July 15, 2025 | Global Equity

Investments

ASSET-CLASS CAPABILITIES

Insights

EDUCATION CENTER

SUBSCRIBE

July 15, 2025 | Global Equity

Five years ago, in “Three Pillars of International Investing,” we explained why we think investors should consider allocating to non-U.S. equities. The crux of our argument was threefold.

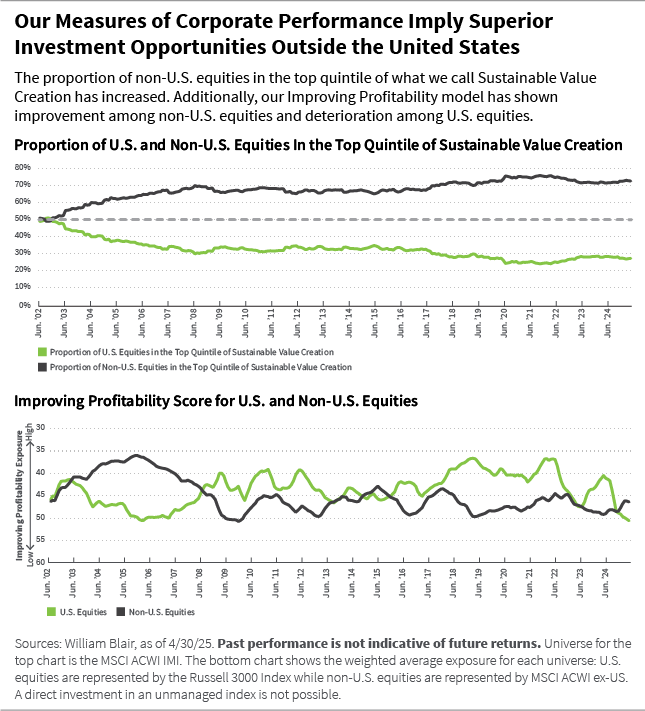

First, company-specific factors, including what we call Sustainable Value Creation (which is essentially strong corporate performance), are increasingly more important than country-specific factors, and as we look across our opportunity set of global equities, we find that more companies that deliver strong Sustainable Value Creation are found outside the United States.

Second, expectations for earnings growth and return on invested capital (ROIC) have become more favorable outside the United States—and our outlook for growth in key industries suggests accelerating demand and emerging business models abroad.

Third, the regulatory environment outside the United States is more conducive to the proliferation of disruptive business models.

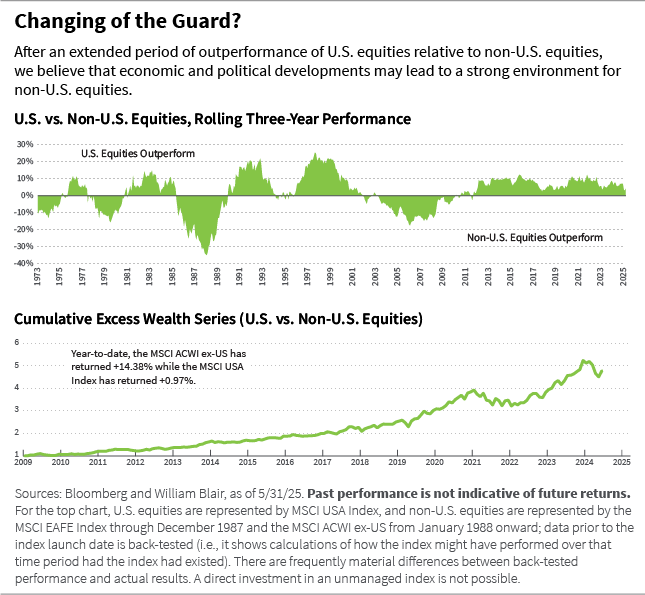

We find that new forces are emerging that underpin why the year-to-date outperformance of non-U.S. equities is a movement—not just a moment.

While each of these pillars remains a relevant argument as to why we believe investors should allocate to non-U.S. equities, we find that new forces are emerging that underpin why the year-to-date outperformance of non-U.S. equities is a movement—not just a moment. See below.

For more than two decades, the fishing pond of high-quality growth investments has been expanding such that the opportunity set outside the United States is now larger than inside the United States. This is likely non-controversial given that the percent of nominal global gross domestic product (GDP) outside the United States has grown from 68% in 2011 to over 73% currently.

In addition, our quantitative indicators such as Improving Profitability—which tracks directional shifts in corporate profitability—are accelerating outside the United States while showing greater volatility and deterioration within the United States.

The charts below illustrate.

