July 28, 2025 | Global Equity

Investments

ASSET-CLASS CAPABILITIES

Insights

EDUCATION CENTER

SUBSCRIBE

The first half of 2025 generated plenty of news flow to worry about, including tariffs, wars, and the Deep Seek moment. Yet, equity markets performed well: developed markets outside the United States returned more than 17%, while the broader U.S. indices returned just shy of 6%, reversing a trend of U.S. dominance over the last several years (see chart below).

We believe collapsing growth differentials are one of the primary explanations for what is happening in the global financial markets. Economic growth in the United States is now expected to be weaker than its four-year recent trend, while the economies of Japan and the euro area may actually accelerate.

As quality growth investors, seeking answers to “where is growth?” and “where is it changing?” remains central to how we invest. We believe quality companies have the ability to exploit opportunities afforded by economic growth, and some actually create new demand (though these are rarer but more valuable).

The world outside of the United States has performed significantly better than the United States for the first time in nearly a decade. How can this be when discussions of U.S. exceptionalism are all the rage?

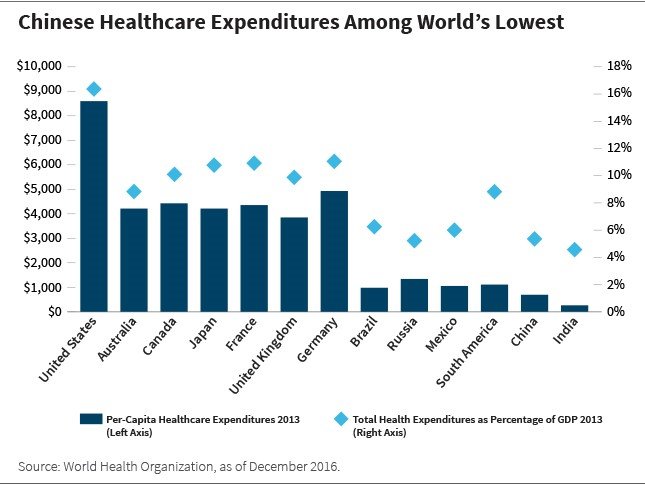

In a nutshell, gross domestic product (GDP) growth outside the United States has improved, particularly in the euro area, Japan, and China. Notably, the excess real GDP growth of the United States relative to Europe has meaningfully declined from more than 3% in 2020 on the back of significant COVID-related stimulus in the United States to 0.5% estimated excess growth over the next several years.

While it remains true that U.S. companies innovate and commercialize scientific breakthroughs particularly well, other countries are now moving to create conditions to help unlock domestic growth opportunities. What’s behind the shift?

In our opinion, a flurry of policy changes by the Trump administration has forced countries around the world to grapple with now-inescapable challenges: how to respond to a reduced, and more costly, U.S. security blanket; how to adjust to a new tariff regime from the world’s principal demand center; how to stay relevant in the age of artificial intelligence (AI); and more fundamentally, how to overcome stagnant or falling incomes (that have fueled political populism) without upending the global order that led to unprecedented peace and prosperity.

We believe policy responses to these challenges can be viewed as sources of economic growth.

We believe policy responses to these challenges can be viewed as sources of economic growth.

The United States has long spent more on defense than the next 10 North Atlantic Treaty Organization (NATO) members combined. The Russia-Ukraine war, coupled with the United States wavering to uphold its NATO commitments, jolted the European Union (EU) into ratcheting up its defense spending. Most members recently committed to elevate military and related spending to 5% of GDP, something that seemed unthinkable only a few years ago.

But why spend more to buy gear from an increasingly fickle partner? Europe is mobilizing funds and streamlining procurement to enable the rapid rise of its domestic defense industry. Even Germany finally shed its fiscal straitjacket and committed to spending at least €500 billion over the next decade to upgrade its infrastructure and military capabilities.

It is little wonder, then, that many new defense companies have sprung up in Europe over the last five years when the sector remained taboo for decades.

In addition, tariffs are back—even though they were widely seen as inimical to growth the last time they were used in earnest a century ago. Thus, when the goods a country sells to the world’s largest economy become more expensive at the stroke of a pen, it is forced to innovate and to seek out new markets.

