January 3, 2023 | Global Equity

Subscribe Now

Want the latest insights on the economy and other forces shaping the investment landscape?

Subscribe to our Investing Insights newsletter.

January 3, 2023 | Global Equity

Want the latest insights on the economy and other forces shaping the investment landscape?

Subscribe to our Investing Insights newsletter.

As we look out to 2023, the U.S. Federal Reserve (Fed) has reached its “neutral” monetary policy stance, and the European Central Bank (ECB) is not far behind. Europe has moved fast to secure fossil fuel supply away from Russia, even at higher—but stable—prices. U.S. consumer price inflation is moderating. Asynchronous reopening, with China’s consumers set to rejoin the post-COVID economy, is likely to mean more inflation volatility next year.

Even so, if we can avoid geopolitical pressures escalating meaningfully from current levels (which are already uncomfortably high), can the world’s biggest demand centers pivot toward a multiyear cycle of modest but sustainable growth?

If so, equities may not be a bad place to be in 2023.

Slowflation—economic slowdown combined with rapidly rising inflation fueled by energy supply disruptions—proved a tough backdrop for financial markets in 2022. In the past two decades, only 2008 recorded worse returns for equities, while fixed-income investors have not had to contend with the likes of the year’s declines even in the depths of the Global Financial Crisis (GFC). On an absolute basis, both equities and fixed income were down about 14% to 18%.

