January 9, 2025 | Global Equity

Subscribe Now

Want the latest insights on the economy and other forces shaping the investment landscape?

Subscribe to our Investing Insights newsletter.

Before the U.S. election on November 5, 2024, the outlook for the world economy looked robust and consistent with economic expansion. Both the U.S. and European economies were expected to enjoy ongoing real wage growth, which would support private consumption, the largest component of aggregate gross domestic product (GDP) for both economies.

In addition, ongoing deceleration in inflation was expected to support real wage gains and, by extension, private consumption. Meanwhile, in China, unwanted fiscal retrenchment is being addressed, such that the economy was likely to accelerate modestly as we head into 2025.

But the results of the U.S. election have made this outlook far more uncertain. There are now many more plausible outcomes, and their distribution is nearly flat, with both left and right tails having increased significantly.

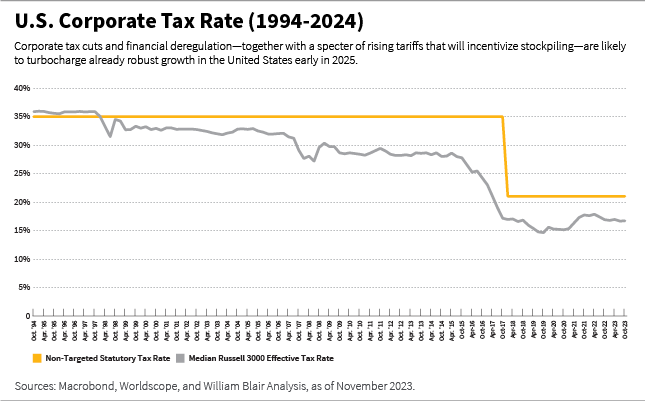

The tax cuts from the 2017 Tax Cuts and Jobs Act, due to expire next year, are now likely to become permanent. Corporate tax cuts usually flow directly into corporate earnings, which are now likely to be stronger. Deregulation—especially in banks and financial services more broadly—can also spur activity and earnings in some pockets of U.S. financials.

Corporate tax cuts and financial deregulation—together with a specter of rising tariffs that will incentivize stockpiling—are likely to turbocharge already robust growth in the United States early in 2025.

To the extent that the newly minted, time-limited Department of Government Efficiency (DOGE) committee incentivizes digitalization of federal government efforts, this could bring information technology (IT) services projects and further down the road, efficiency and quality-of-service gains for the U.S. government.

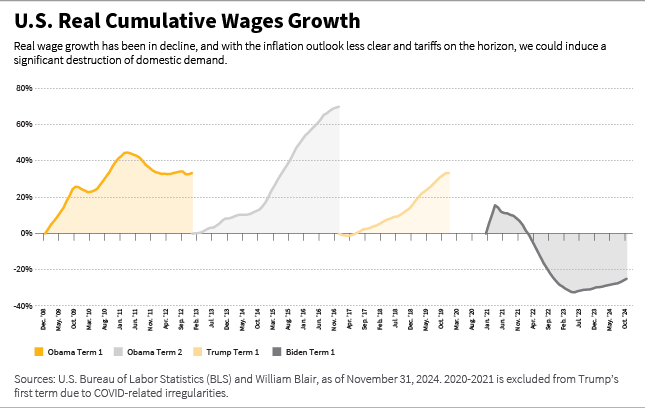

The inflation outlook is now less clear, too. We expect U.S. households will likely bear the full brunt of price increases that result from tariffs. Thus, higher prices mean reduced purchasing power and, therefore, reduced demand.

Tariffs are a regressive tax on domestic consumers; poorer consumers pay a higher share of their income for goods and therefore pay a higher proportion (relative to their income) of tariffs, as tariffs on steel and autos are likely in the near term insofar as they have been prepared already.

We believe broadening tariffs to progressively more products will hit U.S. consumers harder and could induce a significant destruction of domestic demand.

Tariffs are also likely to have second-round price effects on domestic producers: if we are to levy a tax on French cheese and wine, Wisconsin cheese and Napa Valley wines would cost more but still be cheaper than imported cheese.

For more durable goods, it may be cheaper to keep repairing an old washing machine than to buy a new one; thus, the demand for repair services will increase, and with it, domestic services prices will increase.

U.S. domestic price pressures are likely to intensify further if the proposed immigration policies—deportations and inflow reduction—are enacted. To the extent that illegal migrants tend to fill labor-intensive jobs in construction, agriculture, and industrial services, wage pressures may already show up here in 2025.

