February 14, 2024 | Emerging Markets Debt

Investments

ASSET-CLASS CAPABILITIES

Insights

EDUCATION CENTER

SUBSCRIBE

February 14, 2024 | Emerging Markets Debt

In the two years since we published our research on electric vehicles (EVs) and metals, we’ve seen a dynamic metals market unfold before our eyes.

The copper, lithium, and nickel markets are undergoing a rapid transformation, driven by the green energy revolution, which has spurred investments and innovation to meet the growing demand of EVs and renewable energy.

In this blog post series, we explore how supply and demand for some of these “commodities of the future” have been shaped by the transition to a low-carbon future. We also explore governmental responses from emerging markets (EMs) to these shifting dynamics.

Let’s start with demand dynamics, where the energy transition from traditional fossil fuels to renewable resources, as well as the electrification of several global economic sectors, is now evident in the demand for copper, lithium, and nickel. Investments in electric grids worldwide have accelerated in the last couple of years as a result of investments in renewable power systems and the infrastructure needed to support the electrification of transportation and other sectors.

According to the International Energy Agency (IEA), global investment in electricity grids increased around 8% in 2022.

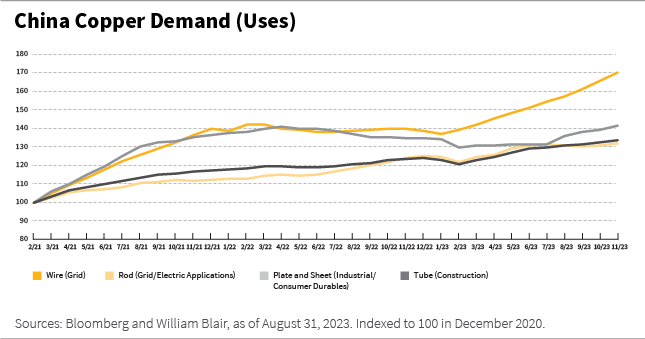

China has led this growth, with investments in grid and infrastructure up 28% year-over-year from January to October 2023. Chinese demand for copper now constitutes 60% of the world total. While demand for all copper uses is higher than historical records, demand for wire, which has multiple uses in the grid and EV infrastructure, has significantly outperformed demand for other copper uses in China.

In Europe, EV sales continue to advance, with EV registrations recording a whopping compound annual growth rate (CAGR) of 55% from 2017 to 2022. Grid and infrastructure investments, coupled with EV adoption, constitute the largest consumers of copper worldwide, strengthening copper demand resilience in the face of current economic challenges.

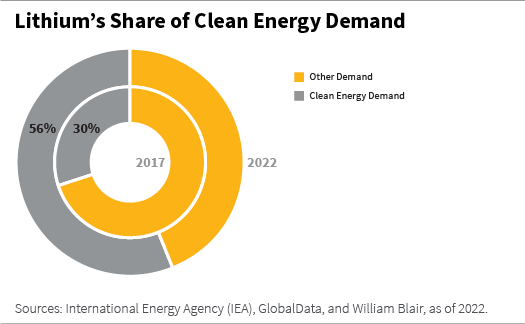

Among all commodities of the future, lithium has probably undergone the greatest transformation. The electrification of transportation has driven a colossal shift in the demand composition for lithium, which had a CAGR of 23% from 2017 to 2022. EV batteries are the biggest contributor to this dynamic, now representing more than 50% of total demand for lithium (up from about 30% in 2017). Other uses of lithium include consumer electronics (which use lithium-ion batteries), glass making, ceramics, and pharmaceuticals.

Nickel demand has been accelerating in the last three years. It grew 11% in 2022 and is expected to grow another 14% in 2023. For context, demand growth for most industrial metals is comparable to global annual gross domestic product (GDP) growth, which has been much lower than the double-digit growth experienced in nickel. This growth is a result of nickel being used as a component of EV batteries. The composition of nickel demand has been changing too. Clean energy now constitutes 16% of total demand, up from just 6% in 2017.

In my next post, I’ll discuss supply dynamics, as the response to the very pronounced demand shifts observed in these metals has been remarkable.

Alexandra Symeonidi, CFA, is a senior corporate credit and sustainability analyst on William Blair’s emerging markets debt team.

Part 1 | Metals of the Future: Demand Dynamics in the Driver’s Seat

Want the latest insights on the economy and other forces shaping the investment landscape?

Subscribe to our Investing Insights newsletter.

Any investment or strategy mentioned herein may not be appropriate for every investor. There can be no assurance that investment objectives will be met. Products and services listed are available only to residents of this jurisdiction and may only be available to certain categories of investors. The information on this website does not constitute an offer for products or services, or a solicitation of an offer to any persons outside of this jurisdiction who are prohibited from receiving such information under applicable laws and regulations. Nothing on this webpage should be construed as advice and is therefore not a recommendation to buy or sell shares.

Please carefully consider the William Blair Funds’ investment objectives, risks, charges, and expenses before investing. This and other information is contained in the Funds’ prospectus and summary prospectus, which you may obtain by calling 1-800-742-7272. Read the prospectus and summary prospectus carefully before investing. Investing includes the risk of loss.

