January 4, 2024 | Global Equity

Subscribe Now

Want the latest insights on the economy and other forces shaping the investment landscape?

Subscribe to our Investing Insights newsletter.

January 4, 2024 | Global Equity

Want the latest insights on the economy and other forces shaping the investment landscape?

Subscribe to our Investing Insights newsletter.

In 2023, the global economy defied widespread expectations of a recession and falling interest rates. Instead, the United States, Japan, and, to a lesser extent, Europe delivered significantly better growth than was expected at the turn of the year, even as the U.S. Federal Reserve (Fed) and the European Central Bank (ECB) continued to raise policy rates through most of the year.

Underappreciated economic growth is powerful fuel for global equities: the performance of the U.S. “Magnificent 7” stocks (Apple, Microsoft, Alphabet, Amazon, Nvidia, Meta, and Tesla) is widely discussed, but as of December 31, 2023, German, Spanish, and Italian bourses[1] also returned 24.5%, 32.5%, and 39%, respectively, in U.S. dollar terms. This is in line with or better than 26.4% for the S&P 500 Index. Even Japanese equities[2] are up at double-digit rates in U.S. dollar terms, despite the Japanese yen depreciating to lows last observed in the early 1990s.

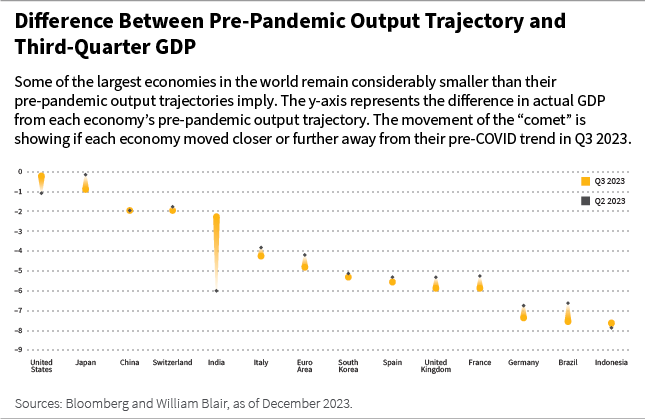

To be sure, the world economy has some ground to cover. At the end of 2023, many of the largest economies remain significantly smaller than their pre-COVID growth trajectory implies, as shown in the chart below. The United States and Japan are the closest, while the United Kingdom, Germany, and Indonesia are among the furthest away from their pre-pandemic output trajectory.

The experience in 2023 has defied the commonplace view of an inevitable trade-off between inflation and unemployment. Many continue to argue that for inflation to decline to the 2% range, the economy needs to shrink and unemployment needs to rise. This view assumes that the run-up in inflation over the last two years is due mainly to excessive demand growth.

Underappreciated economic growth is powerful fuel for global equities.

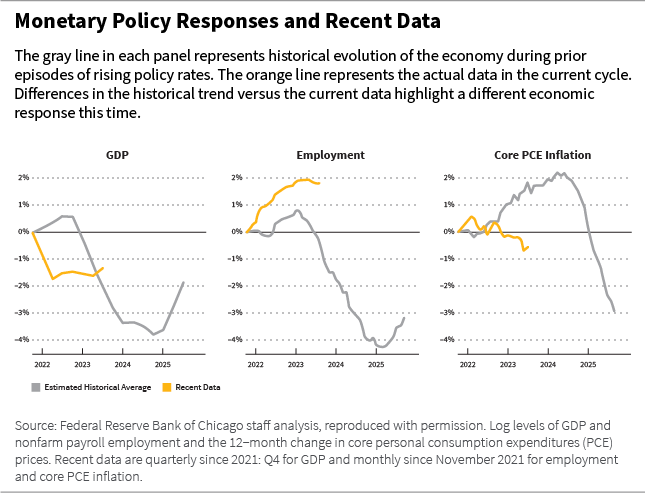

In the chart below, analysis by the Federal Reserve Bank of Chicago shows just how differently U.S. economic variables are behaving in the aftermath of the Fed’s tightening policy and makes a powerful argument that inflation this time was primarily due to pandemic-induced supply constraints. Viewed in this light, it is hardly surprising that both the United States and Europe have defied dire predictions of an imminent recession so far.

