January 13, 2025 | Global Equity

Quality as the Path to Growth in Emerging Markets

January 13, 2025 | Global Equity

View Fund:

https://im.williamblair.com/investments/mutual-funds/wbeix-emerging-markets-growth-fund

View Fund:

https://im.williamblair.com/investments/mutual-funds/wbelx-emerging-markets-leaders-fund

View Fund:

https://im.williamblair.com/investments/mutual-funds/besix-emerging-markets-small-cap-growth-fund

View Fund:

https://im.williamblair.com/investments/mutual-funds/wxcix-emerging-markets-ex-china-growth-fund

We believe emerging markets (EMs) present a landscape of opportunity amid increasing macroeconomic headwinds, as these markets remain an efficient gateway to powerful secular themes, from technology-driven transformations to consumer growth stories across many regions.

However, the recent U.S. election has introduced a new layer of uncertainty for EMs. Ultimately, though the U.S. election may shape the near-term backdrop, we believe diverse secular growth drivers and competitive valuations in EMs offer a compelling case for investing in quality, growth-oriented companies.

Higher U.S. interest rates and a stronger dollar may challenge EM currencies and investor sentiment in 2025. EM investors should be prepared for uneven outcomes across regions, with some markets likely to face near-term pressures while others could continue to thrive on solid growth trajectories.

In an environment marked by political shifts and uncertain economic policy, we believe a focus on high-quality companies (healthy balance sheets, strong management teams, and sustainable competitive advantages) is paramount for EM investors.

While obstacles exist, we believe the underlying case for EMs remains strong, especially for those who are selective about where they invest. — Todd McClone, CFA, Partner

In sum, while obstacles exist, we believe the underlying case for EMs remains strong, especially for those who are selective about where they invest—and in this section, we will explore three key themes that highlight the breadth of opportunity in the asset class.

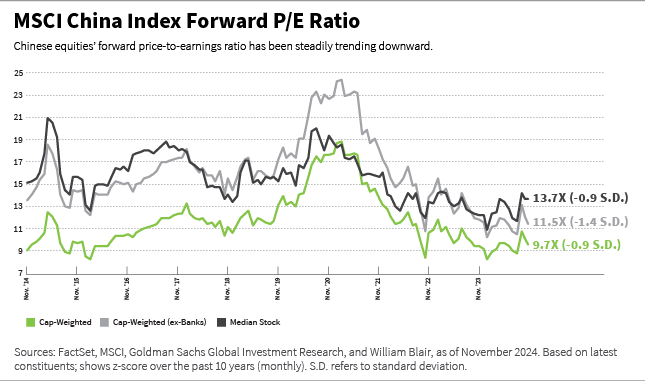

First is China. Although stimulus and relatively low valuations could offer near-term opportunities, China’s long-term growth prospects remain tempered by structural economic challenges and policy uncertainties.

Second is India. Often compared to China’s early-1990s growth phase, India stands out as a compelling long-term investment, supported by strong demographics, rising consumer spending, and pro-business policies—though its high valuations may warrant a selective approach.

Lastly, we will explore the AI boom. EMs play a pivotal role in the global artificial intelligence (AI) buildout, supplying critical components and infrastructure for AI advancements, while also addressing the energy demands that accompany this technological growth.

In 2024, emerging equity markets showed resilience, though returns were mixed across regions. As of November 30, 2024, EM equities (as represented by the MSCI EM IMI) posted a year-to-date (YTD) return of 7.38%, trailing developed markets, which returned 21.10% (as represented by the MSCI World IMI).

China’s economy continues to face significant structural issues, particularly in its heavily indebted local government sector and struggling property market.

In November, Beijing introduced a substantial 10 trillion renminbi ($1.4 trillion) fiscal package aimed at stabilizing the economy by bailing out local governments and restructuring their debts. While investor response to these measures has been mixed, recent efforts reflect a more forceful and coordinated approach, with both monetary and fiscal measures working in tandem.

In addition, authorities are displaying a more constructive stance on the real estate sector, recognizing it as a critical component of Chinese consumers’ net worth and overall sentiment.

Positives

China has shown signs of easing regulatory pressure and a refocusing on growth, with initiatives aimed at fostering self-reliance in high-end manufacturing sectors, such as semiconductors and automation.

Beijing has also increased monetary support, including reductions in the reserve requirement ratio and policy rates.

