Renewable energy is one of the key growth sectors for India, a priority for the newly formed government and critical for the country’s future development. Below, I dive into India’s renewable energy sector, exploring its growth trajectory, key drivers, challenges, and investment opportunities, while also examining policy initiatives shaping its evolution.

Earth: India’s Commitment to a Cleaner Future

Renewable energy is a major government focus and is crucial for energy security, as India is the world's third-largest energy consumer and one of the fastest-growing economies in the world. Clean energy is also a tremendous economic opportunity for India, which aims to become a green hydrogen and battery hub.

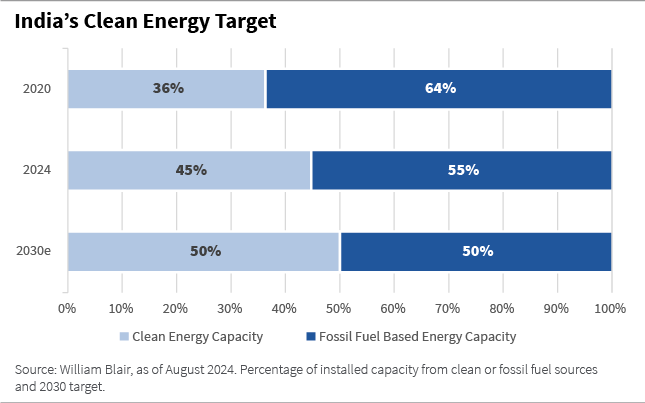

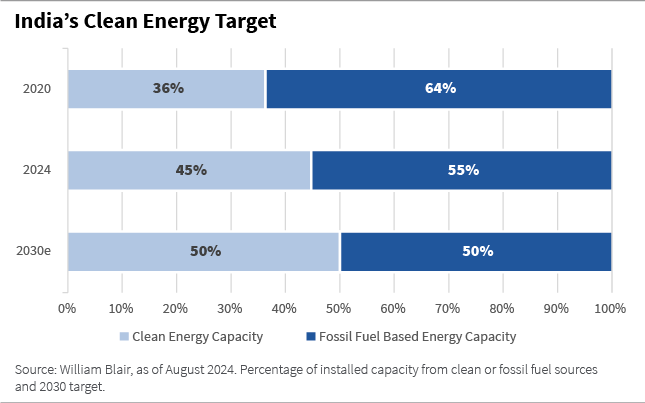

At the United Nations’ (UN) annual climate change conference (COP26) in 2021, Prime Minister Narendra Modi announced a net-zero 2070 goal, aiming for net-zero emissions by 2070. Modi also announced an ambitious decarbonization target that seeks to achieve 50% of installed energy capacity from clean sources and attain 500 gigawatts (GW) of installed capacity from renewable energy by 2030. The 2030 target is expected to reduce the emissions intensity of India’s economy by 45% from 2005 and reduce carbon dioxide (CO2) emissions by 1 billion tonnes.

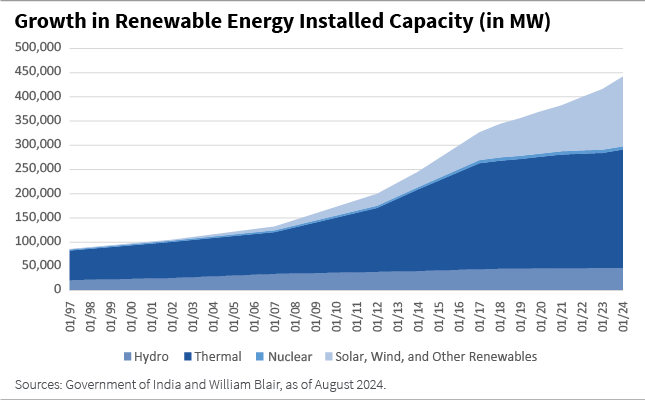

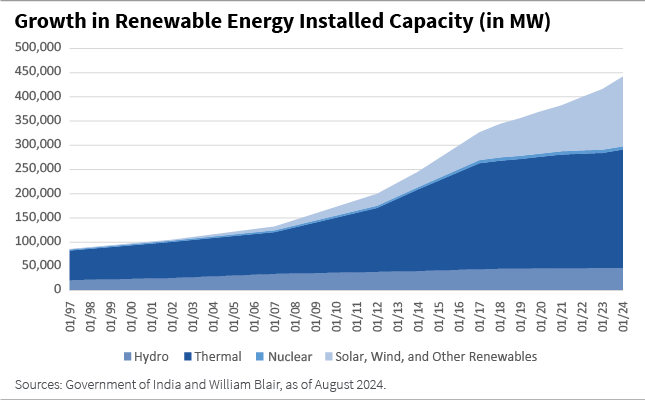

In addition, India’s renewable energy capacity installations have been growing at a staggering rate. Capacity additions of solar and wind have doubled since 2017, with 18 GW added in fiscal year 2024, to a total of nearly 200 GW of renewable energy capacity.