The sequence with which the proposed policies are enacted will likely play a crucial role in actual GDP growth outcomes. Based on current pronouncements of the next administration, we expect that the direction of travel for the U.S. economy is likely higher inflation, poorer households, and lower growth—and therefore, lower corporate profits, too—but maybe not in 2025.

We believe broadening tariffs to progressively more products will hit U.S. consumers harder and could induce a significant destruction of domestic demand.

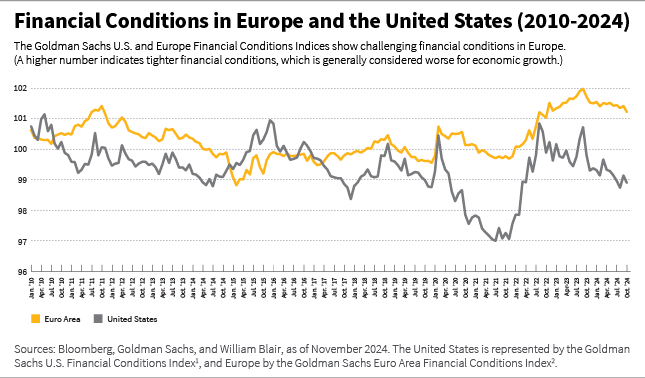

The outlook for Europe remains challenged by domestic policy paralysis and inappropriately tight liquidity conditions. The rebound from the COVID trough was arrested when the Russia-Ukraine war triggered an energy price shock. A sharp rise in energy prices hurt energy-intensive parts of the industrial supply chain, and nowhere more so than in Germany, Europe’s largest economy.

Germany, much like the rest of the continent, needs a significant investment boost, but in November 2023, Germany’s constitutional court threw fiscal policies into disarray by insisting on a narrow interpretation of the debt brake rule, which is enshrined in the German constitution.

In addition, France is putting its own fiscal consolidation package in place, which could weigh on growth in 2025.

As the European Central Bank (ECB) has a single inflation mandate, it maintains monetary policy that is too tight for some of the largest economies in the European bloc. As inflation subsides, monetary policy should adjust, albeit gradually. In 2025, it is likely to be less of a headwind compared to the recent past, but it will likely remain far from accommodative.

The European economic outlook for 2025 also comes with considerable left- and right-tail possible outcomes. On the negative side, Europe runs the second-largest bilateral trade deficit (behind China) with the United States. To the extent that the incoming U.S. administration abhors trade deficits, European exporters are firmly in the line of fire for tariff increases, which is likely to have a chilling effect on demand for their products.

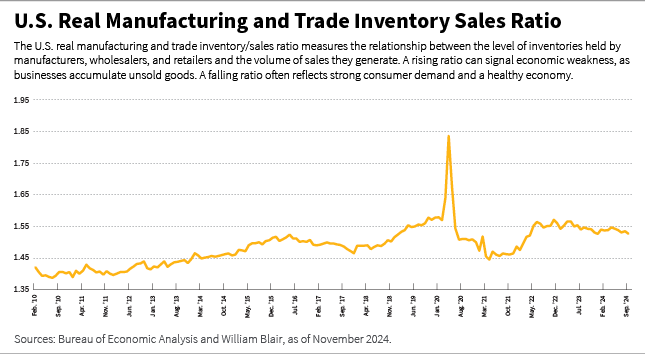

At the same time, any tariffs will likely be preceded with inventory buildup, to the extent that importers are anticipating a disruption. In the opening quarters of 2025, U.S. demand for European goods may look stronger than purely economic fundamentals warrant.

If the incoming U.S. administration succeeds in establishing a permanent ceasefire between Russia and

Ukraine, European companies are likely to benefit from reconstruction efforts in Ukraine. Qatar is scheduled to bring significant liquified natural gas (LNG) export volumes online, which may help bring down energy prices closer towards levels last seen prior to the 2022 Russia-Ukraine war.

Finally, upcoming elections in Germany may pave the way for a new law of debt brake and with it, a series of reforms that could unlock much-needed investment spending in Germany and Europe more broadly.

European exporters are firmly in the line of fire for tariff increases, which is likely to have a chilling effect on demand for their products.