As institutional investor interest in developed non-U.S. and emerging markets (EM) equities has grown, companies in these jurisdictions have professionalized their operations and implemented a shareholder return focus that has resulted in a higher-quality investment opportunity set.

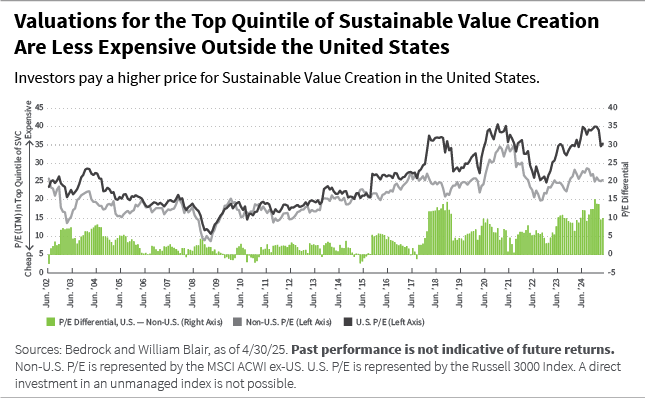

Additionally, within our quality growth opportunity set, we see more attractive valuations outside the United States. This is illustrated in the chart below, which exhibits the valuation difference between U.S. and non-U.S. companies that are in the top quintile of Sustainable Value Creation.

As we entered 2025, the gap between the United States and the rest of the world—in economic growth, corporate profit margins, and relatedly, equity valuations—was at or near a historic high. While the performance gap between U.S. and non-U.S. equities has historically been cyclical, the latest divergence was underpinned by a distinct combination in the United States of economic dynamism, leadership in technology innovation, and strong institutions.

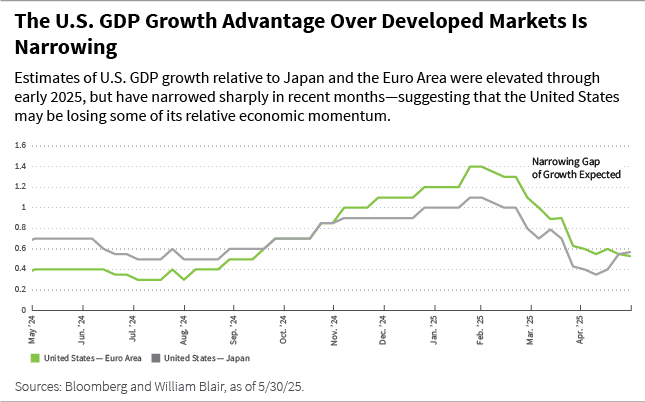

Today, however, shifts in policy direction under the current U.S. administration, combined with the ambitions and commitments of a galvanized European Union (EU), suggest we may on the precipice of change.

What’s different now is that the growth differential between the United States and the rest of the world is narrowing, as shown below. In a low-growth environment, we have observed that investors have been willing to pay a premium for U.S. earnings growth, which has consistently outpaced non-U.S. markets since the global financial crisis. But that premium may no longer be justified.

We believe several forces—tariffs that weigh on U.S. household disposable income, shifts in fiscal and economic policy abroad, and evolving macroeconomic conditions—could compress growth differentials between the United States, Europe, Japan, and China. As a result, the valuation per unit of growth equation looks increasingly favorable for markets outside the United States, potentially supporting greater capital flows into non-U.S. equities. We will explore these forces in the next blog in this series, “Three Global Shifts That Favor Non-U.S. Markets."

Alaina Anderson, CFA, partner, is a portfolio manager on William Blair’s global equity team.

Part 1 | Three Pillars of Non-U.S. Investing Revisited

Want the latest insights on the economy and other forces shaping the investment landscape?

Subscribe to our Investing Insights newsletter.

Any investment or strategy mentioned herein may not be appropriate for every investor. There can be no assurance that investment objectives will be met. Products and services listed are available only to residents of this jurisdiction and may only be available to certain categories of investors. The information on this website does not constitute an offer for products or services, or a solicitation of an offer to any persons outside of this jurisdiction who are prohibited from receiving such information under applicable laws and regulations. Nothing on this webpage should be construed as advice and is therefore not a recommendation to buy or sell shares.

Please carefully consider the William Blair Funds’ investment objectives, risks, charges, and expenses before investing. This and other information is contained in the Funds’ prospectus and summary prospectus, which you may obtain by calling 1-800-742-7272. Read the prospectus and summary prospectus carefully before investing. Investing includes the risk of loss.

The William Blair Funds are distributed by William Blair & Company, L.L.C., member FINRA/SIPC.

The William Blair SICAV is a Luxembourg investment company with variable capital registered with the Commission de Surveillance du Secteur Financier (“CSSF”) which qualifies as an undertaking for collective investment in transferable securities (“UCITS”). The Management Company of the SICAV has appointed William Blair Investment Management, LLC as the investment manager for the fund.

