China’s equity markets performed relatively well in 2024 but remain policy-driven and somewhat directionless as investors await further potential stimulus announcements from the government.

Meanwhile, the Chinese government bond market has benefited from risk-averse domestic investors shifting asset allocations to fixed income. There is widespread agreement that bolder stimulus measures are needed.

Prospects for both equity and bond markets in 2025 depend on the government’s next moves to revive the economy and restart a market-driven growth cycle in the face of deflationary pressures at home and the threat of higher export tariffs abroad.

What will the impact be of the stimulus package announced at the November National People’s Congress meeting?

Vivian: In early November, the National People’s Congress (NPC) announced measures better described as a debt swap rather than traditional stimulus. The 10-trillion-yuan package comprises two parts: 6 trillion yuan in local government debt ceiling increases over three years to pay down hidden (or off-balance sheet) debt in local government financing vehicles (LGFVs) used to fund infrastructure and real estate development projects, and 4 trillion yuan in additional special bond issuance by local governments to pay down the same hidden debt over five years.

These measures will help to diffuse the default risk of local governments and marginally improve their long-strained fiscal status. But at the end of the day, we are still waiting for the “show me the money” moment—the stimulus needed to support consumption and service industries, complete unfinished property projects, repair consumer confidence, and jump-start the economy.

Further measures are widely expected, and the Ministry of Finance has left that door open. The completion of the U.S. election could be a catalyst for more targeted or customized stimulus measures from the Chinese government. President-elect Donald Trump has been talking about a second trade war with China, including a tariff up to 60% on all Chinese imports.

It’s still unclear how much of this will come to fruition. China remains a very big exporter to the United States, accounting for about 16.5% of total U.S. imports. Raising tariffs could increase U.S. inflation, which conflicts with Trump’s stated goal of reducing interest rates. It seems likely, however, that Trump will push for higher tariffs in some way or other, not only with China but with all trading partners.

We are still waiting for the “show me the money” moment—the stimulus needed to support consumption and service industries, complete unfinished property projects, repair consumer confidence, and jump-start the economy. – Vivian Lin Thurston, CFA, Partner

Clifford: The NPC’s recent steps to stabilize the local government financing situation are a positive development and could lead to more targeted policies to follow. The central government could focus next on boosting consumption and implementing a bank recapitalization plan to make it easier for the policy banks and local banks to grant new loans without worrying too much about reserve ratios.

While the policy efforts announced in November are a step in the right direction, investors tend to be impatient. The Chinese government has yet to unveil policies robust enough to drive consumer spending, revive equity markets, or stimulate economic activity in a meaningful way. Investors are hoping for further targeted measures in the months to come.

