April 8, 2025 | Emerging Markets Debt

Investments

ASSET-CLASS CAPABILITIES

Insights

EDUCATION CENTER

SUBSCRIBE

April 8, 2025 | Emerging Markets Debt

Unique forces are set to shape the commodity markets in 2025: plentiful supplies threaten oil; rising tariff risks threaten the cleantech momentum for copper; supply challenges boost aluminium; and gold shines brighter amid economic and geopolitical uncertainty.

This commentary is based on a March 4, 2025, webinar.

Global crude oil consumption was approximately 103 million barrels per day as of year-end 2024, with emerging markets (EMs) the main drivers of consumption. By 2030, we expect crude oil consumption to grow to about 105 million barrels, with EMs continuing to drive consumption and developed market countries reducing their usage. Gasoline remains the primary driver of oil demand, but its growth is expected to slow with rising electric vehicle (EV) adoption and the energy transition. However, this decline should be offset by increasing demand for industrial and jet fuels (which aren’t significantly cleaner).

On the supply side, OPEC’s share of global crude production has fallen from nearly 36% to below 30% as of 2024.

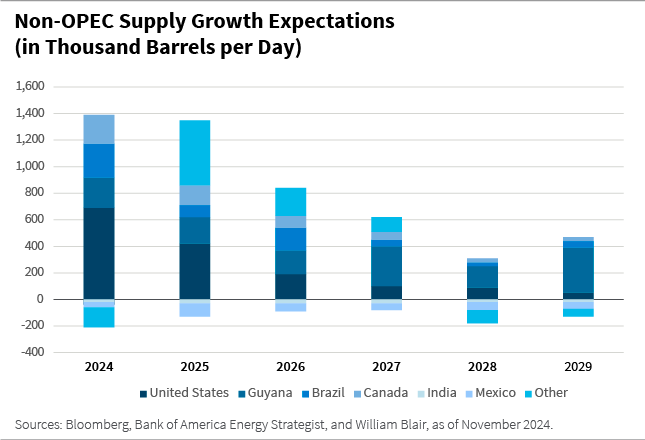

The United States has largely filled this gap, with shale production expanding significantly. The new administration aims to increase U.S. output from 13 million to 16 million barrels per day over time. Achieving this may be challenging, but a key distinction of U.S. shale production is its short lead time. Unlike traditional oil projects, which take three to five years from investment decision to production, U.S. shale can ramp up within a year (and sometimes within three months), making it a much faster and more flexible supply source.

Looking at other parts of the world, Asian oil production has declined slightly, while Europe’s, though not a major contributor, has dropped significantly. Russia has faced constraints, though less severe than initially expected under sanctions. However, some regions are seeing growth.

One of the fastest-growing producers is Guyana, where output has surged from near zero just a few years ago to around 650,000 barrels per day. Estimates suggest it could reach 1.5 million to 2 million barrels per day, making it one of the largest sources of new supply.

The outlook for other suppliers is mixed.

Mexico’s Pemex faces ongoing challenges, with production falling from 2.5 million to 1.6 million barrels per day due to underinvestment, brain drain, and aging infrastructure. Without significant reforms or partnerships—unlikely but possible—this decline will be difficult to reverse.

Brazil, on the other hand, is a growing focus. Petrobras has expanded production to nearly 3 million barrels per day while divesting assets, fueling the rise of smaller exploration and production (E&P) companies and service providers. This ecosystem is creating new investment opportunities, with production growth and sector maturity expected to continue.

Canada remains a key producer, though U.S.-Canada tariff tensions add some uncertainty. However, its heavier crude requires specialized refining, particularly in the U.S. Midwest, creating a symbiotic relationship that is likely to endure despite political volatility.

But it’s not just about supply and demand; as a quote from the International Energy Agency (IEA; circa 2005-2006) states, “Oil is driven by a multitude of factors that vary in influence over time.” Our approach involves analyzing these many variables, so let’s look at a few.

We believe several positive factors are likely to support oil markets.

Additional positive factors, though less certain, could also support oil markets.

We believe several negative factors are likely to impact oil markets.

Additional negative factors, though less certain, could also put downward pressure on oil markets.