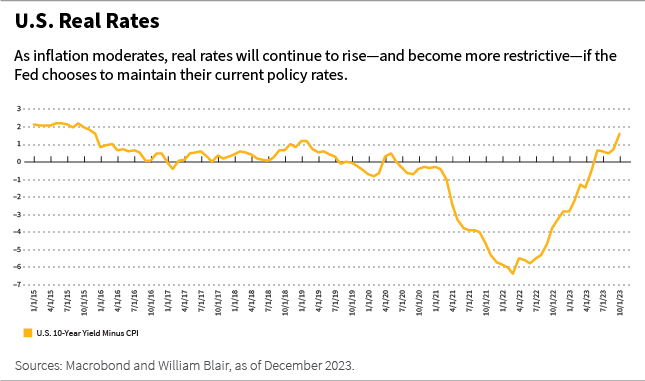

The Fed’s monetary policy stance is becoming de facto more restrictive, as stable policy rates amid rapidly falling inflation imply rising real rates. Our outlook for 2024 hinges on whether the Fed and the ECB can begin to lower policy rates early enough to prevent high accurate rates from meaningfully dampening economic activity.

As annual price inflation converges back to a 2% rate in the early months of 2024, current monetary policy, as measured by real interest rates, will become de facto more restrictive, as shown in the chart below. The real interest rate is nothing more than nominal rates minus inflation. Thus, lower inflation automatically means higher real rates if the Fed chooses to maintain current settings. Therefore, we expect the Fed to begin to lower the nominal policy rate as early as the first half of 2024, even as domestic economic growth remains resilient.

The disinflation process in the United States and Europe is already well advanced. At the beginning of 2023, consumer prices rose by 6% year-over-year. By the end of the year, the Consumer Price Index (CPI) registered year-on-year increases of 3.2%. Nevertheless, the Fed’s preferred gauge of domestic inflation—PCE excluding food and energy, which tend to be volatile—is still growing at 3.8% as of September 2023, nearly twice the 2% stated goal of the Fed.

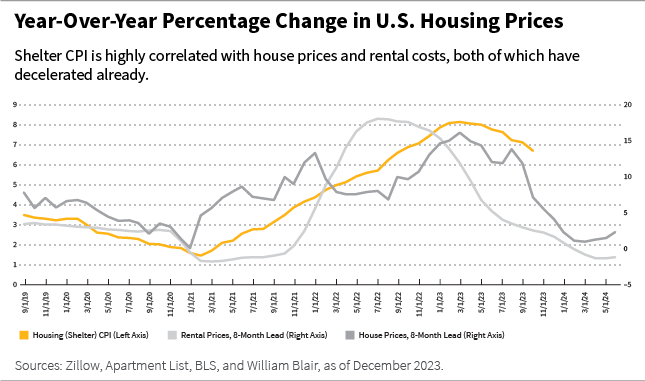

A closer look at the components of the price increases suggests that the principal offender remains housing. It is the single largest component of the CPI basket, weighing roughly one-third of the index. The housing component of the CPI is an imprecise blend of housing prices and rent costs. Online platforms for home purchasing and rents now make more current pricing information readily available, and these price trends suggest that the contribution of housing to the CPI is likely to diminish significantly in the first half of 2024, as shown in the chart below.

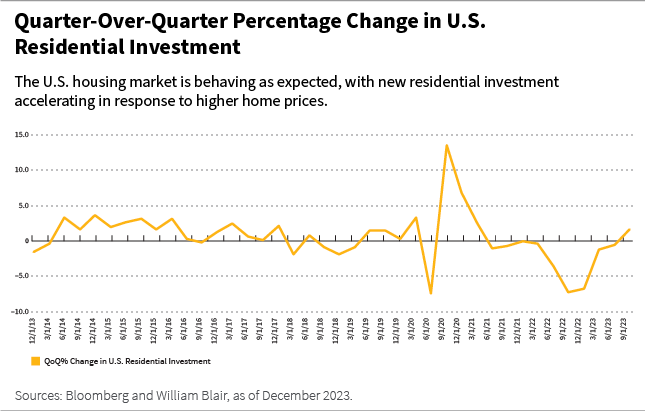

Recent house price increases have motivated more building: residential investment has returned to growth after two years of continuous declines, as shown in the chart below. Over time, this is likely to support more housing market activity and mitigate future price increases.