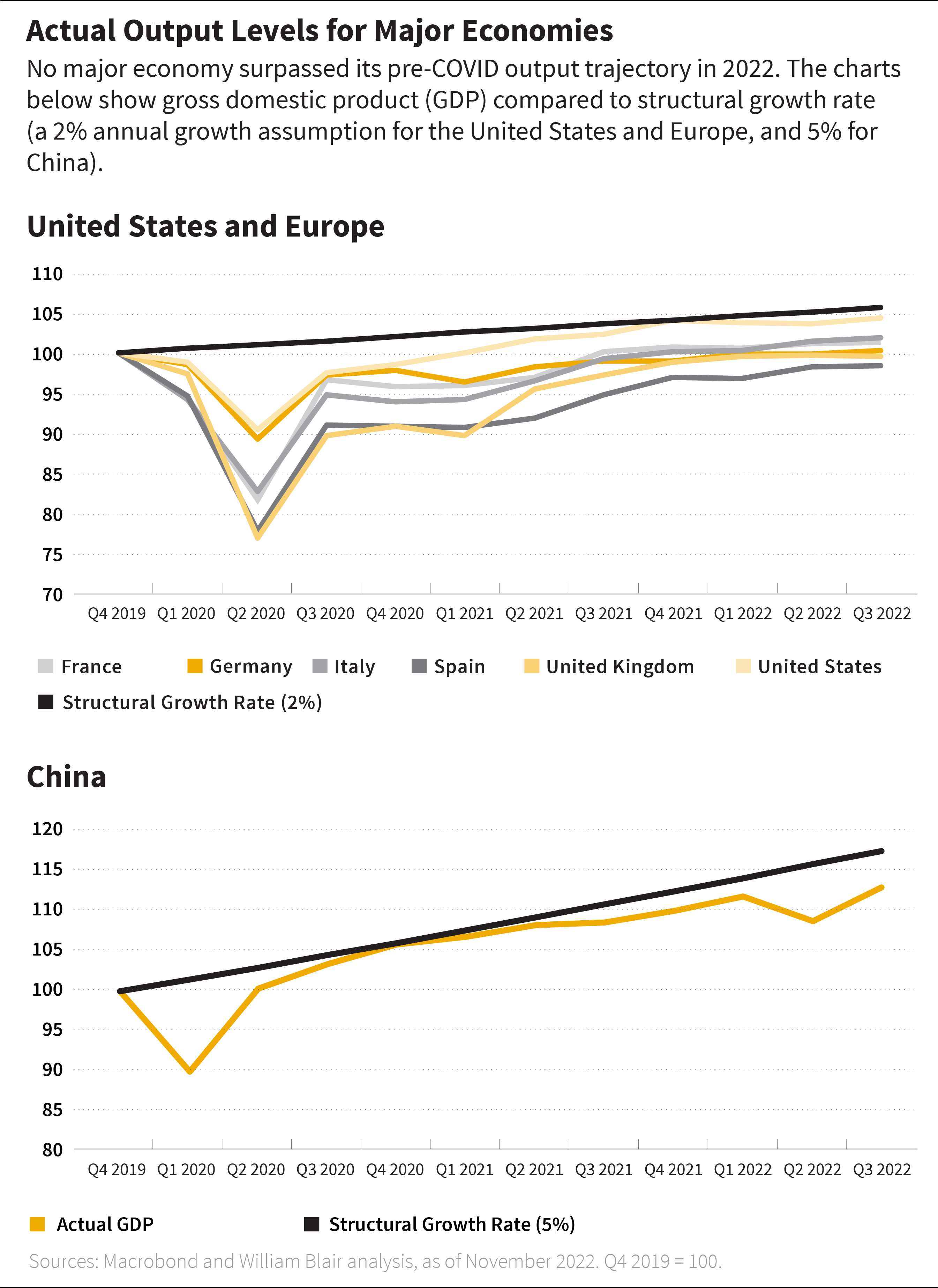

The post-COVID economic transition back to something “more normal” proved volatile and is complicated further by rising geopolitical conflicts. None of the major economic powers have surpassed their pre-COVID output trajectories. The U.S. economy is the closest: by the end of the third quarter of 2022, its output was about 1.5% lower than it might have been in the absence of the pandemic. Euro area and Japanese output is more than 3.5% lower. And in larger EM economies, such as China, Brazil, and Indonesia, output ranges from about 5% to 7% lower.

Latest expectations, as embedded in consensus estimates, suggest that economic observers do not expect major economies to regain pre-COVID levels of output next year.

Open warfare between Russia and Ukraine amplified tensions between the world’s largest consumers of fossil fuel energy and its producers. Although the world has plenty of oil and gas, natural gas spot prices in Europe spiked to about seven times higher in 2022 compared to just one year prior. No economy can adjust to a cost shock of this magnitude in the space of a few quarters. Indeed, purchasing managers indices were already suggesting in the autumn of 2022 that the European economy is likely to enter a recession.

Today’s high prices may well lead to tomorrow’s low prices, and tomorrow may arrive sooner than many feared.

Although the outlook for fossil fuel energy supply in Europe remains unusually volatile, the risks are balanced. The Organization of the Petroleum Exporting Countries (OPEC) sought to limit crude supply by cutting daily production by 2 million barrels, just as Europe and the United States are implementing the next round of sanctions on Russian barrels (in part by barring Western firms from insuring Russian cargo).

Simultaneously, Germany has all but replaced importing capacity equivalent to its gas supply from the Nord Stream I pipeline. The government chartered five so-called floating storage and regasification units (FSRUs), which will be able to process 25 billion cubic meters of gas per year, roughly equivalent to half the capacity of the Nord Stream I pipeline. Meanwhile, the country’s first liquified natural gas (LNG) import terminal, in the port of Wilhelmshaven, is expected to be completed in early 2023—commissioned and built in less than a year.

A glut of LNG-carrying vessels destined for Europe, together with rapidly increasing capacity to process this supply, suggests that the meteoric rise of LNG prices and its dramatic drag on European inflation may be a story left in 2022. What is more, within a few years, Qatar and the United States should expand their respective LNG export capacity, and Europe should build enough proper import terminals. Today’s high prices may well lead to tomorrow’s low prices, and tomorrow may arrive sooner than many feared.

Yet the world’s leading central banks have signaled that they will not wait.

Perhaps one of the biggest surprises in 2022 was the speed with which the Fed moved its main policy rate toward a neutral stance. Assuming annual domestic inflation returns to a 2% to 3% range by the end of 2023, a neutral policy rate—where real rate is around 1.5%—is somewhere in the neighborhood of 3.5% to 4.5%. The federal funds rate—the Fed’s main policy instrument—currently stands at 4.50%. Further rate increases tilt the U.S. monetary-policy stance toward restrictive.

Asynchronous reopening is set to bedevil the global economy for at least another year.

When the Fed intends to stop lifting its benchmark rate is a matter of not only domestic economic concern. Rapidly rising interest rates impact global liquidity conditions. We have already seen macroeconomic stress in Sri Lanka, a near credit event of sorts in the United Kingdom, and a blowup in the cryptocurrency markets.

So far, these stresses have not spilled into broader markets, but interest-rate increases impact financial conditions non-linearly. Debt payments of all sorts, and especially housing payments the world over, are linked directly to prevailing interest rates; when these rise rapidly, the possibility of financial and economic stress rises, too.