The property market has also received targeted support, with measures such as mortgage rate cuts, reduced downpayment requirements, and eased purchase restrictions to encourage housing demand.

Furthermore, large and growing household savings, alongside attractive market valuations, present a potential foundation for renewed consumer activity if confidence improves.

Negatives

Consumer confidence remains weak, with excess household savings accumulating but not translating into spending.

The property sector continues to struggle, with declining new property starts, primary market sales, and overall investment. China’s housing starts have outpaced urbanization rates, contributing to a surplus in residential real estate that weighs on the broader market.

In addition, the employment and income outlook remains subdued, further constraining consumer demand. Geopolitical tensions, especially with the United States, add an external risk layer that could impact trade and investment flows.

China’s fiscal response—especially if expanded to include potential bank recapitalization and support for the housing sector—could present a near-term opportunity for investors, as has been the case historically.

Key Takeaway

President Xi Jinping appears committed to maintaining economic stability, and we anticipate the series of incremental positive measures will support China’s 5% gross domestic product (GDP) target for 2024 and the growth trajectory for 2025. With valuations still relatively low and company fundamentals improving in certain areas, stimulus efforts could fuel short-term boosts to the equity market as Beijing focuses on stabilizing key economic sectors.

But the sustainability of such rallies remains uncertain given the persistent structural challenges China faces. The country’s long-term outlook is still clouded by high debt levels, demographic pressures, and slowing growth.

Stimulus efforts could fuel short-term boosts to the Chinese equity market as Beijing focuses on stabilizing key economic sectors. — Casey Preyss, CFA, Partner

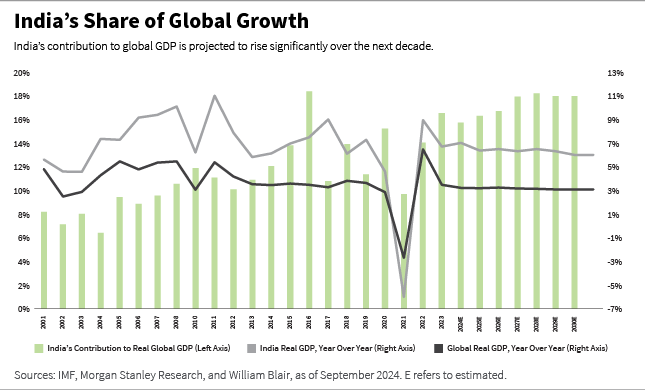

India’s growth story is one of the most compelling among EMs, in our view, driven by favorable demographics, a burgeoning middle class, and strong economic policies.

Now the fourth-largest equity market globally in terms of market capitalization, India has risen to become the second-largest market in the MSCI EMI IMI as of November 30, 2024, with its weight roughly doubling over the past five years to approximately 20%. India’s share of global GDP growth now exceeds 15% and is expected to trend higher.

The country’s young and well educated population supports a growing consumer base with increasing disposable income. Low household debt—at only 19% of GDP compared with 65% in China—signals potential for sustained consumer demand. Low penetration rates for durable goods, such as air conditioners, refrigerators, and cars, indicate a potentially large runway for consumption growth.

Positives

India’s pro-business policies have introduced structural reforms that should bolster economic growth and support secular trends across key sectors, particularly in financials and manufacturing. Initiatives like the Make in India and Production Linked Incentive (PLI) schemes have catalyzed a robust capital expenditures (capex) cycle, with public capex projected to reach $20.6 trillion rupees in 2024, up from $6.4 trillion rupees in 2014. This focus on domestic manufacturing and infrastructure is strengthening India’s self-reliance and enhancing its appeal to global investors.

Key sectors such as real estate, personal financial services, healthcare, and travel services are seeing strong demand as consumer spending shifts from staples to experiences and services. In addition, India’s aerospace and defense industry is moving up the value chain, while the domestic manufacturing sector is benefiting from the China +1 supply chain diversification trend.

We believe India’s recent inclusion in global bond indices reinforce its attractiveness as an investment destination.

Negatives

Certain challenges in the country warrant caution. India is a net commodity importer, making it vulnerable to fluctuations in global commodity prices and external imbalances. The country’s current account deficit reflects this dependency, and any sharp rise in commodity prices could impact economic stability. In addition, India’s strong recent equity market performance has led to elevated valuations which, while justified (in our view) by high growth potential, may limit near-term upside. Relative to other EMs, India’s higher valuations suggest that investors may need to take a selective approach.