After considering these factors, what’s in store for oil prices? Looking at historical trends provides some context. During COVID we saw WTI prices briefly dip into negative territory due to extraordinary circumstances, while Brent remained low but never turned negative. As demand rebounded and COVID-related shutdowns eased, prices surged past $100, further driven by the Russia-Ukraine war and resulting sanctions on a major oil producer. OPEC’s gradual release of withheld barrels then put downward pressure on prices, leading to a stabilization between $70 and $90 over the past few years. Despite fluctuations, oil prices have remained relatively within this range.

Looking ahead, we expect some U.S. demand growth and a boost from China’s stimulus, both positive factors. On the other hand, OPEC’s eventual supply release and rising non-OPEC production will likely exert downward pressure on prices. Currently, Brent sits around $75 per barrel and WTI around $71. Most sell-side analysts anticipate further declines, and we share that view.

For the companies we invest in, the focus remains on cost structure, operational efficiency, and barrel replacement rather than short-term oil price fluctuations. Management teams recognize that crude price volatility is inevitable, so we prioritize companies that can operate sustainably at $70 per barrel without significant credit risks. If prices rise, credit metrics improve but most of the upside accrues to equity value.

Copper is an industrial metal with broad applications. It’s used by a variety of industries, including construction (28%) and power (16%), the latter of which is increasing its share due to renewable energy applications. Use in transportation (13%) is also expanding, driven by EVs, which use three to four times more copper than conventional cars.

The energy transition is a major driver of copper demand, with clean energy currently accounting for about 25% of consumption. This share is projected to rise to 45% by 2040, with overall demand expected to increase by 40%—an additional 11 million tons—according to the IEA.

China accounts for nearly 60% of global copper demand, though its growth has fluctuated. In 2024, refined copper demand in China grew just 2%, compared to 9% in 2023 and 25% in 2021, largely driven by grid and renewable energy investments and EVs.

On the supply side, more than 80% of global mine production comes from EMs. Chile leads with 24% of global output, while the Democratic Republic of Congo (DRC) has seen double-digit production growth in recent years. Peru remains a major supplier as well.

After extraction, copper must be smelted and refined, with China dominating global refining capacity at 45%.

Copper prices surged in 2024, particularly in May, driven by short squeezes on Comex and speculation about a broader metals supercycle. Prices are also highly sensitive to China’s economic headlines, particularly around stimulus measures. In 2020 and 2021, supply concerns and low inventories pushed prices higher and kept them elevated.

Looking ahead, trade wars present the biggest downside risk, with U.S.-China tariffs already announced and further escalation a key uncertainty. However, strong green energy demand remains a positive catalyst, alongside China’s stimulus measures, which have yet to fully impact the market.

Gold demand saw strong positive trends last year, prompting a greater focus on the metal. The three main demand drivers are jewelry, which accounts for 50% of global demand, followed by central bank purchases and investment demand—including futures, exchange-traded funds (ETFs), coins, and bars.

China and India together make up about half of global gold demand, with historically strong physical consumption. In 2024, physical demand increased, though China’s numbers were more muted, possibly reflecting differing economic sentiment between the two countries.

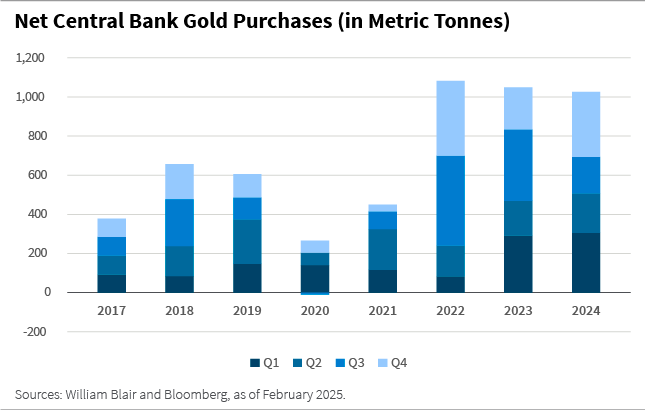

Since 2022, central bank gold purchases have remained high, contributing significantly to demand. In 2024 we saw gold purchases at similar levels to 2022, which was a year of high demand of gold from central banks. China, in particular, has been steadily increasing its gold reserves over the past 15 years, accelerating since 2022 as part of a broader de-dollarization strategy and a hedge against geopolitical risks. Other major holders include Japan, Switzerland, and the United States.

