After a very strong 2023, the performance of emerging markets (EM) debt lost some of its positive momentum in 2024, a year characterized by strong U.S. economic growth and persistent inflation. While EM credit spreads continued to tighten, reflecting resilient economic conditions in EM countries, higher U.S. Treasury yields and a strong U.S. dollar created headwinds for the asset class, leading to higher EM bond yields and weaker EM currencies.

However, EM debt credit fundamentals remain supportive. Economic conditions are still resilient; fiscal, debt, and external dynamics are supportive; and disinflation creates opportunity for monetary policy easing.

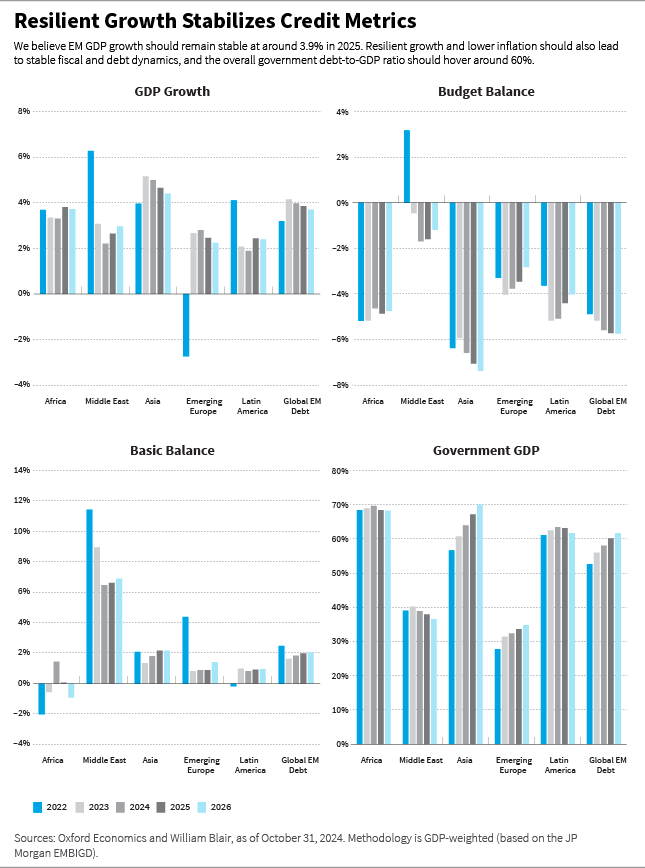

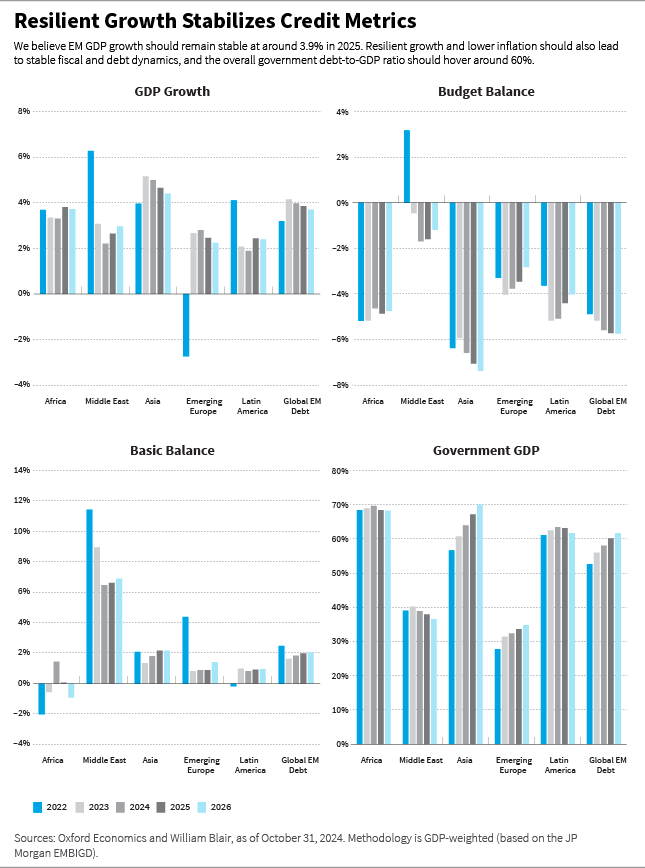

We believe EM gross domestic product (GDP) growth should remain above potential, stable at around 3.9% in 2025. Concurrently, we expect inflation to fall from 5.9% in 2024 to 4.2% in 2025.