Key Takeaway

Overall, we believe India remains one of the most attractive long-term growth stories in EMs. The current valuation premium, however, should encourage investors to take a cautious, quality-focused approach in the current environment. As the country continues on its growth trajectory, it holds the potential to echo China’s rapid economic ascent since the early 1990s, albeit with a more balanced and sustainable growth model.

AI technology has become a central focus for global tech investment, and EMs are integral to the sector’s development. Markets such as Taiwan and South Korea, for example, are critical to the AI supply chain, as they house leading manufacturers and suppliers who produce the hardware essential for AI applications, from high-performance semiconductors to data centers to autonomous vehicles. Taiwan, in particular, is at the forefront as a “picks and shovels” supplier of advanced components used in semiconductors and data centers, further strengthening its role in the AI buildout.

The growth of AI places unprecedented demands on energy infrastructure. Data centers, which are essential for AI-driven computations, are highly energy-intensive and create a need for reliable power sources and sophisticated grid infrastructure.

In addition to AI data center demand, there are several other big drivers of power infrastructure needs, such as the EV transition, government renewable targets, and power infrastructure and replacement demand from aging grid in Europe and the United States. We believe many EM companies could benefit from providing equipment to meet these high levels of transmission and distribution demands.

We believe many EM companies could benefit from providing equipment to meet unfractured power needs. — Ian Smith, Partner

China is an energy importer, and by heavily investing in renewable energy, is trying to become more self-sufficient. Solar energy requires energy storage solutions given the limitations of daylight hours. Furthermore, much of the renewable power is generated in the west of China and needs to be transported through ultra-high-voltage lines to the east, where the majority of demand is.

Indian power investment is driven by historical underinvestment, with future strong economic growth requiring prolonged high levels of capacity expansion. India is earlier in its journey than China, but also investing heavily in renewable forms of energy.

Key Takeaway

EMs are positioned as pivotal players in the global AI supply chain and the development of next-generation energy infrastructure. For EM investors, this intersection of AI growth and energy expansion is compelling.

Select EMs stand out for their unique growth narratives paired with country-specific risk factors, and we believe active management within these nuanced opportunities can help investors participate in targeted growth opportunities while managing localized risks.

South Africa: Signs of Political Improvement

In South Africa, we believe political developments have created a cautiously optimistic outlook for investors.

The African National Congress (ANC), South Africa’s ruling party since the end of Apartheid in 1994, recently lost its parliamentary majority for the first time, leading it to form a coalition with more conservative, pro-business parties. This shift has raised hopes for economic reforms and improved governance, as the coalition’s influence may drive policies more favorable to business and investment.

We think early signs of economic recovery, alongside lower inflation and potential rate cuts, make South Africa a more compelling opportunity than it was a year ago.

Mexico: Growth Potential Amid Political Uncertainty

Mexico has become a key player in the global reshoring trend, attracting companies seeking proximity to the United States to reduce supply chain vulnerabilities. The country’s competitive labor costs and established manufacturing base position it as an appealing location for production hubs.

But the recent election results, which granted the ruling Morena party a supermajority, have introduced uncertainty. Investors are concerned about the constitutional changes impacting the independence of the judiciary and other institutions, raising questions around Mexico’s long-term stability. Given these political risks, a more cautious approach may be prudent.

In Saudi Arabia, geopolitical risks and the volatility of oil prices pose ongoing concerns for investors. — Paul Birchenough, Partner

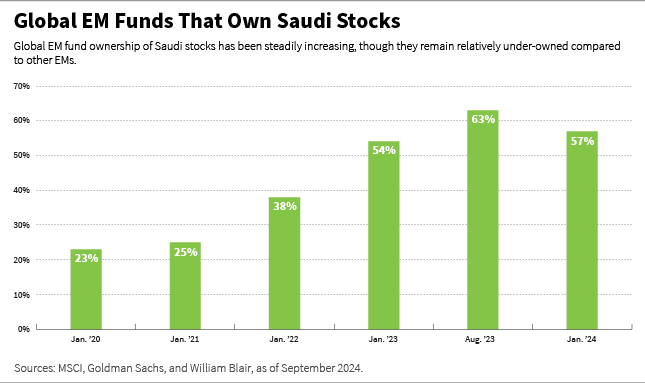

Saudi Arabia: Structural Reforms and Vision 2030

Saudi Arabia’s ambitious Vision 2030 program has driven significant economic reforms, aiming to reduce the country’s dependence on oil by fostering growth in sectors like finance, tourism, and technology. The Saudi government’s fiscal largesse has spurred investment across these industries, creating opportunities for companies that align with the country’s diversification efforts.