Investor positioning has also been strengthening, with futures markets showing increasing long positions—a sign of optimism. Similar trends are evident in ETFs, bars, and coins, though positioning does not yet appear overstretched, suggesting further upside potential.

Gold prices recently broke above $2,950, continuing a strong upward trend throughout 2024. Several factors have contributed, including geopolitical risks and economic uncertainty—drivers that are expected to persist, which may limit downside risks. However, sustained high prices could dampen demand, particularly in the jewelry sector and potentially among central banks.

Aluminum, another industrial metal, shares many similarities with copper, and has comparable demand trends across key sectors.

China dominates the market, accounting for 58% of global aluminum demand and holding the largest smelting capacity, making it the top producer. Europe also plays a significant role, representing 14% of demand.

The energy transition is a major driver, with green demand—renewable energy, EVs, and grid updates—currently making up 8% of total aluminum demand. This share is expected to rise to 18% by 2030, further supporting long-term growth.

In 2024, aluminum prices were elevated due to supply disruptions in alumina, a key feedstock, which squeezed producer margins and provided cost support for prices. Supply-driven price surges also occurred in 2022 following Russia’s invasion of Ukraine, as concerns over disruptions temporarily pushed aluminum prices higher. While supply chains have since adjusted, we believe ongoing energy transition demand and potential supply constraints create a positive outlook for aluminum going forward.

We’ve analyzed the fundamentals of key commodity sectors within the EM debt universe, including independent and national oil, aluminum, copper, and gold companies.

Leverage trends have generally improved since the COVID period, with a notable decline in aluminum companies. Gold companies, in contrast, have maintained stable leverage, reflecting their strong credit quality—something also seen in other sectors.

Margins across most commodity sectors remain high, at or above 50%, and have been relatively stable over time. Aluminum, however, continues to experience lower margins due to its energy-intensive and higher-cost production process, making it a structurally less profitable sector compared to others.

But understanding a company’s position in its credit cycle is crucial to making sense of bond yields. Most commodity sectors offer a broad range of yields, creating diverse investment opportunities. Gold and copper companies, for example, typical yield between 5% and 8% in today’s markets. Aluminum yields tend to be a bit lower. Independent oil companies vary significantly, with smaller producers (20,000 to 30,000 barrels per day) differing from larger ones (150,000 to 250,000 barrels per day), but yields generally average close to 9%.

On the national oil company side, yields range from 5% to 9%, influenced by credit quality and country risk, with an average around 7%. Duration is less of a factor in the difference in yields, as most bonds in this universe are five- to seven-year maturities, though national oil companies sometimes issue longer-dated debt. Overall, there is a wide set of opportunities for investors to identify the best risk-reward balance.

Luis Olguin, CFA, is a portfolio manager on William Blair’s emerging markets debt team.

Alexandra Symeonidi, CFA, is a senior corporate credit and sustainability analyst on William Blair’s emerging markets debt team.

Want the latest insights on the economy and other forces shaping the investment landscape?

Subscribe to our Investing Insights newsletter.

Any investment or strategy mentioned herein may not be appropriate for every investor. There can be no assurance that investment objectives will be met. Products and services listed are available only to residents of this jurisdiction and may only be available to certain categories of investors. The information on this website does not constitute an offer for products or services, or a solicitation of an offer to any persons outside of this jurisdiction who are prohibited from receiving such information under applicable laws and regulations. Nothing on this webpage should be construed as advice and is therefore not a recommendation to buy or sell shares.

Please carefully consider the William Blair Funds’ investment objectives, risks, charges, and expenses before investing. This and other information is contained in the Funds’ prospectus and summary prospectus, which you may obtain by calling 1-800-742-7272. Read the prospectus and summary prospectus carefully before investing. Investing includes the risk of loss.

The William Blair Funds are distributed by William Blair & Company, L.L.C., member FINRA/SIPC.

The William Blair SICAV is a Luxembourg investment company with variable capital registered with the Commission de Surveillance du Secteur Financier (“CSSF”) which qualifies as an undertaking for collective investment in transferable securities (“UCITS”). The Management Company of the SICAV has appointed William Blair Investment Management, LLC as the investment manager for the fund.

Please carefully consider the investment objectives, risks, charges, and expenses of the William Blair SICAV. This and other important information is contained in the prospectus and Key Investor Information Document (KIID). Read these documents carefully before investing. The information contained on this website is not a substitute for those documents or for professional external advice.