Crucially, the labor market has healed as the post-pandemic supply constraints have all but unwound. Wage growth continues to moderate; hourly earnings are now growing at 4%, down from nearly 6% a year ago. The number of job vacancies has continued to decline as the economy has added 150,000 net new jobs per month for most of the second half of 2023. In other words, the returning workers and resumption of immigrant inflows resolved the severe worker supply shortage without any meaningful pick up in unemployment.

Falling inflation is likely to remain a powerful tailwind to consumer spending and, by extension, overall economic growth, as moderate wage gains in excess of falling inflation boost real incomes. This dynamic is also playing out in Europe, where the disinflation process commenced later and has further to run. Economic growth is likely to remain more moderate in Europe than in the United States, not least due to significant geopolitical tensions on its borders and meaningfully higher energy prices compared to pre-pandemic levels.

We expect the Fed to begin to lower the nominal policy rate as early as the first half of 2024, even as domestic economic growth remains resilient.

With goods and services prices already converging to pre-pandemic trends, it is not a stretch to assume that U.S. inflation will normalize to its long-term 2% rate in the first half of 2024.

As the disinflation process progresses, current monetary policy will de facto become more restrictive, suggesting that some moderation in the federal funds rate will become necessary even if economic activity remains resilient. The ECB is just as likely to face low inflation and underwhelming growth in Europe within months. Relying on today’s or, more accurately, last month’s indicators of price movements, risks keeping monetary policy too restrictive and punitive for future economic activity. We expect the Fed to bring policy rates down to the 3.5% range on an 18-month view and to begin this process in the first half of 2024.

So, if the Fed adjusts its “neutral” monetary policy stance to be in line with meaningfully lower inflation and does so in a timely manner, and if the ECB follows suit in Europe, the world’s principal demand centers can maintain modest but sustainable economic growth in 2024. In other words, 2024 may be the first year of “normal” economic expansion post-COVID.

Olga Bitel, partner, is a global strategist on William Blair’s global equity team.

Part 1 | Economy Hits Cruising Altitude, But Beware of Bumps

Part 2 | Emerging Markets Diverge as a New Cycle Unfolds

Part 3 | EM Debt: From Headwinds to Tailwinds

Part 4 | Restarting China's Economic Growth

[1] Bourses are represented by the DAX Index (Germany), the IBEX 35 Index (Spain), and the FTSE MIB Index (Italy).

[2] Japanese equities are represented by the Tokyo Price Index (TOPIX).

The DAX is a stock market index consisting of the 40 major German blue chip companies trading on the Frankfurt Stock Exchange. The FTSE MIB Index is the primary benchmark index for the Italian equity market and represents the large cap component of the FTSE Italia All-Share Index. The IBEX 35 is the benchmark stock market index of the Bolsa de Madrid, Spain's principal stock exchange. The Standard & Poor’s (S&P) 500 Index tracks the performance of 500 large companies listed on stock exchanges in the United States. The Tokyo Price Index (TOPIX) is a metric for stock prices on the Tokyo Stock Exchange (TSE).

Index performance is provided for illustrative purposes only. Indices are unmanaged and do not incur fees or expenses. A direct investment in an unmanaged index is not possible.

Any investment or strategy mentioned herein may not be appropriate for every investor. There can be no assurance that investment objectives will be met. Products and services listed are available only to residents of this jurisdiction and may only be available to certain categories of investors. The information on this website does not constitute an offer for products or services, or a solicitation of an offer to any persons outside of this jurisdiction who are prohibited from receiving such information under applicable laws and regulations. Nothing on this webpage should be construed as advice and is therefore not a recommendation to buy or sell shares.

Please carefully consider the William Blair Funds’ investment objectives, risks, charges, and expenses before investing. This and other information is contained in the Funds’ prospectus and summary prospectus, which you may obtain by calling 1-800-742-7272. Read the prospectus and summary prospectus carefully before investing. Investing includes the risk of loss.

The William Blair Funds are distributed by William Blair & Company, L.L.C., member FINRA/SIPC.

The William Blair SICAV is a Luxembourg investment company with variable capital registered with the Commission de Surveillance du Secteur Financier (“CSSF”) which qualifies as an undertaking for collective investment in transferable securities (“UCITS”). The Management Company of the SICAV has appointed William Blair Investment Management, LLC as the investment manager for the fund.

Please carefully consider the investment objectives, risks, charges, and expenses of the William Blair SICAV. This and other important information is contained in the prospectus and Key Investor Information Document (KIID). Read these documents carefully before investing. The information contained on this website is not a substitute for those documents or for professional external advice.