Asynchronous reopening is set to bedevil the global economy for at least another year. We believe economic growth in the United States and Europe will depend largely on how quickly inflation abates.

This, in turn, depends on when and how China reopens its economy. A full or significant reopening in China is likely to impact tourism flows in Asia and further afield, especially in Europe and North America. This should buoy local domestic demand and may fuel services-related inflation in the affected jurisdictions. It should also support current accounts and local currencies from Thailand and Japan all the way to Europe.

China’s reopening is likely to make inflation readings in the United States and Europe more volatile and thereby complicate the Fed’s job of cooling domestic demand. In the absence of Chinese consumers, there are mounting reasons to believe that annual inflation of 3% toward the end of next year is attainable. Since the second half of 2022, housing and rental prices, continued improvement in supply chains, and domestic wage gains all point to accelerating moderation in annual inflation.

Let’s start with housing. The price of shelter accounts for nearly 40% of the Consumer Price Index (CPI); it is thus the single biggest—and stickiest—component of the U.S. basket of prices used to calculate national inflation. As 30-year fixed-rate mortgage rates passed 5% and then 6%, housing activity decelerated precipitously: sales of new builds are at the 2017-2019 average, while sales of existing homes are at decade lows and still falling.

Where transactions lead, prices follow: annual housing price inflation peaked in May 2022 and has been falling consistently since then. Private-sector measures of rentals point to outright price declines in the monthly data. Shelter inflation is notoriously difficult to convert into monthly CPI estimates, and we believe it will remain a drag on overall inflation for months to come, but broad housing market activity during much of 2022 suggests that we will see well-behaved shelter prices before the end of 2023.

Broad housing market activity during much of 2022 suggests that we will see well-behaved shelter prices before the end of 2023.

Goods prices reversed two decades of outright declines and grew strongly in the pandemic years. Supply-chain disruption proved difficult to remedy quickly, but as we enter 2023, spot price of a typical 40-foot shipping container is down some 80% from peak, purchasing manager surveys point to input price normalization, and suppliers’ delivery times are within reach of 2018-2019 averages. Annual goods price inflation peaked last February and has been declining steadily ever since.

Lower-value-add, high-touch services do not see much in the way of productivity gains. It is difficult—and maybe even undesirable—to increase the speed of a haircut or improve the efficiency of waitstaff beyond a certain point. For this reason, the Fed worries about wage inflation in services feeding directly into consumer price inflation. Yet, in the second half of 2022, services wage gains have decelerated from four-decade highs.

So, if the Fed reaches its neutral monetary policy stance and the ECB is not far behind; if fossil fuel supply away from Russia is secured, even at higher (but stable) prices; if consumer price inflation is moderating fast and the Fed does not overtighten into a major credit event somewhere; and crucially, if geopolitical pressures do not escalate meaningfully from their current uncomfortably high levels—then the world’s biggest demand centers may be able to pivot toward modest growth.

If so, risk assets may not be a bad place to be in 2023.

Olga Bitel, partner, is a global strategist on William Blair’s Global Equity team.

Part 1 | Outlook 2023: Better Than Feared

Part 2 | Emerging Markets Equities: Positioned for a Rebound?

Part 3 | Emerging Markets Debt: Clearer Skies Ahead?

Part 4 | China: Reopening Should Drive Growth

Any investment or strategy mentioned herein may not be appropriate for every investor. There can be no assurance that investment objectives will be met. Products and services listed are available only to residents of this jurisdiction and may only be available to certain categories of investors. The information on this website does not constitute an offer for products or services, or a solicitation of an offer to any persons outside of this jurisdiction who are prohibited from receiving such information under applicable laws and regulations. Nothing on this webpage should be construed as advice and is therefore not a recommendation to buy or sell shares.

Please carefully consider the William Blair Funds’ investment objectives, risks, charges, and expenses before investing. This and other information is contained in the Funds’ prospectus and summary prospectus, which you may obtain by calling 1-800-742-7272. Read the prospectus and summary prospectus carefully before investing. Investing includes the risk of loss.

The William Blair Funds are distributed by William Blair & Company, L.L.C., member FINRA/SIPC.

The William Blair SICAV is a Luxembourg investment company with variable capital registered with the Commission de Surveillance du Secteur Financier (“CSSF”) which qualifies as an undertaking for collective investment in transferable securities (“UCITS”). The Management Company of the SICAV has appointed William Blair Investment Management, LLC as the investment manager for the fund.