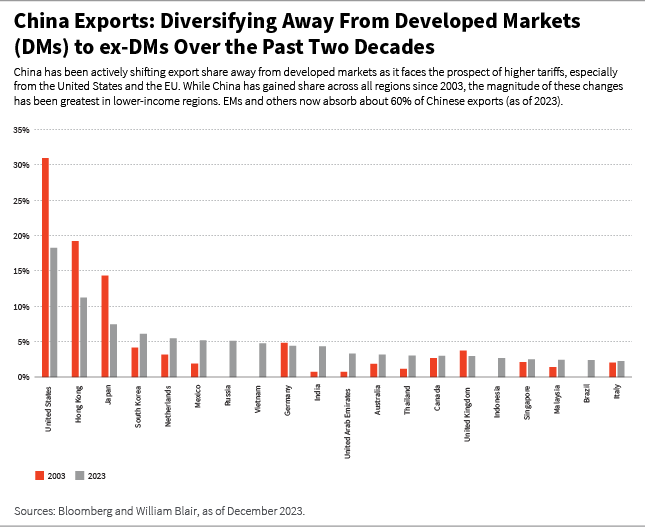

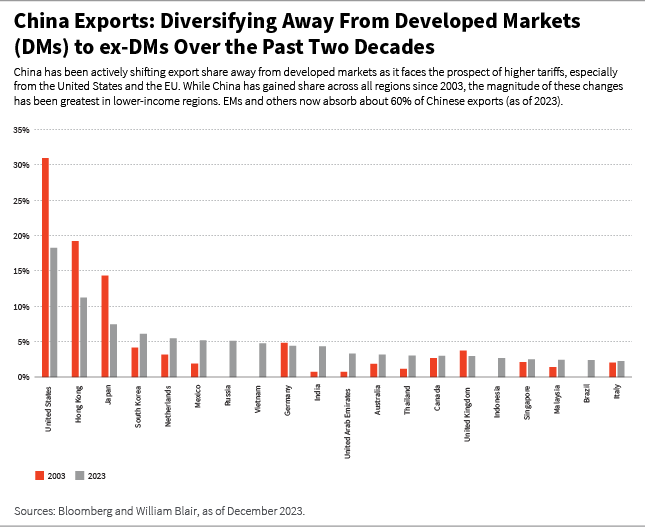

On Chinese exports, since Trump was first elected back in 2016, there have been eight years of tariff pressure from the United States and increasingly from the European Union (EU) as well. As a result, China has tried to reposition its exports away from developed markets. Emerging markets (EMs) now make up nearly 50% percent of Chinese exports. Still, if the United States and the EU impose 60% tariffs on Chinese imports, it could knock one or two percentage points off China’s gross domestic product (GDP) in the coming year.

What were the defining characteristics of Chinese equity and bond markets in 2024?

Vivian: The first 10 months of 2024 saw Chinese equity markets go through three distinct phases. The start of the year through mid-May saw renewed hopes of stimulus coming through, resulting in relatively calm market conditions. Export-driven industries did well, and first-quarter earnings showed improvement. It was a good backdrop for quality growth investors like us, and we were able to find attractive opportunities even though the broader market was still somewhat weak.

From mid-May to mid-September, the market took a nosedive because stimulus packages did not come through as people had anticipated. Second-quarter GDP numbers were much weaker than expected, the consensus GDP forecast was revised downward, and deflationary pressures became more evident. Chinese equities sold off substantially, with quality growth stocks taking a bigger hit as the markets lost faith in growth and investors rotated to stocks with low valuations or high-dividend yields.

The market entered another phase in the middle of September. As Chinese equity valuations fell to near 15-year lows, U.S. investors, especially hedge funds, moved in, sparking a dramatic rally.

Then, President Xi Jinping unexpectedly chaired a Politburo meeting in late September and put out urgent signals that the economy needed more support. At the same time, the People’s Bank of China (PBOC) announced further monetary support measures.

If the United States and the EU impose 60% tariffs on Chinese imports, it could knock one or two percentage points off China’s GDP in the coming year. – Clifford Lau, CFA

These events spurred a nearly 30% rally in Chinese equities over a two-week period, just before the markets closed for the Golden Week holiday in early October. When markets reopened, the rally faltered because further stimulus did not seem to be forthcoming.

When you put this all together, year-to-date (YTD) performance has been impressive. The key index of the China A-Share market, the CSI 300[1], was up 18% in dollar terms through November 30, 2024, and the MSCI China Index[2] was up 16%. This compares to about 8% for the MSCI Emerging Markets Index[3] and about 8% for the MSCI ACWI ex-US Index[4], which tracks both developed and emerging markets. Among major markets, only the United States has done better, with the S&P 500 Index[5] up around 28% YTD.

Despite this relatively strong performance, it remains a difficult market for quality growth investors. The market has become policy driven, putting many investors in a holding pattern as they wait for the next policy event. Market leadership has been very fluid from one sector to another as underlying earnings have remained weak and volatile, offering little direction for fundamental investors.

