In a bleak year for equity investors globally, several emerging markets (EMs) have been among the best performers on a relative basis. Although the economic and monetary pictures vary dramatically among EMs, developing economies broadly are further ahead than developed markets in their monetary tightening and equity derating cycles.

This cyclical positioning and the resilient macroeconomic fundamentals of EMs lead us to believe that EMs are better positioned for equity gains in 2023 than developed economies.

We examine key economic and investment themes facing EM investors and highlight several important regions. We also look at the long-term trends we believe are creating an increasingly attractive EM investment opportunity set for equity investors.

Five Themes Shaping the EM Equity Landscape

Many of the core issues confronting developed markets—inflation, monetary tightening, equity-market derating, and downward earnings adjustments—are playing out differently in EMs. In many cases, EMs are further along in working through these issues, creating optimism for investors.

Inflation

EM economies, in general, have less of an inflation problem than developed economies. This gives EM central banks more policy options, including restimulating into a global downturn.

Brazil, Mexico, and other Latin American countries began raising interest rates well before the United States and Europe. Brazil moved furthest; its policy rate was 13.75% as of October 2022, which explains why the Brazilian real has been the top-performing currency against the U.S. dollar in 2022, up 7.3% through November 2022. Inflation rates in these countries remain moderate to high but have started to trend down. All of these countries exhibit positive real interest rates, unlike the United States and Europe.

Inflation in Asia is relatively modest. China, in particular, is experiencing inflation well below the EM average, giving Chinese policymakers room to become even more stimulatory in 2023.

Valuations and Earnings Estimates

Equities have already derated in many EMs, suggesting that these countries are now in the late stages of a bear market. They seem now better positioned for a rebound, especially given that we expect interest-rates cuts and other stimulative measures to come in 2023.

Many metrics suggest that the EM bear market is getting long in the tooth. Historically, the average EM bear market has lasted 263 days and produced a 38.2% drawdown, according to Morgan Stanley. The current EM bear market, which began in February 2021 when China tech stocks peaked, is nearly 600 days old, and the MSCI EM Index was down 40% heading into October 2022.

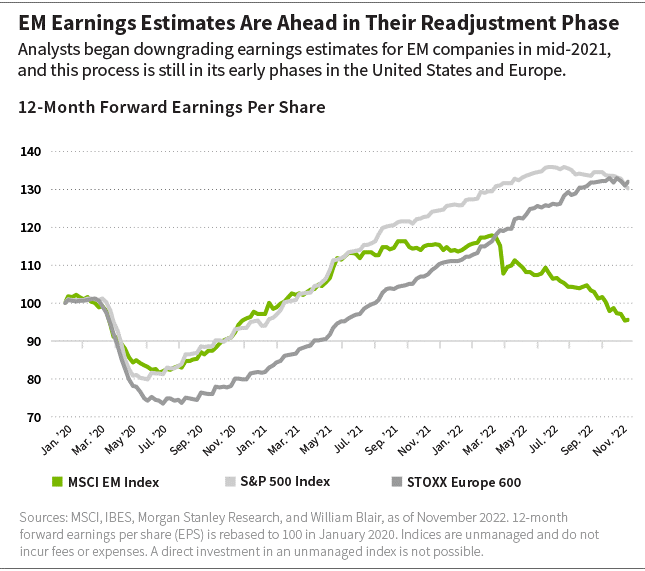

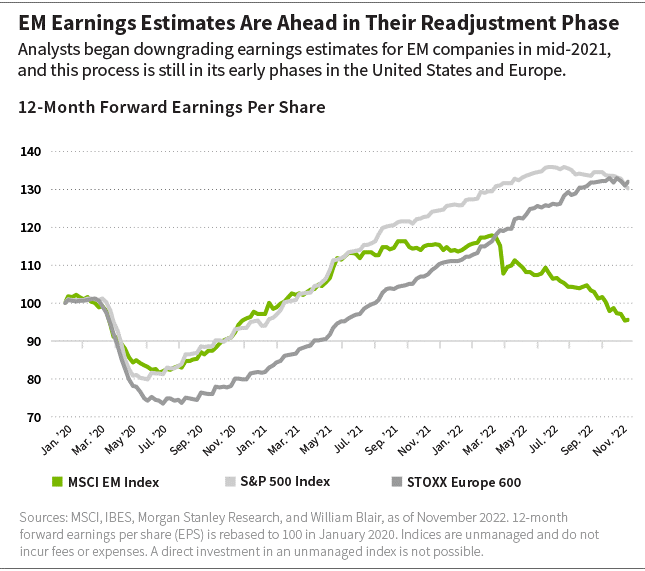

EM valuations have derated 39% versus an average of 34% for EM bear markets, and EM earnings estimates have been downgraded sharply in 2022, in contrast to the United States and Europe, where the negative earnings revision process has barely begun.