However, to reach the ambitious 2030 decarbonization target, capacity additions need to grow by 50 GW per annum, an amount nearly equal to Australia’s total renewable energy capacity.

Six years ahead of India’s 2030 commitment, the first component of the target is within reach, as clean energy capacities comprised 45% of total capacity in May 2024. Of that, 65% is solar and wind, 26% hydro, 5% biofuels, 3% nuclear, and 1% waste to energy. Solar and wind capacities have grown at a 14% compound annual growth rate (CAGR) since March 2017.

India’s renewable energy capacity installations have been growing at a staggering rate.

Wind: Harnessing Opportunity in Renewable Energy Providers

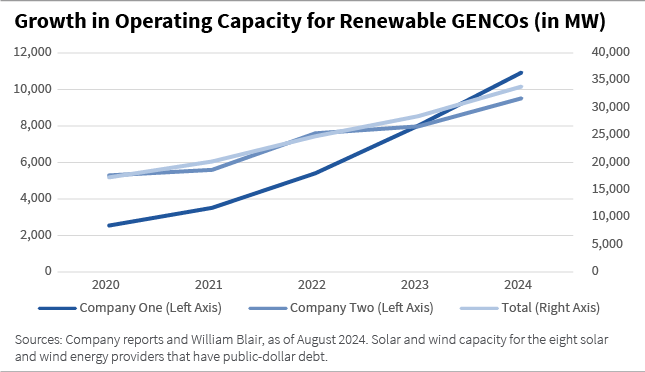

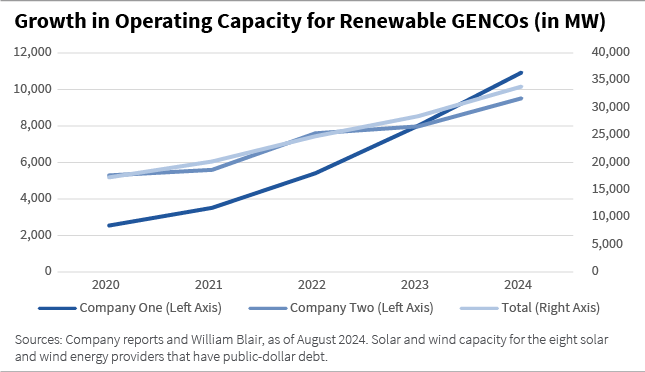

Currently, there are eight renewable energy generation companies (GENCOs) in India that have issued public-dollar debt and operate solar and wind energy generation projects. Installed capacity has grown aggressively over the past few years, supporting India’s decarbonization goals.

Together, these companies now boast over 33 GW of installed capacity, up from 17 GW in 2020. Most of this growth comes from two of these companies, which make up 60% of total operating capacities, as shown in the chart below.

