Health and wellness are not confined to New Year’s resolutions—they are a state of mind and being that has grown into a trillion-dollar global economy. This rapid growth was spurred on largely by the COVID-19 pandemic and has created many unique investment opportunities.

It can be helpful to look at health and wellness through three different lenses: in your body, on your body, and with your body. We explore each in further detail below.

In Your Body

Health and wellness are not only identified by reading a label; they are also defined by how a person feels when eating or drinking. Consumers have become more aware of what they are putting in their bodies, with diet and nutrition at the core: “What foods give me more energy? How do I stay hydrated? Do I prefer animal- or plant-based proteins? Or both?”

Gone are the days of “fat free” and “diet sodas.” Instead, the focus has shifted to whole foods and clean ingredients. Increased education and demand for clean, organic food has led to specialty products becoming more widely available today than ever and created a growing number of choices for consumers.

The “in your body” lens will continue to expand and evolve over time as sourcing and supply chain infrastructures evolve.

On Your Body

Consumers are increasingly making conscious choices about the types of clothing or fabric they want to wear, and the personal care products they decide to use on their skin and hair, through the lens of both safety and comfort. Increased transparency around ingredient labels, fabric origin, recycled content, and recyclable and/or sustainable packaging all play a role in influencing purchase decisions. A brand’s ethos or DNA is key to communicating a company’s core beliefs around its people, its product or service, and how it interacts with society and the planet.

A brand’s ethos or DNA is key to communicating a company’s core beliefs around its people, its product or service, and how it interacts with society and the planet.

The “on your body” lens also includes wearables, which is where healthcare and wellness begin to blend. In a 2020 PricewaterhouseCoopers study, 70% of respondents said they expect their devices to help increase their lifespan, 63% said they expect their devices to help maintain a healthy body weight, and 62% said they expect their devices to help reduce the cost of insurance premiums. These are powerful statistics that demonstrate wearables are being utilized beyond the simple functionality they were once known for. They have evolved to become devices that consumers depend on to lead a long, healthy life.

With Your Body

Lastly, the “with your body” lens focuses on physical movement, with an emphasis on the balance between fitness/activity and relaxation. This lens includes fitness/activity ranging from the gym, outdoors, and at the home. It is also important to counterbalance these more strenuous activities with relaxation, which may include sleep, medication, and work/life balance.

Why Should Health and Wellness Matter to Investors?

Health and wellness should matter to investors because it matters to consumers. For many consumers, overall wellbeing is now a major factor in everyday choices. These choices range from what to buy at the grocery store, to what kind of transportation to use, and what menu item to order at a restaurant. Looking at the industry on a global scale, we see that it is not just a U.S. or developed market phenomenon. It is a rising priority among consumers from emerging markets as well.

This increased prioritization of health and wellness, combined with a growing global middle class, could lead to a rise in global spending in health and wellness categories and has the potential to meaningfully outpace overall economic growth, both globally and in the United States.

Increased prioritization of health and wellness, combined with a growing global middle class, could lead to a rise in global spending in these categories.

To help frame this, let’s look at global population figures. China has a population of over 1.4 billion, India has a population of roughly 1.3 billion, and the United States has a population of about 330 million. These three markets represent roughly 3 billion people, and as China and India continue to expand their middle class, the wealth effect should grow, meaning consumers making a middle-class wage will have more money to spend on discretionary items.