Given the combination of price declines, the derating of valuation multiples, and earnings estimate cuts, we believe that EM equity markets have already readjusted and are better positioned for recovery than developed markets. Some select EM equity markets have already been among the top performers globally in 2022 through November, among them Brazil (+17.64%), Mexico (+5.12%), and India (–2.62%), according to Bloomberg.

Currency Exchange Rates

EM equities typically underperform when the U.S. dollar is strong. We believe that the U.S. dollar is likely close to peaking, which could be a bullish signal for EM equities.

As an asset class, the relative performance of emerging markets tends to be negatively correlated with a strong U.S. dollar. As the dollar rises, EM equities tend to underperform because their currencies come under pressure, and these countries must raise interest rates to protect the exchange rate. Once the dollar peaks, that pressure abates—monetary policy can loosen, and equity markets typically rerate higher. We expect the U.S. dollar to peak, which would likely turn a headwind into a tailwind for EM equities in 2023.

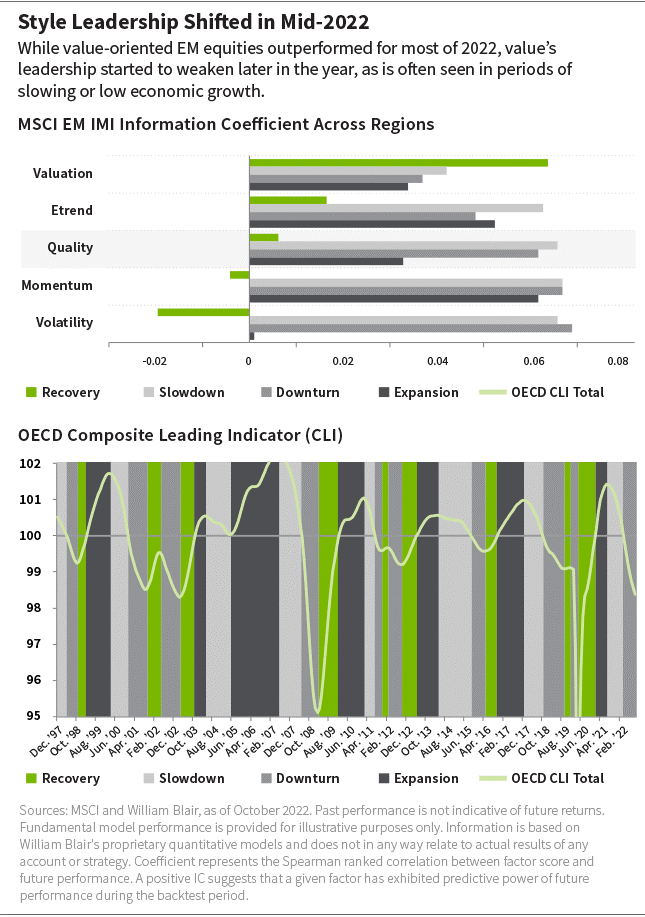

Style Rotation

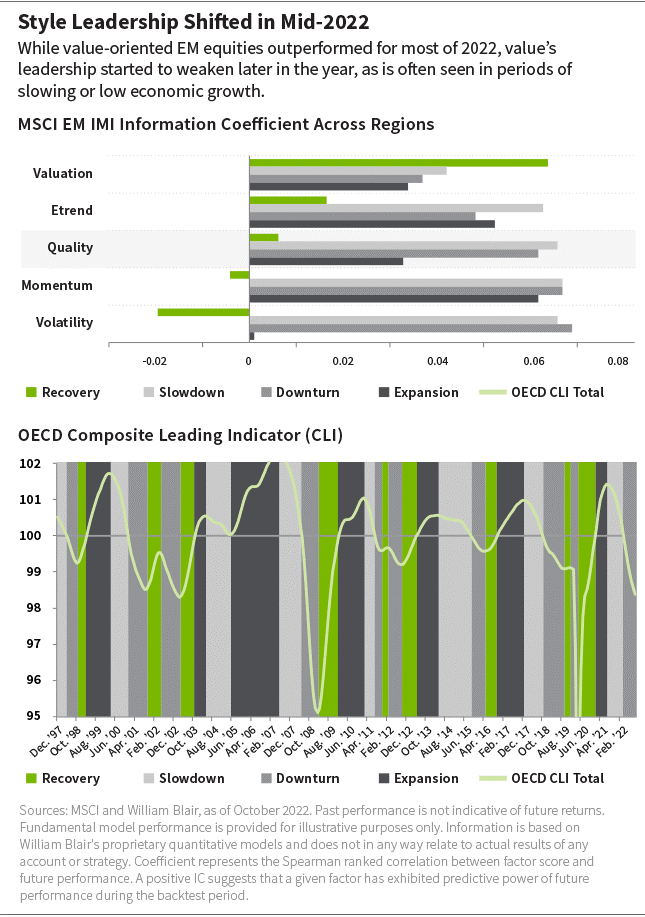

There has been a recent shift in leadership among EM style factors, with the outperformance of value-oriented equities starting to abate somewhat.

EM value stocks outperformed in the first half of 2022, as is typical when interest rates rise. Since then, the global economic regime has switched from “slowdown” to “downturn,” as defined by the Organisation for Economic Co-operation and Development (OECD) composite leading indicator, and other equity factors have taken leadership—namely quality, earnings trend, and momentum.

In an economic downturn, higher-growth EM stocks that have derated and have strong and stable earnings could outperform, in our opinion.

In an economic downturn, higher-growth EM stocks that have derated and have strong and stable earnings could outperform, in our opinion. Strong earnings are usually rewarded in a downturn because most companies’ earnings growth tends to weaken and/or decline as the economic downturn progresses. Higher-quality companies generally do better under financial tightening because they have either (a) easier access to credit or (b) stronger balance sheets and are generally self funded. Low-volatility stocks are at a premium because they are more defensive and less exposed to cyclicality.