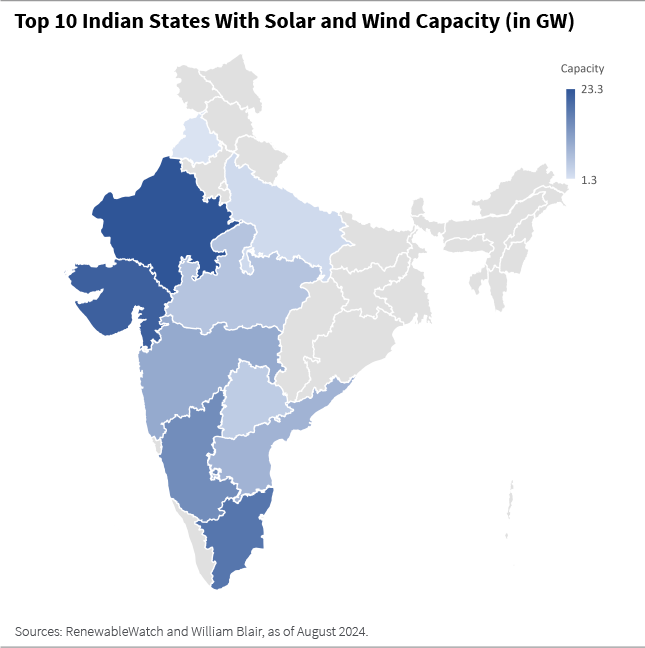

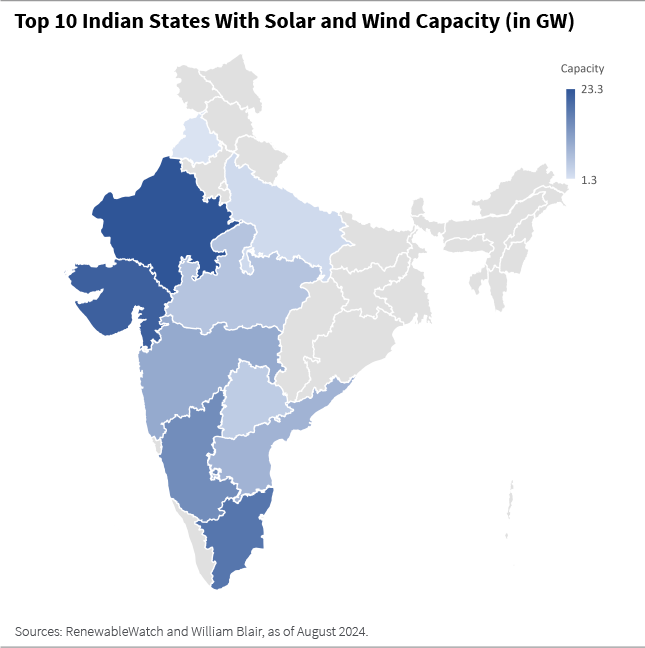

In India, the highest wind and solar power densities are observed in western, far northern, and far southern regions, as shown in the chart below. High solar-power densities are present in the central regions, too. Renewable energy providers are strategically located in these regions, with operations concentrated in the west, central, and southern parts of the country.

The energy mix is evolving as renewable energy companies expand. Previously, operating capacities were typically skewed toward either wind or solar energy.

But companies are increasingly focusing on wind-solar hybrid (WSH) projects, which integrate solar panels and wind farms within a specific area. WSH projects enhance energy generation and stability, optimize land use, and reduce environmental impacts.

Shareholding structures typically include some founder ownership, while strategic and long-term investors like large pension funds and sovereign wealth funds have taken an interest in these companies.

Long-term equity investors are of pivotal importance to the growth of renewable GENCOs as new projects are funded with 25% equity (75% debt), which can take the form of direct equity injection from equity partners.

The renewable energy sector is a strategically important sector for India, and companies enjoy a variety of debt-funding sources such as loans from commercial banks, non-bank financial companies, development and international finance institutions, and onshore and offshore public and private debt.

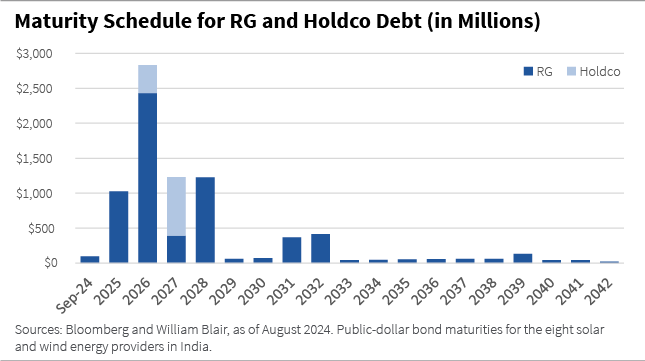

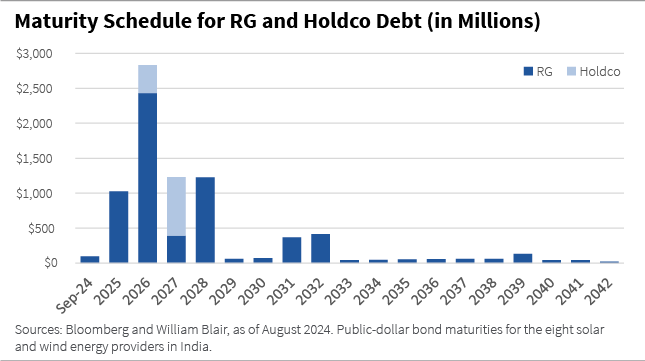

In the public-dollar bond markets, renewable energy providers issue debt at the holding company (holdco) level or at the asset level with fixed and secured debt over ringfenced assets in structures called restricted groups (RG).

As shown in the chart below, there is a large amount of holdco and RG bonds maturing in the coming years, which might be followed by a period of issuance from these companies.