Resilient growth and lower inflation should lead to stable fiscal and debt dynamics. We believe fiscal deficits should stay at approximately 5.7% of GDP in 2025, and the overall government debt-to-GDP ratio should remain stable at 60%. We also expect solid external accounts, with the aggregate basic balance remaining at roughly 2% of EM GDP.

Importantly, fundamentals in the EM financial sector remain positive, with rising interest rates only having a limited impact on asset quality.

Overall, we expect this positive fundamental backdrop to continue to support the outlook for EM assets.

That said, there are risks. The upcoming Donald Trump presidency introduces uncertainty to this scenario. During the presidential campaign, Trump voiced strong opinions about immigration, taxation, international trade, regulation, energy, and foreign policy. While we are unlikely to have clarity on the scope of the new administration’s policy agenda until after Trump’s inauguration in January, the direction of travel seems clear. One area of particular concern is international trade. Trump has been vocal about the potential introduction of hefty tariffs on imports, particularly from China. Investors should expect material changes to regulations.

In the United States, higher tariffs on imported goods would likely lead to a temporary increase in inflation, putting pressure on consumer discretionary spending and economic activity. While we would not expect the U.S. Federal Reserve (Fed) to initially react to transitory inflationary pressures, the path toward monetary easing becomes less certain.

Globally, higher tariffs could negatively impact trade. Countries running large trade surpluses with the United States would likely see the biggest impact on their economies. China and, to a lesser extent, Europe could be particularly affected. In those places, we would expect to see significant fiscal and monetary policy reactions to offset the impacts of higher tariffs imposed by the new U.S. administration. We would also expect strong retaliation, as tariffs could violate World Trade Organization (WTO) commitments, creating additional risks for global trade.

While U.S. tariffs have the potential to impact global trade, we believe EM countries should be less directly exposed given the significant growth in intra-EM trade observed over the past few years. In China, we expect to see a combination of strong fiscal and monetary stimulus and a weaker currency as the government implements measures to offset the impact of U.S. tariffs. China should also continue to shift exports away from developed economies, in our opinion. EM countries now make up nearly 50% of Chinese exports.

We believe the new U.S. administration will adopt a more gradual and pragmatic trade agenda, aiming to avoid creating higher inflation for U.S. consumers.

Despite these risks, we believe the new U.S. administration will adopt a more gradual and pragmatic trade agenda, aiming to avoid creating higher inflation for U.S. consumers. On the foreign policy front, we have a positive view of the new administration’s intentions to mediate international conflicts, which could potentially result in significant de-escalation of the wars in Russia/Ukraine and the Middle East.

In our opinion, U.S. government policies will not significantly disrupt the outlook for the global economy. We expect the global disinflationary process to continue, albeit at a potentially slower pace, and anticipate additional monetary policy easing in developed and emerging economies. The gradual removal of monetary policy restrictions should lead to lower global rates and improved liquidity conditions in 2025, in our opinion.

All in all, we expect a favorable market environment for EM debt in 2025 and believe that higher volatility induced by political noise and bombastic rhetoric could create opportunities for long-term investors.

Opportunities in Hard Currency EM Debt

EM hard currency sovereign and corporate credit spreads compressed significantly in 2024, reflecting a benign fundamental backdrop, low credit default rates, and a positive turn in the credit-rating cycle. Credit-spread compression was more significant in the higher-yielding part of the investment universe, particularly in places where valuations were attractive. In this process, EM debt outperformed developed-market credit during the year.