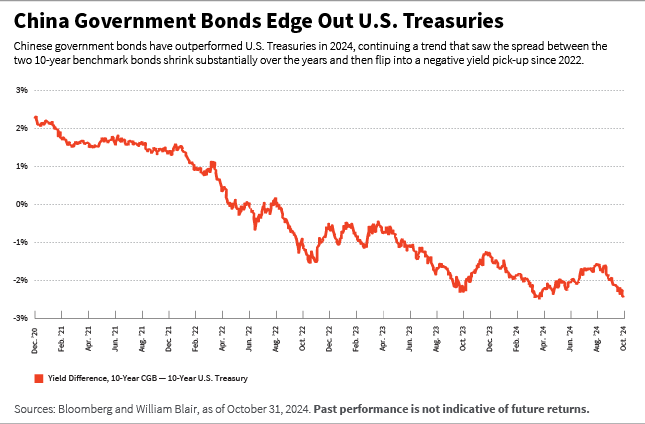

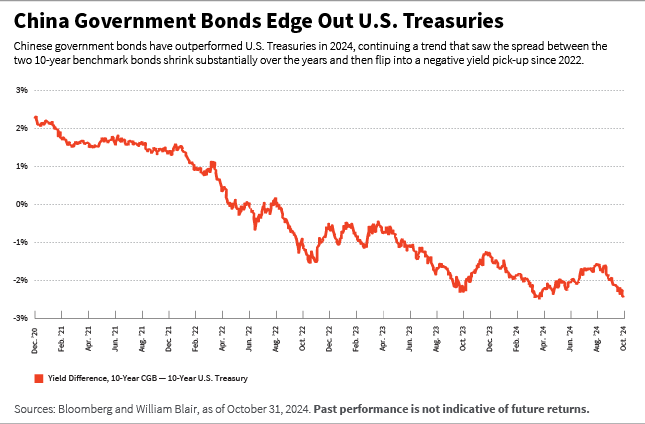

Clifford: China’s bond market is very isolated and typically uncorrelated with the rest of the world, and the spread between the U.S. Treasury and the 10-year benchmark Chinese government bond (CGB) widened dramatically in 2024. While the 10-year U.S. Treasury sold off by almost 40 basis points during the first 10 months of 2024, the 10-year CGB has rallied almost 50 basis points.

Onshore demand from Chinese investors who have become extremely risk-averse has driven the CGB’s outperformance. Chinese investors appear to have little interest in risk assets, not only Chinese equities but property ownership as well. Plummeting property values have had an enormous negative wealth effect in recent years, and rental yields offer little respite—the current rental yield is only around 2% to 3%. Therefore, investing in the risk-free 10-year CGB yielding 2% on an annual basis is a relatively attractive option for Chinese investors.

What government policies are needed in 2025 to support the Chinese economy and equity markets?

Vivian: We are in a prolonged cyclical downturn primarily because of low consumer confidence. People just don’t want to consume, buy properties, or invest, resulting in rising levels of excess savings. Chinese consumers need to see policy measures that will restore their confidence before they put this capital to work.

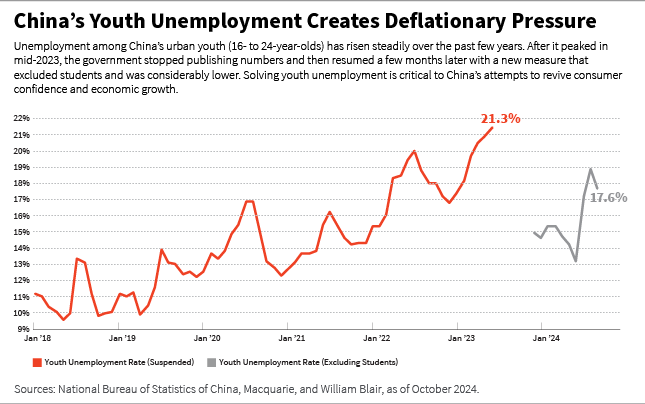

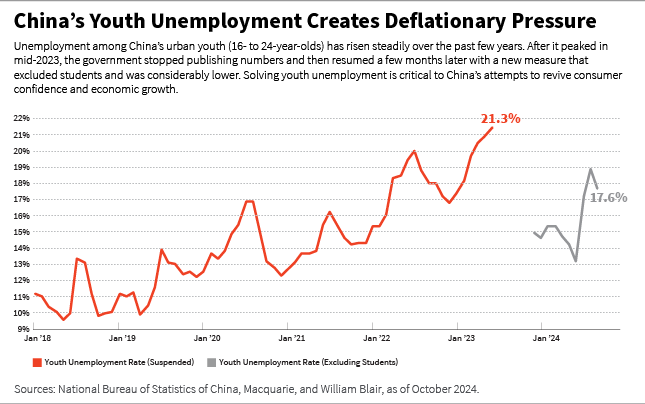

I believe these efforts should focus on fixing the issues underlying the property market and supporting service industries, which are a major source of employment, especially for young people. When young people’s economic prospects are dim, it inhibits household formation and sustainable consumption.

On top of that, China has many of the same structural issues as other developed countries, including an aging population. These factors resemble the conditions that led to Japan’s two-decade deflationary experience. Even though China is not yet at this point, the country needs a jump start to get back on track and restart a market-driven growth cycle.

Once these issues start to get resolved, which sectors do you believe offer the most promising prospects for quality growth investors?