Please carefully consider the investment objectives, risks, charges, and expenses of the William Blair SICAV. This and other important information is contained in the prospectus and Key Investor Information Document (KIID). Read these documents carefully before investing. The information contained on this website is not a substitute for those documents or for professional external advice.

Information and opinions expressed are those of the authors and may not reflect the opinions of other investment teams within William Blair Investment Management, LLC, or affiliates. Factual information has been taken from sources we believe to be reliable, but its accuracy, completeness or interpretation cannot be guaranteed. Information is current as of the date appearing in this material only and subject to change without notice. Statements concerning financial market trends are based on current market conditions, which will fluctuate. This material may include estimates, outlooks, projections, and other forward-looking statements. Due to a variety of factors, actual events may differ significantly from those presented.

Investing involves risks, including the possible loss of principal. Equity securities may decline in value due to both real and perceived general market, economic, and industry conditions. The securities of smaller companies may be more volatile and less liquid than securities of larger companies. Investing in foreign denominated and/or domiciled securities may involve heightened risk due to currency fluctuations, and economic and political risks. These risks may be enhanced in emerging markets and frontier markets. Investing in the bond market is subject to certain risks including market, interest rate, issuer, credit, and inflation risk. High-yield, lower-rated, securities involve greater risk than higher-rated securities. Different investment styles may shift in and out of favor depending on market conditions. Diversification does not ensure against loss.

Past performance is not indicative of future returns. References to specific companies are for illustrative purposes only and should not be construed as investment advice or a recommendation to buy or sell any security.

William Blair Investment Management, LLC is an investment adviser registered with the U.S. Securities and Exchange Commission.

Issued in the United Kingdom by William Blair International, Ltd., authorized and regulated by the Financial Conduct Authority (FCA), and is only directed at and is only made available to persons falling within articles 19, 38, 47, and 49 of the Financial Services and Markets Act of 2000 (Financial Promotion) Order 2005 (all such persons being referred to as "relevant persons").

Issued in the European Economic Area (EEA) by William Blair B.V., authorized and supervised by the Dutch Authority for the Financial Markets (AFM) under license number 14006134 and also supervised by the Dutch Central Bank (DNB), registered at the Dutch Chamber of Commerce under number 82375682 and has its statutory seat in Amsterdam, the Netherlands. This material is only intended for eligible counterparties and professional clients.

Issued in Switzerland by William Blair Investment Services (Zurich) GmbH, Talstrasse 65, 8001 Zurich, Switzerland ("WBIS"). WBIS is engaged in the offering of collective investment schemes and renders further, non-regulated services in the financial sector. WBIS is affiliated with FINOS Finanzomubdsstelle Schweiz, a recognized ombudsman office where clients may initiate mediation proceedings pursuant to articles 74 et seq. of the Swiss Financial Services Act ("FinSA"). The client advisers of WBIS are registered with regservices.ch by BX Swiss AG, a client adviser registration body authorized by the Swiss Financial Market Supervisory Authority ("FINMA"). WBIS is not supervised by FINMA or any other supervisory authority or self-regulatory organization. This material is only intended for institutional and professional clients pursuant to article 4(3) to (5) FinSA.

Issued in Australia by William Blair Investment Management, LLC (“William Blair”), which is exempt from the requirement to hold an Australian financial services license under Australia's Corporations Act 2001 (Cth). William Blair is registered as an investment advisor with the U.S. Securities and Exchange Commission (“SEC”) and regulated by the SEC under the U.S. Investment Advisers Act of 1940, which differs from Australian laws. This material is intended only for wholesale clients.

Issued in Singapore by William Blair International (Singapore) Pte. Ltd. (Registration Number 201943312R), which is regulated by the Monetary Authority of Singapore under a Capital Markets Services License to conduct fund management activities. This material is intended only for institutional investors and may not be distributed to retail investors.

Issued in Canada by William Blair Investment Management, LLC, which relies on the international adviser exemption, pursuant to section 8.26 of National Instrument 31-103 in Canada.

The content contained in this site is intended as informational or educational in nature and does not constitute investment advice or a recommendation of any investment strategy or product for a particular investor. Investment advice and recommendations can be provided only after careful consideration of an investor’s objectives, guidelines, and restrictions. Investors should consult a financial professional/financial consultant or investment adviser before making any investment decisions. Investing includes the risk of loss.

Copyright © 2026 William Blair. William Blair is a registered trademark of William Blair & Company, L.L.C. “William Blair” refers to William Blair Investment Management, LLC and affiliates.