Please carefully consider the investment objectives, risks, charges, and expenses of the William Blair SICAV. This and other important information is contained in the prospectus and Key Investor Information Document (KIID). Read these documents carefully before investing. The information contained on this website is not a substitute for those documents or for professional external advice.

Information and opinions expressed are those of the authors and may not reflect the opinions of other investment teams within William Blair Investment Management, LLC, or affiliates. Factual information has been taken from sources we believe to be reliable, but its accuracy, completeness or interpretation cannot be guaranteed. Information is current as of the date appearing in this material only and subject to change without notice. Statements concerning financial market trends are based on current market conditions, which will fluctuate. This material may include estimates, outlooks, projections, and other forward-looking statements. Due to a variety of factors, actual events may differ significantly from those presented.

Investing involves risks, including the possible loss of principal. Equity securities may decline in value due to both real and perceived general market, economic, and industry conditions. The securities of smaller companies may be more volatile and less liquid than securities of larger companies. Investing in foreign denominated and/or domiciled securities may involve heightened risk due to currency fluctuations, and economic and political risks. These risks may be enhanced in emerging markets and frontier markets. Investing in the bond market is subject to certain risks including market, interest rate, issuer, credit, and inflation risk. High-yield, lower-rated, securities involve greater risk than higher-rated securities. Different investment styles may shift in and out of favor depending on market conditions. Diversification does not ensure against loss.

Past performance is not indicative of future returns. References to specific companies are for illustrative purposes only and should not be construed as investment advice or a recommendation to buy or sell any security.

William Blair Investment Management, LLC is an investment adviser registered with the U.S. Securities and Exchange Commission.

Issued in the United Kingdom by William Blair International, Ltd., authorized and regulated by the Financial Conduct Authority (FCA), and is only directed at and is only made available to persons falling within articles 19, 38, 47, and 49 of the Financial Services and Markets Act of 2000 (Financial Promotion) Order 2005 (all such persons being referred to as "relevant persons").

Issued in the European Economic Area (EEA) by William Blair B.V., authorized and supervised by the Dutch Authority for the Financial Markets (AFM) under license number 14006134 and also supervised by the Dutch Central Bank (DNB), registered at the Dutch Chamber of Commerce under number 82375682 and has its statutory seat in Amsterdam, the Netherlands. This material is only intended for eligible counterparties and professional clients.

Issued in Switzerland by William Blair Investment Services (Zurich) GmbH, Talstrasse 65, 8001 Zurich, Switzerland ("WBIS"). WBIS is engaged in the offering of collective investment schemes and renders further, non-regulated services in the financial sector. WBIS is affiliated with FINOS Finanzomubdsstelle Schweiz, a recognized ombudsman office where clients may initiate mediation proceedings pursuant to articles 74 et seq. of the Swiss Financial Services Act ("FinSA"). The client advisers of WBIS are registered with regservices.ch by BX Swiss AG, a client adviser registration body authorized by the Swiss Financial Market Supervisory Authority ("FINMA"). WBIS is not supervised by FINMA or any other supervisory authority or self-regulatory organization. This material is only intended for institutional and professional clients pursuant to article 4(3) to (5) FinSA.

Issued in Australia by William Blair Investment Management, LLC (“William Blair”), which is exempt from the requirement to hold an Australian financial services license under Australia's Corporations Act 2001 (Cth). William Blair is registered as an investment advisor with the U.S. Securities and Exchange Commission (“SEC”) and regulated by the SEC under the U.S. Investment Advisers Act of 1940, which differs from Australian laws. This material is intended only for wholesale clients.

Issued in Singapore by William Blair International (Singapore) Pte. Ltd. (Registration Number 201943312R), which is regulated by the Monetary Authority of Singapore under a Capital Markets Services License to conduct fund management activities. This material is intended only for institutional investors and may not be distributed to retail investors.

Issued in Canada by William Blair Investment Management, LLC, which relies on the international adviser exemption, pursuant to section 8.26 of National Instrument 31-103 in Canada.

The content contained in this site is intended as informational or educational in nature and does not constitute investment advice or a recommendation of any investment strategy or product for a particular investor. Investment advice and recommendations can be provided only after careful consideration of an investor’s objectives, guidelines, and restrictions. Investors should consult a financial professional/financial consultant or investment adviser before making any investment decisions. Investing includes the risk of loss.

Copyright © 2026 William Blair. William Blair is a registered trademark of William Blair & Company, L.L.C. “William Blair” refers to William Blair Investment Management, LLC and affiliates.