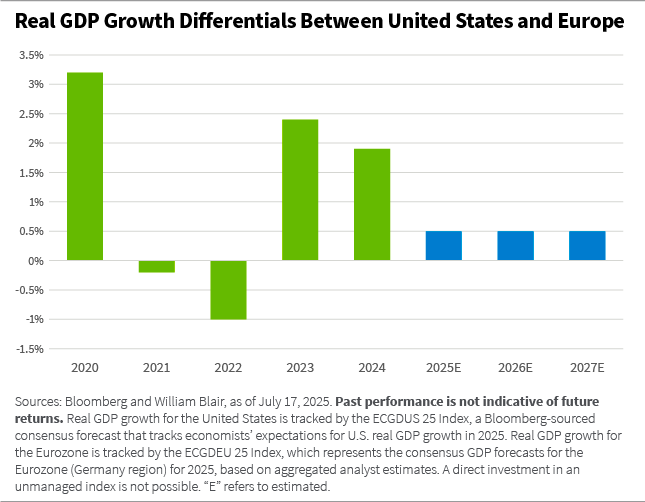

Said another way, a new problem requires a new solution, which is a path that may lie through stronger domestic growth. For Europe, we believe that means removing internal barriers to trade and unleashing investment. And for China, we believe that means building out a social safety net to generate stronger domestic demand.

In our opinion, technological advancements underpin economic and political realignments as well. The rapid proliferation of AI capabilities is already redefining modern warfare and will soon be evident in healthcare and manufacturing. These changes will likely affect not only where we work, but whether we drive to get there, how we spend our leisure, and what we consume.

To enable these advancements, we think data centers need to become as ubiquitous as factories were 50 years ago. But supporting datacenters requires building out all the attendant additional electricity generation and related infrastructure necessary to connect and operate these facilities. In other words, more economic growth in most parts of the world will likely be spurred by investment into power generation and distribution.

A new problem requires a new solution, which is a path that may lie through stronger domestic growth.

Finally, underpinning these recent policy changes is the challenge of generating income growth in most modern, mature democracies.

Following the Global Financial Crisis (GFC), most countries, with the notable exception of the United States, embarked on a path of fiscal consolidation, which resulted in chronic underinvestment, anemic economic activity, and the rise of populism (which we also saw in the United States).

In response, the political class in most established democracies has prioritized economic growth as an antidote to economic stagnation and rising populism. Indeed, U.S. tariffs can be seen as a political response to the hollowing out of the middle class and market share loss to producers from other countries following decades of pro-globalization policy.

Exact policies are, of course, specific to local conditions. Japan continues to focus on improving capital allocation and corporate governance, with South Korea now looking to follow suit. China is stabilizing its real estate market and rolling out social services provisions where people live rather than where they’re registered (for those social services).

And in Europe, the report, “Towards a Genuine Economic and Monetary Union,” prepared under the leadership of former European Central Bank (ECB) President Mario Draghi, has been used as a policy blueprint to streamline intra-EU regulations so European domestic markets can grow and European companies can regain competitiveness.

The proliferation of economic growth as an outcome of solving current challenges is perhaps less surprising than meets the eye.

To answer the question, “why does growth happen?”, our global equity strategy team created a framework called the Perpetual Growth Machine (PGM). Its core thesis is that human beings want to improve their lot; they always have and always will, and so they’ll deploy ingenuity and resources toward developing new tools and new solutions. Growth, therefore, is the result.

The Perpetual Growth Machine’s core thesis is that human beings want to improve their lot; they always have and always will.

Acute problems generate solutions, and solutions to existing problems generate new challenges, which in turn must be overcome. We believe this process can result in economic growth.

The PGM is always on, identifying where people are trying to solve current problems, and we believe this will help point towards improving growth, potentially impacting asset price performance.

Hugo Scott‐Gall, partner, is the head of William Blair’s global equity team, on which he also serves as a portfolio manager.

Want the latest insights on the economy and other forces shaping the investment landscape?

Subscribe to our Investing Insights newsletter.

Any investment or strategy mentioned herein may not be appropriate for every investor. There can be no assurance that investment objectives will be met. Products and services listed are available only to residents of this jurisdiction and may only be available to certain categories of investors. The information on this website does not constitute an offer for products or services, or a solicitation of an offer to any persons outside of this jurisdiction who are prohibited from receiving such information under applicable laws and regulations. Nothing on this webpage should be construed as advice and is therefore not a recommendation to buy or sell shares.

Please carefully consider the William Blair Funds’ investment objectives, risks, charges, and expenses before investing. This and other information is contained in the Funds’ prospectus and summary prospectus, which you may obtain by calling 1-800-742-7272. Read the prospectus and summary prospectus carefully before investing. Investing includes the risk of loss.

The William Blair Funds are distributed by William Blair & Company, L.L.C., member FINRA/SIPC.

The William Blair SICAV is a Luxembourg investment company with variable capital registered with the Commission de Surveillance du Secteur Financier (“CSSF”) which qualifies as an undertaking for collective investment in transferable securities (“UCITS”). The Management Company of the SICAV has appointed William Blair Investment Management, LLC as the investment manager for the fund.