EMs of Interest

China

The growth outlook remains muted and cloudy while zero-COVID policies persist. But the completion of the recent National Congress could provide clarity and raise the possibility of more stimulative monetary and fiscal policies as well as a roadmap out of zero-COVID policies.

Chinese equities have been among the worst performers in 2022, and valuations are at a 15-year low. The government’s zero-COVID policy is much to blame, creating uncertainty and pessimism and causing consumer confidence to collapse. The government has provided some stimulus but not enough to offset the impact of zero-COVID.

Other concerns include the government’s targeting of technology companies and its reticence to address the property market issues, coupled with uncertainty as to the economic impact of the country’s Common Prosperity doctrine, which is intended to promote equality.

In China, we are cautiously positive on possible policy changes ahead and early signs of a roadmap out of zero-COVID.

Now that the 20th National Congress of the Chinese Communist Party wrapped up in late October 2022, party leadership may have a freer hand to focus on economic growth, setting the stage for China to relax zero-COVID policies and increase economic stimulus. As this occurs, we believe the Chinese equity market could be set to outperform.

As a result, we raised our weighting in China in late 2022. We are still underweight China but less so than we were previously. Valuations appear attractive, and we are cautiously positive on possible policy changes ahead and early signs of a roadmap out of zero-COVID, more definitive support for the property market, and the economy in general.

India

The country enjoys very favorable fundamentals, including strong economic growth, a pro-business government, and a large and growing middle class of more than 300 million people. But we recognize that some of these are factored into the Indian equity market’s valuation premium.

Despite its valuation premium versus other EMs, we are overweight India. In our view, its positives include favorable demographics, a well-educated population, strong economic growth, a pro-business government, and an English legal system and a relatively high degree of visibility into how monetary and fiscal policies are executed.