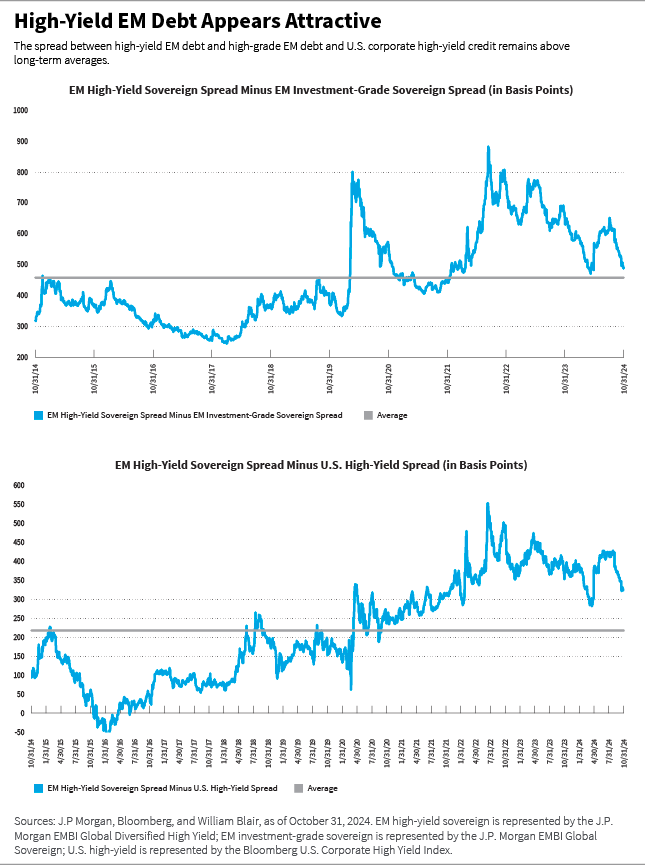

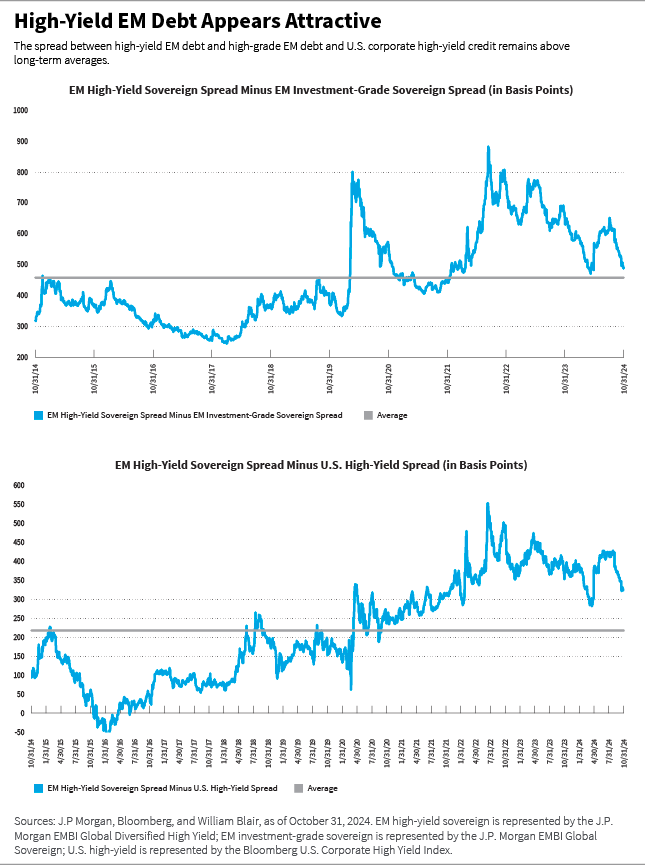

We now believe EM debt credit spreads are more indicative of fair valuations. While high-grade credit spreads are below long-term averages, high-yield credit spreads are still marginally above long-term averages. The spread between high-yield EM debt and high-grade EM debt (as well as U.S. corporate high-yield credit) remains above long-term averages.