Please carefully consider the investment objectives, risks, charges, and expenses of the William Blair SICAV. This and other important information is contained in the prospectus and Key Investor Information Document (KIID). Read these documents carefully before investing. The information contained on this website is not a substitute for those documents or for professional external advice.

Information and opinions expressed are those of the authors and may not reflect the opinions of other investment teams within William Blair Investment Management, LLC, or affiliates. Factual information has been taken from sources we believe to be reliable, but its accuracy, completeness or interpretation cannot be guaranteed. Information is current as of the date appearing in this material only and subject to change without notice. Statements concerning financial market trends are based on current market conditions, which will fluctuate. This material may include estimates, outlooks, projections, and other forward-looking statements. Due to a variety of factors, actual events may differ significantly from those presented.

Investing involves risks, including the possible loss of principal. Equity securities may decline in value due to both real and perceived general market, economic, and industry conditions. The securities of smaller companies may be more volatile and less liquid than securities of larger companies. Investing in foreign denominated and/or domiciled securities may involve heightened risk due to currency fluctuations, and economic and political risks. These risks may be enhanced in emerging markets and frontier markets. Investing in the bond market is subject to certain risks including market, interest rate, issuer, credit, and inflation risk. High-yield, lower-rated, securities involve greater risk than higher-rated securities. Different investment styles may shift in and out of favor depending on market conditions. Diversification does not ensure against loss.

Past performance is not indicative of future returns. References to specific companies are for illustrative purposes only and should not be construed as investment advice or a recommendation to buy or sell any security.

William Blair Investment Management, LLC is an investment adviser registered with the U.S. Securities and Exchange Commission.

Issued in the United Kingdom by William Blair International, Ltd., authorized and regulated by the Financial Conduct Authority (FCA), and is only directed at and is only made available to persons falling within articles 19, 38, 47, and 49 of the Financial Services and Markets Act of 2000 (Financial Promotion) Order 2005 (all such persons being referred to as "relevant persons").

Issued in the European Economic Area (EEA) by William Blair B.V., authorized and supervised by the Dutch Authority for the Financial Markets (AFM) under license number 14006134 and also supervised by the Dutch Central Bank (DNB), registered at the Dutch Chamber of Commerce under number 82375682 and has its statutory seat in Amsterdam, the Netherlands. This material is only intended for eligible counterparties and professional clients.

Issued in Switzerland by William Blair Investment Services (Zurich) GmbH, Talstrasse 65, 8001 Zurich, Switzerland ("WBIS"). WBIS is engaged in the offering of collective investment schemes and renders further, non-regulated services in the financial sector. WBIS is affiliated with FINOS Finanzomubdsstelle Schweiz, a recognized ombudsman office where clients may initiate mediation proceedings pursuant to articles 74 et seq. of the Swiss Financial Services Act ("FinSA"). The client advisers of WBIS are registered with regservices.ch by BX Swiss AG, a client adviser registration body authorized by the Swiss Financial Market Supervisory Authority ("FINMA"). WBIS is not supervised by FINMA or any other supervisory authority or self-regulatory organization. This material is only intended for institutional and professional clients pursuant to article 4(3) to (5) FinSA.

Issued in Australia by William Blair Investment Management, LLC (“William Blair”), which is exempt from the requirement to hold an Australian financial services license under Australia's Corporations Act 2001 (Cth). William Blair is registered as an investment advisor with the U.S. Securities and Exchange Commission (“SEC”) and regulated by the SEC under the U.S. Investment Advisers Act of 1940, which differs from Australian laws. This material is intended only for wholesale clients.

Issued in Singapore by William Blair International (Singapore) Pte. Ltd. (Registration Number 201943312R), which is regulated by the Monetary Authority of Singapore under a Capital Markets Services License to conduct fund management activities. This material is intended only for institutional investors and may not be distributed to retail investors.

Issued in Canada by William Blair Investment Management, LLC, which relies on the international adviser exemption, pursuant to section 8.26 of National Instrument 31-103 in Canada.

The content contained in this site is intended as informational or educational in nature and does not constitute investment advice or a recommendation of any investment strategy or product for a particular investor. Investment advice and recommendations can be provided only after careful consideration of an investor’s objectives, guidelines, and restrictions. Investors should consult a financial professional/financial consultant or investment adviser before making any investment decisions. Investing includes the risk of loss.

Copyright © 2026 William Blair. William Blair is a registered trademark of William Blair & Company, L.L.C. “William Blair” refers to William Blair Investment Management, LLC and affiliates.