Despite these positives, geopolitical risks and the volatility of oil prices pose ongoing concerns for investors. In addition, while the market has grown in size and influence within EM indices, it remains relatively under-owned, suggesting potential for increased foreign investment as reforms continue to unfold.

Paul Birchenough, partner, is director of research and a portfolio manager on William Blair’s global equity team.

Todd McClone, CFA, partner, is a portfolio manager on William Blair’s global equity team.

Casey Preyss, CFA, partner, is a portfolio manager on William Blair’s global equity team.

Ian Smith, partner, is a portfolio manager on William Blair’s global equity team.

Part 1 | Macro Outlook: Uncertainty Abounds

Part 2 | Quality as the Path to Growth in Emerging Markets

Part 3 | Emerging Markets Debt in an Evolving World

Part 4 | China: Stimulus and Tariff Uncertainty Clouds Investment Environment

[1]All country performance is based on MSCI IMI indices.

The MSCI China Index captures large- and mid-cap representation across China A shares, H shares, B shares, Red chips, P chips, and foreign listings (such as ADRs). The MSCI Emerging Markets (EM) Investable Market Index (IMI) captures large-, mid- and small-cap representation across 27 EMs. The MSCI World Investable Market Index (IMI) is a stock market index that captures large-, mid-, and small-cap companies across 23 developed markets worldwide. Index performance is provided for illustrative purposes only. Indices are unmanaged and do not incur fees or expenses. A direct investment in an unmanaged index is not possible.

View Fund:

https://im.williamblair.com/investments/sicav-funds/lu0995405320-emerging-markets-growth-fund

View Fund:

https://im.williamblair.com/investments/sicav-funds/lu0995405593-emerging-markets-leaders-fund

View Fund:

https://im.williamblair.com/investments/sicav-funds/lu1397782274-emerging-markets-small-cap-growth-fund

View Strategy:

https://im.williamblair.com/investments/separate-accounts/emerging-markets-growth

View Strategy:

https://im.williamblair.com/investments/separate-accounts/emerging-markets-leaders

View Strategy:

https://im.williamblair.com/investments/separate-accounts/emerging-markets-leaders-concentrated

View Strategy:

https://im.williamblair.com/investments/separate-accounts/emerging-markets-small-cap-growth

View Strategy:

https://im.williamblair.com/investments/separate-accounts/emerging-markets-ex-china-growth

Want the latest insights on the economy and other forces shaping the investment landscape?

Subscribe to our Investing Insights newsletter.

Any investment or strategy mentioned herein may not be appropriate for every investor. There can be no assurance that investment objectives will be met. Products and services listed are available only to residents of this jurisdiction and may only be available to certain categories of investors. The information on this website does not constitute an offer for products or services, or a solicitation of an offer to any persons outside of this jurisdiction who are prohibited from receiving such information under applicable laws and regulations. Nothing on this webpage should be construed as advice and is therefore not a recommendation to buy or sell shares.

Please carefully consider the William Blair Funds’ investment objectives, risks, charges, and expenses before investing. This and other information is contained in the Funds’ prospectus and summary prospectus, which you may obtain by calling 1-800-742-7272. Read the prospectus and summary prospectus carefully before investing. Investing includes the risk of loss.

The William Blair Funds are distributed by William Blair & Company, L.L.C., member FINRA/SIPC.

The William Blair SICAV is a Luxembourg investment company with variable capital registered with the Commission de Surveillance du Secteur Financier (“CSSF”) which qualifies as an undertaking for collective investment in transferable securities (“UCITS”). The Management Company of the SICAV has appointed William Blair Investment Management, LLC as the investment manager for the fund.

Please carefully consider the investment objectives, risks, charges, and expenses of the William Blair SICAV. This and other important information is contained in the prospectus and Key Investor Information Document (KIID). Read these documents carefully before investing. The information contained on this website is not a substitute for those documents or for professional external advice.