While EM debt credit spreads are clearly less appealing than they were in 2023 and early 2024, yield levels remain attractive, in our opinion, driven by higher underlying U.S. Treasury yields. Therefore, we expect EM hard currency debt returns in 2025 to be driven predominantly by lower U.S. underlying Treasury yields and carry, and less by credit-spread compression.

Our favorable outlook for the 10-year U.S. Treasury yield has not changed since the U.S. elections. We continue to believe that there are attractive opportunities for investors to increase exposure to long-duration securities to lock in attractive real and nominal yields.

We continue to see marginally better value in high-yield, high-beta credit and remain positioned for further high-yield/investment-grade credit spread compression. That said, we believe the distressed/defaulted universe should present fewer investment opportunities, as we do not expect EM sovereign credit defaults over the next year.

We continue to see scope for fundamental differentiation and prefer countries with easier access to multilateral and bilateral funding. Multilateral and bilateral support to EMs remains strong, and we believe it will continue to make a meaningful contribution to external funding in 2024 and beyond.

Tariffs are likely to be applied unevenly across a broad selection of EM countries, potentially resulting in a wider dispersion of returns and the creation of additional opportunities for active investors.

In this context, we expect favorable technical conditions, and 2025 should be another year of subdued new net debt issuance. We also expect positive flows into the asset class as higher yields drive investors back to fixed income in a Fed rate-cutting cycle.

EM corporate credit should continue to offer attractive investment opportunities, in our opinion. The diversity of the asset class presents ample opportunities for outperformance given the dispersion of fundamental drivers and investable themes. While issuance rebounded in 2024, net financing needs are still subdued for the universe. Credit default rates are expected to remain contained in 2025. Overall credit fundamentals remain stronger than in developed markets as evidenced by better leverage and coverage metrics. While valuations have compressed, EM corporate credit still offers a spread pickup given higher credit spreads and lower durations.

All in all, we believe EM hard currency debt is well positioned to continue to outperform within the public fixed income space in 2025.

Opportunities in Local Currency EM Debt

We believe the U.S. dollar will remain supported by a strong U.S. economy and a cautious Fed. Against this backdrop, we expect EM local markets to face headwinds, with EM currency depreciation likely to offset tariff costs to a large extent. However, tariffs are likely to be applied unevenly across a broad selection of EM countries, potentially resulting in a wider dispersion of returns and the creation of additional opportunities for active investors.

Moreover, it remains to be seen how the Trump administration will address a strengthening U.S. dollar and if the negative impact on growth from higher inflation and interest rates will lead to a softer stance on trade.

We believe local rates should continue to be well supported by prudent EM central banks, an overall benign inflationary backdrop, and economic activity remaining broadly in line with potential growth levels.

One relative bright spot in our investment universe is frontier markets, where local currency bonds play an important role in our approach. From a structural perspective, more of these countries are making a conscious effort to open up their capital markets to diversify their financing sources and reduce dependence on foreign currency debt issuance.

Measures to achieve this include strong reform momentum, often supported by multilateral organizations; the reduction or removal of capital controls; and additional liquidity measures provided by the central banks. This means that many frontier market currencies offer opportunities for investment with currencies at or below our estimates of fair value, supported by high real and nominal local interest rates. These currencies can provide an attractive combination of a lower beta to the strong U.S. dollar trend and higher carry than is normally found in their larger EM counterparts.

We also expect a number of these markets to continue to benefit from official sector support given their geopolitical importance. This means that they enjoy a combination of strong multilateral and bilateral support. For example, a high number of frontier markets are currently on an International Monetary Fund (IMF) program. This benefits them through both cheap levels of financing and strong economic reforms that have been designed to ensure a higher and more consistent level of potential growth.