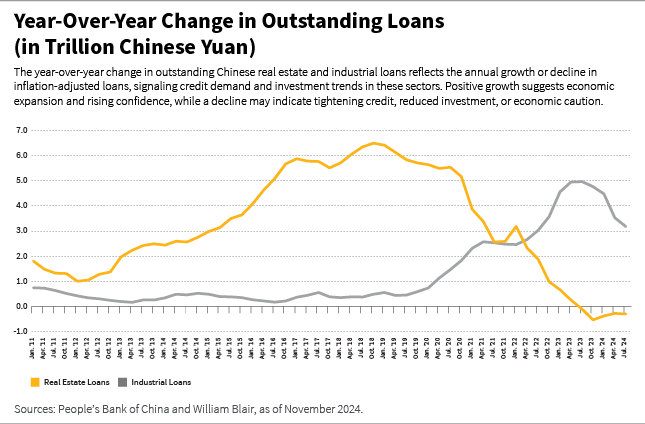

The outlook for China remains one of sequential, gradual improvement. The ongoing downturn in the property market generated a significant contraction in fiscal spending in 2024. As of August 2024, local governments have collectively underspent an estimated 1.6 trillion renminbi. Local authorities in China still rely on land sales for most of their revenues, and since they cannot issue debt to cover the shortfall in land sales, they curtailed spending.

Beijing has already announced a series of policy measures to reverse fiscal drag on a more sustainable basis. The announced policies fall into four broad categories: local government support in writing off hidden debt; recapitalization of large state-owned banks; limited property support measures; and income support for the most vulnerable. Eliminating fiscal contraction is likely to boost GDP growth sequentially in 2025.

Furthermore, Chinese leadership took the United States’ 2016 pivot in foreign policy quite seriously and embarked on a path of self-sustainability and wholesale industrial upgrading. The story of auto exports, particularly electric vehicles (EVs), is quite well known at this point, but the industrial upgrading is far broader.

An increasing number of Chinese smartphone makers are now eyeing European markets, with China’s domestic output of semiconductors having more than doubled in the last four years to an annual rate of 400 billion chips.

And according to the International Federation of Robotics (IFR), domestically designed and produced industrial robots increased their market share to 47% by the end of 2023, up from 30% in 2020. Western biotech and pharma companies have also been busy snapping up Chinese counterparts, who now produce advancements in oncology and other diseases.

All this domestic upgrading has resulted in permanently lower imports of intermediate goods, which used to be sourced from Western companies. A new round of tariff negotiations with the United States will likely commence from a different place.

To the extent that the incoming administration wishes to re-industrialize the U.S. Rust Belt, it is conceivable that many Chinese companies would be welcome to set up production facilities in the United States. Far from becoming a drag on growth, a U.S. policy tilt may prove a boon for China Inc.

Olga Bitel, partner, is a global strategist on William Blair’s global equity team.

Part 1 | Macro Outlook: Uncertainty Abounds

Part 2 | Quality as the Path to Growth in Emerging Markets

Part 3 | Emerging Markets Debt in an Evolving World

Part 4 | China: Stimulus and Tariff Uncertainty Clouds Investment Environment

[1] The Goldman Sachs U.S. Financial Conditions Index aggregates various financial variables to assess the overall state of U.S. financial conditions. It includes factors such as interest rates, credit spreads, equity prices, and exchange rates. [2] The Goldman Sachs Euro Area Financial Conditions Index aggregates various financial indicators—such as interest rates, credit spreads, equity prices, and exchange rates—to assess the overall financial environment in the euro area. Index performance is provided for illustrative purposes only. Indices are unmanaged and do not incur fees or expenses. A direct investment in an unmanaged index is not possible.

Any investment or strategy mentioned herein may not be appropriate for every investor. There can be no assurance that investment objectives will be met. Products and services listed are available only to residents of this jurisdiction and may only be available to certain categories of investors. The information on this website does not constitute an offer for products or services, or a solicitation of an offer to any persons outside of this jurisdiction who are prohibited from receiving such information under applicable laws and regulations. Nothing on this webpage should be construed as advice and is therefore not a recommendation to buy or sell shares.

Please carefully consider the William Blair Funds’ investment objectives, risks, charges, and expenses before investing. This and other information is contained in the Funds’ prospectus and summary prospectus, which you may obtain by calling 1-800-742-7272. Read the prospectus and summary prospectus carefully before investing. Investing includes the risk of loss.

The William Blair Funds are distributed by William Blair & Company, L.L.C., member FINRA/SIPC.

The William Blair SICAV is a Luxembourg investment company with variable capital registered with the Commission de Surveillance du Secteur Financier (“CSSF”) which qualifies as an undertaking for collective investment in transferable securities (“UCITS”). The Management Company of the SICAV has appointed William Blair Investment Management, LLC as the investment manager for the fund.