Information and opinions expressed are those of the authors and may not reflect the opinions of other investment teams within William Blair Investment Management, LLC, or affiliates. Factual information has been taken from sources we believe to be reliable, but its accuracy, completeness or interpretation cannot be guaranteed. Information is current as of the date appearing in this material only and subject to change without notice. Statements concerning financial market trends are based on current market conditions, which will fluctuate. This material may include estimates, outlooks, projections, and other forward-looking statements. Due to a variety of factors, actual events may differ significantly from those presented.

Investing involves risks, including the possible loss of principal. Equity securities may decline in value due to both real and perceived general market, economic, and industry conditions. The securities of smaller companies may be more volatile and less liquid than securities of larger companies. Investing in foreign denominated and/or domiciled securities may involve heightened risk due to currency fluctuations, and economic and political risks. These risks may be enhanced in emerging markets and frontier markets. Investing in the bond market is subject to certain risks including market, interest rate, issuer, credit, and inflation risk. High-yield, lower-rated, securities involve greater risk than higher-rated securities. Different investment styles may shift in and out of favor depending on market conditions. Diversification does not ensure against loss.

Past performance is not indicative of future returns. References to specific companies are for illustrative purposes only and should not be construed as investment advice or a recommendation to buy or sell any security.

William Blair Investment Management, LLC is an investment adviser registered with the U.S. Securities and Exchange Commission.

Issued in the United Kingdom by William Blair International, Ltd., authorized and regulated by the Financial Conduct Authority (FCA), and is only directed at and is only made available to persons falling within articles 19, 38, 47, and 49 of the Financial Services and Markets Act of 2000 (Financial Promotion) Order 2005 (all such persons being referred to as "relevant persons").

Issued in the European Economic Area (EEA) by William Blair B.V., authorized and supervised by the Dutch Authority for the Financial Markets (AFM) under license number 14006134 and also supervised by the Dutch Central Bank (DNB), registered at the Dutch Chamber of Commerce under number 82375682 and has its statutory seat in Amsterdam, the Netherlands. This material is only intended for eligible counterparties and professional clients.

Issued in Switzerland by William Blair Investment Services (Zurich) GmbH, Talstrasse 65, 8001 Zurich, Switzerland ("WBIS"). WBIS is engaged in the offering of collective investment schemes and renders further, non-regulated services in the financial sector. WBIS is affiliated with FINOS Finanzomubdsstelle Schweiz, a recognized ombudsman office where clients may initiate mediation proceedings pursuant to articles 74 et seq. of the Swiss Financial Services Act ("FinSA"). The client advisers of WBIS are registered with regservices.ch by BX Swiss AG, a client adviser registration body authorized by the Swiss Financial Market Supervisory Authority ("FINMA"). WBIS is not supervised by FINMA or any other supervisory authority or self-regulatory organization. This material is only intended for institutional and professional clients pursuant to article 4(3) to (5) FinSA.

Issued in Australia by William Blair Investment Management, LLC (“William Blair”), which is exempt from the requirement to hold an Australian financial services license under Australia's Corporations Act 2001 (Cth). William Blair is registered as an investment advisor with the U.S. Securities and Exchange Commission (“SEC”) and regulated by the SEC under the U.S. Investment Advisers Act of 1940, which differs from Australian laws. This material is intended only for wholesale clients.

Issued in Singapore by William Blair International (Singapore) Pte. Ltd. (Registration Number 201943312R), which is regulated by the Monetary Authority of Singapore under a Capital Markets Services License to conduct fund management activities. This material is intended only for institutional investors and may not be distributed to retail investors.

Issued in Canada by William Blair Investment Management, LLC, which relies on the international adviser exemption, pursuant to section 8.26 of National Instrument 31-103 in Canada.

The content contained in this site is intended as informational or educational in nature and does not constitute investment advice or a recommendation of any investment strategy or product for a particular investor. Investment advice and recommendations can be provided only after careful consideration of an investor’s objectives, guidelines, and restrictions. Investors should consult a financial professional/financial consultant or investment adviser before making any investment decisions. Investing includes the risk of loss.

Copyright © 2026 William Blair. William Blair is a registered trademark of William Blair & Company, L.L.C. “William Blair” refers to William Blair Investment Management, LLC and affiliates.