We believe rising per-capita income and a growing middle class are persistent structural tailwinds for Indian equity markets. When per-capita income crosses the $2,000 mark, developing countries typically see an explosion of demand for consumer goods and services, from household appliances to mortgage loans. India is at that inflection point—over 40% of the population is already there, and this is expected to rise to 60% by 2025, according to Spark Capital.

In India, we are constructive on financials and housing-related stocks.

Inflows from domestic retail investors also act to underpin Indian equity markets. Systematic investment plans (SIPs) that automatically invest in mutual funds have become wildly popular. The share of equities in household savings is at an all-time high of around 5%, having been as low as 2.5% only a few years ago—but it still has a long way to grow before approaching the levels of more developed countries.

In India, we are constructive on financials and housing-related stocks. In the financial sector, penetration levels of financial products are extremely low and set to rise along with the emerging middle class. In addition, high-quality private-sector banks in which we invest have the potential to take a huge amount of market share from public-sector banks that still control nearly 70% of the Indian financial sector. In housing, affordability is at a 10-year high, and the market is booming, which we believe are positive tailwinds for our Indian financial and property-development companies.

Other EMs to Watch

Brazil: Brazil raised interest rates sharply in 2021 to counter high inflation. These moves drastically hurt equity markets in 2021 but put Brazil much further ahead in the monetary cycle than most countries. Brazil has been a top-performing equity market this year (as of November 2022). We expect Brazil to be one of the first countries globally to begin a rate-cutting cycle, perhaps early in 2023. Once this happens, we expect investors to take a positive view of forward growth, corporate fundamentals to improve, and valuations to rise.

Indonesia: Indonesia has an attractive combination of strong gross domestic product (GDP) growth, moderate inflation, and gently rising interest rates combined with a strong demographic profile and an emerging middle class. We believe this provides a long runway for secular growth. Indonesia is also a beneficiary of commodity-price increases and a reform-minded government. In our view, corporate fundamentals are predominantly good and valuations appear reasonable, and the economy is still on a strong growth trajectory. We are overweight Indonesia, particularly financials.

Saudi Arabia: Saudi Arabia now represents more than 4% of the MSCI EM Index. It has in some ways filled the gap that Russia left when it was removed from the index after invading Ukraine. Saudi Arabia’s market is active with numerous initial public offerings (IPOs) and a plethora of companies benefiting from strong oil prices and the transformation of the country’s economy. The economy is evolving rapidly; women are increasingly in the workforce, more social events are allowed, and tourism is encouraged.