Information and opinions expressed are those of the authors and may not reflect the opinions of other investment teams within William Blair Investment Management, LLC, or affiliates. Factual information has been taken from sources we believe to be reliable, but its accuracy, completeness or interpretation cannot be guaranteed. Information is current as of the date appearing in this material only and subject to change without notice. Statements concerning financial market trends are based on current market conditions, which will fluctuate. This material may include estimates, outlooks, projections, and other forward-looking statements. Due to a variety of factors, actual events may differ significantly from those presented.

Investing involves risks, including the possible loss of principal. Equity securities may decline in value due to both real and perceived general market, economic, and industry conditions. The securities of smaller companies may be more volatile and less liquid than securities of larger companies. Investing in foreign denominated and/or domiciled securities may involve heightened risk due to currency fluctuations, and economic and political risks. These risks may be enhanced in emerging markets and frontier markets. Investing in the bond market is subject to certain risks including market, interest rate, issuer, credit, and inflation risk. High-yield, lower-rated, securities involve greater risk than higher-rated securities. Different investment styles may shift in and out of favor depending on market conditions. Diversification does not ensure against loss.

Past performance is not indicative of future returns. References to specific companies are for illustrative purposes only and should not be construed as investment advice or a recommendation to buy or sell any security.

William Blair Investment Management, LLC is an investment adviser registered with the U.S. Securities and Exchange Commission.

Issued in the United Kingdom by William Blair International, Ltd., authorized and regulated by the Financial Conduct Authority (FCA), and is only directed at and is only made available to persons falling within articles 19, 38, 47, and 49 of the Financial Services and Markets Act of 2000 (Financial Promotion) Order 2005 (all such persons being referred to as "relevant persons").

Issued in the European Economic Area (EEA) by William Blair B.V., authorized and supervised by the Dutch Authority for the Financial Markets (AFM) under license number 14006134 and also supervised by the Dutch Central Bank (DNB), registered at the Dutch Chamber of Commerce under number 82375682 and has its statutory seat in Amsterdam, the Netherlands. This material is only intended for eligible counterparties and professional clients.

Issued in Switzerland by William Blair Investment Services (Zurich) GmbH, Talstrasse 65, 8001 Zurich, Switzerland ("WBIS"). WBIS is engaged in the offering of collective investment schemes and renders further, non-regulated services in the financial sector. WBIS is affiliated with FINOS Finanzomubdsstelle Schweiz, a recognized ombudsman office where clients may initiate mediation proceedings pursuant to articles 74 et seq. of the Swiss Financial Services Act ("FinSA"). The client advisers of WBIS are registered with regservices.ch by BX Swiss AG, a client adviser registration body authorized by the Swiss Financial Market Supervisory Authority ("FINMA"). WBIS is not supervised by FINMA or any other supervisory authority or self-regulatory organization. This material is only intended for institutional and professional clients pursuant to article 4(3) to (5) FinSA.

Issued in Australia by William Blair Investment Management, LLC (“William Blair”), which is exempt from the requirement to hold an Australian financial services license under Australia's Corporations Act 2001 (Cth). William Blair is registered as an investment advisor with the U.S. Securities and Exchange Commission (“SEC”) and regulated by the SEC under the U.S. Investment Advisers Act of 1940, which differs from Australian laws. This material is intended only for wholesale clients.

Issued in Singapore by William Blair International (Singapore) Pte. Ltd. (Registration Number 201943312R), which is regulated by the Monetary Authority of Singapore under a Capital Markets Services License to conduct fund management activities. This material is intended only for institutional investors and may not be distributed to retail investors.

Issued in Canada by William Blair Investment Management, LLC, which relies on the international adviser exemption, pursuant to section 8.26 of National Instrument 31-103 in Canada.

The content contained in this site is intended as informational or educational in nature and does not constitute investment advice or a recommendation of any investment strategy or product for a particular investor. Investment advice and recommendations can be provided only after careful consideration of an investor’s objectives, guidelines, and restrictions. Investors should consult a financial professional/financial consultant or investment adviser before making any investment decisions. Investing includes the risk of loss.

Copyright © 2026 William Blair. William Blair is a registered trademark of William Blair & Company, L.L.C. “William Blair” refers to William Blair Investment Management, LLC and affiliates.