This ample and diversified source of funding has been particularly evident in recent years and has been a strong provider of financial support. In the past, it was standard for EM debt managers to add a small number of frontier markets to their portfolios in a rather concentrated way. However, the evolution of funding has convinced us that the asset class now has the diversification necessary to be relevant as a standalone asset class.

The Oil Outlook

As we end the year, it seems likely that oil markets will close at the lower end of their 2024 range of $70 to $90 per barrel for Brent crude. In 2025, we believe demand growth expectations of approximately 1 million barrels per day, or 1% growth, will be mostly driven by China and the United States, although demand from India and the Middle East is becoming more of a factor.

In China, consumption growth decelerated into the second half of 2024, with 2025 expected to be at its lowest level in years. Attempts to stimulate the economy are yet to come to fruition and EV penetration is growing, suppressing oil product demand.

In the United States, it is likely that the new administration will be more supportive of fossil fuel usage, with consumption hovering around 20 million barrels per day, about 20% of the market, for years. Prices were pressured in the second half of 2024 by expectations of a return of curtailed Organization of the Petroleum Exporting Countries (OPEC) supply. Although the cartel deferred its decision, it is likely that some supply will return in 2025, pressuring the market. The Trump administration’s support for further growth in U.S. oil production will also be an overhang for prices, although questions remain about how much and how quickly the industry can respond.

A reversal in Iranian supply growth would temper this outlook, as we expect the new Trump administration to put the regime under pressure once again. Non-OPEC supplies, particularly from Brazil and Guyana, are also expected to grow. The geopolitical risk premium in oil markets has recently diminished, but conflict in the Middle East could directly affect oil supplies at any point (though it should be buffered by significant spare capacity in the region). All in all, we believe fundamental drivers of oil markets suggest a cautious outlook as we begin 2025.

The Metals Outlook

Base and precious metals had a good year in 2024. Base metals traded higher on improved Chinese demand growth, which stemmed from green investments and exports of downstream products. Alumina emerged as the standout performer, achieving record highs following a bauxite supply disruption in Guinea, a major producer. Aluminum, a feedstock to alumina, traded higher in sympathy. Precious metals were similarly robust, with silver prices surging and gold prices reaching all-time highs due to a combination of interest-rate cuts, geopolitical risks, and strong physical demand.

Our 2025 outlook for base metals remains resilient. We expect the energy transition theme to remain intact, supporting copper and aluminum demand. While expected tariffs under the Trump administration will likely be a clear headwind for base metal prices, more targeted Chinese stimulus measures might offset the losses. Supply disruptions, which were a key factor for several metals in 2024, including alumina and zinc, might persist for a longer period, supporting prices.

Meanwhile, in the precious metals market, gold prices remain supported despite uncertainty around the trajectory of interest-rate cuts following the U.S. elections. Inflation concerns, fiscal deficit risks from the new administration’s tax policies, and strong demand from EM central banks contribute to a positive outlook for 2025.

Marcelo Assalin, CFA, partner, is the head of William Blair’s emerging markets debt team, on which he also serves as a portfolio manager.

Emerging Markets 2025 Outlook Series

Part 1 | Macro Outlook: Uncertainty Abounds

Part 2 | Quality as the Path to Growth in Emerging Markets

Part 3 | Emerging Markets Debt in an Evolving World

Part 4 | China: Stimulus and Tariff Uncertainty Clouds Investment Environment

The Bloomberg US Corporate High Yield Index measures the USD-denominated, high-yield, fixed-rate corporate bond market. The J.P. Morgan EMBI Global Sovereign tracks the performance of U.S. dollar-denominated sovereign debt issued by EMs, including both investment-grade and below-investment-grade bonds. (Index information has been obtained from sources believed to be reliable but J.P. Morgan does not warrant its completeness or accuracy. The indices are used with permission. The indices may not be copied, used, or distributed without J.P. Morgan’s prior written approval. Copyright 2024, JPMorgan Chase & Co. All rights reserved.) Index performance is provided for illustrative purposes only. Indices are unmanaged and do not incur fees or expenses. A direct investment in an unmanaged index is not possible.