The William Blair Funds are distributed by William Blair & Company, L.L.C., member FINRA/SIPC.

The William Blair SICAV is a Luxembourg investment company with variable capital registered with the Commission de Surveillance du Secteur Financier (“CSSF”) which qualifies as an undertaking for collective investment in transferable securities (“UCITS”). The Management Company of the SICAV has appointed William Blair Investment Management, LLC as the investment manager for the fund.

Please carefully consider the investment objectives, risks, charges, and expenses of the William Blair SICAV. This and other important information is contained in the prospectus and Key Investor Information Document (KIID). Read these documents carefully before investing. The information contained on this website is not a substitute for those documents or for professional external advice.

Information and opinions expressed are those of the authors and may not reflect the opinions of other investment teams within William Blair Investment Management, LLC, or affiliates. Factual information has been taken from sources we believe to be reliable, but its accuracy, completeness or interpretation cannot be guaranteed. Information is current as of the date appearing in this material only and subject to change without notice. Statements concerning financial market trends are based on current market conditions, which will fluctuate. This material may include estimates, outlooks, projections, and other forward-looking statements. Due to a variety of factors, actual events may differ significantly from those presented.

Investing involves risks, including the possible loss of principal. Equity securities may decline in value due to both real and perceived general market, economic, and industry conditions. The securities of smaller companies may be more volatile and less liquid than securities of larger companies. Investing in foreign denominated and/or domiciled securities may involve heightened risk due to currency fluctuations, and economic and political risks. These risks may be enhanced in emerging markets and frontier markets. Investing in the bond market is subject to certain risks including market, interest rate, issuer, credit, and inflation risk. High-yield, lower-rated, securities involve greater risk than higher-rated securities. Different investment styles may shift in and out of favor depending on market conditions. Diversification does not ensure against loss.

Past performance is not indicative of future returns. References to specific companies are for illustrative purposes only and should not be construed as investment advice or a recommendation to buy or sell any security.

William Blair Investment Management, LLC is an investment adviser registered with the U.S. Securities and Exchange Commission.

Issued in the United Kingdom by William Blair International, Ltd., authorized and regulated by the Financial Conduct Authority (FCA), and is only directed at and is only made available to persons falling within articles 19, 38, 47, and 49 of the Financial Services and Markets Act of 2000 (Financial Promotion) Order 2005 (all such persons being referred to as "relevant persons").

Issued in the European Economic Area (EEA) by William Blair B.V., authorized and supervised by the Dutch Authority for the Financial Markets (AFM) under license number 14006134 and also supervised by the Dutch Central Bank (DNB), registered at the Dutch Chamber of Commerce under number 82375682 and has its statutory seat in Amsterdam, the Netherlands. This material is only intended for eligible counterparties and professional clients.

Issued in Switzerland by William Blair Investment Services (Zurich) GmbH, Talstrasse 65, 8001 Zurich, Switzerland ("WBIS"). WBIS is engaged in the offering of collective investment schemes and renders further, non-regulated services in the financial sector. WBIS is affiliated with FINOS Finanzomubdsstelle Schweiz, a recognized ombudsman office where clients may initiate mediation proceedings pursuant to articles 74 et seq. of the Swiss Financial Services Act ("FinSA"). The client advisers of WBIS are registered with regservices.ch by BX Swiss AG, a client adviser registration body authorized by the Swiss Financial Market Supervisory Authority ("FINMA"). WBIS is not supervised by FINMA or any other supervisory authority or self-regulatory organization. This material is only intended for institutional and professional clients pursuant to article 4(3) to (5) FinSA.

Issued in Australia by William Blair Investment Management, LLC (“William Blair”), which is exempt from the requirement to hold an Australian financial services license under Australia's Corporations Act 2001 (Cth). William Blair is registered as an investment advisor with the U.S. Securities and Exchange Commission (“SEC”) and regulated by the SEC under the U.S. Investment Advisers Act of 1940, which differs from Australian laws. This material is intended only for wholesale clients.

Issued in Singapore by William Blair International (Singapore) Pte. Ltd. (Registration Number 201943312R), which is regulated by the Monetary Authority of Singapore under a Capital Markets Services License to conduct fund management activities. This material is intended only for institutional investors and may not be distributed to retail investors.

Issued in Canada by William Blair Investment Management, LLC, which relies on the international adviser exemption, pursuant to section 8.26 of National Instrument 31-103 in Canada.

The content contained in this site is intended as informational or educational in nature and does not constitute investment advice or a recommendation of any investment strategy or product for a particular investor. Investment advice and recommendations can be provided only after careful consideration of an investor’s objectives, guidelines, and restrictions. Investors should consult a financial professional/financial consultant or investment adviser before making any investment decisions. Investing includes the risk of loss.

Copyright © 2026 William Blair. William Blair is a registered trademark of William Blair & Company, L.L.C. “William Blair” refers to William Blair Investment Management, LLC and affiliates.