Seeking Opportunities

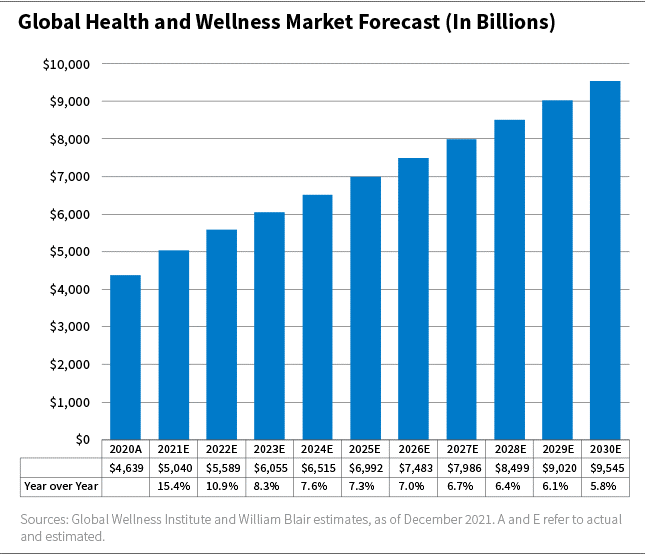

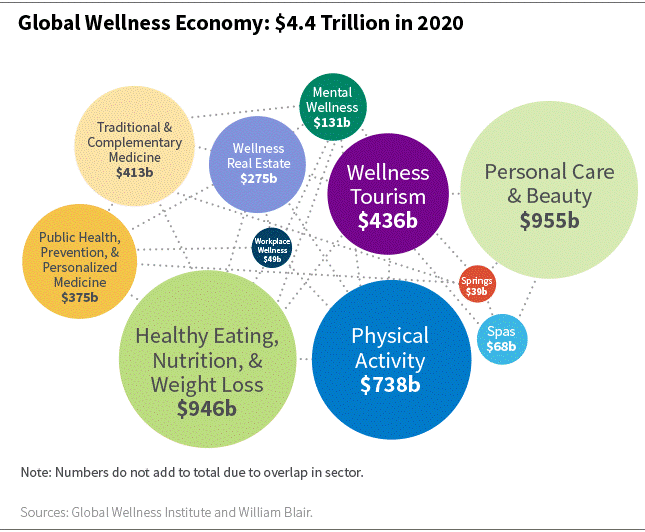

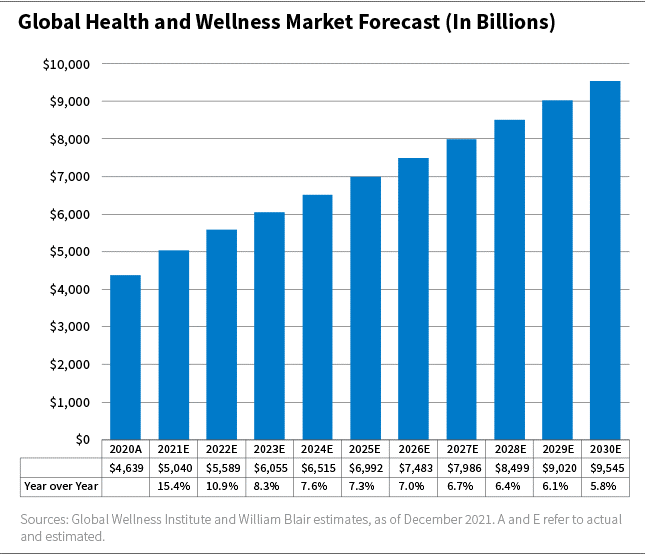

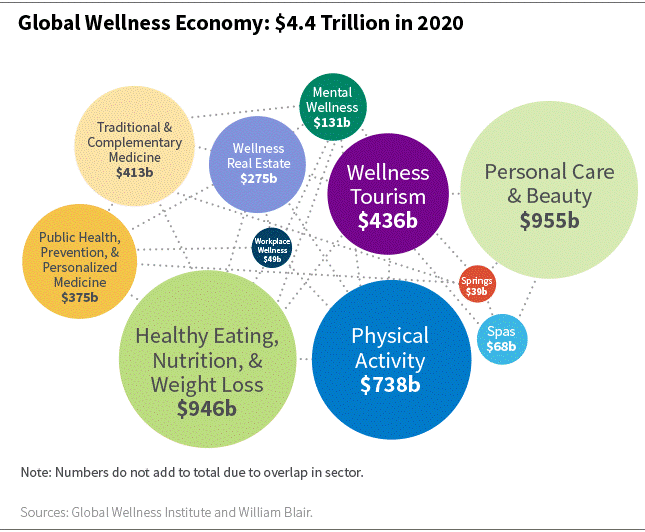

According to the Global Wellness Institute, the global total addressable market (TAM) for health and wellness reached $4.4 trillion in 2020. To put that number into context, 2020 global gross domestic product (GDP) was $85 trillion. Today, health and wellness spending represents about 4% of global GDP and is expected to rapidly increase at an 8% compound annual growth rate (CAGR) through 2030. Mature industries such as food retailers, in comparison, grow on average in the low single digits on an annual basis.

Identifying top health and wellness spending categories is helpful when trying to identify growing companies within this industry.

The top spending category in 2020 was personal care and beauty at $955 billion, representing about 22% of the total $4.4 trillion market. Examples of companies in this category include Estee Lauder, a multinational cosmetics company, and Coty, a manufacturer and distributor of beauty products.

The next biggest spending category was healthy eating, nutrition, and weight loss at $946 billion, or 21% of the total market and includes companies like Celsius, a healthy energy drink manufacturer, and Weight Watchers, an interactive weight loss program provider. This category is followed by physical activity, which saw spending of $738 billion and represents 17%.

Identifying top health and wellness spending categories is helpful when trying to identity growing companies within this industry.

The fourth largest category is wellness tourism, an industry that will likely experience meaningful growth in the years to come. It is a relatively new trend. The Global Wellness Institute defines wellness tourism as “travel associated with the pursuit of maintaining or enhancing one’s personal wellbeing.” Vacations that fall under this category typically emphasize mindfulness and enlightenment, and involve workouts, curated meals, and an escape from technology. Consumers spent $436 billion on the category in 2020, and we believe it could see nearly 21% annual growth through 2025.

Long-Term Implications

As an industry, health and wellness will continually evolve and new trends are already emerging, from wellness music and television to wellness architecture, “dirty” wellness—which advocates for “regenerative-certified food and ingredients”—and survivalist wellness. The fast-rising global trend of functional fitness fits with survivalist wellness, or movement that preps you for real-world activities and environments, to build balance, coordination, basic strength, and endurance versus only preparing for another gym workout. As new trends like these emerge, and categories continue to grow, there will be potential opportunities for investors seeking alpha for their portfolios.

Nancy Aversa, CFA, partner, is a research analyst on William Blair’s U.S. growth and core equity team.