increased over the likelihood of meeting the 2026 trigger, which would shorten the bond’s maturity to 2035 and increase the coupon.

We believe there will be a global economic deceleration, not a global recession.

Sri Lanka: We predominantly hold local currency, which is supported by a low and stable inflation outlook, the potential for onshore investors to add duration, a clearer path for the rupee (with only modest depreciation of 2% expected in 2025), and high carry. The Central Bank of Sri Lanka has indicated that there is scope to ease policy further if needed to sustain growth, which should support local rates. On the hard currency side, our overweight position in Sri Lankan macro-linked bonds (MLBs) is underpinned by improving gross domestic product (GDP) growth, a stronger rupee, lower oil prices, and declining domestic rates. The market has already priced in an “intermediate upside” scenario, as we see room for a shift toward “higher upside” pricing as the triggers or improvement come into clearer view. The U.S. tariff reduction in early July—from 44% to 30%—fell short of the government’s hopes but represents progress. Officials continue to lobby for a further cut before the August 1 deadline.

Despite rising policy-related risks, our base-case scenario has not changed. Emerging markets debt, including frontier markets debt, tends to be impacted by two predominant global forces—global economic growth and global liquidity conditions. And the outlook for both is positive, in our opinion. We believe there will be a global economic deceleration, not a global recession. We also believe the global disinflationary trend will persist, allowing central banks around the world to continue normalizing monetary conditions, albeit at a slower pace, and continue to expect gradually improving global liquidity conditions. Elevated real rates and a favorable backdrop for frontier currencies are, in our view, likely to bode well for frontier market performance in the third quarter.

Yvette Babb is a portfolio manager on William Blair’s emerging markets debt team.

Daniel Wood is a portfolio manager on William Blair’s emerging markets debt team.

Want the latest insights on the economy and other forces shaping the investment landscape?

Subscribe to our Investing Insights newsletter.

Any investment or strategy mentioned herein may not be appropriate for every investor. There can be no assurance that investment objectives will be met. Products and services listed are available only to residents of this jurisdiction and may only be available to certain categories of investors. The information on this website does not constitute an offer for products or services, or a solicitation of an offer to any persons outside of this jurisdiction who are prohibited from receiving such information under applicable laws and regulations. Nothing on this webpage should be construed as advice and is therefore not a recommendation to buy or sell shares.

Please carefully consider the William Blair Funds’ investment objectives, risks, charges, and expenses before investing. This and other information is contained in the Funds’ prospectus and summary prospectus, which you may obtain by calling 1-800-742-7272. Read the prospectus and summary prospectus carefully before investing. Investing includes the risk of loss.

The William Blair Funds are distributed by William Blair & Company, L.L.C., member FINRA/SIPC.

The William Blair SICAV is a Luxembourg investment company with variable capital registered with the Commission de Surveillance du Secteur Financier (“CSSF”) which qualifies as an undertaking for collective investment in transferable securities (“UCITS”). The Management Company of the SICAV has appointed William Blair Investment Management, LLC as the investment manager for the fund.

Please carefully consider the investment objectives, risks, charges, and expenses of the William Blair SICAV. This and other important information is contained in the prospectus and Key Investor Information Document (KIID). Read these documents carefully before investing. The information contained on this website is not a substitute for those documents or for professional external advice.

Information and opinions expressed are those of the authors and may not reflect the opinions of other investment teams within William Blair Investment Management, LLC, or affiliates. Factual information has been taken from sources we believe to be reliable, but its accuracy, completeness or interpretation cannot be guaranteed. Information is current as of the date appearing in this material only and subject to change without notice. Statements concerning financial market trends are based on current market conditions, which will fluctuate. This material may include estimates, outlooks, projections, and other forward-looking statements. Due to a variety of factors, actual events may differ significantly from those presented.

Investing involves risks, including the possible loss of principal. Equity securities may decline in value due to both real and perceived general market, economic, and industry conditions. The securities of smaller companies may be more volatile and less liquid than securities of larger companies. Investing in foreign denominated and/or domiciled securities may involve heightened risk due to currency fluctuations, and economic and political risks. These risks may be enhanced in emerging markets and frontier markets. Investing in the bond market is subject to certain risks including market, interest rate, issuer, credit, and inflation risk. High-yield, lower-rated, securities involve greater risk than higher-rated securities. Different investment styles may shift in and out of favor depending on market conditions. Diversification does not ensure against loss.

Past performance is not indicative of future returns. References to specific companies are for illustrative purposes only and should not be construed as investment advice or a recommendation to buy or sell any security.

William Blair Investment Management, LLC is an investment adviser registered with the U.S. Securities and Exchange Commission.

Issued in the United Kingdom by William Blair International, Ltd., authorized and regulated by the Financial Conduct Authority (FCA), and is only directed at and is only made available to persons falling within articles 19, 38, 47, and 49 of the Financial Services and Markets Act of 2000 (Financial Promotion) Order 2005 (all such persons being referred to as "relevant persons").

Issued in the European Economic Area (EEA) by William Blair B.V., authorized and supervised by the Dutch Authority for the Financial Markets (AFM) under license number 14006134 and also supervised by the Dutch Central Bank (DNB), registered at the Dutch Chamber of Commerce under number 82375682 and has its statutory seat in Amsterdam, the Netherlands. This material is only intended for eligible counterparties and professional clients.

Issued in Switzerland by William Blair Investment Services (Zurich) GmbH, Talstrasse 65, 8001 Zurich, Switzerland ("WBIS"). WBIS is engaged in the offering of collective investment schemes and renders further, non-regulated services in the financial sector. WBIS is affiliated with FINOS Finanzomubdsstelle Schweiz, a recognized ombudsman office where clients may initiate mediation proceedings pursuant to articles 74 et seq. of the Swiss Financial Services Act ("FinSA"). The client advisers of WBIS are registered with regservices.ch by BX Swiss AG, a client adviser registration body authorized by the Swiss Financial Market Supervisory Authority ("FINMA"). WBIS is not supervised by FINMA or any other supervisory authority or self-regulatory organization. This material is only intended for institutional and professional clients pursuant to article 4(3) to (5) FinSA.

Issued in Australia by William Blair Investment Management, LLC (“William Blair”), which is exempt from the requirement to hold an Australian financial services license under Australia's Corporations Act 2001 (Cth). William Blair is registered as an investment advisor with the U.S. Securities and Exchange Commission (“SEC”) and regulated by the SEC under the U.S. Investment Advisers Act of 1940, which differs from Australian laws. This material is intended only for wholesale clients.

Issued in Singapore by William Blair International (Singapore) Pte. Ltd. (Registration Number 201943312R), which is regulated by the Monetary Authority of Singapore under a Capital Markets Services License to conduct fund management activities. This material is intended only for institutional investors and may not be distributed to retail investors.

Issued in Canada by William Blair Investment Management, LLC, which relies on the international adviser exemption, pursuant to section 8.26 of National Instrument 31-103 in Canada.

The content contained in this site is intended as informational or educational in nature and does not constitute investment advice or a recommendation of any investment strategy or product for a particular investor. Investment advice and recommendations can be provided only after careful consideration of an investor’s objectives, guidelines, and restrictions. Investors should consult a financial professional/financial consultant or investment adviser before making any investment decisions. Investing includes the risk of loss.

Copyright © 2026 William Blair. William Blair is a registered trademark of William Blair & Company, L.L.C. “William Blair” refers to William Blair Investment Management, LLC and affiliates.