Please carefully consider the investment objectives, risks, charges, and expenses of the William Blair SICAV. This and other important information is contained in the prospectus and Key Investor Information Document (KIID). Read these documents carefully before investing. The information contained on this website is not a substitute for those documents or for professional external advice.

Information and opinions expressed are those of the authors and may not reflect the opinions of other investment teams within William Blair Investment Management, LLC, or affiliates. Factual information has been taken from sources we believe to be reliable, but its accuracy, completeness or interpretation cannot be guaranteed. Information is current as of the date appearing in this material only and subject to change without notice. Statements concerning financial market trends are based on current market conditions, which will fluctuate. This material may include estimates, outlooks, projections, and other forward-looking statements. Due to a variety of factors, actual events may differ significantly from those presented.

Investing involves risks, including the possible loss of principal. Equity securities may decline in value due to both real and perceived general market, economic, and industry conditions. The securities of smaller companies may be more volatile and less liquid than securities of larger companies. Investing in foreign denominated and/or domiciled securities may involve heightened risk due to currency fluctuations, and economic and political risks. These risks may be enhanced in emerging markets and frontier markets. Investing in the bond market is subject to certain risks including market, interest rate, issuer, credit, and inflation risk. High-yield, lower-rated, securities involve greater risk than higher-rated securities. Different investment styles may shift in and out of favor depending on market conditions. Diversification does not ensure against loss.

Past performance is not indicative of future returns. References to specific companies are for illustrative purposes only and should not be construed as investment advice or a recommendation to buy or sell any security.

William Blair Investment Management, LLC is an investment adviser registered with the U.S. Securities and Exchange Commission.

Issued in the United Kingdom by William Blair International, Ltd., authorized and regulated by the Financial Conduct Authority (FCA), and is only directed at and is only made available to persons falling within articles 19, 38, 47, and 49 of the Financial Services and Markets Act of 2000 (Financial Promotion) Order 2005 (all such persons being referred to as "relevant persons").

Issued in the European Economic Area (EEA) by William Blair B.V., authorized and supervised by the Dutch Authority for the Financial Markets (AFM) under license number 14006134 and also supervised by the Dutch Central Bank (DNB), registered at the Dutch Chamber of Commerce under number 82375682 and has its statutory seat in Amsterdam, the Netherlands. This material is only intended for eligible counterparties and professional clients.

Issued in Switzerland by William Blair Investment Services (Zurich) GmbH, Talstrasse 65, 8001 Zurich, Switzerland ("WBIS"). WBIS is engaged in the offering of collective investment schemes and renders further, non-regulated services in the financial sector. WBIS is affiliated with FINOS Finanzomubdsstelle Schweiz, a recognized ombudsman office where clients may initiate mediation proceedings pursuant to articles 74 et seq. of the Swiss Financial Services Act ("FinSA"). The client advisers of WBIS are registered with regservices.ch by BX Swiss AG, a client adviser registration body authorized by the Swiss Financial Market Supervisory Authority ("FINMA"). WBIS is not supervised by FINMA or any other supervisory authority or self-regulatory organization. This material is only intended for institutional and professional clients pursuant to article 4(3) to (5) FinSA.

Issued in Australia by William Blair Investment Management, LLC (“William Blair”), which is exempt from the requirement to hold an Australian financial services license under Australia's Corporations Act 2001 (Cth). William Blair is registered as an investment advisor with the U.S. Securities and Exchange Commission (“SEC”) and regulated by the SEC under the U.S. Investment Advisers Act of 1940, which differs from Australian laws. This material is intended only for wholesale clients.

Issued in Singapore by William Blair International (Singapore) Pte. Ltd. (Registration Number 201943312R), which is regulated by the Monetary Authority of Singapore under a Capital Markets Services License to conduct fund management activities. This material is intended only for institutional investors and may not be distributed to retail investors.

Issued in Canada by William Blair Investment Management, LLC, which relies on the international adviser exemption, pursuant to section 8.26 of National Instrument 31-103 in Canada.

The content contained in this site is intended as informational or educational in nature and does not constitute investment advice or a recommendation of any investment strategy or product for a particular investor. Investment advice and recommendations can be provided only after careful consideration of an investor’s objectives, guidelines, and restrictions. Investors should consult a financial professional/financial consultant or investment adviser before making any investment decisions. Investing includes the risk of loss.

Copyright © 2026 William Blair. William Blair is a registered trademark of William Blair & Company, L.L.C. “William Blair” refers to William Blair Investment Management, LLC and affiliates.