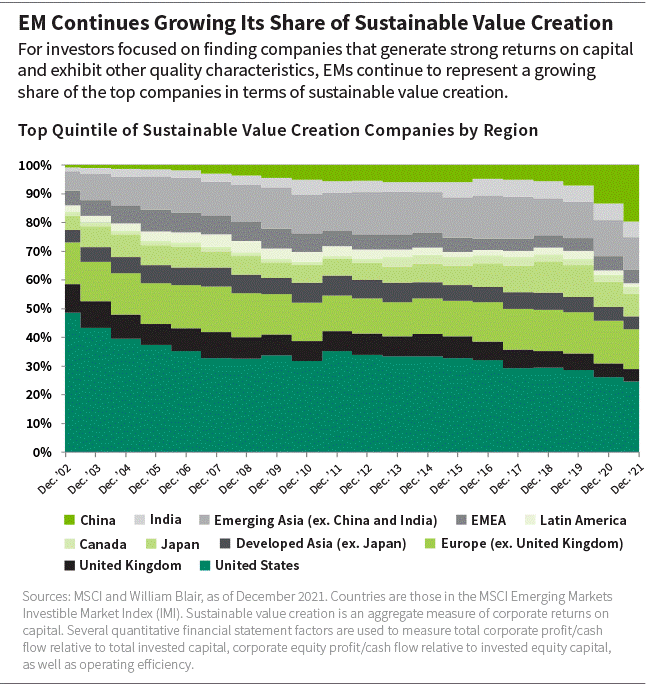

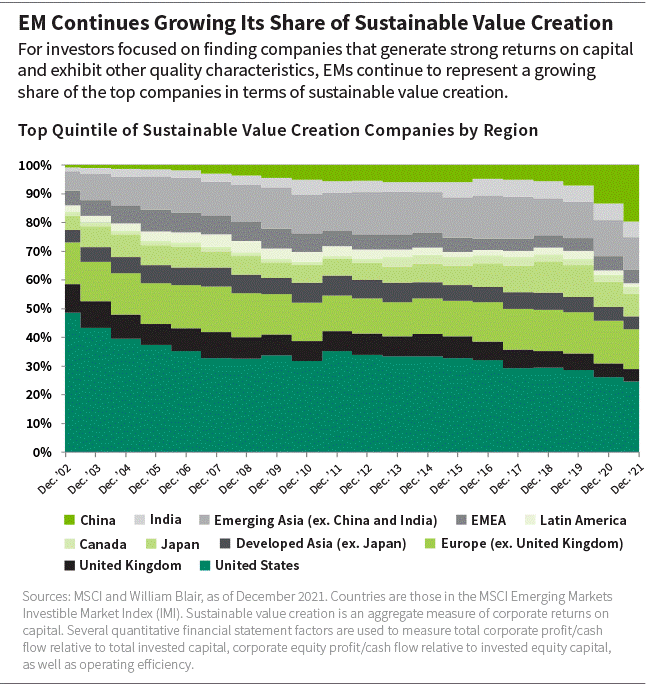

Rich and Growing Opportunity Set for Quality Growth Investors

EM companies punch well above their weight globally with regard to sustainable value creation, as measured by return on capital employed. As of December 2021, EMs represented slightly more than 10% of the MSCI ACWI IMI by market cap but accounted for about 40% of the global top quintile of quality growth companies as defined by sustainable value creation, up from about 15% in 2002. By contrast, the United States represented about 60% of the index but less than roughly 30% of the top value quintile.

Many of these quality growth companies are in China and India, which have rising per-capita income, a fundamental driver of sustainable value creation. Opportunities to find quality in these countries are abundant. For example, about 40% of China A-share companies—more than 1,200 companies in total—exhibit higher quality, based on return on equity (ROE), than the average of the broader EM universe. In India, 20% of companies have higher ROE than the EM average, which represents around 400 companies.

Sectors to Watch

We identify two specific sector opportunities going into 2023 and beyond:

Technology: We believe the semiconductor industry is in the midst of a cyclical slowdown, but the long-term, secular growth story remains very attractive. While we have tactically reduced our technology hardware exposure, we will look to increase positions as opportunities arise in 2023.

Healthcare: Healthcare expenditure in developing countries ties into the growth dynamic of an emerging middle class. Healthcare spending in EM countries is well below developed country averages, both per capita and as a percentage of GDP. We believe this is another secular growth path that will track income growth, and we are positioning ourselves accordingly.

Green Economy

We believe the world’s transition to a low-carbon economy offers strong growth opportunities for years to come. Decreasing cost curves, increasing innovation, and policy/societal support are some of the factors boosting adoption and growth.

Many EM companies are well positioned for this transition; some are even global leaders in the space, especially in solar and electric vehicle (EV) batteries.

We believe growth momentum and investments could accelerate in the coming years as the world seeks to reach net-zero targets. We have increased exposure to renewable energy and energy storage and their supply chains across our portfolios.

Final Take

The EM bear market is long in the tooth in terms of time, price, and multiples. Earnings expectations have already been cut, and many EMs are well ahead of developed markets in monetary tightening. EMs could be a bright spot in a cloudy picture for equities globally in 2023.

Todd McClone, CFA, partner, is a portfolio manager on William Blair’s global equity team.

Emerging Markets 2023 Outlook Series

Part 1 | Outlook 2023: Better Than Feared

Part 2 | Emerging Markets Equities: Positioned for a Rebound?

Part 3 | Emerging Markets Debt: Clearer Skies Ahead?

Part 4 | China: Reopening Should Drive Growth

The MSCI ACWI IMI captures large-, mid-, and small-cap representation across 23 developed markets. The MSCI EM Index captures large- and mid-cap representation across 27 EMs. The MSCI EM IMI captures large-, mid- and small-cap representation across 27 EMs. The S&P 500 Index tracks the performance of 500 large companies listed on stock exchanges in the United States. The STOXX Europe 600, also called STOXX 600, tracks the performance of European stocks. Index performance is provided for illustrative purposes only. Indices are unmanaged and do not incur fees or expenses. A direct investment in an unmanaged index is not possible.