Vivian: Even with the current economic headwinds, there are green shoots of improving fundamentals in certain areas, including internet-related industries. Online advertising took an early hit because it is very sensitive to economic conditions, and it is now one of the first to recover.

Tencent, for example, posted strong earnings in the first half of 2024 based on improvement in online advertising. Its online gaming has also continued to improve as the regulatory pressures have decreased and their product cycle is improving. E-commerce is also starting to recover although competition remains intense.

Online travel is another bright spot, in our view, especially outbound travel. Travel activity in China still hasn’t returned to pre-COVID levels because many direct flights have not yet been reinstated and there were changes to the visa program, but the overall trends are improving.

We believe power equipment is another intriguing structural growth story. Demand for electrical power has surged because of the global electrification trend, and artificial intelligence (AI) data centers have only added to the demand. The power industry has underinvested in infrastructure for many years, resulting in a large imbalance between supply and demand, with rising prices. Chinese power equipment producers supply domestically and generally have strong export markets in developed countries and developing countries alike.

We also like an AI-driven theme for Chinese semiconductor hardware companies, whether they service the Nvidia and global hyperscalers supply chain globally or the Huawei supply chain domestically. We find that there are quite a few impressive tech and industrials companies in China with advanced technologies in the electric vehicle (EV) supply chain, high-end manufacturing, and the energy transition—all areas that align with President Xi Jinping's desire to further advance Chinese technologies.

There are green shoots of improving fundamentals in certain areas, including internet-related industries. – Vivian Lin Thurston, CFA, Partner

What is the outlook for the Chinese bond markets in 2025?

Clifford: We expect the Chinese government to fund its stimulus packages by selling more bonds. The question is which part of the yield curve will see the most issuances. The government has signaled a plan to increase supply by issuing more ultra-long bonds, but we think the increase in issuances could be across the curve.

If the PBOC carries on with monetary easing, I believe the short end of the CGB yield curve should continue to be anchored at the current low level (the two-year CGB is 1.4%). If there is indeed increased issuance targeting more supply of ultra-long bonds, then the curve is likely to get steeper, with the long end underperforming the short end.

Moving from the supply side of the CGB market to the demand side, I believe domestic investors’ strong appetite for risk-free assets should sustain demand in the bond market. In my view, the primary reason that the onshore bond market might substantially underperform in 2025 would be if domestic investors were to significantly shift asset allocations from fixed income to equities.

For that to happen, the Chinese economy would need to rebound sharply, the government would need to further intervene in the equity market by instructing state-owned enterprises (SOEs) to buy more local stocks by providing cheap funding, or Chinese companies would need to step up share buybacks further. None of these scenarios seems very likely.

Currency outlook is an important consideration for offshore bond investors. We believe we will continue to see near-term pressure on the renminbi, particularly in light of the threat of further U.S. tariffs. The Chinese government will likely turn even more defensive should tariff threats escalate, by advancing policies not only to stimulate the domestic economy but also guide the renminbi to gradually weaken to maintain export competitiveness.

Vivian Lin Thurston, CFA, partner, is a portfolio manager on William Blair’s global equity team.

Clifford Lau, CFA, is a portfolio manager on William Blair’s emerging markets debt team.

Emerging Markets 2025 Outlook Series

Part 1 | Macro Outlook: Uncertainty Abounds

Part 2 | Quality as the Path to Growth in Emerging Markets

Part 3 | Emerging Markets Debt in an Evolving World

Part 4 | China: Stimulus and Tariff Uncertainty Clouds Investment Environment

[1] The CSI 300 Index is a market-capitalization-weighted index that consists of 300 A-share stocks traded on the Shanghai and Shenzhen exchanges. [2] The MSCI China Index captures large- and mid-cap representation across China A shares, H shares, B shares, Red chips, P chips, and foreign listings (such as ADRs). [3] The MSCI Emerging Markets (EM) Index captures large- and mid-cap representation across 27 EMs. [4] The MSCI All Country World Index (ACWI) ex-US captures large- and mid-cap representation across developed and emerging markets, excluding the United States. It is a subset of the MSCI ACWI, and includes both developed and emerging markets, excluding U.S.-based stocks. [5] The Standard & Poor’s (S&P) 500 Index tracks the performance of 500 large companies listed on stock exchanges in the United States. Index performance is provided for illustrative purposes only. Indices are unmanaged and do not incur fees or expenses. A direct investment in an unmanaged index is not possible.