Fire: Government Backing Sparks the Renewable Energy Sector

The influx of investments and growth to the renewable energy generation sector was not met with equal investments in the distribution and transmission sectors, which created hiccups in the growth outlook for renewable energy a few years ago.

State-owned distribution companies (DISCOMs) have been facing piling debt and a widening cost to revenue gap caused by technical and commercial losses due to system inefficiencies and aged equipment, theft, and inadequate tariff increases. The liabilities of DISCOMs to energy generation companies were accumulating, affecting the financial health of the latter and threatening one of India’s pivotal growth sectors.

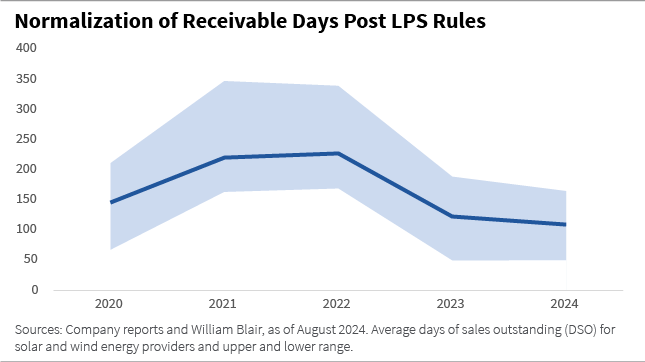

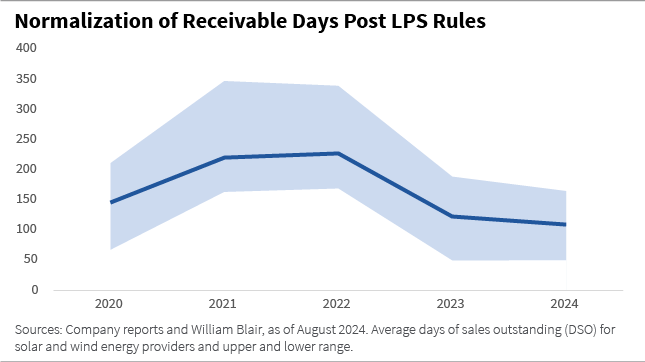

In 2021, the government announced Late Payment Surcharge (LPS) rules, effective from 2022, which imposed financial penalties on DISCOMs that failed to pay their dues to GENCOs by the agreed-upon date, with surcharges accruing on overdue payments.

The LPS rules included incentives for early payments but also reduced power supply from GENCOs in the case of persistent defaults on payments from DISCOMs. These rules encouraged timely payments from DISCOMs and reduced the number of days it took GENCOs to receive payments, thereby improving their cash flows by decreasing the days of sales outstanding from 2022 when the rules became effective.

The Indian government has also rolled out a series of transformative measures to bolster and energize its power sector over the years. One such measure is the Revamped Distribution Sector Scheme (RDSS), a reform aimed at improving the quality and reliability of the power supply to consumers by enhancing the operational efficiency and financial stability of the distribution sector. The Rooftop Solar Scheme also provides subsidies for consumers that wish to install panels to power their homes.

Investing in the renewable energy sector is also highly encouraged, with state-owned non-bank financial institutions extending lending across the sector’s value chain and foreign direct investment (FDI) for 100% of a renewable-energy project allowed without further approval from the government in current FDI rules.

Recent tariff increases observed in states with operating renewable-energy capacity such as Tamil Nadu and Maharashtra are also important drivers for the growth and financial sustainability of the sector.

The renewable energy sector is a strategically important sector for India.

The Investment Case for India’s Renewable Energy Sector

India’s renewable energy sector provides various investment opportunities through different bond structures and expected issuance. While RG issuances typically have stable credit profiles due to the ringfencing of certain assets and amortizing bond structures, holdco issuances are more tied to the market and regulatory environment.

With a substantial amount of bonds maturing in the next two to three years and continuing investments in capacity growth, we expect bond issuance, especially for holdco debt, to pick up.

The newly formed Indian government appears poised to continue implementing supportive policies for the renewable energy sector, which we believe will promote stability and contribute to a favorable investment environment.

All in all, India’s renewable energy sector is expanding rapidly within one of the world's fastest-growing economies, supported by favorable policies and providing investment opportunities.

William Blair’s extensive knowledge and experience in investing in this sector for our emerging markets debt strategies helps us to identify and accurately evaluate these potential opportunities.

Alexandra Symeonidi, CFA, is a senior corporate credit and sustainability analyst on William Blair’s emerging markets debt team.