Information and opinions expressed are those of the authors and may not reflect the opinions of other investment teams within William Blair Investment Management, LLC, or affiliates. Factual information has been taken from sources we believe to be reliable, but its accuracy, completeness or interpretation cannot be guaranteed. Information is current as of the date appearing in this material only and subject to change without notice. Statements concerning financial market trends are based on current market conditions, which will fluctuate. This material may include estimates, outlooks, projections, and other forward-looking statements. Due to a variety of factors, actual events may differ significantly from those presented.

Investing involves risks, including the possible loss of principal. Equity securities may decline in value due to both real and perceived general market, economic, and industry conditions. The securities of smaller companies may be more volatile and less liquid than securities of larger companies. Investing in foreign denominated and/or domiciled securities may involve heightened risk due to currency fluctuations, and economic and political risks. These risks may be enhanced in emerging markets and frontier markets. Investing in the bond market is subject to certain risks including market, interest rate, issuer, credit, and inflation risk. High-yield, lower-rated, securities involve greater risk than higher-rated securities. Different investment styles may shift in and out of favor depending on market conditions. Diversification does not ensure against loss.

Past performance is not indicative of future returns. References to specific companies are for illustrative purposes only and should not be construed as investment advice or a recommendation to buy or sell any security.

William Blair Investment Management, LLC is an investment adviser registered with the U.S. Securities and Exchange Commission.

Issued in the United Kingdom by William Blair International, Ltd., authorized and regulated by the Financial Conduct Authority (FCA), and is only directed at and is only made available to persons falling within articles 19, 38, 47, and 49 of the Financial Services and Markets Act of 2000 (Financial Promotion) Order 2005 (all such persons being referred to as "relevant persons").

Issued in the European Economic Area (EEA) by William Blair B.V., authorized and supervised by the Dutch Authority for the Financial Markets (AFM) under license number 14006134 and also supervised by the Dutch Central Bank (DNB), registered at the Dutch Chamber of Commerce under number 82375682 and has its statutory seat in Amsterdam, the Netherlands. This material is only intended for eligible counterparties and professional clients.

Issued in Switzerland by William Blair Investment Services (Zurich) GmbH, Talstrasse 65, 8001 Zurich, Switzerland ("WBIS"). WBIS is engaged in the offering of collective investment schemes and renders further, non-regulated services in the financial sector. WBIS is affiliated with FINOS Finanzomubdsstelle Schweiz, a recognized ombudsman office where clients may initiate mediation proceedings pursuant to articles 74 et seq. of the Swiss Financial Services Act ("FinSA"). The client advisers of WBIS are registered with regservices.ch by BX Swiss AG, a client adviser registration body authorized by the Swiss Financial Market Supervisory Authority ("FINMA"). WBIS is not supervised by FINMA or any other supervisory authority or self-regulatory organization. This material is only intended for institutional and professional clients pursuant to article 4(3) to (5) FinSA.

Issued in Australia by William Blair Investment Management, LLC (“William Blair”), which is exempt from the requirement to hold an Australian financial services license under Australia's Corporations Act 2001 (Cth). William Blair is registered as an investment advisor with the U.S. Securities and Exchange Commission (“SEC”) and regulated by the SEC under the U.S. Investment Advisers Act of 1940, which differs from Australian laws. This material is intended only for wholesale clients.

Issued in Singapore by William Blair International (Singapore) Pte. Ltd. (Registration Number 201943312R), which is regulated by the Monetary Authority of Singapore under a Capital Markets Services License to conduct fund management activities. This material is intended only for institutional investors and may not be distributed to retail investors.

Issued in Canada by William Blair Investment Management, LLC, which relies on the international adviser exemption, pursuant to section 8.26 of National Instrument 31-103 in Canada.

The content contained in this site is intended as informational or educational in nature and does not constitute investment advice or a recommendation of any investment strategy or product for a particular investor. Investment advice and recommendations can be provided only after careful consideration of an investor’s objectives, guidelines, and restrictions. Investors should consult a financial professional/financial consultant or investment adviser before making any investment decisions. Investing includes the risk of loss.

Copyright © 2026 William Blair. William Blair is a registered trademark of William Blair & Company, L.L.C. “William Blair” refers to William Blair Investment Management, LLC and affiliates.